Do You Pay Tax On Meal Allowance The lunch benefit i e meal benefit has been defined by the Tax Administration as 25 tax free The benefit is loaded to employees benefit accounts on a monthly basis The amount to be loaded varies according to the number of monthly working days of each employee The lunch benefit is working day specific and intended to

As long as employees stick to these daily rates their employer doesn t have to pay tax on the expense allowance One of the most popular and widely used per diem expense allowances is the HMRC meal allowance It covers food and drink costs for travel both in the UK and overseas Yes include total allowance in gross payment Yes Non deductible expenses Part day travel no overnight absence from employee s ordinary place of residence Meals not award overtime meal allowance or overnight travel allowance Motor vehicle for non deductible travel eg home to work including cents per kilometre payments

Do You Pay Tax On Meal Allowance

Do You Pay Tax On Meal Allowance

https://1.bp.blogspot.com/-W6-EuvK1X1Q/WjECGM2-kBI/AAAAAAAAARQ/wn1pyxy1DqoHgAZsxEKcLRrq7aBYawOtgCLcBGAs/s1600/digital-meal-vouchers.jpg

WHAT YOU NEED TO KNOW ABOUT YOUR 2020 INCOME TAX RETURN The Beancounter

https://thebeancounter.co.za/wp-content/uploads/2020/08/Filing-tax-return-1536x864.jpeg

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

https://www.self.inc/info/img/post/life-of-tax/lifetime-tax-spend-average-american-self-financial.jpg

Types of allowances Your employer may pay you an allowance that provides for expenses you have that are not deductible such as meals and snacks during your normal working hours Specific examples include part day travel allowance meal allowance that are not award overtime meal allowances Technical guidance Overview As an employer providing meals for your employees you have certain tax National Insurance and reporting obligations What s included What you have to report

Award overtime allowances are not required to be taxed or reported on PAYG summaries Reasonable meal allowances Reasonable Overtime Meal Allowances as determined by the Commissioner of Taxation updated annually are For 2023 24 35 65 per meal The meal by meal amounts for employee long Now it s important to remember that per diem rates aren t taxed as long as the payment is less than or equal to the current federal per diem rate What Expenses are Listed as Per Diem Rates by the IRS The IRS has specified three different allowances that you re able to list as expenses when it comes to per diem rates

Download Do You Pay Tax On Meal Allowance

More picture related to Do You Pay Tax On Meal Allowance

How Much Tax Do You Pay On Your Income Mint

https://images.livemint.com/img/2020/02/02/original/taxchart_1580665978559.png

Income Tax Malaysia 2022 Who Pays And How Much

https://25174313.fs1.hubspotusercontent-eu1.net/hubfs/25174313/assets_comparehero/income-tax-how-much-featured-image.png

The Importance Of Paying Your Taxes University Herald

https://1540443815.rsc.cdn77.org/data/images/full/55350/the-importance-of-paying-your-taxes.jpeg

If the meals or vouchers you provide aren t exempt you may have to report them to HM Revenue and Customs HMRC and deduct and pay tax and National Insurance on the costs Free or The overtime meal allowance is shown on your annual income statement and you declare it as income in your tax return A meal you buy and eat while you are working overtime is an expense you incur in earning your employment income Example deduction for overtime meal expense

