Do You Pay Taxes On Tax Refunds You ll likely get a refund if your tax withholdings or estimated payments exceed your tax liability for a tax year

Taxpayers get tax refunds when they overpay federal or state taxes Find out how tax refunds work and use these tips to prepare for your next tax season While your IRS refund remains non taxable your state refund is taxable This means you will need to include the state refund as income on your tax return for the year you received it

Do You Pay Taxes On Tax Refunds

Do You Pay Taxes On Tax Refunds

https://stophavingaboringlife.com/wp-content/uploads/2020/11/tax-time-1536x1086.jpeg

Tips To Get A Bigger Tax Refund This Year Money Savvy Living

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Paying Taxes The Pros And Cons Of Doing It With A Credit Card

https://www.gannett-cdn.com/-mm-/2836aaa5a122ccfaf3f251ad914b02ff84c86c72/c=0-103-2128-1305/local/-/media/2017/04/03/USATODAY/USATODAY/636268502332211071-GettyImages-495699718.jpg?width=3200&height=1680&fit=crop

A tax refund is a state or federal reimbursement to a taxpayer who overpaid the taxes that they owed for the year often by having too much withheld from their paychecks You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses

Refunds of state and local taxes are sometimes included as taxable income on a federal tax return Here are the rules and how you can report this income If you paid more through the year than you owe in tax you may get money back Even if you didn t pay tax you may still get a refund if you qualify for a refundable credit To get your refund you must file a return You have 3 years to claim a tax refund Refund Claim it or lose it video 2 05

Download Do You Pay Taxes On Tax Refunds

More picture related to Do You Pay Taxes On Tax Refunds

Why Tax Refunds Are Shrinking Under First Trump Tax Cut

https://www.gannett-cdn.com/-mm-/9e1f6e2ee20f44aa1f3be4f71e9f3e52b6ae2c7e/c=0-110-2121-1303/local/-/media/2019/02/12/USATODAY/usatsports/tax-refund_gettyimages-663281702.jpg?width=3200&height=1680&fit=crop

