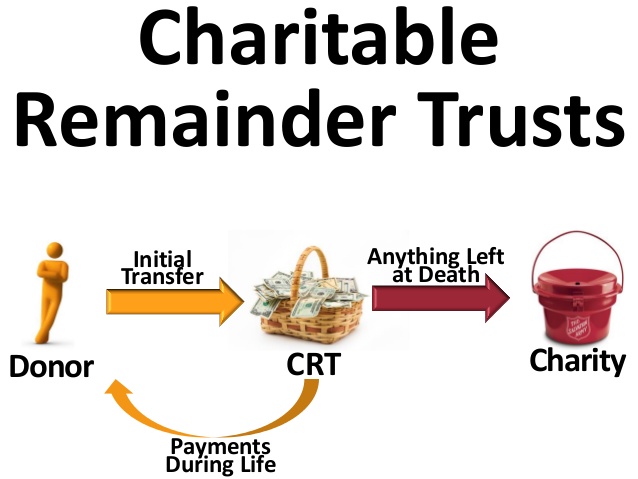

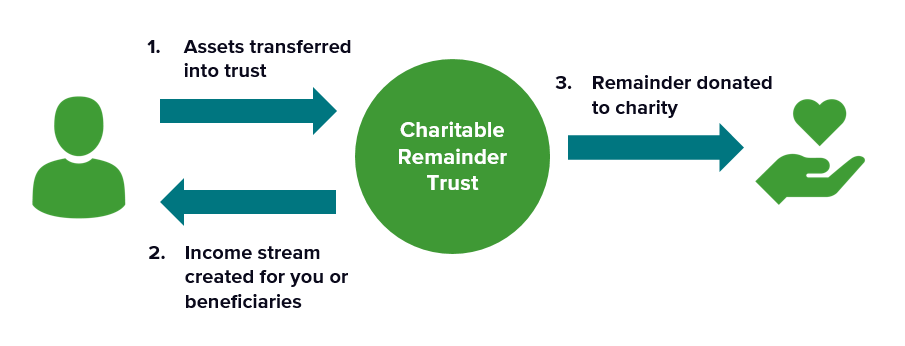

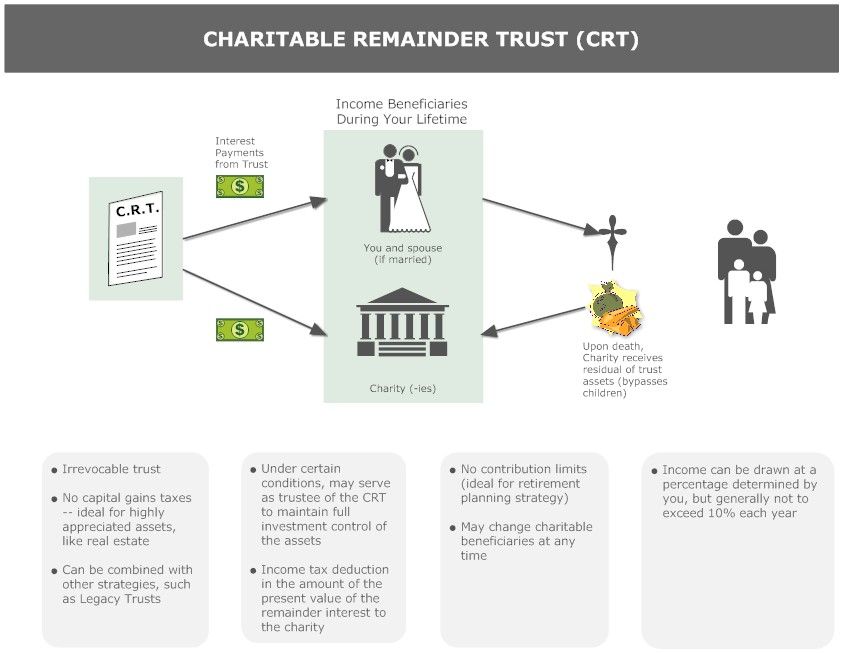

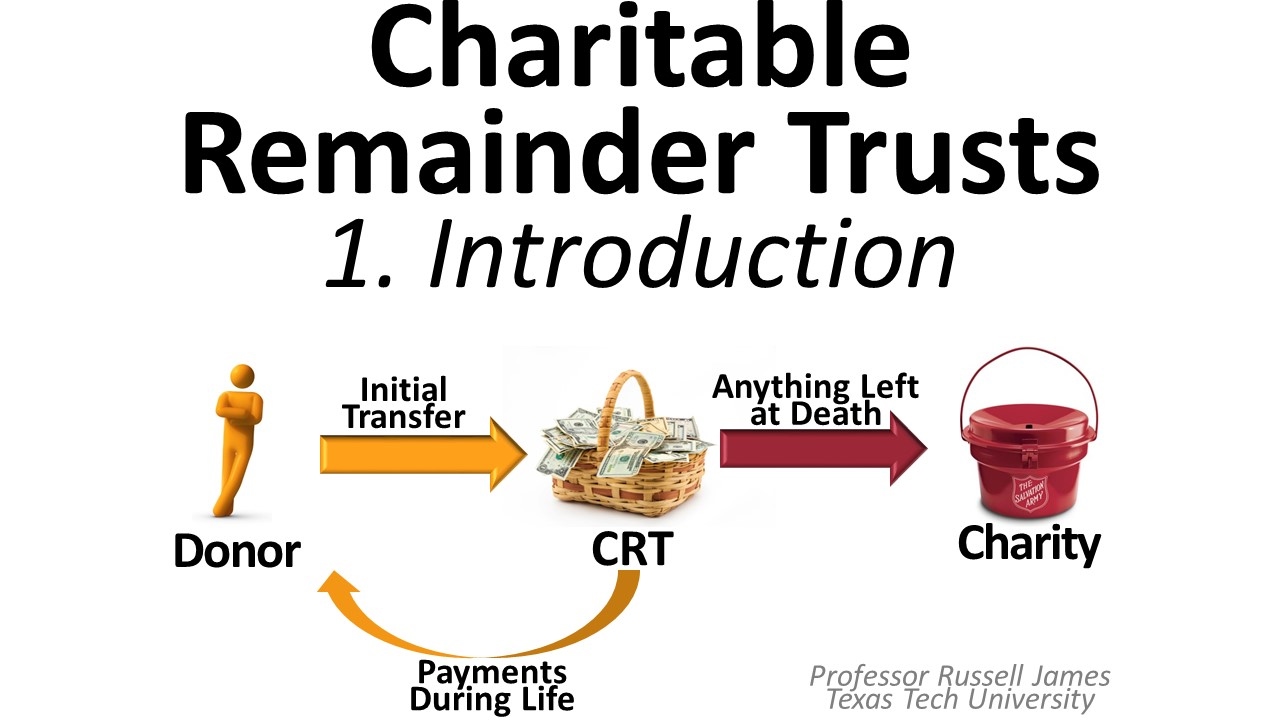

Does A Charitable Remainder Trust File A Tax Return Charitable remainder trusts are not a part of your taxable estate and are not taxable even though someone may be receiving income throughout their lifetime or for a set term Instead a CRT is considered a separate entity from your estate and from the estate of your named beneficiary

