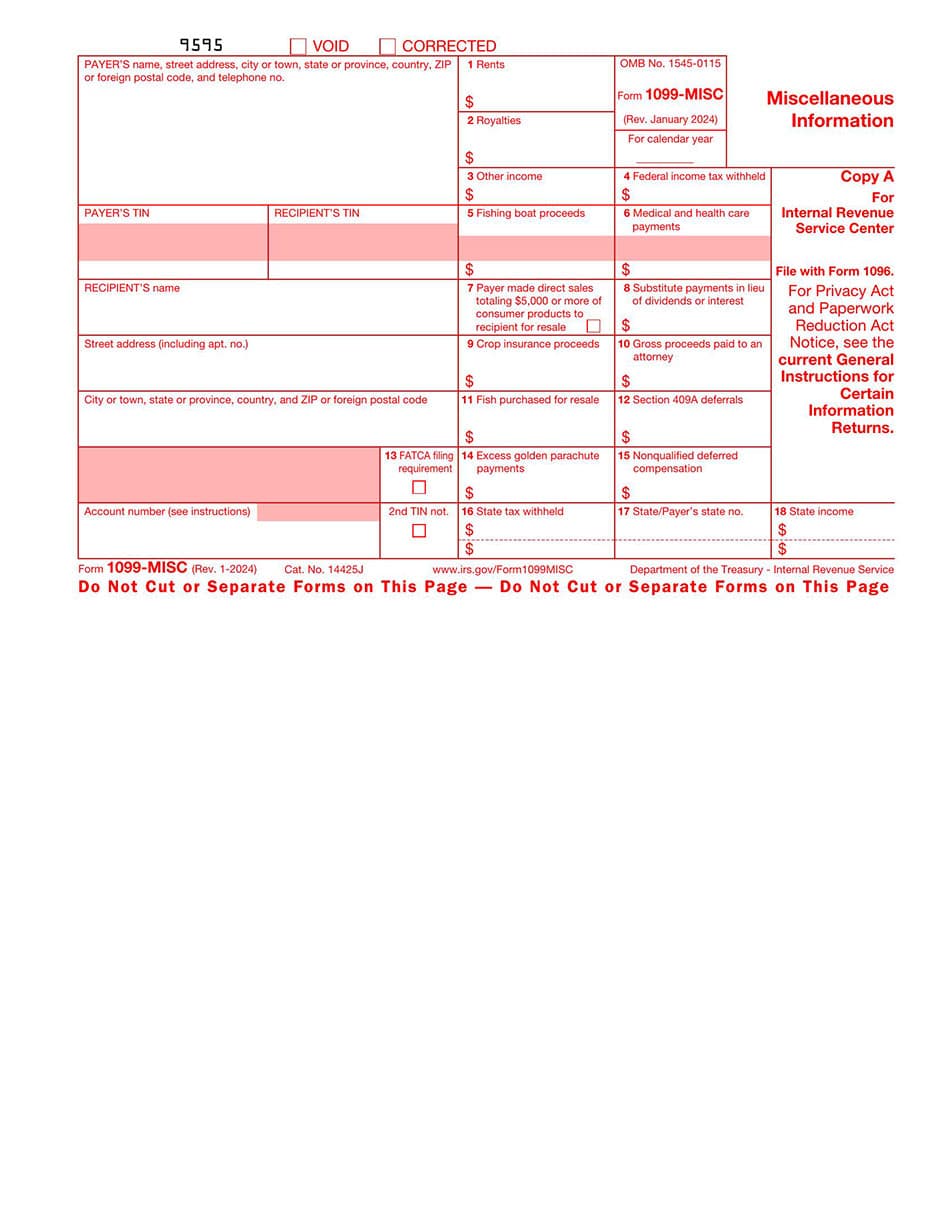

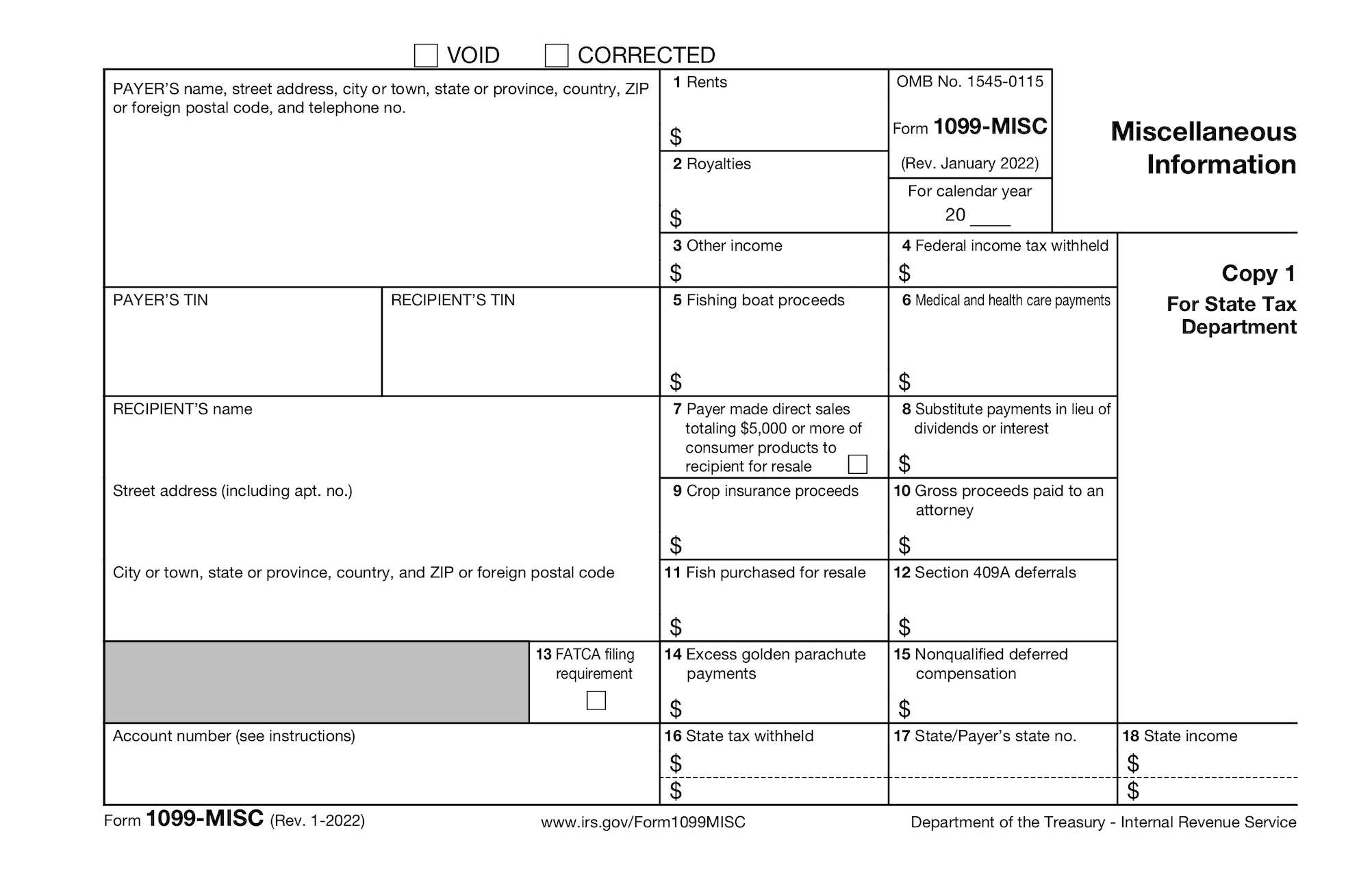

Does An Llc Require A 1099 Absent any exception e g medical or substitute payments the IRS doesn t require you to send a 1099 to S corporations C corporations LLCs that elected S corp tax status

A limited liability company that has elected to keep corporation status does not need a 1099 The statement gets replaced when working with Type C LLCs because these businesses have specific rigid rules and forms required for reporting income to If you are paying an LLC taxed as a disregarded entity a 1099 is required This document must include the sole proprietor s name and Social Security number as well as the name of his or her LLC

