Does Discount Allowed Have Gst Discounts that are given before or at the time of sale can be deducted from transaction value at the time of sale no GST will be levied on the same However such

Excise Discounts given on before time of sale are allowed VAT Different treatment in different States Service tax Allowed Discounts under GST regime GST is chargeable on the net price after the prompt payment discount i e 90 of the selling price excluding GST GST to be charged 7 x 90 6 30 For this

Does Discount Allowed Have Gst

Does Discount Allowed Have Gst

https://vakilsearch.com/blog/wp-content/uploads/2022/03/find-company-by-gst-number.jpg

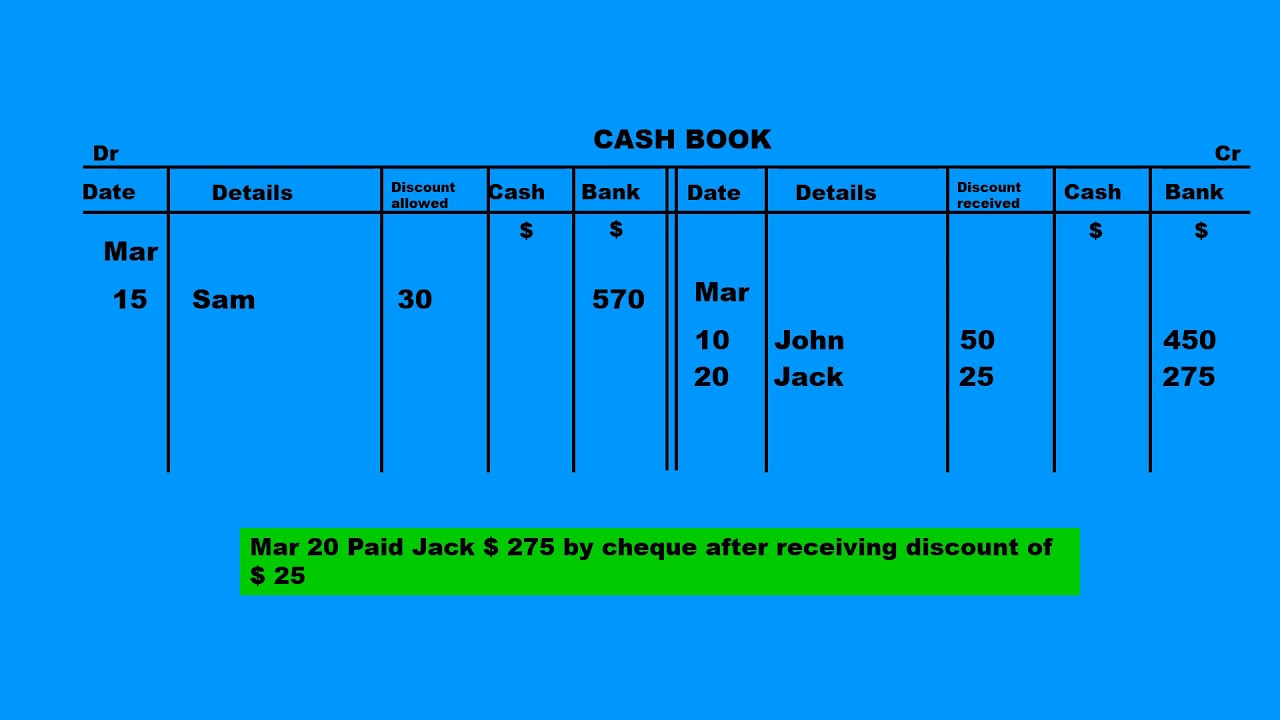

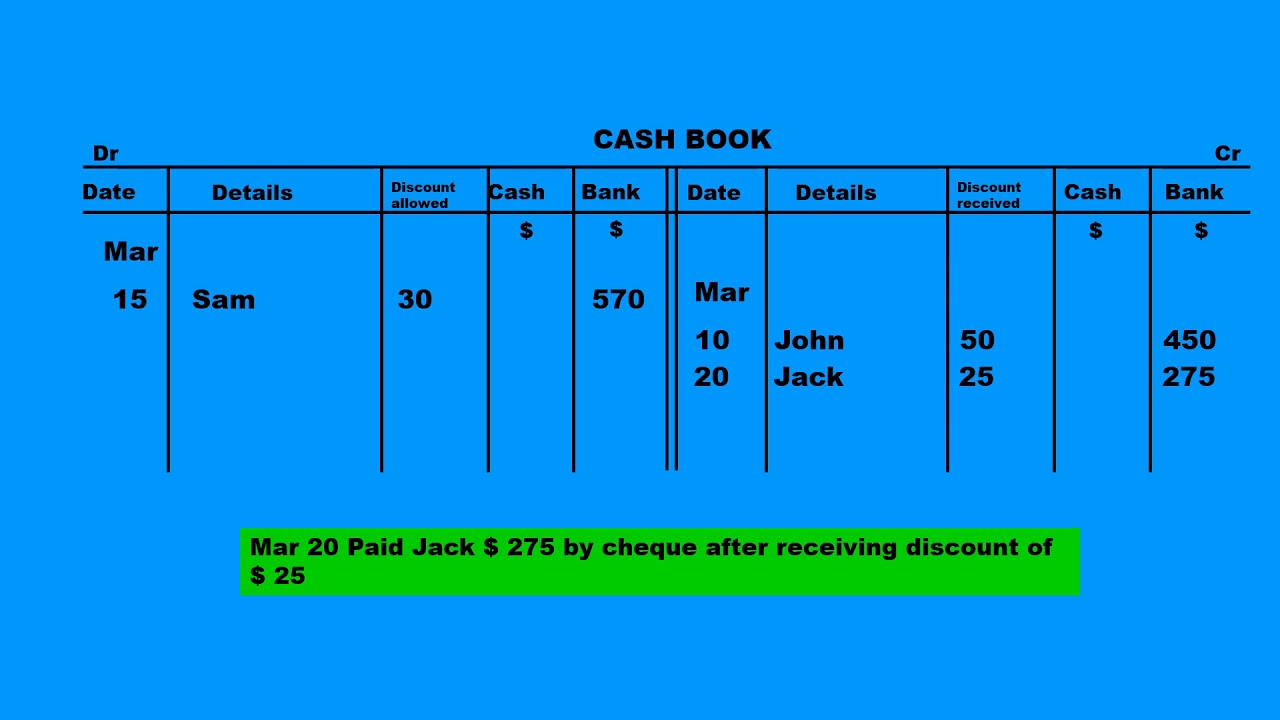

Cash Discount Discount Allowed And Discount Received YouTube

https://i.ytimg.com/vi/iNdpSQEATEg/maxresdefault.jpg

What Is GST GST BAS Guide Xero AU

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to GST-BAS_whatx2.1646877577000.png

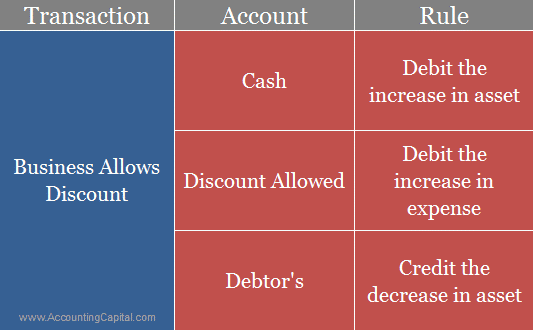

Discounts like trade discount quantity discount etc are part of the normal trade and commerce therefore pre supply discounts i e discounts recorded in the In fact GST segregates the discounts allowed into two categories Those given before or at the time of supply and Those given after the time of supply Discount

Discounts given before or at the time of supply will be allowed as deduction from transaction value Such discounts must be clearly mentioned on the invoice Discounts The tax authorities have always disputed the claim of post sale trade discounts cash or quantity discounts claimed by the taxpayers on the ground that the said discounts

