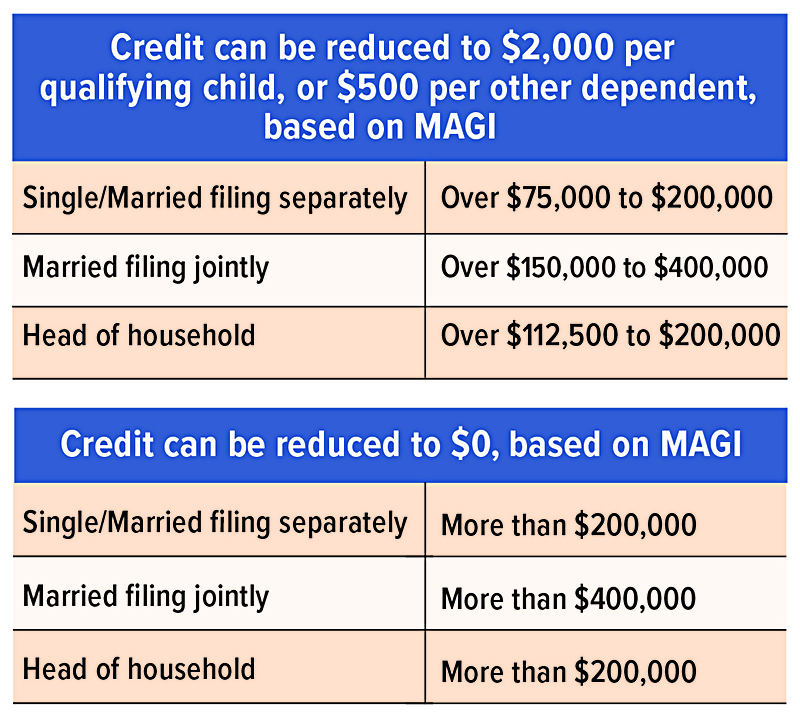

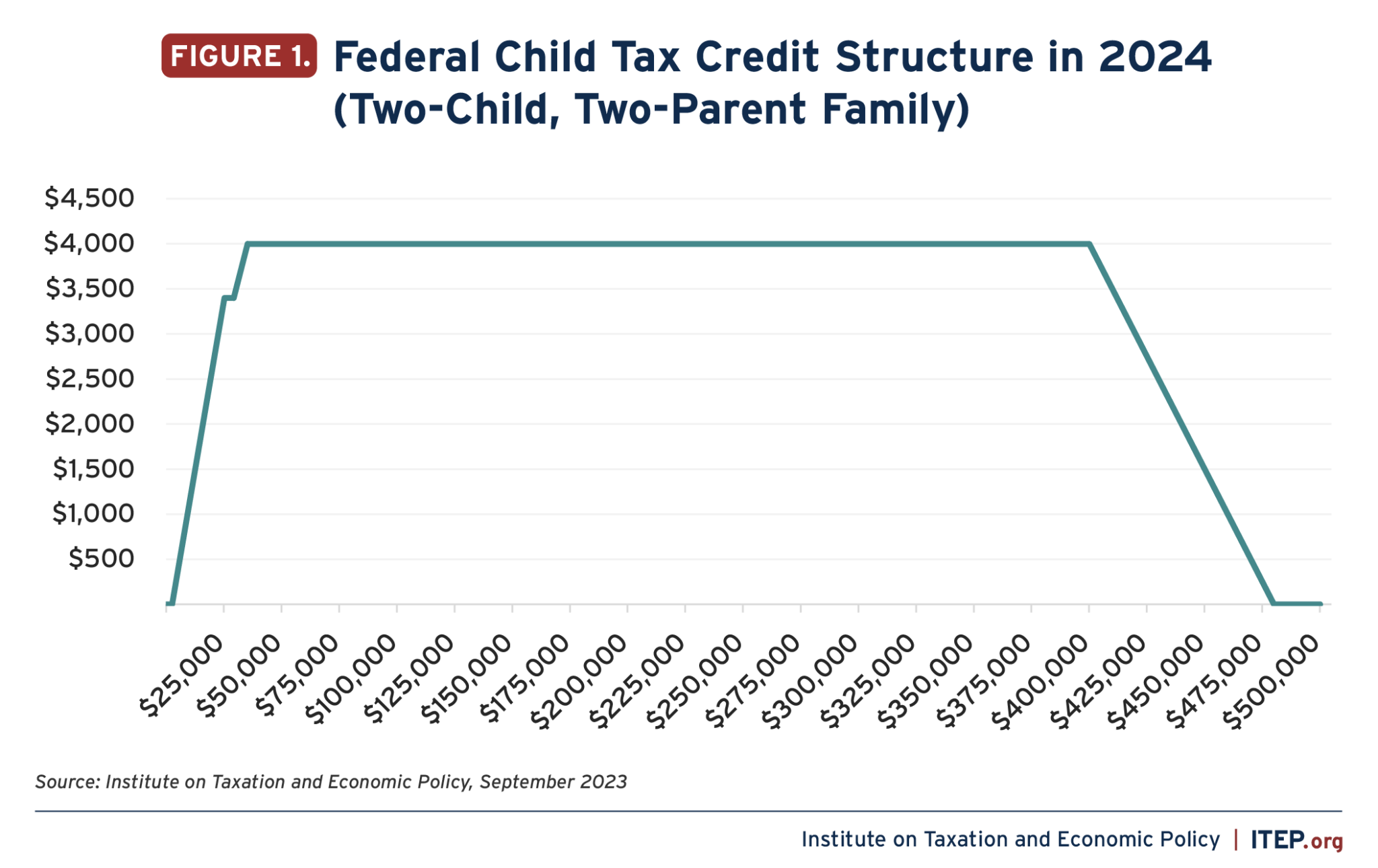

Does Child Tax Credit Phase Out 2022 You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child The child tax credit is limited to 2 000 for every you have who s under age 17 1 600 being refundable for the 2023 tax year That increases to 1 700 for the 2024 tax year Modified adjusted gross income MAGI thresholds for single taxpayers and heads of household are set at 200 000 to qualify and 400 000 for joint filers

Does Child Tax Credit Phase Out 2022

Does Child Tax Credit Phase Out 2022

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

Dependent Care Fsa Or Child Tax Credit 2022 Kitchen Cabinet

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Does The Child Tax Credit Continue In 2022 Must Know For Parents

https://media.marketrealist.com/brand-img/SWwYe-NBr/1440x753/does-child-tax-credit-continue-2022-1642613456076.jpg?position=top

What s Next for 2022 Do You Still Have Questions VITA and TCE Interactive Tax Assistant Are You Ready to File The new expanded Child Tax Credit CTC of 2021 was part of President Joe Biden s American Rescue Plan This tax break was one of the measures aimed at helping struggling families during the pandemic Tax Changes and Key Amounts for the 2022 Tax Year Parents with higher incomes also have two phase out schemes to worry about for 2021 The first one applies to the extra credit

Child Tax Credit The Child Tax Credit is given to taxpayers for each qualifying dependent child who is under the age of 17 at the end of the tax year Currently it s a 1 000 nonrefundable Tax Year 2021 Filing Season 2022 Child Tax Credit Frequently Asked Questions Topic C Reconciling Advance Child Tax Credit Payments and Claiming the 2021 Child Tax Credit on Your 2021 Tax Return Internal Revenue Service

Download Does Child Tax Credit Phase Out 2022

More picture related to Does Child Tax Credit Phase Out 2022

The Proposed 2022 Child Tax Credit How Will The Changes Affect You

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-6863513-1920w.jpeg

Child Tax Credit For 2021 Will You Get More Velocity Retirement

https://www.broadridgeadvisor.com/images/origres/FI3_ChildTaxCredit_0821.jpg

Earned Income Credit 2022 Calculator INCOMEBAU

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

