Do You Pay Tax On Rebates Web A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and therefore taxable

Web The IRS may be taxing rebates points and rewards and sending out 1099s How the IRS interprets taxing rebates points and rewards can be confusing at best For example your credit card rewards may be taxable income Sometimes however the IRS considers Web 1 d 233 c 2022 nbsp 0183 32 The eligibility requirements for tax rebates vary widely but generally taxpayers do not have to wait until they file next year s tax return to receive payment In many cases your tax rebate check isn t directly

Do You Pay Tax On Rebates

Do You Pay Tax On Rebates

https://img.hechtgroup.com/do_you_pay_tax_on_commercial_property.aspx

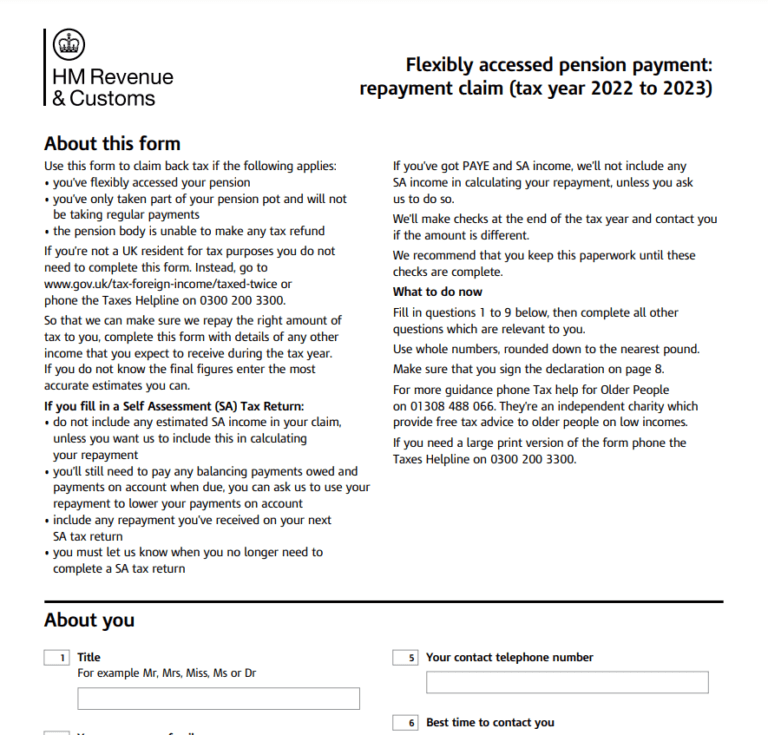

P55 Tax Rebate Form By State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/P55-Tax-Rebate-Form-768x735.png

IRS New Mexicans Won t Need To Pay Federal Taxes On Rebates Or Relief

https://i.ytimg.com/vi/NFzQz5Kevgo/maxresdefault.jpg

Web 22 d 233 c 2021 nbsp 0183 32 When coupons or certificates are accepted by retailers as a part of the selling price of any taxable item the value of the coupon or certificate is excludable from the tax as a cash discount regardless of whether the retailer is reimbursed for the amount Web Are sales taxes calculated before or after a rebate or incentive is applied The short answer is it depends on the state Please see What Fees Should You Pay for detailed information on

Web 9 sept 2023 nbsp 0183 32 So if you ve received a special state payment or are looking forward to one a question on your mind might be whether you ll have to pay tax on that money the IRS has offered an answer Web 11 mars 2023 nbsp 0183 32 Taxes Do You Have to Pay Taxes on a State Stimulus or Rebate Check from Last Year At least 22 states gave residents money back last year but only a few will need to report it on their

