Does Bank Deduct Tax On Fd Interest The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with any applicable surcharge or cess For example if your total annual income is above Rs

Answer As per Section 206AA since your mother does not have a PAN number the bank must deduct tax 20 on the interest even if your mother has submitted form No 15G Since your mother is a Regardless of where an individual has opened an FD account the interest on FD is taxable One must note that earnings generated from a tax saving FD are also subject to TDS In case of joint FD account holders TDS on FD interest is deducted on the basis of

Does Bank Deduct Tax On Fd Interest

Does Bank Deduct Tax On Fd Interest

https://i2.wp.com/thedailycpa.com/wp-content/uploads/2017/06/36858563_xl.jpg?fit=3831%2C2554&ssl=1

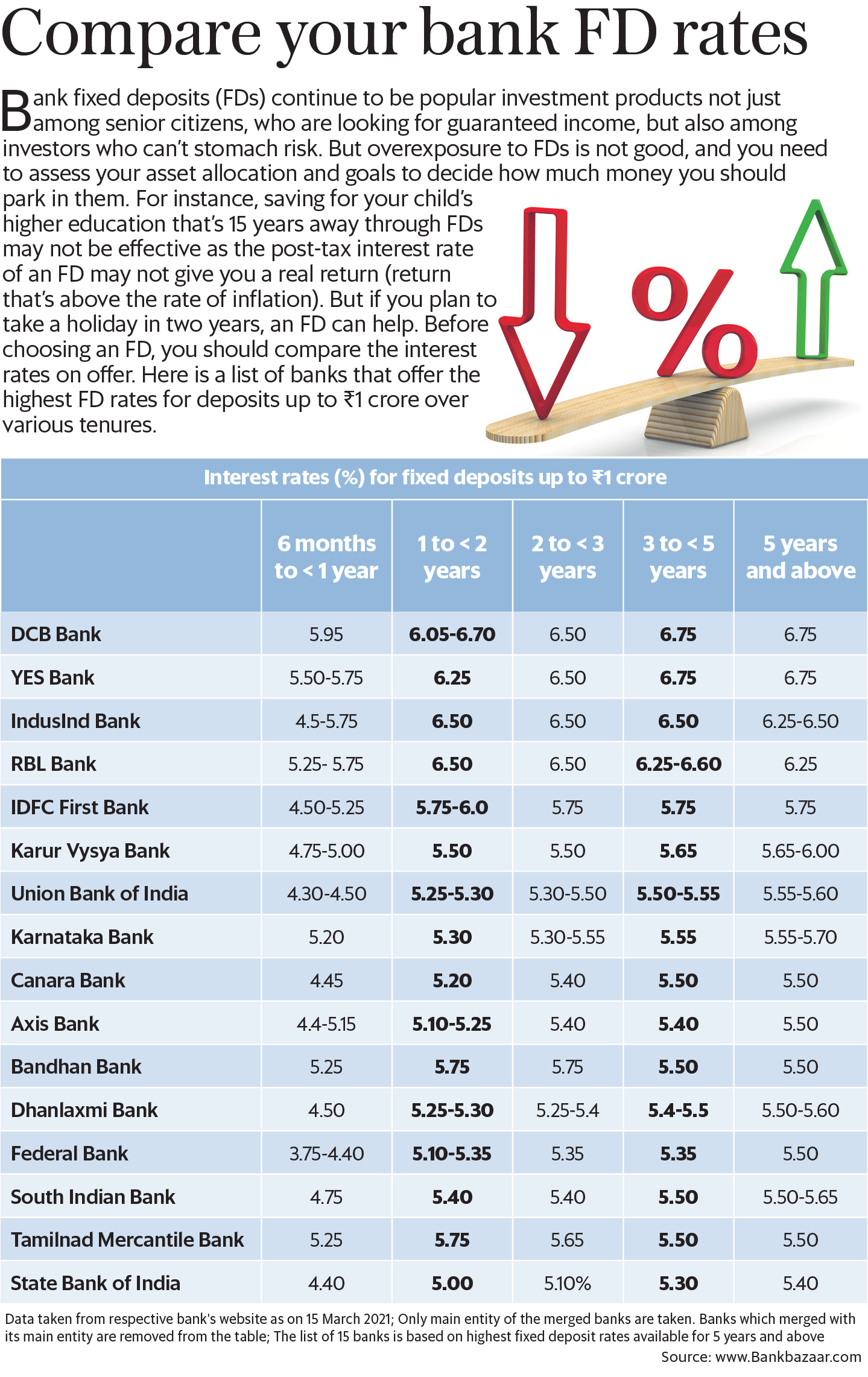

Know More About Highest FD Interest Rates In India In 2020

http://softrop.com/wp-content/uploads/2020/08/FD-Interest-Rates.jpg

Tax On FD Interest Everything You Need To Know

https://www.wintwealth.com/blog/wp-content/uploads/2022/10/Tax-on-FD-Interest.jpg

In the following circumstances the Bank does not deduct TDS on the Interest generated on FDs When an individual s annual Income is less than INR 3 00 000 the Bank will not deduct any TDS which means that even if an individual s interest income is INR 40 000 or higher than INR 40 000 One can determine the TDS amount deducted by the bank on FD interest from Form 16A It serves as a valid proof of deduction of TDS by the deductor Form 26AS is available on the TRACES portal and can be downloaded by the individual taxpayers through login to income tax e filing portal

