Do You Pay Tax On Your State Pension In Ireland The State Pension is considered taxable income but whether you actually pay tax on it depends on your overall income Here s how to calculate it Start with your annual State Pension amount 14 404 for a full rate pension in 2024

State Pension Contributory is subject to tax but you are unlikely to pay tax if it is your only income If you have worked or lived in other countries such as the UK you might Personal pensions and occupational pensions are taxable sources of income They are liable to Income Tax and Universal Social Charge USC They may also be liable to

Do You Pay Tax On Your State Pension In Ireland

Do You Pay Tax On Your State Pension In Ireland

https://blackdiamondfs.com/wp-content/uploads/2021/08/taxfilingstatus.jpeg

You And Your UK State Pension Archway Private Wealth LLC Archway

https://archwayprivatewealth.us/wp-content/uploads/sites/5/2021/04/UK-state-pension.jpg

Changes Around The Corner For State Pension In Mason Hayes Curran

https://www.mhc.ie/uploads/images/Changes-Around-the-Corner-for-State-Pension-in-Ireland.jpg

To get a State Pension Contributory at 66 you must have started paying PRSI before the age of 56 The date you first started paying PRSI is called your date of entry into IMPORTANT ENSURE YOUR PENSION IS TAXED CORRECTLY The Revenue Commissioners can tell you the correct rate of income tax that you should pay on your pension

The state pension from the Department of Social Protection is liable for income tax However the state pension are exempt from both PRSI and the USC The required income tax is not deducted from your pension payments when they When you pay into your pension your pension contributions get income tax relief at the marginal rate You do not get relief on the Universal Social Charge USC or Pay Related Social

Download Do You Pay Tax On Your State Pension In Ireland

More picture related to Do You Pay Tax On Your State Pension In Ireland

State Pension In Ireland All You Need To Know Alpha Wealth

https://alphawealth.ie/wp-content/uploads/2023/07/State-Pension-In-Ireland.png

How Much Is The State Pension In Ireland Moneycube

https://moneycube.ie/wp-content/uploads/2018/09/mntgiwvdcy-1024x684.jpg

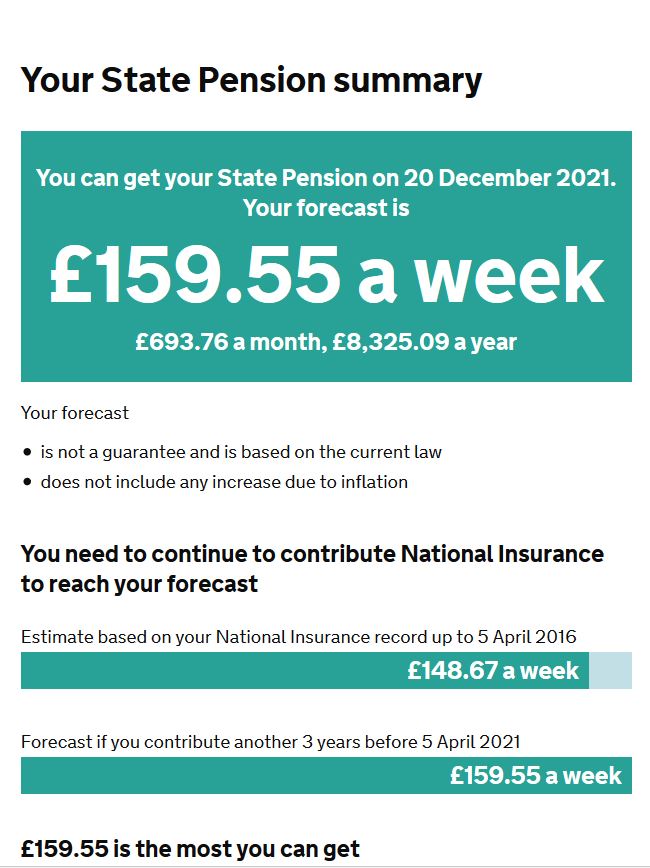

Your State Pension Forecast Explained Which

https://media.product.which.co.uk/prod/images/original/12b4afe2cd76-statepensiongraphicforgareth1.jpg

Is a State pension taxed In general if your only source of income is a State pension then even though the pension is taxable you will not pay income tax on your pension If you are over 65 you do not pay income tax if your income is The current state pension from January 2024 is 277 30 per week The pension is taxable but you are unlikely to pay tax if the State Pension is your only source of income If you retire at

You pay tax in a lump sum on your pension when you receive it however up to 200 000 of this is tax free If the lump sum is over 200 000 and under 500 000 the maximum allowable the income tax rate is 20 When you receive State Pension Contributory you will pay income tax on it if your total income is above certain limits The maximum rate of State Pension Contributory is

6 Improvements For Filing Your Freelance Taxes Next Year

https://i0.wp.com/www.smartbizpractices.com/wp-content/uploads/2015/04/Tax.jpg?resize=2000%2C1200&ssl=1

Do You Pay Tax On The State Pension Rules Explained Personal Finance

https://cdn.images.express.co.uk/img/dynamic/23/590x/secondary/do-you-pay-tax-on-state-pension-3113239.jpg?r=1624458547081

https://secureyourfuture.ie › pensions › ho…

The State Pension is considered taxable income but whether you actually pay tax on it depends on your overall income Here s how to calculate it Start with your annual State Pension amount 14 404 for a full rate pension in 2024

https://www.gov.ie › en › service

State Pension Contributory is subject to tax but you are unlikely to pay tax if it is your only income If you have worked or lived in other countries such as the UK you might

State Pension MbarakDaeney

6 Improvements For Filing Your Freelance Taxes Next Year

Pensions In Ireland Qifa Financial Planners Financial Advice 022 57444

Will The State Pension Age Increase To 75 How Old You Will Be When You

How To Check What Your State Pension Will Be Pounds And Sense

UK State Pension Age Forecast How Much Will You Get YouTube

UK State Pension Age Forecast How Much Will You Get YouTube

Life Of Tax How Much Tax Is Paid Over A Lifetime Self

List 93 Background Images Is It Illegal To Print Money On Paper Stunning

100 OFF US Income Tax Preparation IRS Tutorial Bar

Do You Pay Tax On Your State Pension In Ireland - Under Irish tax law you can take up to 25 of the value of your pension fund as a tax free lump sum up to a maximum lifetime limit of 200 000 This means that the maximum pension size