Does Family Tax Benefit Count As Income Taxable income This applies to family assistance payments Carer Allowance and the Commonwealth Seniors Health Card Taxable income is your gross income minus allowable deductions It s the income you have to pay tax on It includes income from any of these wages and salary which is your normal weekly fortnightly or monthly pay

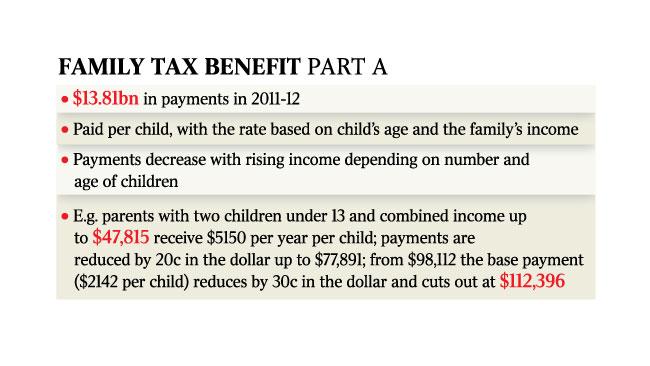

We use an income test if your family s adjusted taxable income is over 115 997 We ll reduce the rate of FTB Part A by 30 cents for each dollar of income over 115 997 This applies until your payment is nil We ll use your adjusted taxable income to work out if you can get Family Tax Benefit Part A and Part B Child Care Subsidy Parental Leave Pay The types of income we look at are taxable income reportable fringe benefits reportable superannuation contributions total net investment losses certain tax free pensions and benefits foreign

Does Family Tax Benefit Count As Income

Does Family Tax Benefit Count As Income

https://production-content-assets.ratecity.com.au/20221118/family-taxes-zQdx3mCFx.jpg

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

7 Reasons Why You File Your Income Tax Return In India TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/12/benefits-of-filing-income-tax-return-2-819x1024.jpeg

Income under the tax free threshold counts as tax able income Taxable lump sum payments also count towards tax able income These may include any taxable superannuation death benefits taxable compensation payments any taxable insurance payouts superannuation released early Centrelink will not count superannuation Important information about income estimates Family Tax Benefit Family Tax Benefit is a payment to help families with the cost of raising child ren To be eligible for Family Tax Benefit you must be a parent guardian carer including foster carer grandparent or an approved care organisation provide care to an eligible child

It is made up of two parts FTB Part A is paid per child and the amount paid is based on the family s circumstances FTB Part B is paid per family and gives extra help to single parents and some couple families with one main income Early released superannuation is also taxable but does not include withdrawals made under the First Home Super Saver Scheme You might receive some payments from us that are not taxable This means they are not included as taxable income Some examples are Family Tax Benefit Child Care Subsidy Additional Child Care Subsidy and

Download Does Family Tax Benefit Count As Income

More picture related to Does Family Tax Benefit Count As Income

Does A Tax Refund Count As Income Yes In Some Cases

https://media.marketrealist.com/brand-img/s_iPuAFJp/1024x536/does-tax-refund-count-as-income-1646229479451.jpg?position=top

Family Tax Benefit Cuts Could Save 1bn A Year The Australian

https://content.api.news/v3/images/bin/5e7d357683d858fd878fce5a66ee1348?width=1280

Foreign Social Security Taxable In Us TaxableSocialSecurity

https://i0.wp.com/cdn2.hubspot.net/hub/109376/file-1514722889-jpg/images/SocialSecurityWorksheet.jpg

Who is eligible for Family Tax Benefit Part A To be eligible for Family Tax Benefit Part A you must care for a dependent child meet the residence rules meet an income test Family Tax Benefit child criteria To be eligible your child must be aged 0 to 15 years aged 16 to 19 years and meet certain study requirements The child must be in What counts as income Usually what you re entitled to is based on your income for the last tax year 6 April 2023 to 5 April 2024 Income includes money from employment before tax

You need to tell Work and Income about what you earn from working and other regular income such as child support ACC weekly compensation pensions rent interest or help from your family Expand all The amount of Family Tax Benefit you get will depend on your family income and circumstances Some things can impact your Family Tax Benefit FTB Payment If you get FTB you must tell us if your circumstances change

