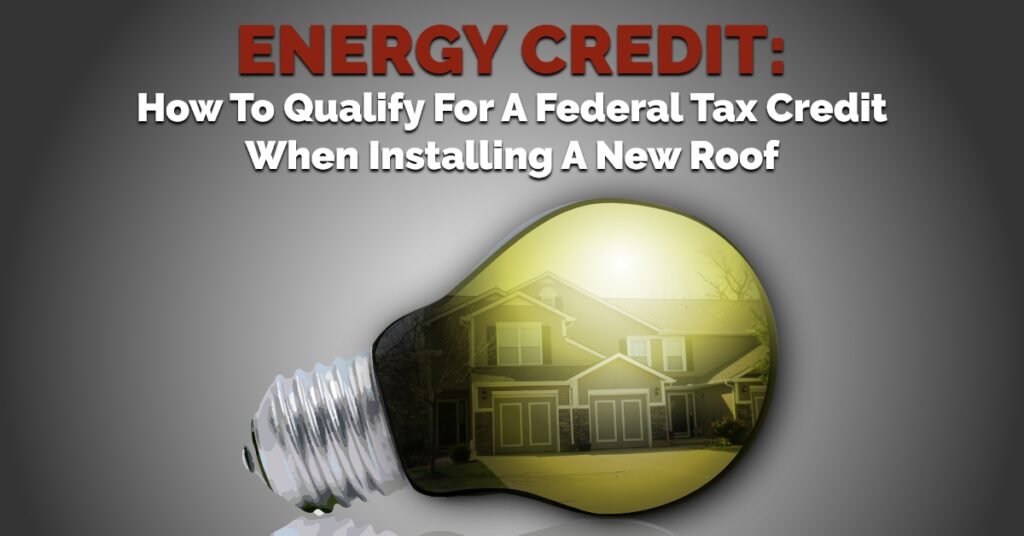

Does A Roof Qualify For The Energy Tax Credit Eligibility Criteria To qualify for and claim the Energy Star Roof Tax Credit homeowners must meet the following criteria Energy Star Certification Homeowners must

Is a roof eligible for the residential energy efficient property tax credit A In general traditional roofing materials and structural components do not qualify for the credit Generally expenses made to upgrade or replace a roof in preparation for installing solar panels and related equipment aren t qualified to claim the Residential Clean Energy Credit because they primarily serve as

Does A Roof Qualify For The Energy Tax Credit

Does A Roof Qualify For The Energy Tax Credit

https://www.armaninollp.com/-/media/images/articles/energy-tax-credits-infographic.jpg

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg)

Clean Energy Tax Credits Mostly Go To The Affluent Is There A Better

https://cdn.vox-cdn.com/thumbor/WuOuOQRdPx1e96FGTdEFcOHebJ8=/0x0:1000x669/1200x800/filters:focal(525x411:685x571)/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg

The Complete List Of Cars Eligible For The 7 500 EV And PHEV Federal

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

Use these steps for claiming a residential clean energy tax credits Step 1 Check eligibility Make sure the property on which you are installing the energy property is If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified newly installed

For qualifying property placed in service after 2022 the nonbusiness energy property credit has been expanded and renamed as the energy efficient home improvement credit Tax Credit Amount 10 of the cost up to 500 NOT INCLUDING INSTALLATION Requirements Metal roofs with appropriate pigmented coatings and

