Does An Llc S Receive A 1099 Here s the final takeaway LLCs will get 1099 forms as long as they re not taxed as an S corps And LLC earnings will be subject to self employment tax At the end of the day

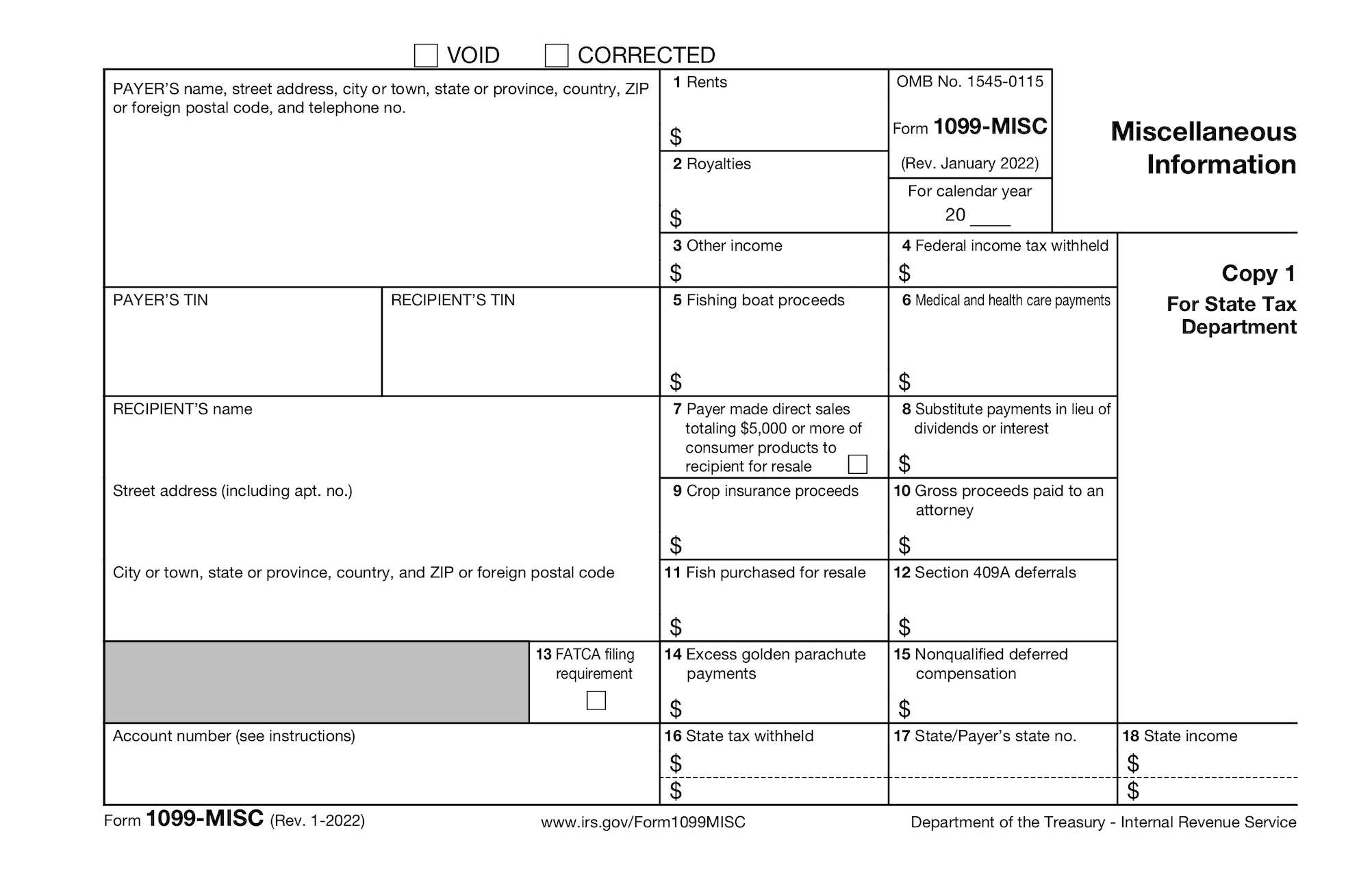

Uncover key insights on 1099 rules for LLCs S Corps tax classifications form nuances and compliance tips in our comprehensive easy to follow guide An LLC will receive a 1099 if it is a sole proprietorship or a multi member LLC taxed as a partnership If the LLC has filed as an S corporation it will not need to file a 1099

