Does Georgia Tax Your Military Retirement Georgia Tax Exemption for Military Retired Pay Retired service members are eligible for the following state tax exemptions on military retired pay Under 62 years old up to

The new law can exempt income tax on up to 35 000 of military retirement income for veterans under 62 years old Up to 17 500 of military retirement benefits will Under the measure a veteran s first 17 500 in retirement pay would be exempt from Georgia s state income tax which has a top rate of 5 75 Another

Does Georgia Tax Your Military Retirement

Does Georgia Tax Your Military Retirement

https://veteranlife.com/wp-content/uploads/2022/08/military-retirement-gifts-1.jpg

States That Don t Tax Military Retirement 2023 Wisevoter

https://wisevoter.com/wp-content/uploads/2022/10/States-That-Dont-Tax-Military-Retirement.png

Retiring These States Won t Tax Your Distributions

https://www.taxdefensenetwork.com/wp-content/uploads/2021/11/states-and-retirement-taxes-1-2500x1875.jpg

Updated 2 56 PM EDT April 20 2022 ATLANTA Military retirement income up to a certain threshold will no longer be subject to the state income tax in Georgia after Gov Brian Kemp Kemp signs tax exemption bill other benefits for Georgia s military retirees New measures allow tax exemption for military retirement income expedites

Published February 23 2022 Some states don t charge income tax on military retired pay In all states U S Department of Veterans Affairs disability payments are tax free If you Military retirees in three states soon will be eligible for significant tax breaks with South Carolina and Oklahoma exempting all military retirement income from state

Download Does Georgia Tax Your Military Retirement

More picture related to Does Georgia Tax Your Military Retirement

States That Won t Tax Your Military Retirement Pay

https://cdn.aarp.net/content/dam/aarp/money/taxes/2020/11/1140-service-member-returning-home.web.jpg

Which States Do Not Tax Military Retirement

https://www.veteransunited.com/assets/craft/images/content/Military-Retirement_Desktop-Hero.png