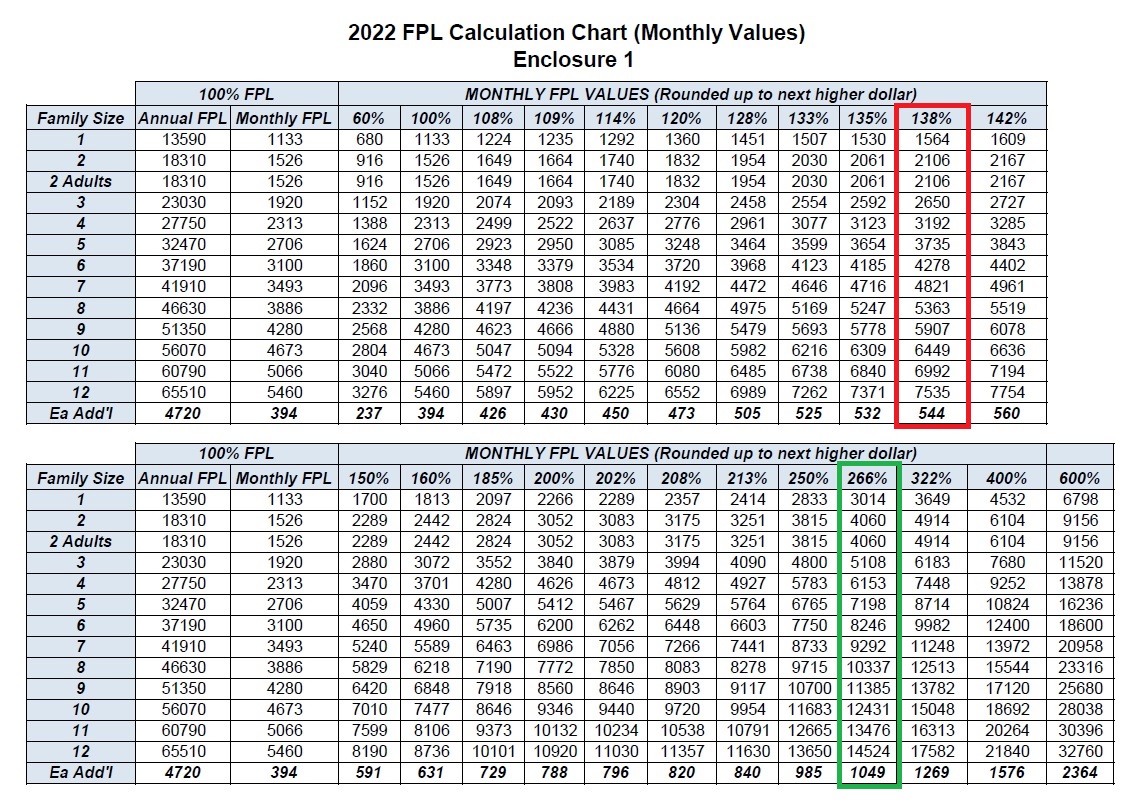

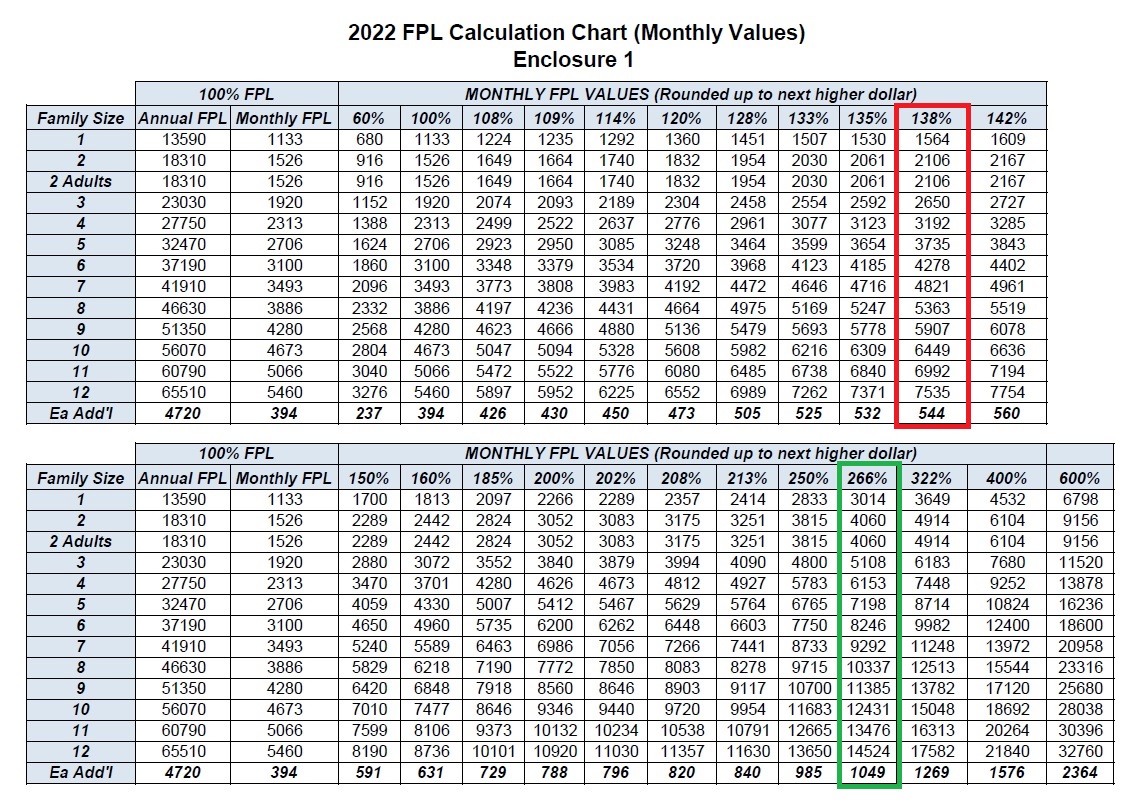

Big Increase For The 2022 Medi Cal Income Amounts

https://insuremekevin.com/wp-content/uploads/2022/02/Monthly-FPL-2022-Income-Chart-Medi_Cal.jpg

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

https://thumbs.dreamstime.com/z/family-tax-benefit-residential-property-estate-concept-members-house-dollar-money-bags-rows-rising-coins-depicts-home-195723204.jpg

https://www.servicesaustralia.gov.au/what-adjusted...

Taxable income This applies to family assistance payments Carer Allowance and the Commonwealth Seniors Health Card Taxable income is your gross income minus allowable deductions It s the income you have to pay tax on It includes income from any of these wages and salary which is your normal weekly fortnightly or monthly pay

https://www.servicesaustralia.gov.au/income-test...

We use an income test if your family s adjusted taxable income is over 115 997 We ll reduce the rate of FTB Part A by 30 cents for each dollar of income over 115 997 This applies until your payment is nil