Does An Llc S Receive A 1099

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png)

Does An Llc S Receive A 1099

https://www.investopedia.com/thmb/hnsDTUkdP_Fyp_wvVPEtpi0xalU=/1622x760/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png

Does An LLC Get A 1099

https://www.corpnet.com/wp-content/uploads/2022/11/1099-Misc-Forms.jpg

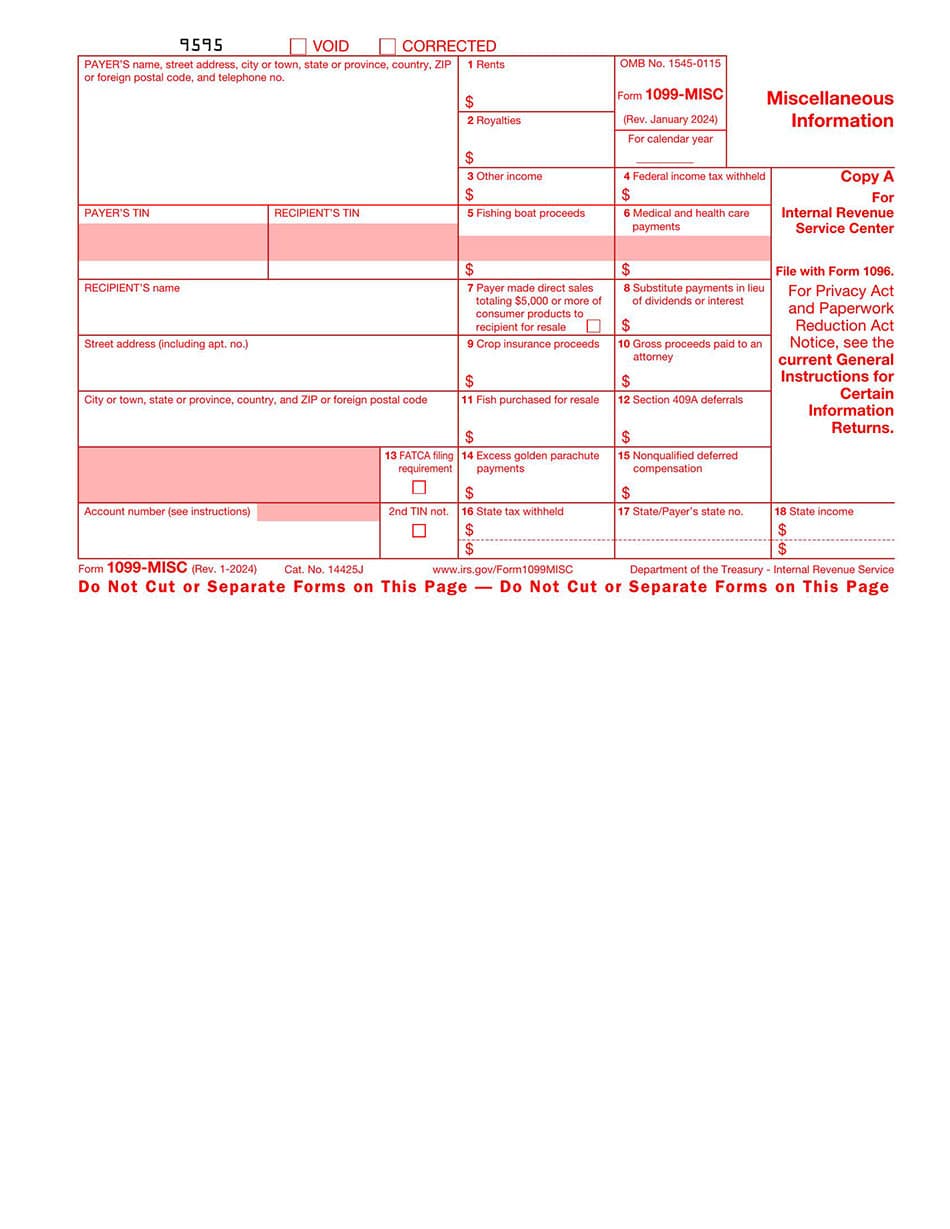

1099 Form Income Statements Fillable Form Soda PDF

https://www.sodapdf.com/soda-form-pages-static/images/forms/f1099msc.jpeg

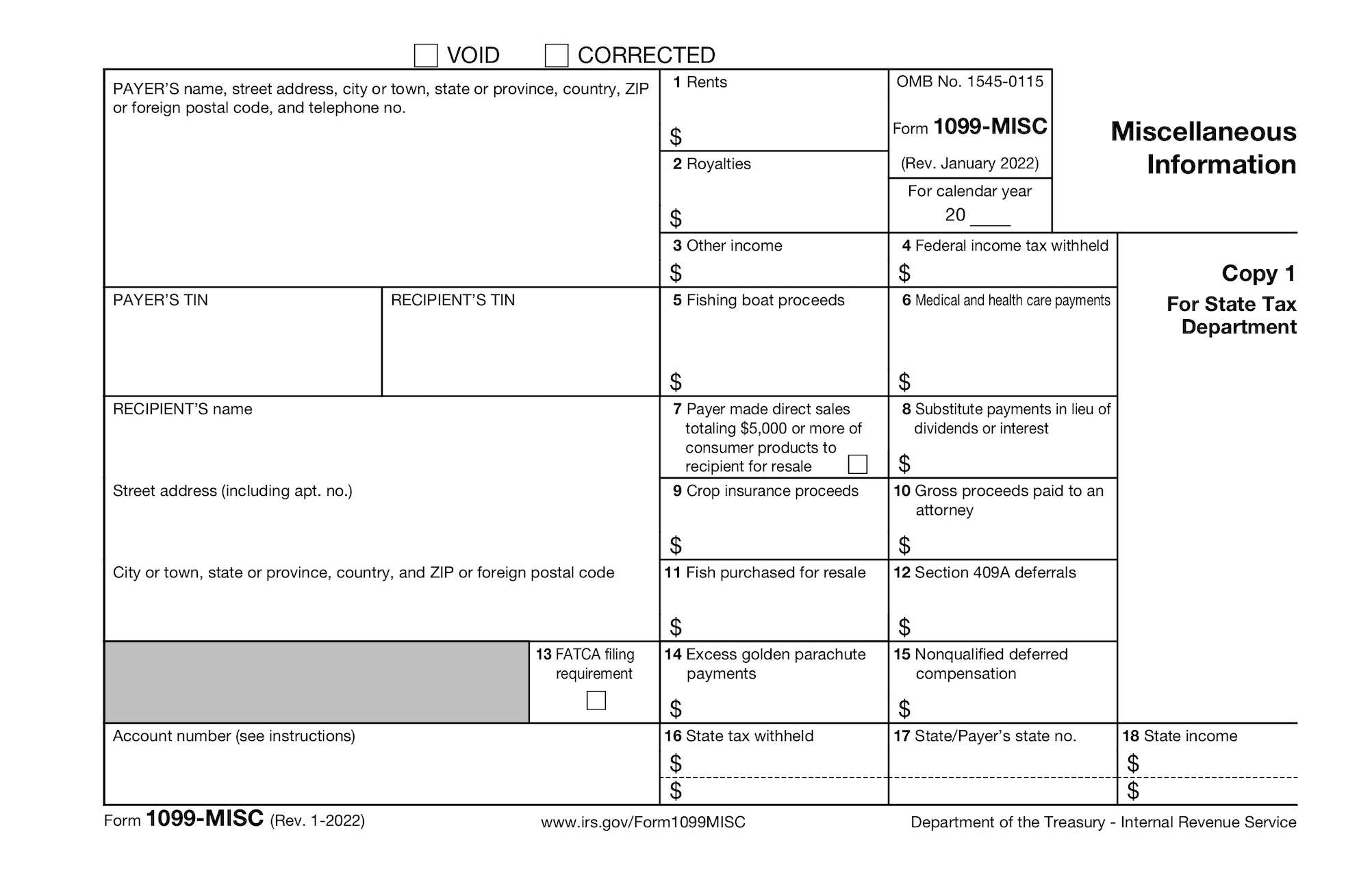

If you own or run a Limited Liability Company LLC then it s very likely you ll receive 1099 forms that you need to include in your tax return and you might even need to send out LLCs can be trickier to determine whether a 1099 is needed because they don t all receive the same tax treatment For example a single member LLC is taxed like a sole proprietorship so

Here are four main ways you can receive payments from your LLC 1 Pay Yourself as a W 2 Employee For many LLC owners the most advantageous way to receive payment Should an LLC receive 1099 Copies If your business makes payments to an LLC that are required to be reported to the IRS you may need to file a 1099 and provide a copy to

Download Does An Llc S Receive A 1099

More picture related to Does An Llc S Receive A 1099