For the 2024 tax year tax returns filed in 2025 the child tax credit will be worth 2 000 per qualifying child with 1 700 being potentially refundable through the additional As part of the 2017 tax overhaul Congress doubled the existing child tax credit to 2 000 per child under age 17 at year end It is a dollar for dollar reduction in taxes that a range of filers

Unless Congress changes the child tax credit for the 2024 tax year returns you ll file in 2025 the refundable portion of the child tax credit is scheduled to increase to 1 700 The U S government disbursed more than 15 billion of monthly child tax credit payments in July to American families These payments were part of the American Rescue Plan a 1 9 trillion dollar

Child Tax Credit 2022 Income Limit Phase Out TAX

https://indianapublicmedia.org/images/news-images/child-tax-credit.jpg

Child Tax Credit

https://db0ip7zd23b50.cloudfront.net/dims4/default/aedfbe6/2147483647/resize/633x10000>/quality/90/?url=http:%2F%2Fbloomberg-bna-brightspot.s3.amazonaws.com%2Fae%2F00%2F2ce5bb3d4ec493a63ec4724e6e05%2Fd64957248d6c49ebb92ef34db2768c4e

https://www.irs.gov/credits-deductions/individuals/child-tax-credit

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than 200 000 400 000 if filing a joint return Parents and guardians with higher incomes may be eligible to claim a partial credit

https://theweek.com/finance/1021293/a-guide-to-the-2022-child-tax-credit

For tax year 2022 the child tax credit is 2 000 per child under 17 who s claimed on your tax return as a dependent Last year the credit was bumped up to 3 000 per child

Big Changes To The Child And Dependent Care Tax Credits FSAs In 2021

Child Tax Credit 2022 Income Limit Phase Out TAX

How Many Monthly Child Tax Credit Payments Were There Leia Aqui How

Child Tax Credit 2022 How Next Year s Credit Could Be Different

/cdn.vox-cdn.com/uploads/chorus_asset/file/24264256/GettyImages_1369365884a.jpg)

At What Age Does Child Tax Credit Stop Leia Aqui Does My 21 Year Old

7 Important Money Matters Every New Mom Forgets Like The Child Tax Credit

7 Important Money Matters Every New Mom Forgets Like The Child Tax Credit

FAQ WA Tax Credit

States Are Boosting Economic Security With Child Tax Credits In 2023 ITEP

Child Tax Credit Schedule 2022 Veryc Blog

Does Child Tax Credit Phase Out 2022 - A quick refresher Congress temporarily expanded the child tax credit for the 2021 tax year It made the credit more generous providing as much as 3 600 per child up from 2 000 And because it