Does Ca Allow Foreign Tax Credit California does not allow a remedy for double taxation from foreign income unless the client meets the conditions to be considered a nonresident under the safe harbor rules There are several possibilities offered by the rest of the states to offset taxation by a foreign jurisdiction

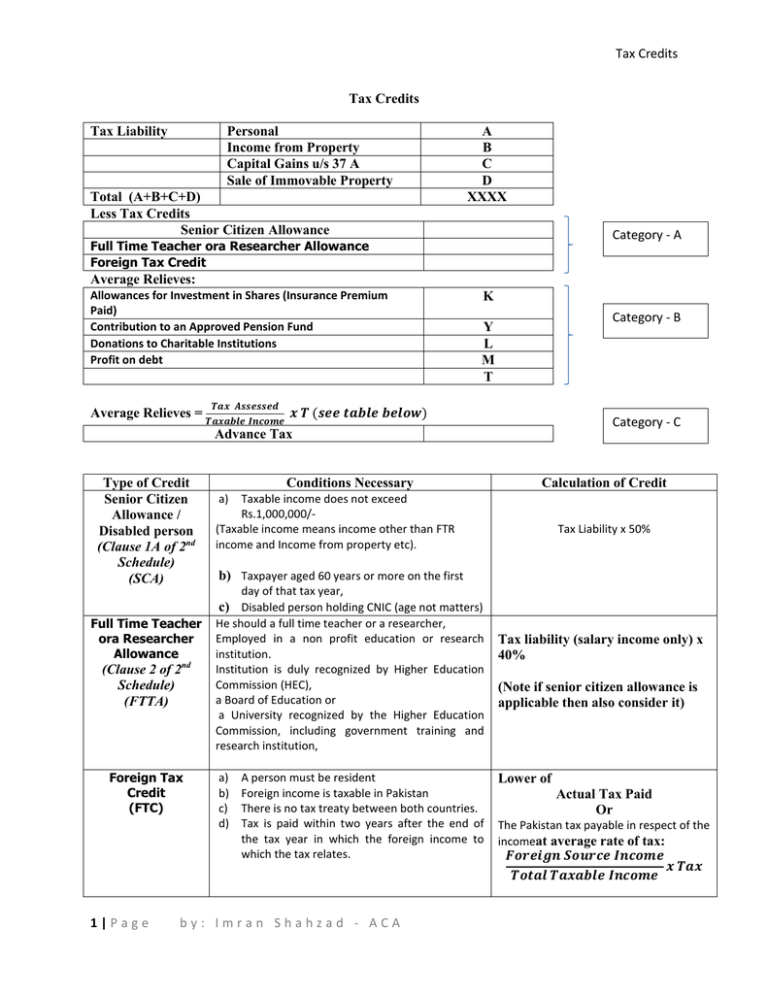

On February 22 2017 the California Franchise Tax Board FTB issued Legal Ruling 2017 01 which provides guidance on the circumstances in which a taxpayer may claim the Other State Tax Credit OSTC or a deduction for taxes paid to another state under the California Revenue and Taxation Code CRTC 1 This ruling applies to taxable years Credit is allowed for net income taxes paid to another state not including any tax comparable to California s alternative minimum tax on income that is also subject to California tax The credit is applied against California net tax less other credits

Does Ca Allow Foreign Tax Credit

Does Ca Allow Foreign Tax Credit

https://sftaxcounsel.com/wp-content/uploads/2020/07/shutterstock_1719160864.jpg

Foreign Tax Credit Eligibility Limits Form 1116 How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiGVYW453n0rJ9HYr-WXTuCc_WbHgGJWBCYnfCvgMCYM2kOSi3Mdhn_in3bsrltNXQIKQUe0yhET4vk19FZxJ0BZCYG-av-JnS8vbDxBC2d6ofxaHs3xjcxYX4HsnMWKOSo-3vtJo5vItO1VTWWxSAFNP3Pnfbczcr50ZyDgHE_LerNoBR33vy44mQC/s928/ftc.jpg

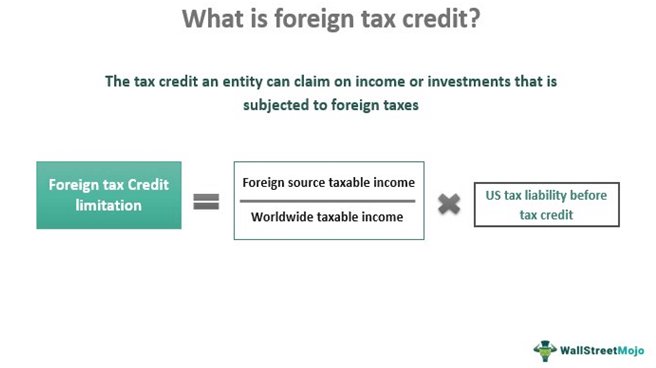

Foreign Tax Credit Meaning Example Limitation Carryover

https://www.wallstreetmojo.com/wp-content/uploads/2021/02/what-is-foreign-tax-credit.png