Download Do You Pay Tax On Rebates

More picture related to Do You Pay Tax On Rebates

Section 87A Tax Rebate Under Section 87A

https://www.nitsotech.com/blog/wp-content/uploads/2020/05/taxrebate87a.jpg

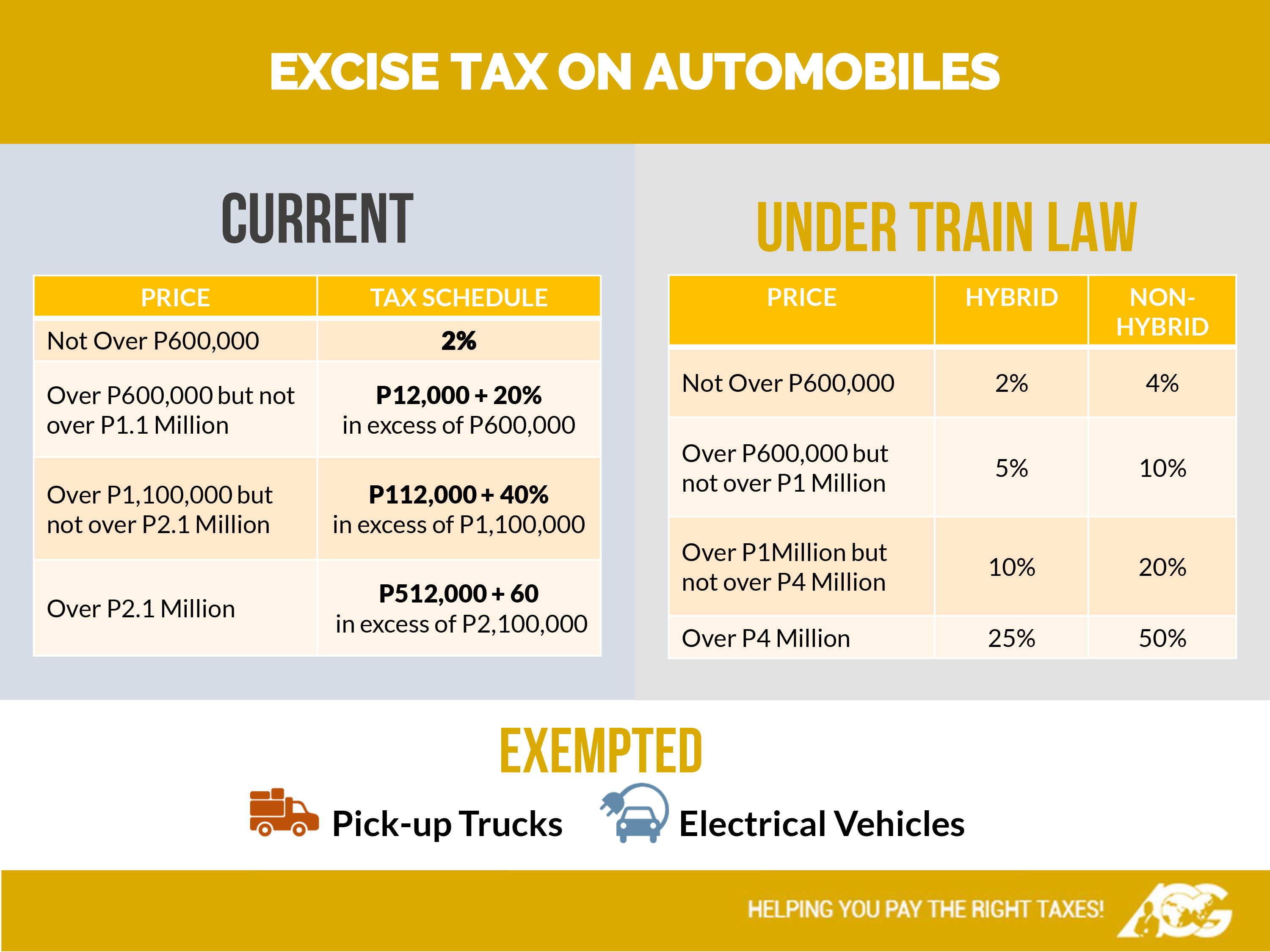

Property Tax Rebate Application Printable Pdf Download

https://data.formsbank.com/pdf_docs_html/140/1407/140793/page_1_bg.png

Pin On Payroll Accounting

https://i.pinimg.com/originals/38/4c/a5/384ca54b487af8d84263dae734038c6d.jpg

Web 23 ao 251 t 2023 nbsp 0183 32 You can get a refund on any taxable income you ve paid taxes on including Pay from your current or previous job Pension payments Income from a life or pension annuity A redundancy Web 13 f 233 vr 2023 nbsp 0183 32 For five other states it s a bit more nuanced but again the majority of filers in these states likely won t need to pay federal taxes on their rebates In Alaska tax filers won t pay federal

Web Insulation and weatherization 1 600 Unlike the tax credits these rebates are based on your income level If you make less than 80 of your area s median income you can receive a rebate for Web 6 avr 2023 nbsp 0183 32 You may be eligible for a tax rebate if you ve overpaid any tax or have yet to claim certain tax refunds during a financial year You can get a refund on any taxable income you ve