Does An LLC S Corp Get A 1099 How To Report Income Hoplerwilms

https://hoplerwilms.com/wp-content/uploads/2022/06/Does-an-LLC-S-Corp-get-a-1099.jpg

What Is Form 1099 NEC For Nonemployee Compensation

https://falconexpenses.com/blog/wp-content/uploads/2020/02/Form-1099-NEC-1024x803.jpg

1099 Vendor Forms Due At Month End January 31st Innovative CPA Group

https://www.innovativecpagroup.com/wp-content/uploads/2022/01/74614g01.gif

There is nothing in the tax code that says LLCs specifically are exempt from 1099 reporting and many payers issue 1099s to LLCs whether they are required or not But here s the kicker LLCs should only get 1099s if If an LLC operates as a sole proprietorship it has to file a 1099 with specific information required by the IRS Required information includes the following Sole proprietor s name

Corporations including C Corporations and S Corporations do not typically receive 1099 forms for payments they receive because they are considered separate legal entities The purpose of issuing 1099 forms is Single member LLCs that have not elected to be treated as a corporation for tax purposes generally do not receive 1099 forms Instead the income and expenses of the LLC

Who Should Receive Form 1099 MISC Global Business Related News Tips

https://www.krdotv.com/wp-content/uploads/2022/05/Who-Should-Receive-Form-1099-MISC.jpg

How To File A 1099 Form For Vendors Contractors And Freelancers

https://assets-global.website-files.com/60a6b551be6130e4e5b19b98/62febbe85290864275ec05d3_Blog_Hero_1099.png

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at5.57.19PM-35858ecdbcb34072ba0d8da6aaf87b8a.png?w=186)

https://www.keepertax.com/posts/do-llc-get-1099

Here s the final takeaway LLCs will get 1099 forms as long as they re not taxed as an S corps And LLC earnings will be subject to self employment tax At the end of the day

https://www.moneyaisle.com/do-llc-s-corporations-get-a-1099

Uncover key insights on 1099 rules for LLCs S Corps tax classifications form nuances and compliance tips in our comprehensive easy to follow guide

E file Form 1099 DIV IRS Form 1099 DIV Dividends And Distributions

Who Should Receive Form 1099 MISC Global Business Related News Tips

Form 1099 MISC For Independent Consultants 6 Step Guide

How To Use The New 1099 NEC Form For 2020 SWK Technologies Inc

Form 1099 NEC Now Used To Report Nonemployee Compensation Ohio Ag Manager

How To Obtain Llc Operating Agreement LLC Bible

How To Obtain Llc Operating Agreement LLC Bible

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.20.15AM-ed3d6962a8d74a509a58ce0cab7069bf.png)