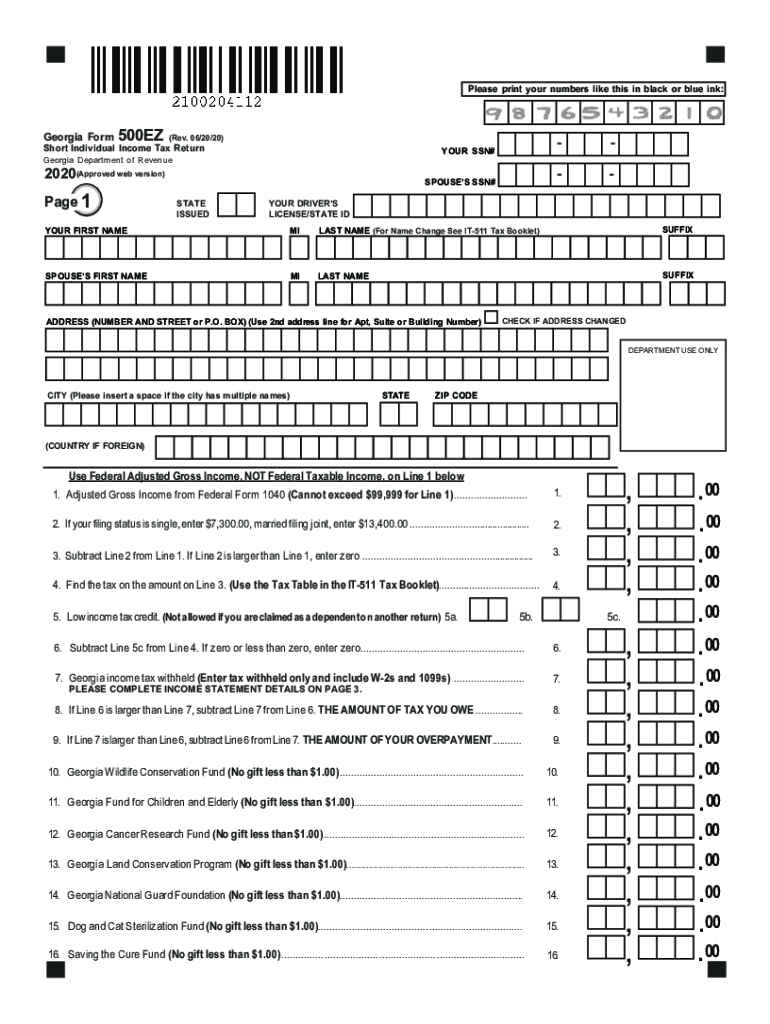

Georgia Income Tax Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/578/869/578869707/large.png

These states include Colorado Delaware Georgia Idaho Kentucky Maryland New Mexico Oregon South Carolina Virginia and West Virginia The District Is my military pension retirement income taxable to Georgia As a resident of Georgia all retirement amounts included in your federal return are also taxable on your Georgia

State Tax Breaks Available for Military and Retirees You may know that military allowances such as the Basic Allowance for Housing are tax free You may Georgia for example has a partial tax exemption for military retirement pay But Alabama just across the Chattahoochee River from Fort Moore formerly Fort

How Much Does Georgia Tax Lottery Winnings

https://www.ajc.com/rf/image_large/Pub/p7/AJC/2016/01/14/Images/photos.medleyphoto.8580611.jpg

Does Georgia Tax Income From Other States YouTube

https://i.ytimg.com/vi/5uld5TbteXc/maxresdefault.jpg

https:// myarmybenefits.us.army.mil /.../…

Georgia Tax Exemption for Military Retired Pay Retired service members are eligible for the following state tax exemptions on military retired pay Under 62 years old up to

https://www. wtoc.com /2022/04/21/veterans...

The new law can exempt income tax on up to 35 000 of military retirement income for veterans under 62 years old Up to 17 500 of military retirement benefits will