Download Does A Roof Qualify For The Energy Tax Credit

More picture related to Does A Roof Qualify For The Energy Tax Credit

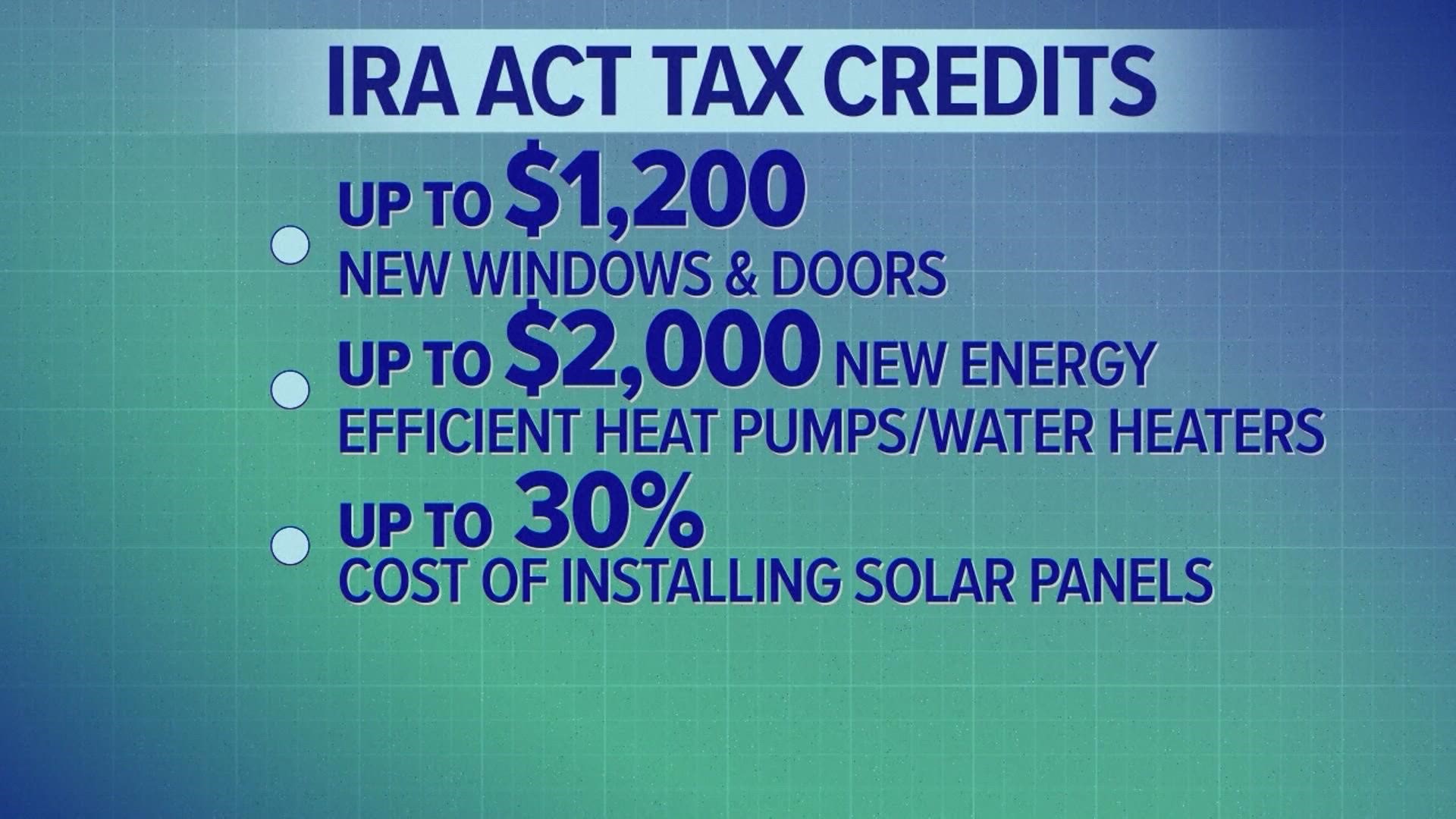

Inflation Reduction Act Increases Home Energy Tax Credits Wfaa

https://media.wfaa.com/assets/WFAA/images/e2c1cb63-8375-4e50-be65-6c75edcd8446/e2c1cb63-8375-4e50-be65-6c75edcd8446_1920x1080.jpg

What Qualifies For The Energy Tax Credit

https://s3media.angieslist.com/s3fs-public/HOUSE-~1.jpeg

Do You Qualify For A Home Energy Tax Credit Benefyd

https://www.benefyd.com/wp-content/uploads/2016/02/home-energy-tax-credits0.png

If you replaced or added a new roof to your home between 2017 and 2022 and did not yet claim it you could qualify for an energy efficient home improvement tax credit for as much as 10 of the cost not including installation costs up Solar Roofs Installing solar panels as part of your roofing system not only generates renewable energy but also qualifies for significant tax incentives including the

The cost of increasing the insulation and reducing air leaks in a home may be eligible for a federal tax credit when the improvements meet the 2021 International Energy Conservation Code IECC The 2021 IECC The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the taxpayer Other types

Energy Tax Credits Armanino

https://www.armanino.com/-/media/images/hero/energy-tax-credits.jpg

Solar Energy Tax Credit Basics

https://s2.studylib.net/store/data/009906505_1-1c8209be4201d8616781301da40ba34d-768x994.png

https://nationaltaxreports.com/energy-star-roof-tax-credit

Eligibility Criteria To qualify for and claim the Energy Star Roof Tax Credit homeowners must meet the following criteria Energy Star Certification Homeowners must

/cdn.vox-cdn.com/uploads/chorus_image/image/47733023/tax-credits.0.jpg?w=186)

https://www.irs.gov/newsroom/energy-incentives-for...

Is a roof eligible for the residential energy efficient property tax credit A In general traditional roofing materials and structural components do not qualify for the credit

Home Energy Tax Credits Will Ease The Pain Of An Ailing A C

Energy Tax Credits Armanino

Energy Credits How To Qualify For A Federal Tax Credit When Installing

The Residential Renewable Energy Tax Credit Is A Little known

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Federal Solar Tax Credit What It Is How To Claim It For 2024

Federal Solar Tax Credit What It Is How To Claim It For 2024

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2023 Residential Clean Energy Credit Guide ReVision Energy

Equipment Tax Credits For Primary Residences About ENERGY STAR

Does A Roof Qualify For The Energy Tax Credit - Use these steps for claiming a residential clean energy tax credits Step 1 Check eligibility Make sure the property on which you are installing the energy property is