Do You Pay Taxes On Rebates Over 600 Web A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking

Web 11 f 233 vr 2021 nbsp 0183 32 The second was up to 600 per person plus 600 for each child Individuals with income of up to 75 000 112 500 for individuals filing as head of household Web 12 juin 2023 nbsp 0183 32 If you earn 600 or more in taxable rewards you may receive a 1099 from your credit card company If you earn less you ll

Do You Pay Taxes On Rebates Over 600

Do You Pay Taxes On Rebates Over 600

https://images.ctfassets.net/90p5z8n8rnuv/x7uT6H5jT8Ua0kXRSpCKS/58e493332e498c7ecd2f41e4614025dd/Do_You_Have_To_Pay_Taxes_on_Unemployment_Benefits_Asset_-_01.jpg

Do You Pay Tax On Lost Stolen Or Hacked Crypto CoinMarketCap

https://academy-public.coinmarketcap.com/srd-optimized-uploads/56c4f404bbba44608f7ea50056155230.png

What Is FUTA Understanding The Federal Unemployment Tax Act Camino

https://img.caminofinancial.com/wp-content/uploads/2019/10/30005001/Do-You-Need-To-File-Taxes-As-a-Small-Business-Owner_-1-730x516.jpg

Web 18 f 233 vr 2023 nbsp 0183 32 Under the new rules set forth by the IRS if you got paid more than 600 for the transaction of goods and services through third party payment platforms you will Web 5 f 233 vr 2023 nbsp 0183 32 IF you received a rebate in 2022 you might have to pay taxes on it and Americans are fuming over it This might apply if you live in the state of California

Web Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be Web 22 f 233 vr 2022 nbsp 0183 32 The IRS is coming after anyone who receives over 600 in payments for goods or services processed by third party payment apps like Paypal or Venmo

Download Do You Pay Taxes On Rebates Over 600

More picture related to Do You Pay Taxes On Rebates Over 600

Cryptoasset And NFT Regulation Litigation And Tax Sterling law

https://sterling-law.co.uk/wp-content/uploads/2023/02/na-cryptocurrency-tax-guide.jpg

Hecht Group Who Is Responsible For Commercial Property Taxes In

https://img.hechtgroup.com/do_you_pay_tax_on_commercial_property.aspx

How Much Tax On Stock BERITA EKONOMI

https://i2.wp.com/photos.demandstudios.com/getty/article/114/113/76800061.jpg

Web The IRS may be taxing rebates points and rewards and sending out 1099s How the IRS interprets taxing rebates points and rewards can be confusing at best For example Revendication 160 There Is NO 600 Tax Rule For Users Making Personal Payments On Cash App PayPal Others

Web 6 juin 2019 nbsp 0183 32 The short answer to this kind of question is no Rebates in general are not taxable income to an individual taxpayer unless that person first took a tax deduction Web 6 d 233 c 2022 nbsp 0183 32 If you earn over 600 from any platform even if not issued a form by the platform you must submit the 1099 K form with your tax return Though this rule