Download Does Discount Allowed Have Gst

More picture related to Does Discount Allowed Have Gst

How To Calculate Discount Allowed In Accounting Haiper

https://www.coursehero.com/qa/attachment/7051045/

Discount Allowed Double Entry

https://i.pinimg.com/736x/43/38/42/4338428635c0f30c67a724377fd91af0.jpg

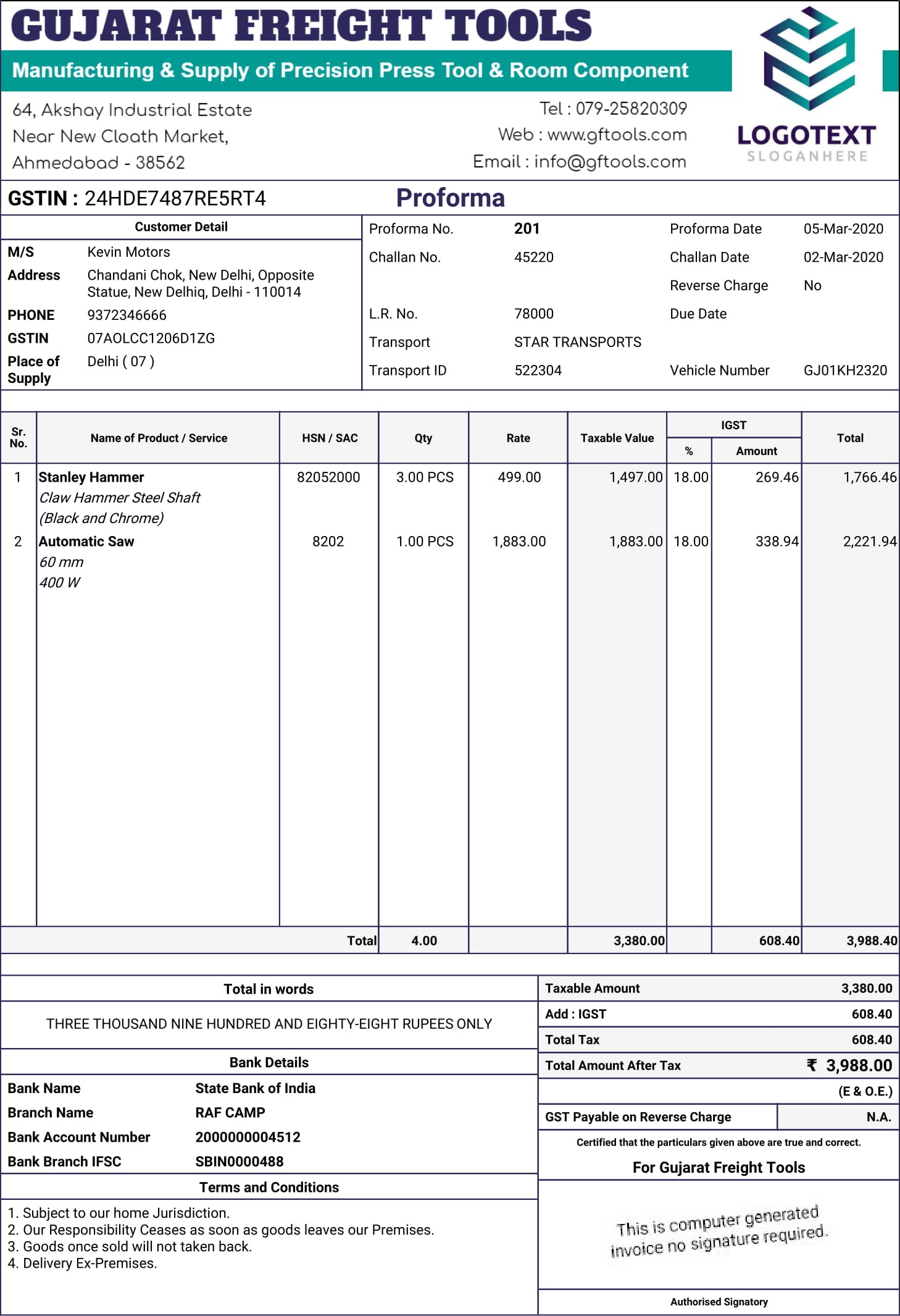

GST Proforma Invoice Format In India 100 Free GST Billing Software

http://gogstbill.com/wp-content/uploads/2020/03/Proforma_201-1.jpg

Discount allowed before or at the time of supply and it has been mentioned in the invoice separately it will not be added in the value of supply Example Company If your customer takes advantage of the discount they should pay you 98 plus 13 of GST HST The tax you as the supplier would need to remit is 13 even though your customer took advantage

Discounts that are given before or at the time of sale can be deducted from transaction value at the time of sale no GST will be levied on the same However such discounts shall be mentioned in the tax invoice Post Section 15 3 of the CGST Act 2017 similar provision exits in SGST UTGST Act 2017 stipulates that the value of the supply shall not include any discount subject to the

A Complete Guide On GST Rate On Food Items Ebizfiling

https://ebizfiling.com/wp-content/uploads/2022/01/gst-on-food.png

The GST Compensation Cess Issue All You Need To Know Marketfeed news

https://149494764.v2.pressablecdn.com/wp-content/uploads/2020/10/gstblog2.jpg

https://gsthero.com/gst-on-discounts-legal...

Discounts that are given before or at the time of sale can be deducted from transaction value at the time of sale no GST will be levied on the same However such

https://taxguru.in/goods-and-service-tax/treatment-discounts-gst-study.html

Excise Discounts given on before time of sale are allowed VAT Different treatment in different States Service tax Allowed Discounts under GST regime

Journal Entry For Discount Allowed Examples Journal Tutor s Tips

A Complete Guide On GST Rate On Food Items Ebizfiling

How To Treat Discount Allowed In Income Statement Aljazeera Medical

Discount Received Journal Entry KaydenceminJoyce

Journal Entry For Discount Allowed And Received GeeksforGeeks

GST FAQ s On Valuation Under Goods And Service Tax

GST FAQ s On Valuation Under Goods And Service Tax

BPA POS Solutions How Offering A Cash Discount Can Benefit Your Business

Journal Entry For Discount Allowed And Received GeeksforGeeks

Ubuntu 22 04

Does Discount Allowed Have Gst - Discounts given before or at the time of supply will be allowed as deduction from transaction value Such discounts must be clearly mentioned on the invoice Discounts