Like your regular income the interest earned from Fixed Deposits FDs is subject to tax deductions This deducted tax is known as Tax Deducted at Source TDS Whether the fixed deposit is with a bank post office or NBFC TDS is deducted in accordance with income tax regulations TDS on FD schemes is currently deducted at a rate of 10 per cent It is to be noted that the tax is levied only on the interest amount not on the principal amount Section 194A of the

Download Does Bank Deduct Tax On Fd Interest

More picture related to Does Bank Deduct Tax On Fd Interest

How To Avoid TDS On Interest On Fixed Deposits Bank FD Wealth18

https://wealth18.com/wp-content/uploads/2014/04/avoid-taxes.jpg

FD RD PPF Tax Hello Maharashtra

https://www.india.com/wp-content/uploads/2021/03/Bank-Fixed-Deposits.jpg

Fixed Deposit Interest Rates Of Major Banks April 2020 Yadnya

https://i1.wp.com/blog.investyadnya.in/wp-content/uploads/2020/03/FD-Interest-Rates-of-Major-Banks-for-Tenure-Less-than-1-year-April-2020_Featured.png?fit=1239%2C891&ssl=1

Interest income from FDs is taxable and banks follow Tax Deduction at Source TDS for this purpose Pay attention to the deadline for tax payments and consider Advance Tax if the total tax liabilities exceed Rs 10 000 In addition banks deduct tax at source if the interest earned exceeds Rs 40 000 in a financial year across all the accounts held with the bank A TDS certificate will be issued to confirm the details of the deduction

Tax Deducted at Source TDS Banks deduct TDS on FD interest if the interest income exceeds Rs 40 000 in a financial year Rs 50 000 for senior citizens The TDS rate is 10 if your PAN is provided to the bank otherwise it is 20 After Budget 2019 TDS is deducted by your bank at the rate of 10 if your interest income from FDs in a year exceeds Rs 40 000 This rate increases to 20 if you have not submitted your PAN details to your Bank

Everything You Need To Know About TDS On FD Interest In India

https://substackcdn.com/image/fetch/f_auto,q_auto:good,fl_progressive:steep/https://bucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com/public/images/49929556-c09e-4832-b6a7-671d390d7e1d_1280x917.png

Compare Your Bank FD Rates Mint

https://images.livemint.com/img/2021/03/18/original/IYHYAB2Z_1616090593916.png

https://www.icicibank.com › blogs › fixed-deposits › tax...

The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with any applicable surcharge or cess For example if your total annual income is above Rs

https://www.livemint.com › money › ask-mint-money › how...

Answer As per Section 206AA since your mother does not have a PAN number the bank must deduct tax 20 on the interest even if your mother has submitted form No 15G Since your mother is a

Student Loan Interest Can You Deduct It On Your Tax Return E S

Everything You Need To Know About TDS On FD Interest In India

Can You Deduct Property Taxes And Mortgage Interest In 2019 YouTube

Income Tax On Interest On Savings Bank FD Account In India Fintrakk

Tax Deductions You Can Deduct What Napkin Finance

List Of Tax Deductions Here s What You Can Deduct

List Of Tax Deductions Here s What You Can Deduct

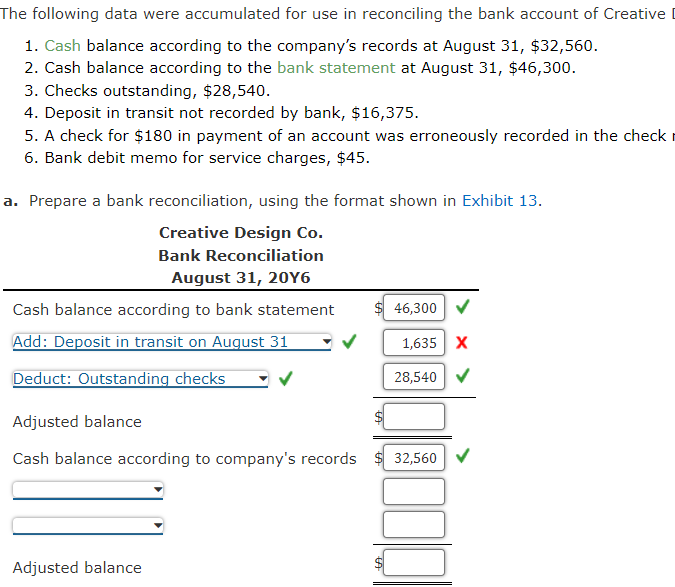

Solved The Following Data Were Accumulated For Use In Chegg

Latest Fixed Deposit Interest Rates Of Major Banks Yadnya Investment

IndusInd Bank Hikes Interest Rates On FDs New Rates Are Effective From

Does Bank Deduct Tax On Fd Interest - The interest income earned on a fixed deposit is taxable and you have to pay taxes as per the applicable tax rates under the IT Act for the said financial year Moreover banks deducts tax at source TDS on interest paid on fixed deposits when interest income exceeds Rs 40 000 Rs 50 000 for senior citizens in any given financial year for