Does An Llc Require A 1099

Does An Llc Require A 1099

https://www.sodapdf.com/soda-form-pages-static/images/forms/f1099msc.jpeg

Free 1099 Template Excel With Step By Step Instructions 2023

https://assets-global.website-files.com/58868bcd2ef4daaf0f072902/61082896963c709838c13dd4_Screen Shot 2021-08-02 at 12.15.36 PM.png

Everything You Need To Know About Form 1099 MISC MISC As An Apartment

https://www.occupancysolutions.com/cm/dpl/images/articles/694/Everything-you-need-to—know-about-form_-1099-misc-misc-as-an-apartment_-manage.jpg

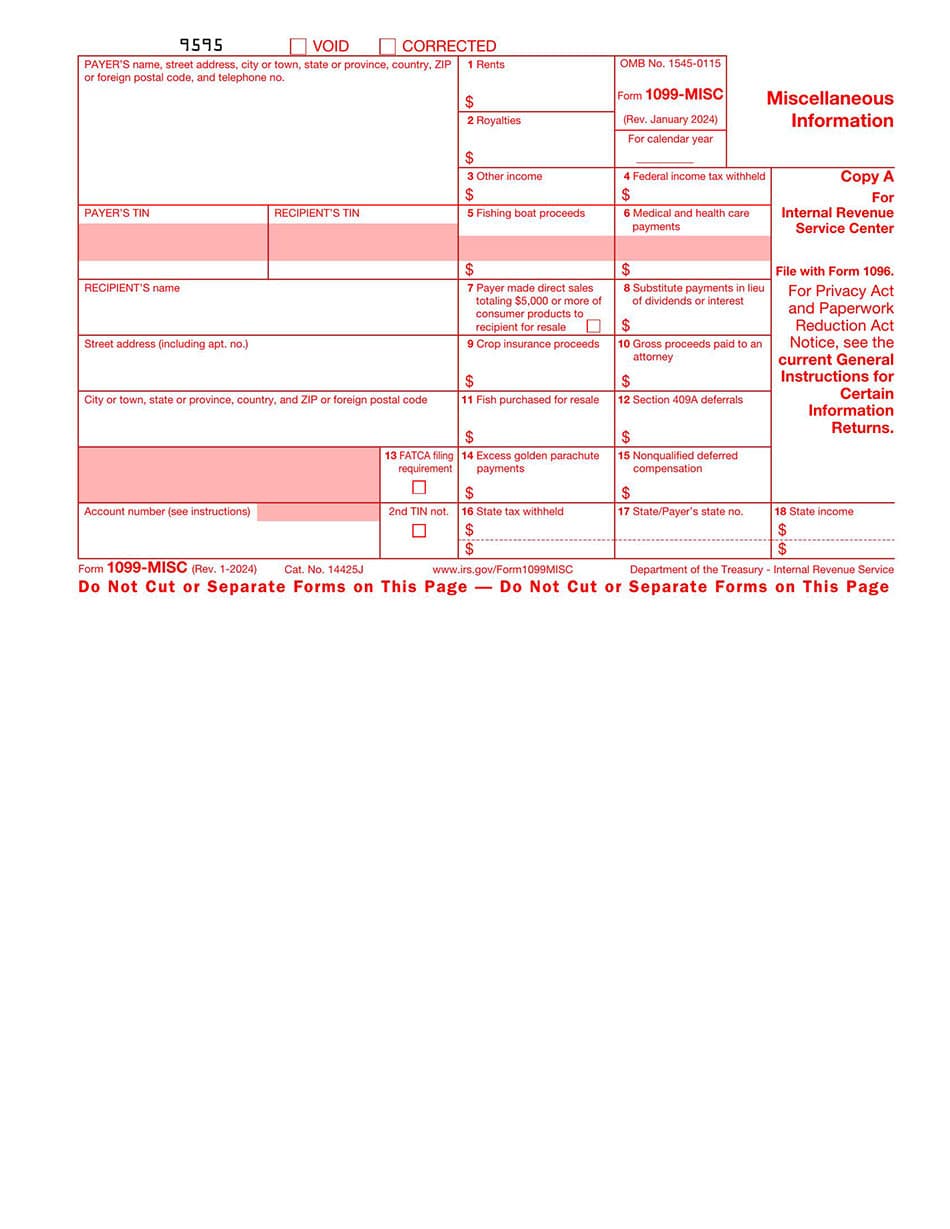

If an LLC operates as a sole proprietorship it has to file a 1099 with specific information required by the IRS Required information includes the following Sole proprietor s name LLC s name Proprietor s social security number which may act as a If your business pays an LLC more than 600 a year for rent business services or independent contractors you ll need to issue a federal form 1099 to report those payments to the Internal Revenue Service

If you own a small business or are self employed use this IRS guidance to determine if you need to file form 1099 or some other information return 10 or more returns E filing now required Starting tax year 2023 if you have 10 or more information returns Do LLCs get a 1099 The answer is not a simple yes or no This article provides some guidelines for knowing when an LLC should get a 1099