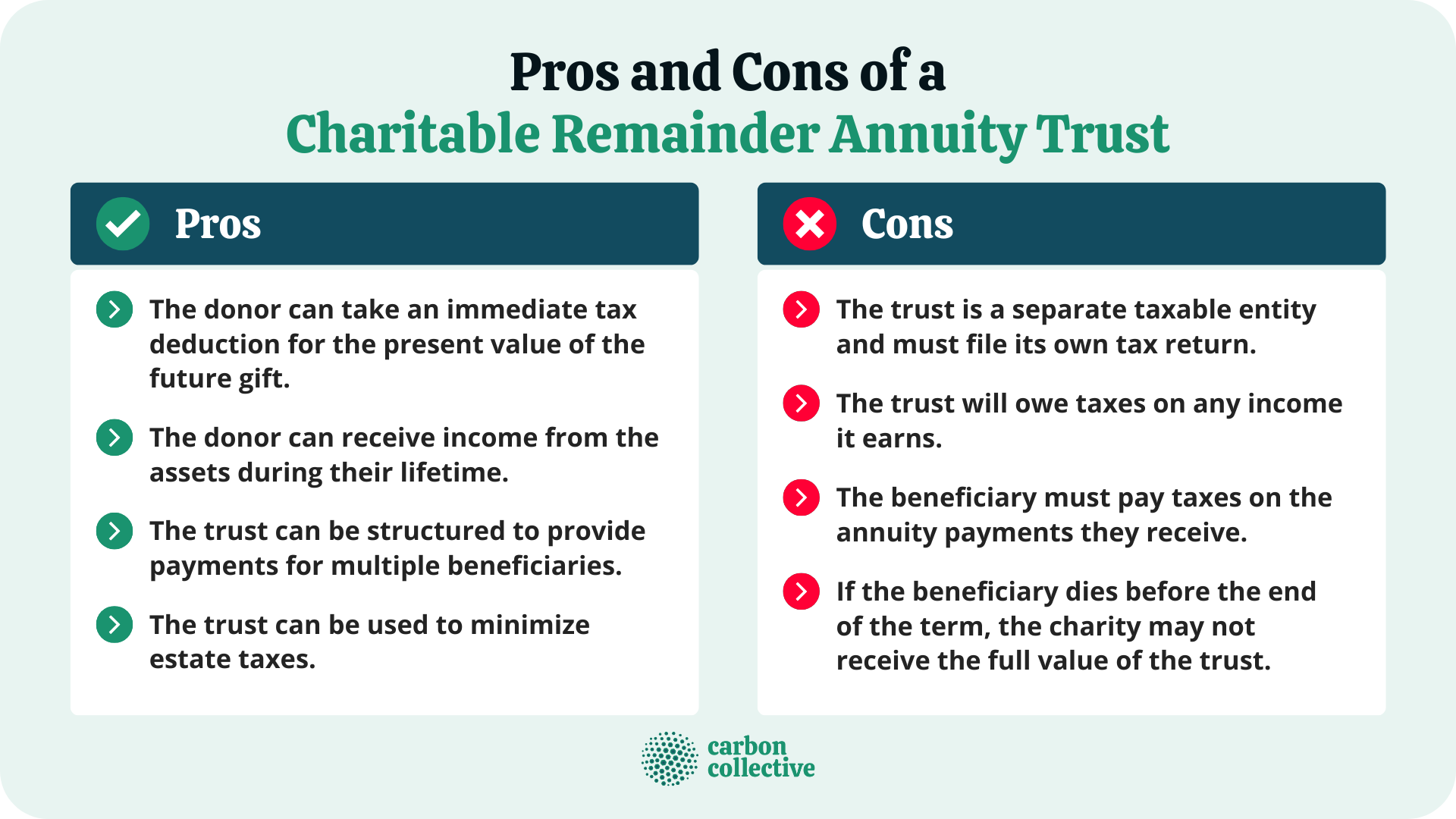

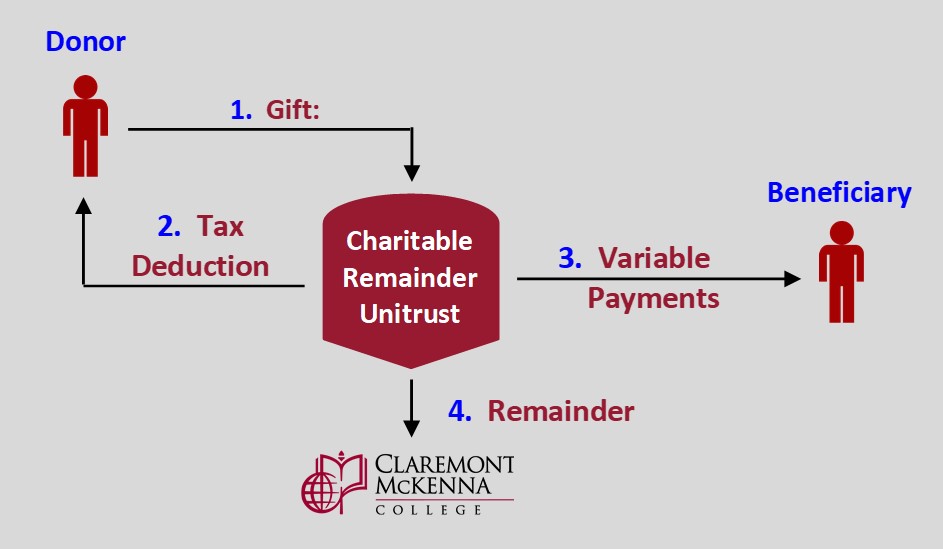

The Charitable Remainder Annuity Trust or CRAT pays a fixed income stream to the taxpayer that is based on a taxpayer chosen percentage of the fair market value of the asset or assets gifted to the CRAT on the date of the initial gift This payment does not change during the course of the CRAT hence the description as an annuity If a charitable remainder trust has any unrelated business taxable income within the meaning of section 512 and related regulations for 2023 the trust is liable for a tax under section 664 c 2 which is treated as a Chapter 42 excise tax