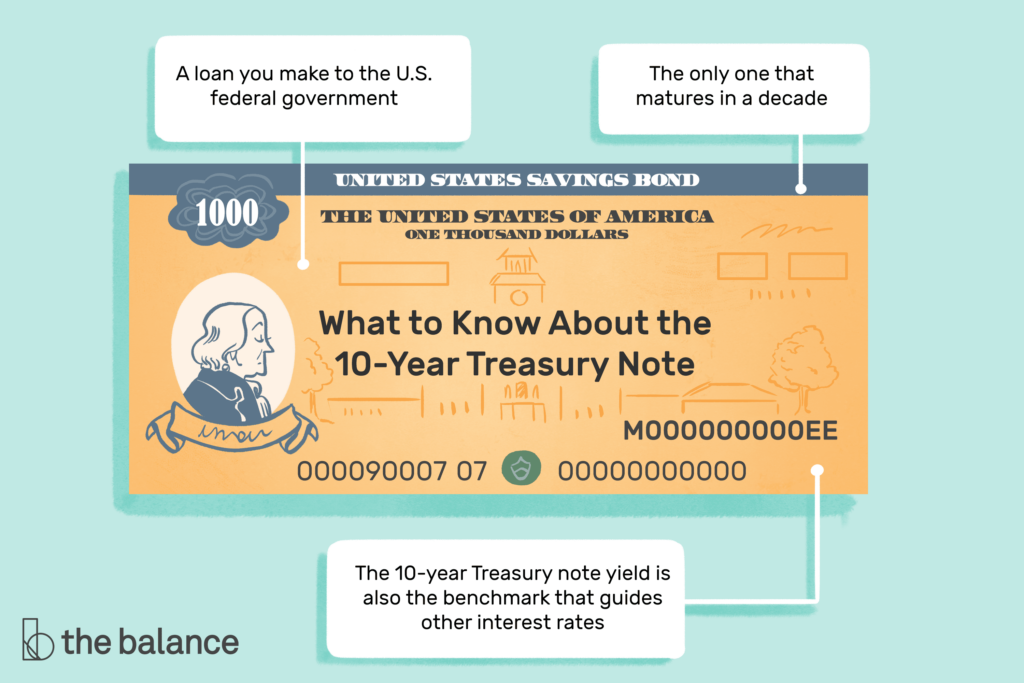

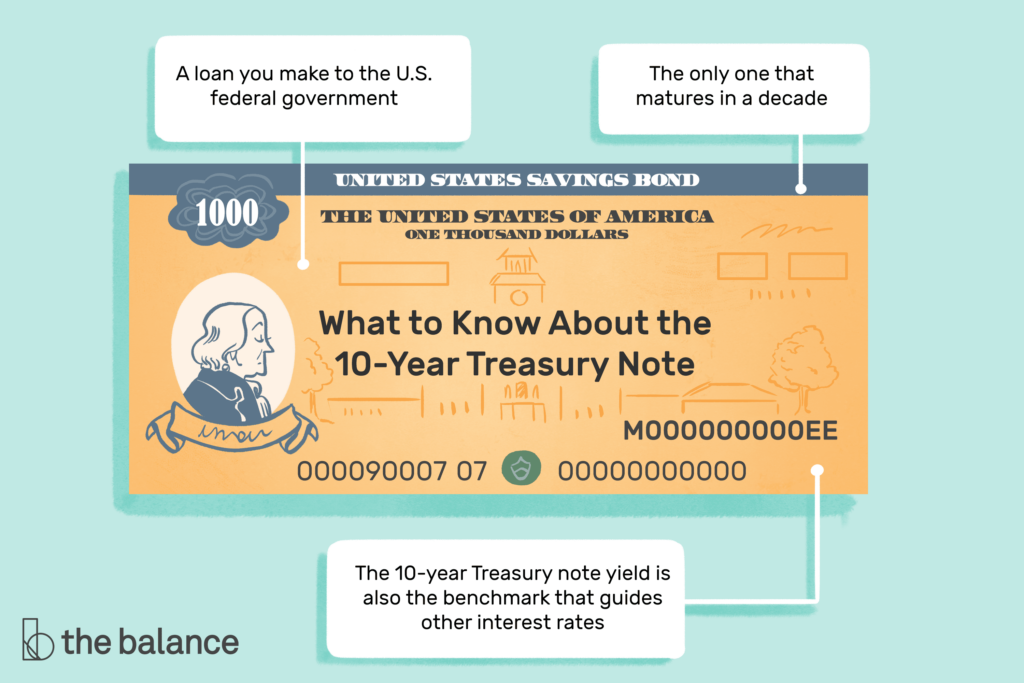

Do You Pay Tax On Loan Notes Note Brokering

https://notebrokering.com/wp-content/uploads/2022/02/Do-you-pay-tax-on-loan-notes-1024x683.png

Do You Pay Tax On HSN Vakilsearch

https://vakilsearch.com/blog/wp-content/uploads/2023/03/Do-You-Pay-Tax-on-HSN_.jpg

https://donotpay.com/learn/are-rebates-taxable

Web A rebate is not subject to tax it is considered a reduction of the item s price and works in the same way as a direct discount However if the reward is offered as a gift for taking

https://www.nytimes.com/2021/02/11/your-money/stimulus-money-taxable...

Web 11 f 233 vr 2021 nbsp 0183 32 The second was up to 600 per person plus 600 for each child Individuals with income of up to 75 000 112 500 for individuals filing as head of household

Sss New Contribution Table 2019 Effective April 2019 Gambaran

Do You Pay Tax On Loan Notes Note Brokering

Do You Have To Pay Taxes On Your Car Every Year

IRS Suggests Californians Hold Off On Filing Taxes Over Gas Tax Rebate

Do You Pay Taxes On Bitcoin TaxesTalk

Your Guide To Crypto Tax Do You Pay Tax On Cryptocurrency

Your Guide To Crypto Tax Do You Pay Tax On Cryptocurrency

Carolyn Wood On Twitter RT POTUS When It Came Time To Actually Do

Poster Calling For Annual Tax Payment Pay Taxes Vector Image

Do You Pay Tax On Equity Release

Do You Pay Taxes On Rebates Over 600 - Web 22 f 233 vr 2022 nbsp 0183 32 The IRS is coming after anyone who receives over 600 in payments for goods or services processed by third party payment apps like Paypal or Venmo