Form 1099 G Definition

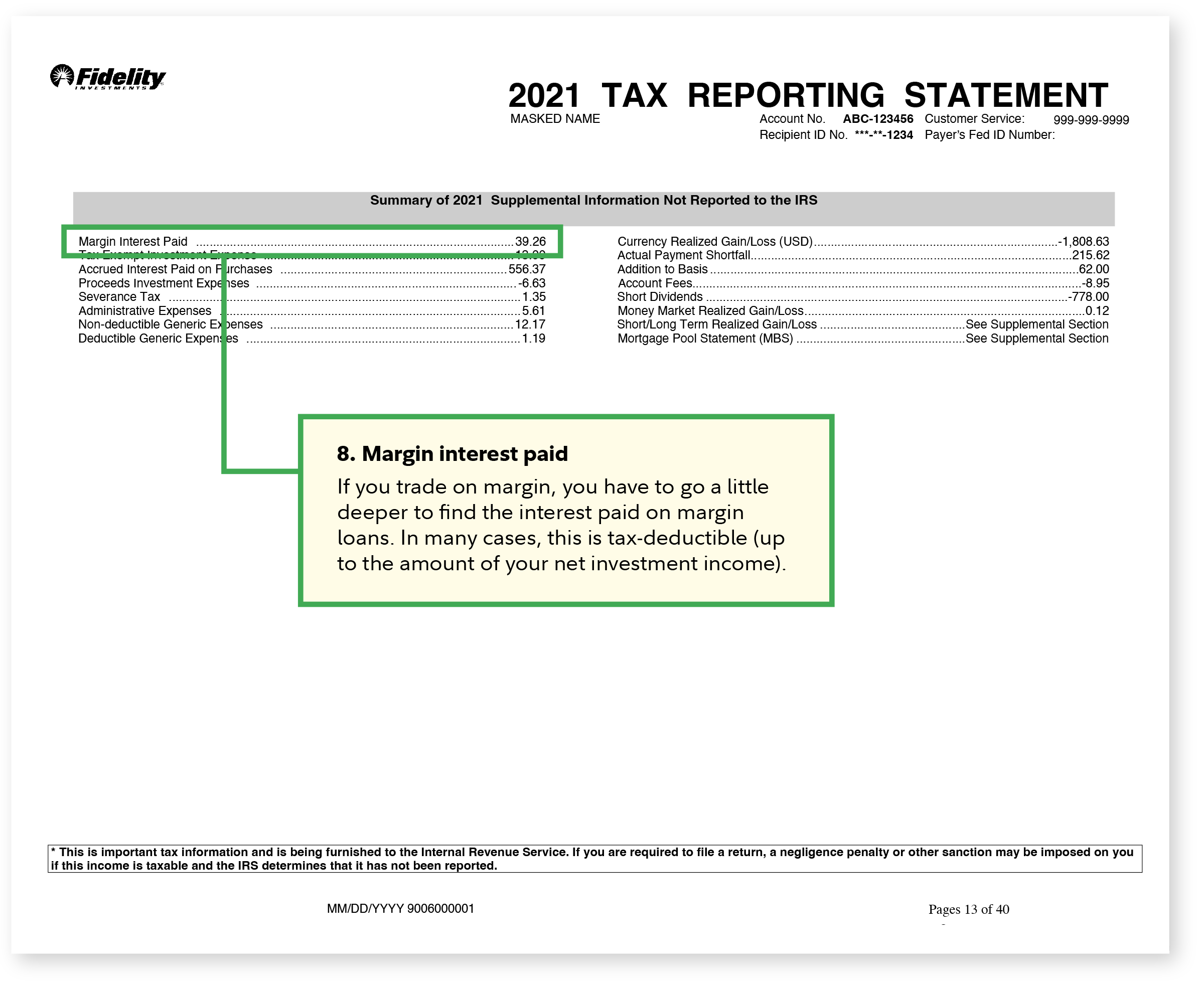

1099 Tax Form 1099 Fidelity

Who Should Send Receive Form 1099 NEC CheckIssuing

Does An Llc S Receive A 1099 - You should receive a Form 1099 from any entity that pays you at least 600 during the year You will not receive a 1099 if you re taxed as an S corporation Eight steps for LLC