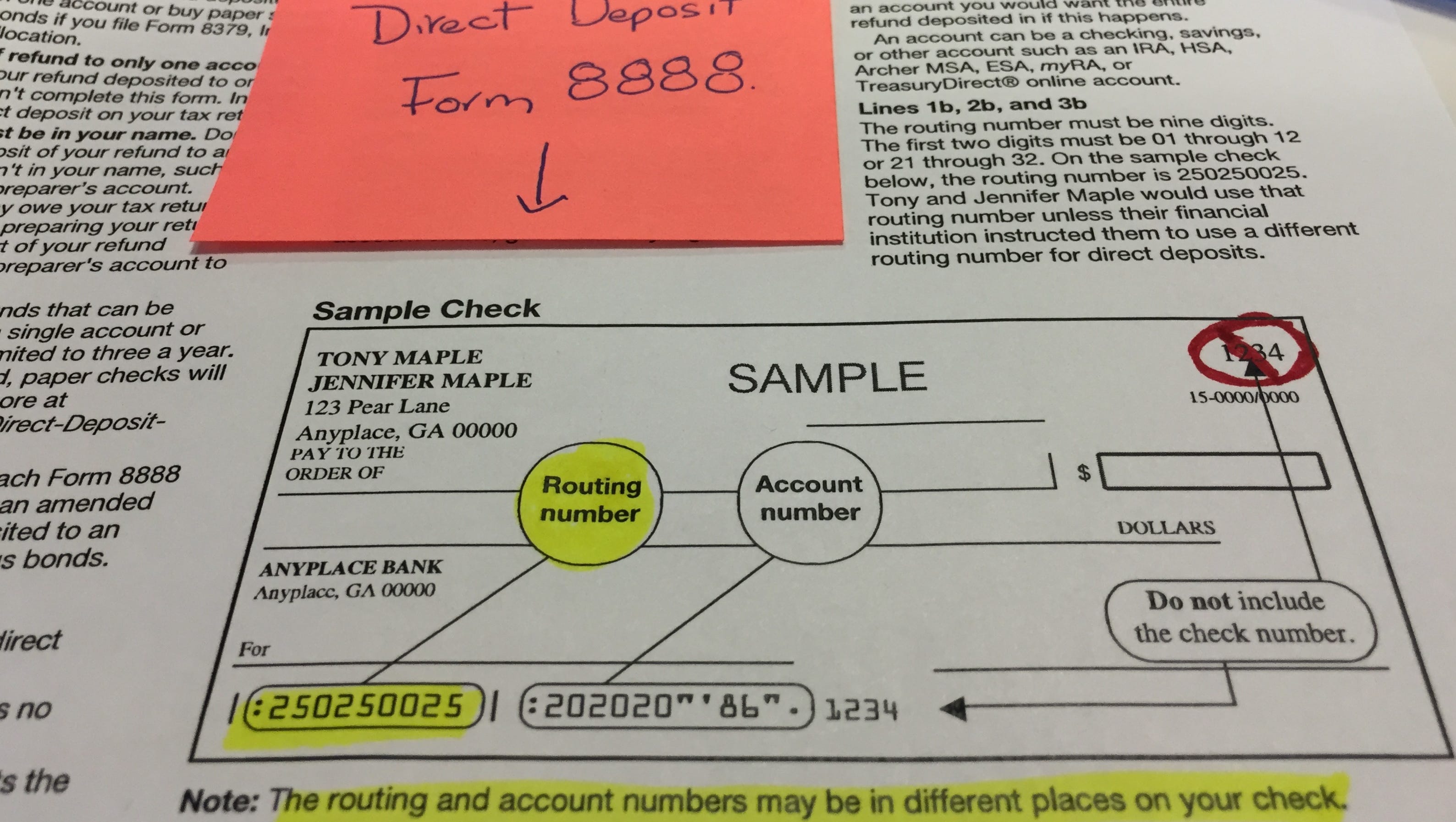

Direct Deposit For Tax Refunds Can Go Very Wrong

https://www.gannett-cdn.com/-mm-/a995824499c81ccaa3f9f23a73e4a0e2c69b891d/c=0-477-3176-2271/local/-/media/2016/03/28/DetroitFreePress/DetroitFreePress/635947703481971388-FullSizeRender.jpg?width=3176&height=1794&fit=crop&format=pjpg&auto=webp

How To Pay Taxes Quarterly A Simple Tax Guide For The Self Employed

https://www.gkaplancpa.com/wp-content/uploads/2020/11/how-to-pay-taxes-quarterly.jpeg

For these individuals state payments will not be included for federal tax purposes if the payment is a refund of state taxes paid and either the recipient claimed the standard deduction or itemized their deductions but did not receive a tax benefit See your personalized refund date as soon as the IRS processes your tax return and approves your refund See your status starting around 24 hours after you e file or 4 weeks after you mail a paper return

In most cases the deadline for paying a tax bill is November 21 But if the assessment of your tax return is issued after 31 October you ll have 21 days after the date the assessment issued Airlines in the United States are now required to give passengers cash refunds if their flight is significantly delayed or canceled even if that person does not explicitly ask for a refund

8 Ways To Pay Less In Taxes And Save Money Business Tax Tax

https://i.pinimg.com/originals/f3/3f/96/f33f9697cbf4b37e6f4f972bfc18d500.jpg

3 Reasons You Shouldn t Receive A Tax Refund Next Year GOBankingRates

https://cdn.gobankingrates.com/wp-content/uploads/2020/05/IRS-Tax-Refund-check-shutterstock_1640116444.jpg

https://money.usnews.com › money › personal-finance › ...

You ll likely get a refund if your tax withholdings or estimated payments exceed your tax liability for a tax year

https://smartasset.com › taxes › what-you-should-know...

Taxpayers get tax refunds when they overpay federal or state taxes Find out how tax refunds work and use these tips to prepare for your next tax season

How To Pay Payroll Taxes A Step by step Guide

8 Ways To Pay Less In Taxes And Save Money Business Tax Tax

Ca Tax Brackets Chart Jokeragri

How To Increase The Value Of A Business By Paying More Taxes

How To Legally Never Pay Taxes Again YouTube

The Importance Of Paying Your Taxes University Herald

The Importance Of Paying Your Taxes University Herald

Are You In Trouble With The IRS Here s How To Get Out

How To File Your LLC Tax Return The Tech Savvy CPA

How Much Does An Employer Pay In Payroll Taxes Tax Rate

Do You Pay Taxes On Tax Refunds - Britons are doubtful that public services can be fixed solely by increasing taxes on the rich 38 or businesses 25 although they do tend to think this is possible solely by increasing taxes on businesses and the rich by 48 to 34 Away from tax options few 14 think that increasing government borrowing alone has a realistic