The answer to your question unfortunately is no California does not recognize the same foreign earned income exclusion that the federal government IRS does Essentially California does not allow a foreign tax credit or a foreign earned income exclusion for income earned abroad unless you fall under the safe harbor Can expats who pay foreign taxes avoid California s taxes Unfortunately expats can t apply the federal Foreign Tax Credit or Foreign Earned Income Exclusion to their California state tax bill

On February 22 2017 the California Franchise Tax Board FTB issued Legal Ruling 2017 01 which provides guidance on the circumstances in which a taxpayer may claim the Other State Tax Credit OSTC or a deduction for taxes paid to another state under the California Revenue and Taxation Code CRTC 1 This ruling applies to taxable years The California Franchise Tax Board FTB released Legal Ruling 2017 01 on Feb 22 2017 providing general guidance on how to determine if a taxpayer is eligible for the Other State Tax Credit OSTC or a deduction for taxes paid to another state under the California Revenue and Taxation Code CRTC

Download Does Ca Allow Foreign Tax Credit

More picture related to Does Ca Allow Foreign Tax Credit

Foreign Tax Credit USA

https://kotaxusa.com/wp-content/uploads/2022/03/A-Complete-Guide-of-foreign-tax-credit-.jpeg

Is Foreign Tax Credit Allowed For Taxes That Are Paid Or Accrued

https://klasing-associates.com/wp-content/uploads/2018/03/WHY-IS-FOREIGN-TAX-CREDIT-ALLOWED.jpg

Foreign Tax Credits A Complete Guide

https://taxsaversonline.com/wp-content/uploads/2022/06/Foreign-Tax-Credits.jpg

The FEIE Foreign Earned Income Exclusion allows qualified taxpayers to exclude from taxable income up to 101 300 of earned income subject to two requirements The taxpayer must establish a tax home in a foreign county or several foreign countries and The taxpayer will need to satisfy the bona fide residence test or the The California nonresident is allowed the credit for tax paid to Arizona because Arizona is a reverse credit state which authorizes California residents doing business in Arizona to credit their California tax on the income derived there against their Arizona income tax liabilities

California Franchise Tax Board issues guidance on credit for income taxes paid to other states The California Franchise Tax Board FTB recently issued much anticipated guidance on the California Other State Tax Credit OSTC and allowable deductions for taxes paid to other states Taxpayer can elect to deduct the foreign taxes which it pays in computing US taxable income rather than claiming a credit for these amounts IRC 901 a Foreign income taxes are generally deductible under IRC 164 a 3 but

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

https://www.greenbacktaxservices.com/wp-content/uploads/2023/01/Screen-Shot-2023-01-24-at-12.18.53-PM-1024x978.png

What Is The Deemed Paid Foreign Tax Credit

https://klasing-associates.com/wp-content/uploads/2018/03/WHAT-IS-THE-DEEMED-PAID-FOREIGN-TAX-CREDIT.jpg

https://www.form8621.com/alleviating-double-taxation

California does not allow a remedy for double taxation from foreign income unless the client meets the conditions to be considered a nonresident under the safe harbor rules There are several possibilities offered by the rest of the states to offset taxation by a foreign jurisdiction

https://www2.deloitte.com/us/en/pages/tax/articles/...

On February 22 2017 the California Franchise Tax Board FTB issued Legal Ruling 2017 01 which provides guidance on the circumstances in which a taxpayer may claim the Other State Tax Credit OSTC or a deduction for taxes paid to another state under the California Revenue and Taxation Code CRTC 1 This ruling applies to taxable years

What Is Foreign Tax Credit FTC Company Registration In India

How Do I Claim Foreign Tax Credit In USA Leia Aqui Can A US Citizen

File

Foreign Tax Credit Form 1116

Foreign Tax Credit What It Is How To Claim It NerdWallet

What Are The Basics Of The Foreign Tax Credit

What Are The Basics Of The Foreign Tax Credit

Calculating The Credit How Foreign Tax Credits Work HowStuffWorks

/79336052-F-56a938475f9b58b7d0f95aa3.jpg)

Foreign Tax Credit Information

The New Foreign Tax Credit Proposed Regulations An Executive Summary

Does Ca Allow Foreign Tax Credit - Can expats who pay foreign taxes avoid California s taxes Unfortunately expats can t apply the federal Foreign Tax Credit or Foreign Earned Income Exclusion to their California state tax bill