Download Does An Llc Require A 1099

More picture related to Does An Llc Require A 1099

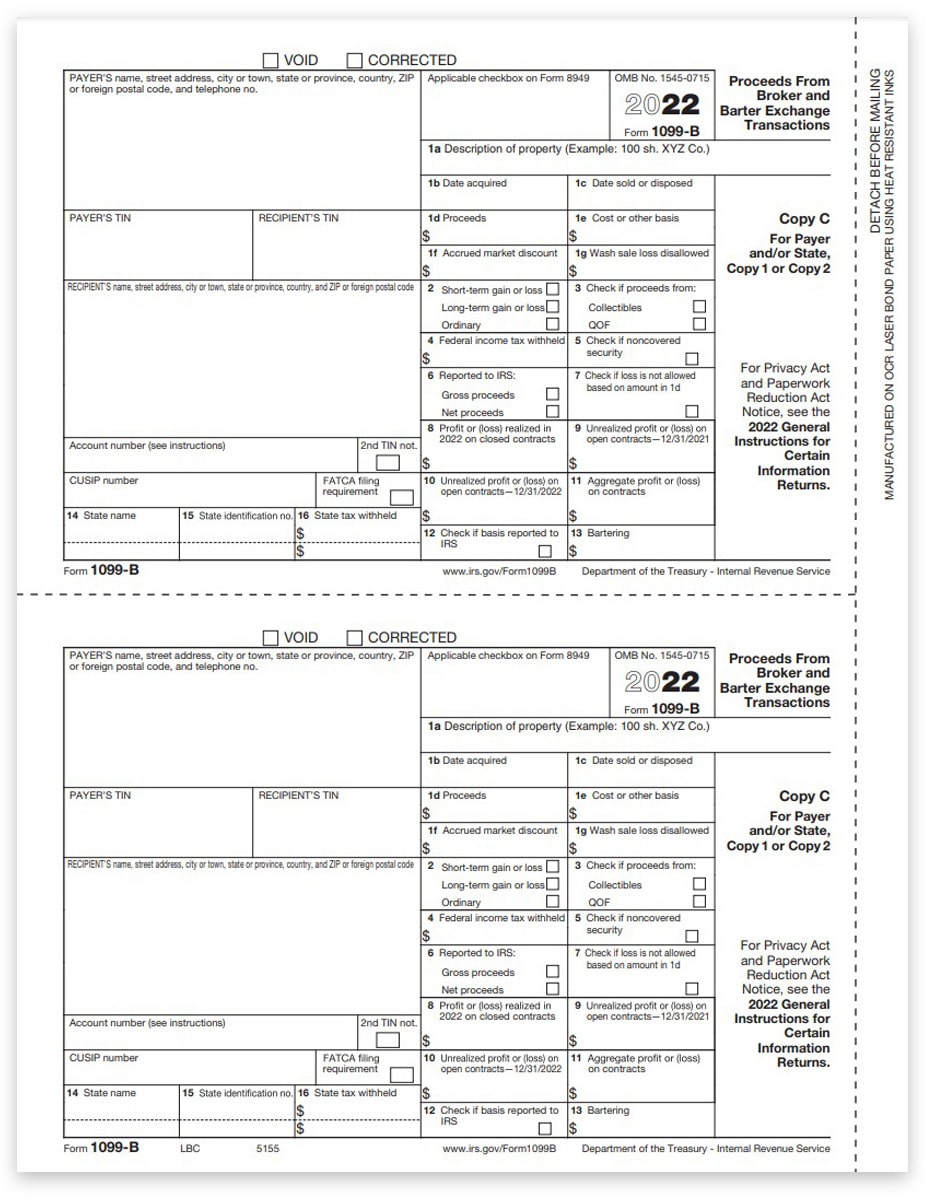

1099B Forms For Broker Transactions State Copy C DiscountTaxForms

https://www.discounttaxforms.com/wp-content/uploads/2016/09/1099B-Form-Copy-C-1-2-Payer-State-LBC-FINAL-min.jpg

What Payments Require A 1099 Global Electronic Technology

https://www.gettrx.com/wp-content/uploads/2023/05/What-Payments-Require-a-1099.png

Does An LLC S Corp Get A 1099 How To Report Income Hoplerwilms

https://hoplerwilms.com/wp-content/uploads/2022/06/Does-an-LLC-S-Corp-get-a-1099.jpg

However many LLC owners often wonder whether their company is subject to receiving a 1099 form In this article we will delve into the intricacies of tax reporting for LLCs explore whether they are If your business makes payments to an LLC that are required to be reported to the IRS you may need to file a 1099 and provide a copy to the LLC However there are specific circumstances in which you should not file a 1099 for the LLC