Income Tax Benefits On Housing Loan In India

Big Increase For The 2022 Medi Cal Income Amounts

How Is The Earned Income Tax Credit Different This Year UnidosUS

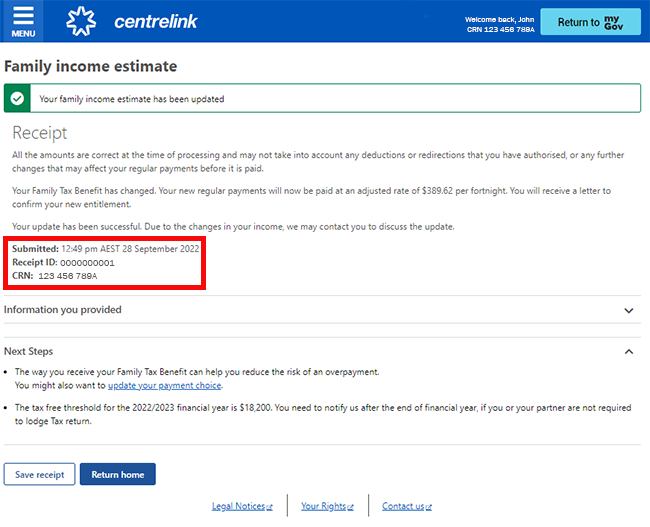

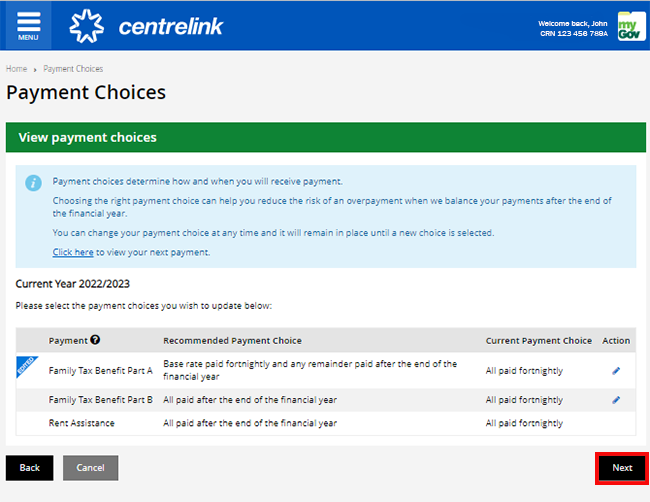

Centrelink Online Account Help Update Your Family Income Estimate And

Does A Tax Refund Count As Income Yes In Some Cases

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Family Tax Benefit Part A Base Rate Tax Walls

Centrelink Online Account Help Update Your Family Income Estimate And

How Does Family Tax Benefit Really Work Grandma s Jars

Does Family Tax Benefit Count As Income - Most of the income you earn will be assessable income Assessable income is income that you pay tax on if you earn enough to exceed the tax free threshold Examples of assessable income you must declare include salary and wages tips gratuities and other payments for your services