Does A Charitable Remainder Trust File A Tax Return

Does A Charitable Remainder Trust File A Tax Return

https://www.carboncollective.co/hs-fs/hubfs/Pros_and_Cons_of_a_Charitable_Remainder_Annuity_Trust.png?width=2880&height=1620&name=Pros_and_Cons_of_a_Charitable_Remainder_Annuity_Trust.png

Charitable Remainder Trust Online Form Fill Out And Sign Printable

https://www.signnow.com/preview/497/328/497328746/large.png

Remainder Unitrust Get Form Fill Out And Sign Printable PDF Template

https://www.signnow.com/preview/497/332/497332974/large.png

A charitable remainder trust is a tax exempt irrevocable trust designed to reduce the taxable income of individuals A charitable remainder trust dispenses income to one or more Yes a charitable remainder trust must file the following forms IRS Form 5227 Split Interest Trust Information Return Filed with the Internal Revenue Service This form is due by April 15 and may be extended to July 15 and October 15

CASE STUDY Computing the Charitable Tax Deduction for a Charitable Remainder Trust February 28 2014 Editor Albert B Ellentuck Esq The donor s charitable contribution for funding a charitable remainder annuity trust CRAT is the value of the property placed in the CRAT less the present value of the CRAT s annuity payments A charitable remainder trust is an irrevocable tax exempt trust that creates a split interest consisting of an income interest paid throughout the trust term and a remainder interest distributed at the end of the trust term

Download Does A Charitable Remainder Trust File A Tax Return

More picture related to Does A Charitable Remainder Trust File A Tax Return

What Are Charitable Lead Trusts And How Do They Work

https://www.wealthenhancement.com/cms/delivery/media/MCUFEU3IOIEJE3FJ3SCXJF43ZZS4

Charitable Remainder Trust Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/328/497328745/large.png

Charitable Remainder Trusts Friends University

https://www.friends.edu/wp-content/uploads/2016/04/CRT.jpg

While charitable remainder trusts are tax exempt entities distributions from them are generally subject to taxation Non charitable beneficiaries pay taxes on the income they Nerdy Tip Charitable trusts support IRS qualified public charities and private philanthropic foundations they must meet specific requirements to qualify for tax exempt status Otherwise

A charitable remainder unitrust CRUT is an irrevocable tax exempt trust that generates income and provides a charitable donation to a chosen charity It can be used to reduce taxable Income Tax Deduction Once you sign a legal agreement to transfer your assets to any of the CRTs you are eligible to receive a charitable income tax deduction for the current value of the remainder interest that is currently going to the charity foundation Depending upon the CRT type or the payout rate the exact deduction will then be

Charitable Remainder Trust Calculator NikiZsombor

https://giftplanning.cmc.edu/sites/cmc/files/sync/2021-05/6494crut.jpg

What Is A Charitable Remainder Trust Independent Financial Services

https://www.ifstampabay.com/wp-content/uploads/2022/04/charitable-remainder-trust-inheritance-estate-planning-beneficiaries-tax-exempt-liabilities-tea-set-1000x675.jpg

https://www.magellanplanning.com/blog/how-to-file...

Charitable remainder trusts are not a part of your taxable estate and are not taxable even though someone may be receiving income throughout their lifetime or for a set term Instead a CRT is considered a separate entity from your estate and from the estate of your named beneficiary

https://actecfoundation.org/podcasts/charitable...

The Charitable Remainder Annuity Trust or CRAT pays a fixed income stream to the taxpayer that is based on a taxpayer chosen percentage of the fair market value of the asset or assets gifted to the CRAT on the date of the initial gift This payment does not change during the course of the CRAT hence the description as an annuity

Charitable Remainder Trust Texas A M Foundation

Charitable Remainder Trust Calculator NikiZsombor

How To Generate Income In Retirement With CRTs

Charitable Remainder Trusts CRT Frequently Asked Questions

Eric Affeltranger CPA What Is A Charitable Remainder Trust

Charitable Remainder Trust Guide Learn With Valur

Charitable Remainder Trust Guide Learn With Valur

Charitable Remainder Trust Definition Taxation Pros Cons

Charitable Remainder Trusts 1 Introduction YouTube

Good Business The Use Case For A Charitable Remainder Trust Tremonte Tax

Does A Charitable Remainder Trust File A Tax Return - Yes a charitable remainder trust must file the following forms IRS Form 5227 Split Interest Trust Information Return Filed with the Internal Revenue Service This form is due by April 15 and may be extended to July 15 and October 15