Generally C corporations S Corporations and LLCs formed as corporations or S Corps don t need to receive a 1099 NEC or 1099 MISC On irs gov check the 1099 NEC instructions and 1099 MISC instructions for exceptions when you are required to issue a Does an LLC get a 1099 In most cases the IRS requires you to report any income paid to a limited liability company on a 1099 form if the amount exceeds 600 in one year unless the LLC is taxed as a corporation This income paid includes income

1099 Vendor Forms Due At Month End January 31st Innovative CPA Group

https://www.innovativecpagroup.com/wp-content/uploads/2022/01/74614g01.gif

![]()

2023 Form 1099 Nec Instructions Printable Forms Free Online

https://cdn.shortpixel.ai/spai/w_977+q_lossy+ret_img+to_webp/https://onpay.com/wp-content/uploads/2022/12/1099-NEC-Boxes-1-3.png

https://www.marketwatch.com/guides/busine…

Absent any exception e g medical or substitute payments the IRS doesn t require you to send a 1099 to S corporations C corporations LLCs that elected S corp tax status

https://www.upcounsel.com/1099-requirements-for-llc

A limited liability company that has elected to keep corporation status does not need a 1099 The statement gets replaced when working with Type C LLCs because these businesses have specific rigid rules and forms required for reporting income to