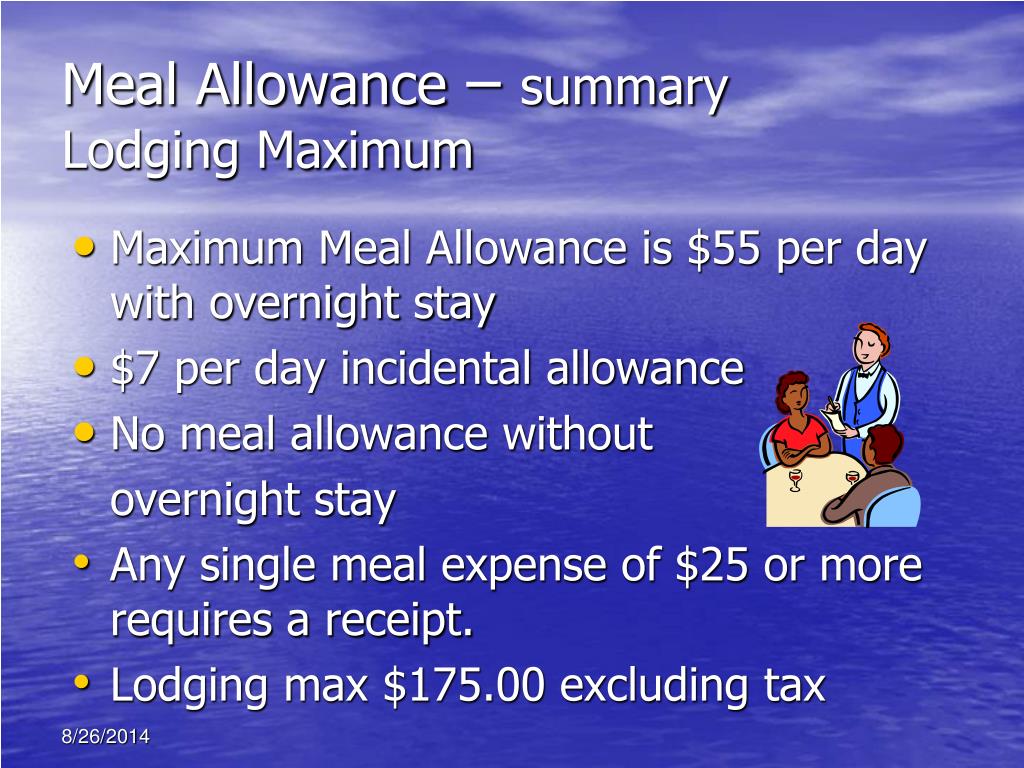

Generally reasonable allowance payments can be reported on payment summaries as part of salary or wages unless the exception applies in which case you don t have to report the allowances on payment summaries as salary or wages The exception applies where Per diem is an allowance paid to your employees for lodging meals and incidental expenses incurred when travelling This allowance is in lieu of paying their actual travel expenses Return to top 2 What is the federal per diem rate for my area Publication 1542 Per Diem Rates provides the rates for all continental U S

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

CI Post 2 Do Immigrants Pay Taxes

http://sites.psu.edu/jasminracquel/wp-content/uploads/sites/4979/2014/01/Undoc_Taxes_Infographic.jpg

https://edenred.fi/en/employer/employee-benefit-taxation

The lunch benefit i e meal benefit has been defined by the Tax Administration as 25 tax free The benefit is loaded to employees benefit accounts on a monthly basis The amount to be loaded varies according to the number of monthly working days of each employee The lunch benefit is working day specific and intended to

https://www.getmoss.com/guide/en/hmrc-meal-allowance-rates

As long as employees stick to these daily rates their employer doesn t have to pay tax on the expense allowance One of the most popular and widely used per diem expense allowances is the HMRC meal allowance It covers food and drink costs for travel both in the UK and overseas

DO YOU PAY TAXES ON DIVIDENDS An Explanation Of How Dividends Are

8 Reasons To Hire Someone To Help With Your Income Tax Planning Black

Do You Pay Taxes On Unemployment Benefits YouTube

How To Legally Never Pay Taxes Again YouTube

PPT University Travel Information PowerPoint Presentation Free

How Much Does An Employer Pay In Payroll Taxes Tax Rate

How Much Does An Employer Pay In Payroll Taxes Tax Rate

/GettyImages-182760257-56a4f3b73df78cf772857675.jpg)

What Are Payroll Taxes And Deductions

Why Should We Pay Tax YouTube

At What Point Do I Have To Pay Taxes On My Online Sales YouTube

Do You Pay Tax On Meal Allowance - Yes loved it Could be better No one offers more ways to get tax help than H R Block File with a tax pro File online When can you take a meal allowance as part of business travel deductions Learn more from the tax experts at H R Block