Does Having Student Loans Help With Taxes Student loans can factor into your taxes as the interest is often tax deductible So you can reduce your tax bill if you include the amount of interest you ve paid during

Student loan payments can reduce your taxable income by up to 2 500 and if you re still in school give you a tax credit of up to 2 500 How student loans Yes interest is tax deductible on all federal and private student loans whether you re paying interest in school or deferring payments until after graduating

Does Having Student Loans Help With Taxes

Does Having Student Loans Help With Taxes

https://d2o6woj9n5zgsq.cloudfront.net/images/blog/photos/3+ways+we+can+help+with+taxes.jpg

How Do Cash Loans Help You During Tight Situations DeeDee s Blog

https://deedeesblog.com/wp-content/uploads/2020/08/cash-loans-e1598680034940.png

Will Paying Off Student Loans Help Or Hurt Your Credit Score

https://financejar.com/wp-content/uploads/2022/07/does-paying-off-student-loans-help-credit-score.jpg

Student loans aren t taxable because you ll eventually repay them Free money used for school is treated differently You don t pay taxes on scholarship or fellowship money used toward Borrowers who are able to make payments towards their loans can take advantage of a federal tax deduction of up to 2 500 on their tax return To cash in this

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in Both student loans and taxes can induce anxiety for many recent graduates but the good news is that using your student loan payments as tax deductions can reduce your tax burden Keep

Download Does Having Student Loans Help With Taxes

More picture related to Does Having Student Loans Help With Taxes

Student Loans Taxes What Deductions Can You Take LendEDU

https://lendedu.com/wp-content/uploads/2019/09/Student-Loans-and-Taxes.jpg

Taxes And Student Loans Married Filing Jointly Or Filing Seperately

https://studentloansherpa.com/wp-content/uploads/2017/02/file-taxes-jointly-or-separately-with-student-loans.jpg

Student Loans Should I Consolidate My Student Loans Consolidating

https://i.ytimg.com/vi/kxbe3C7v0bg/maxresdefault.jpg

The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified The fortunate answer is no the IRS doesn t consider student loans to be income Income that is taxable is usually made up of salary and wages The IRS also

The interest you ve paid for any student loan public or private is tax deductible as long as the loan qualifies it doesn t only have to be federal student aid Five Tax Breaks for Paying Your Student Loan After a three year pause student loan payments have resumed putting a dent in people s wallets But there are

How To Get The Student Loan Interest Deduction NerdWallet

https://assets.nerdwallet.com/blog/wp-content/uploads/2015/10/8-student-faqs-about-taxes.jpg

Some Borrowers Might Have Student Loan Payments Paused Through 2025

https://www.studentloanplanner.com/wp-content/uploads/2023/01/For-Some-Borrowers-the-Student-Loan-Payment-Pause-Will-Last-Until-At-Least-2025-1.png

https://www.investopedia.com/studen…

Student loans can factor into your taxes as the interest is often tax deductible So you can reduce your tax bill if you include the amount of interest you ve paid during

https://www.bankrate.com/loans/student-loans/tips...

Student loan payments can reduce your taxable income by up to 2 500 and if you re still in school give you a tax credit of up to 2 500 How student loans

The Impact Of Student Debt Loans In Taxes Student Loan Law

How To Get The Student Loan Interest Deduction NerdWallet

How Student Loans Could Affect Your Taxes

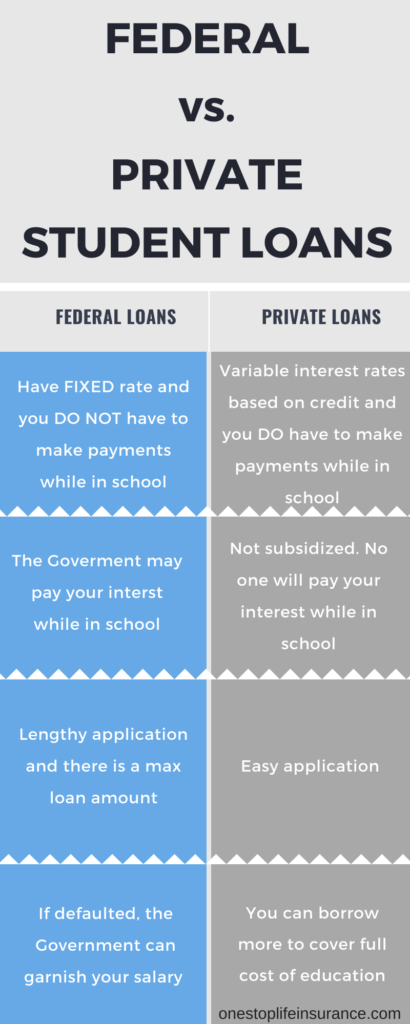

Why Life Insurance And Student Loans Should Go Hand In Hand rates

Do Student Loans Count As Income On My Taxes Credible

Do Student Loans Count As Income For Taxes LendEDU

Do Student Loans Count As Income For Taxes LendEDU

Student Loans And Taxes How To Save More Money

Do You Have Student Loans My Retirement Plan SUITE k A Division

1St Time Buyers With Bad Credit Does Paying Off Student Loans Help

Does Having Student Loans Help With Taxes - Both student loans and taxes can induce anxiety for many recent graduates but the good news is that using your student loan payments as tax deductions can reduce your tax burden Keep