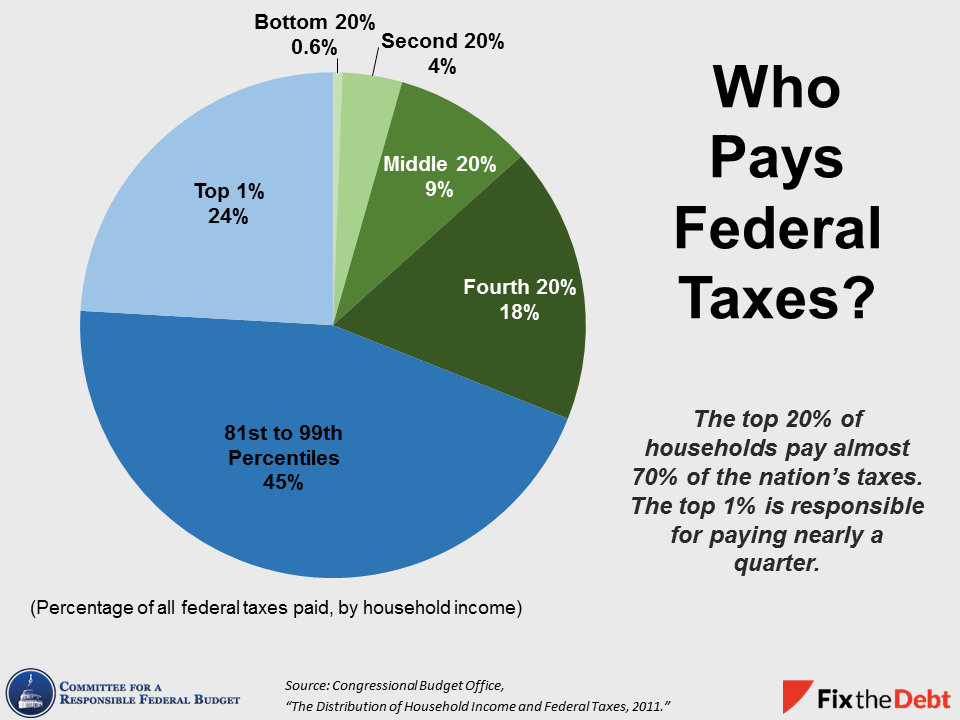

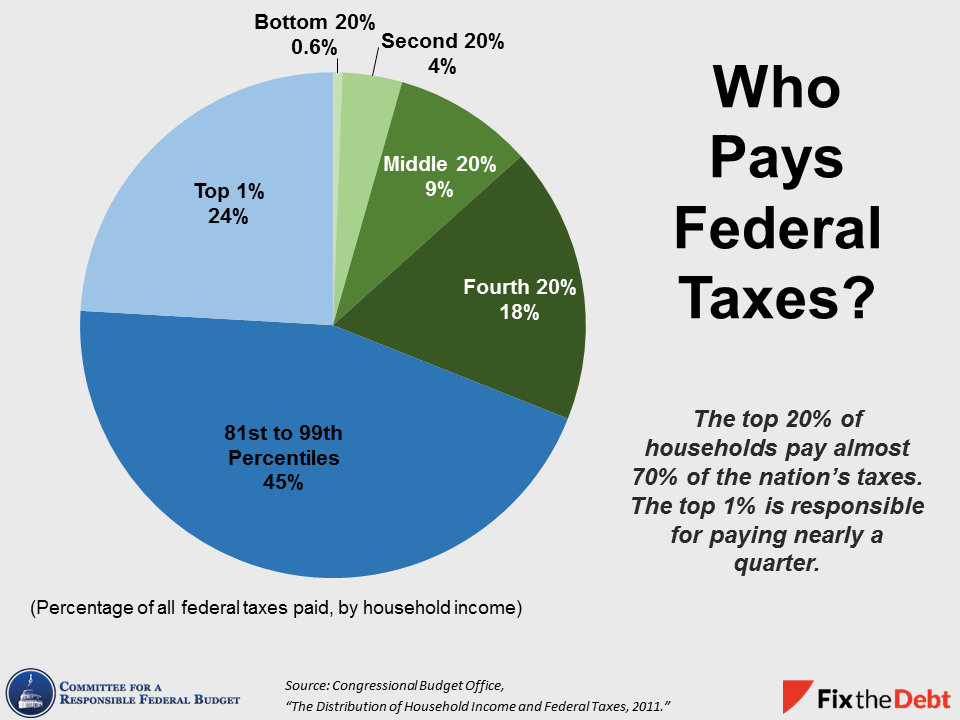

Media Elon Musk Offers To Buy Twitter Page 195 ChiefsPlanet

https://crfb.org/sites/default/files/3-whopaysfederaltaxes.png

Pakistan s Taxation Regime Discourages Self employment And Small

https://i.brecorder.com/primary/2022/05/62841ee17b543.jpg

https://donotpay.com/learn/are-rebates-taxable

Web A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking specific actions like opening a bank account it s considered income and therefore taxable

https://www.hackyourtax.com/taxing-rebates-points-rewards

Web The IRS may be taxing rebates points and rewards and sending out 1099s How the IRS interprets taxing rebates points and rewards can be confusing at best For example your credit card rewards may be taxable income Sometimes however the IRS considers