What Is Form 1099 NEC For Nonemployee Compensation

1099 Vendor Forms Due At Month End January 31st Innovative CPA Group

1099 Vs W 2 What s The Difference QuickBooks

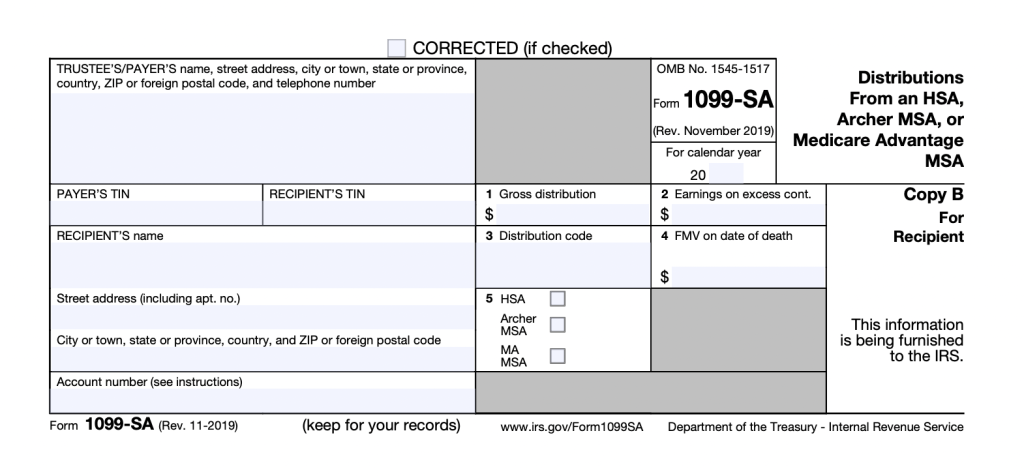

Understanding Form 1099 SA Lendio

How To File A 1099 Form For Vendors Contractors And Freelancers

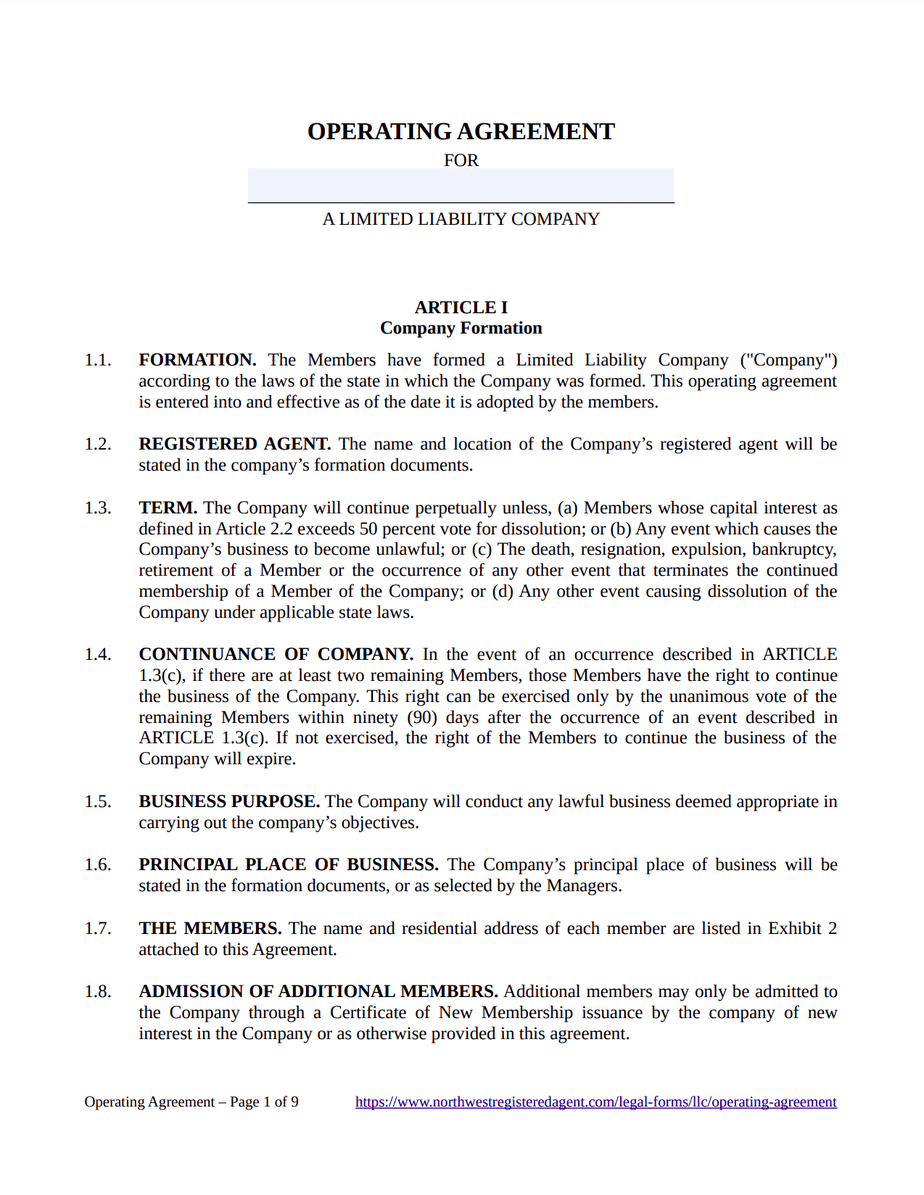

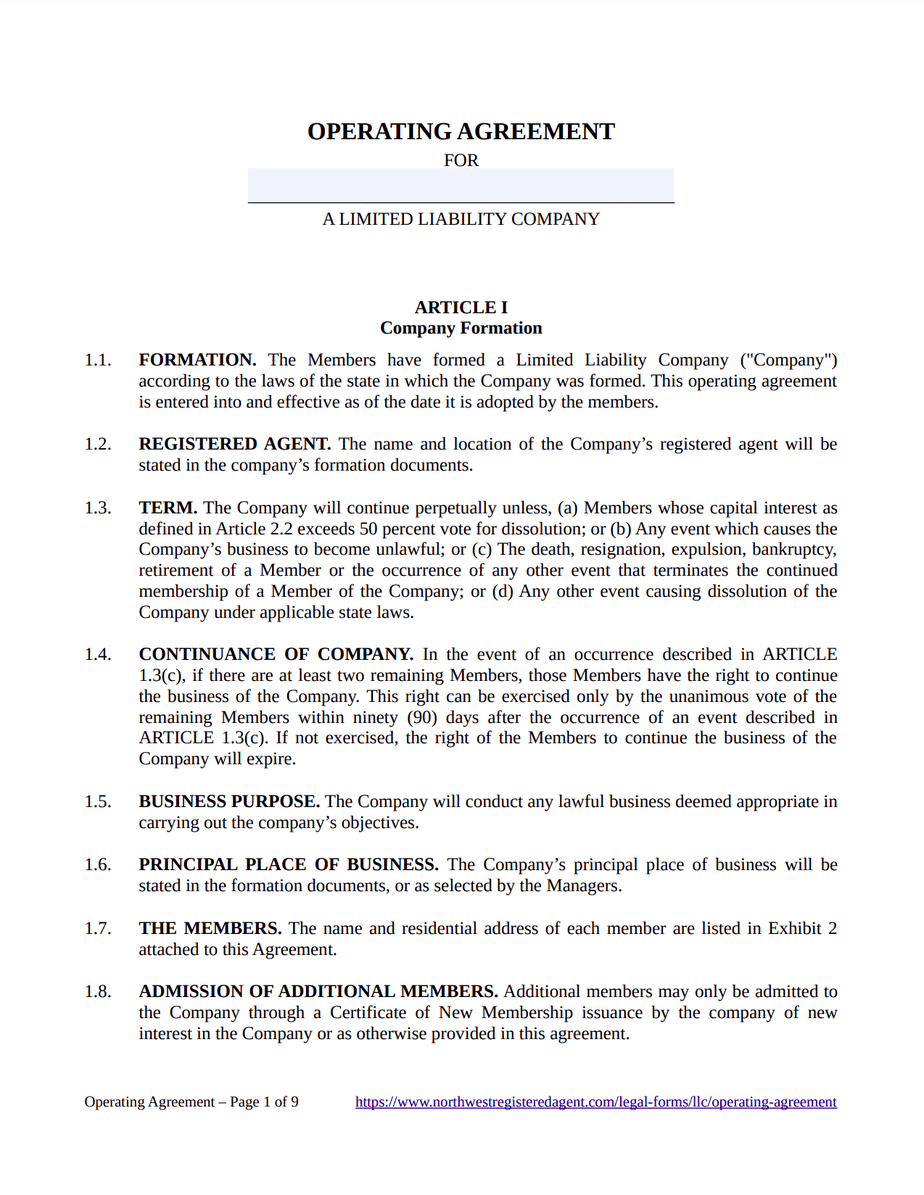

How To Obtain Llc Operating Agreement LLC Bible

How To Obtain Llc Operating Agreement LLC Bible

Who Should Receive Form 1099 MISC Global Business Related News Tips

1099 Vs W2 Archives Eagle Employer Services

Printing 1099 Forms

Does An Llc Require A 1099 - If an LLC operates as a sole proprietorship it has to file a 1099 with specific information required by the IRS Required information includes the following Sole proprietor s name LLC s name Proprietor s social security number which may act as a