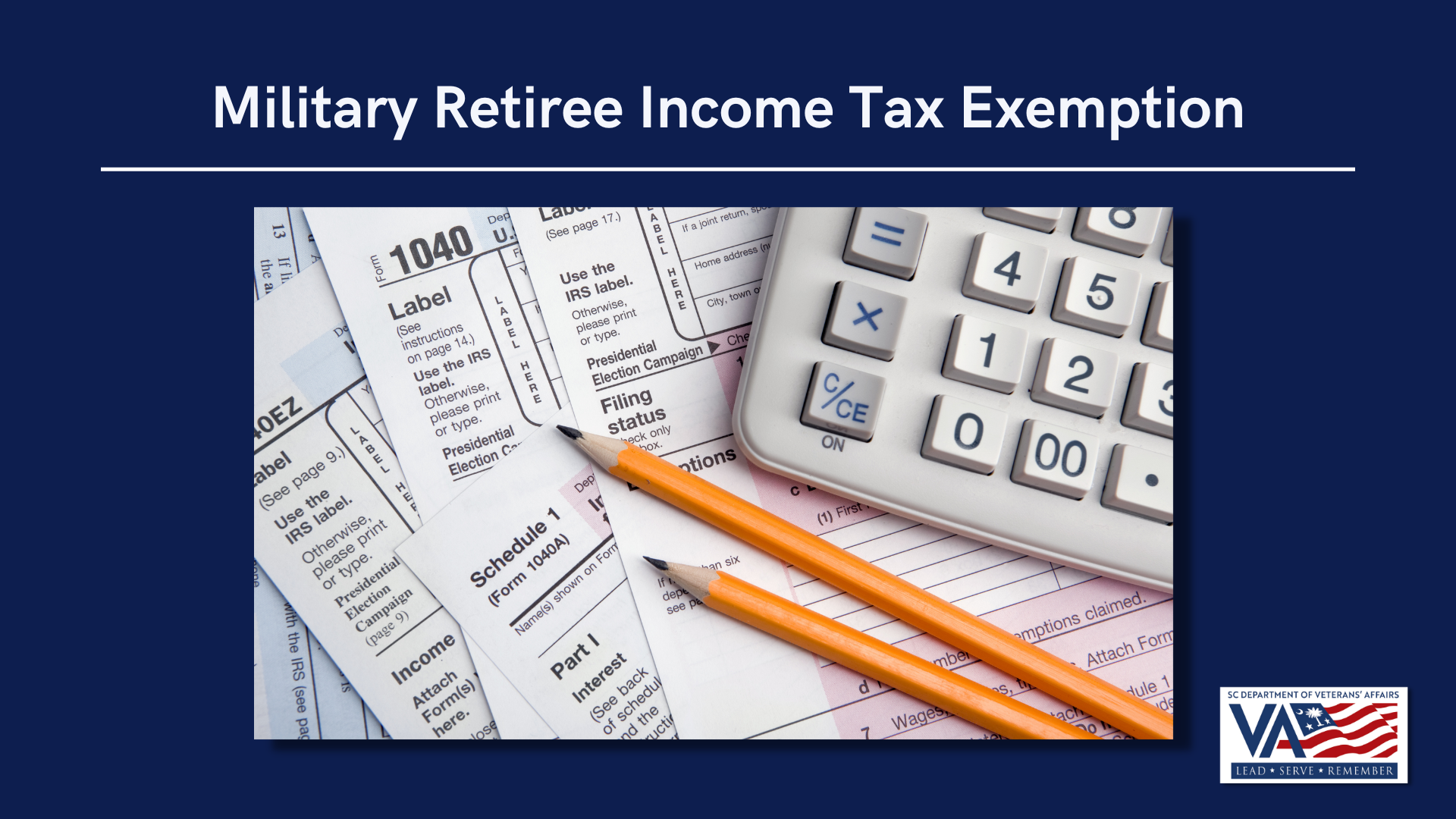

Claiming Military Retiree State Income Tax Exemption In SC Veterans

How Much Does Georgia Tax Lottery Winnings

States That Don t Tax Military Retirement Pay Discover Here

States That Won t Tax Your Retirement Distributions In 2021

Georgia State Income Tax Form 500ez Instructions Bestyfiles

Veteran Democrats Already Targeting The 2018 Elections

Veteran Democrats Already Targeting The 2018 Elections

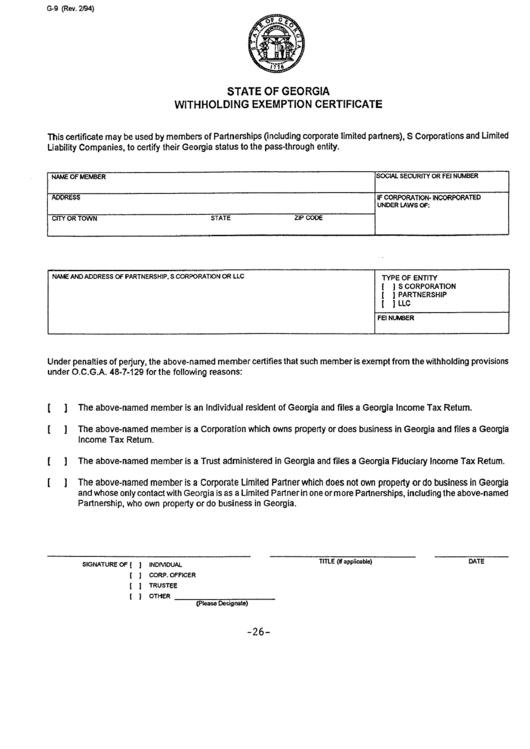

Georgia State Employee Withholding Form 2023 Employeeform

Georgia State Tax Exemption Form ExemptForm

Reserve Military Retirement Pay Calculator

Does Georgia Tax Your Military Retirement - Retirees and Annuitants 2023 Tax Year Statements 2023 tax statements for retirees are available in myPay 2023 tax statements for annuitants are available in myPay 2023 tax