Are Taxes Deducted From Social Security Benefits

Media Elon Musk Offers To Buy Twitter Page 195 ChiefsPlanet

Do You Have To Pay Taxes On Unemployment Benefits Self Credit Builder

Cryptoasset And NFT Regulation Litigation And Tax Sterling law

Tips To Finding Tax Rebates Without The Hassle

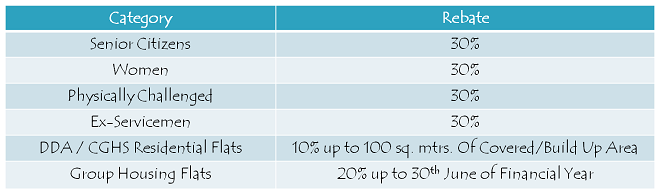

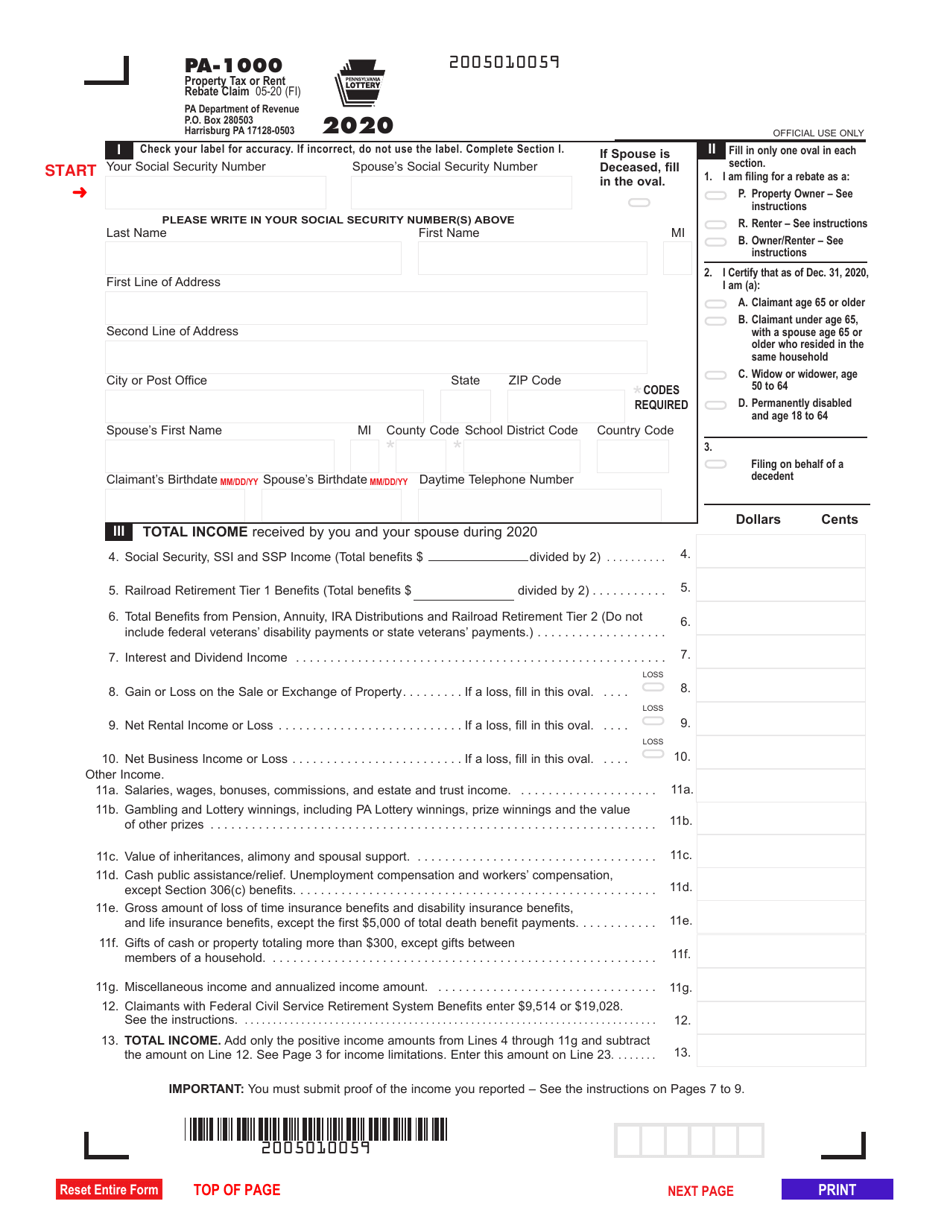

MCD Property Tax Calculating Tax Online Payment Past Payment

MCD Property Tax Calculating Tax Online Payment Past Payment

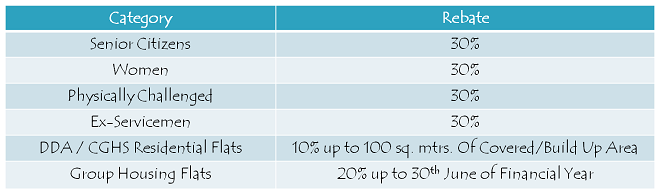

Do You Pay Taxes On Your Car Every Year At Hal McInerney Blog

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent

45 Ways To Reduce Your Carbon Tax Kuby Energy

Do You Pay Tax On Rebates - Web 9 sept 2023 nbsp 0183 32 So if you ve received a special state payment or are looking forward to one a question on your mind might be whether you ll have to pay tax on that money the IRS has offered an answer