Does Hawaii Have 4 712 Sales Tax Hawaii Sales Tax 4 Average Sales Tax With Local 4 5 Hawaii has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 0 5

What is Hawaii s sales tax rate Are we allowed to pass on the business tax to the customer What is the formula for calculating penalty What is the formula for While technically Hawaii does not have a sales tax there is a 4 percent general excise tax GET On top of the state tax rate there may be one or more local taxes as well as one

Does Hawaii Have 4 712 Sales Tax

Does Hawaii Have 4 712 Sales Tax

https://i.cbc.ca/1.6571231.1662140353!/fileImage/httpImage/image.jpg_gen/derivatives/original_780/binnu-jeyakumar.jpg

Manoa lowercampus manoa jpg

http://mediad.publicbroadcasting.net/p/khpr/files/styles/x_large/public/201711/Manoa-lowercampus_manoa.jpg

Americas Hawaii Travel Hawaii Hiking

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiH9eNvUcQ8wASYl_D6eUTYDas8p3sdZu8t2MbtshEFqZWanHsc8X8VESuHsOSf9SK5hkdv5AO63x9UyBtIGxvEUzxQ1sAgxNXrgn08EkWkqg7qYBtchHPiXS9kuNkpwhxKuC1XDSLqnTyEi5e-OkcElzwN9T2zJD3_aoeRlVIPkwfiUT8vyObjVls0/s1920/12719.jpg

Our free online Hawaii sales tax calculator calculates exact sales tax by state county city or ZIP code Hawaii has a 4 statewide sales tax rate but also has four local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of

The GET rate in Hawaii is 4 on retail sales with an additional 0 5 local sales tax added in Oahu County Kauai County and Hawaii County in the form of a county surcharge No Hawaii does not have a sales tax The GET is diferent from a sales tax because a A sales tax is a tax on customers whereas GET is a tax on businesses and b Businesses

Download Does Hawaii Have 4 712 Sales Tax

More picture related to Does Hawaii Have 4 712 Sales Tax

Daniel K Inouye Honolulu Airport HNL Car Rental Guide AutoSlash

https://blog.autoslash.com/wp-content/uploads/2020/09/car-rental-Honolulu-HNL.jpg

Is Hawaii A Country Or A State Facts And History

https://travelcompositions.com/wp-content/uploads/2022/12/kauai-coastline.jpg

Does Hawaii Have A SALES TAX Hawaii General Excise Tax Explained

https://i.ytimg.com/vi/nONFKnnZYQI/maxresdefault.jpg

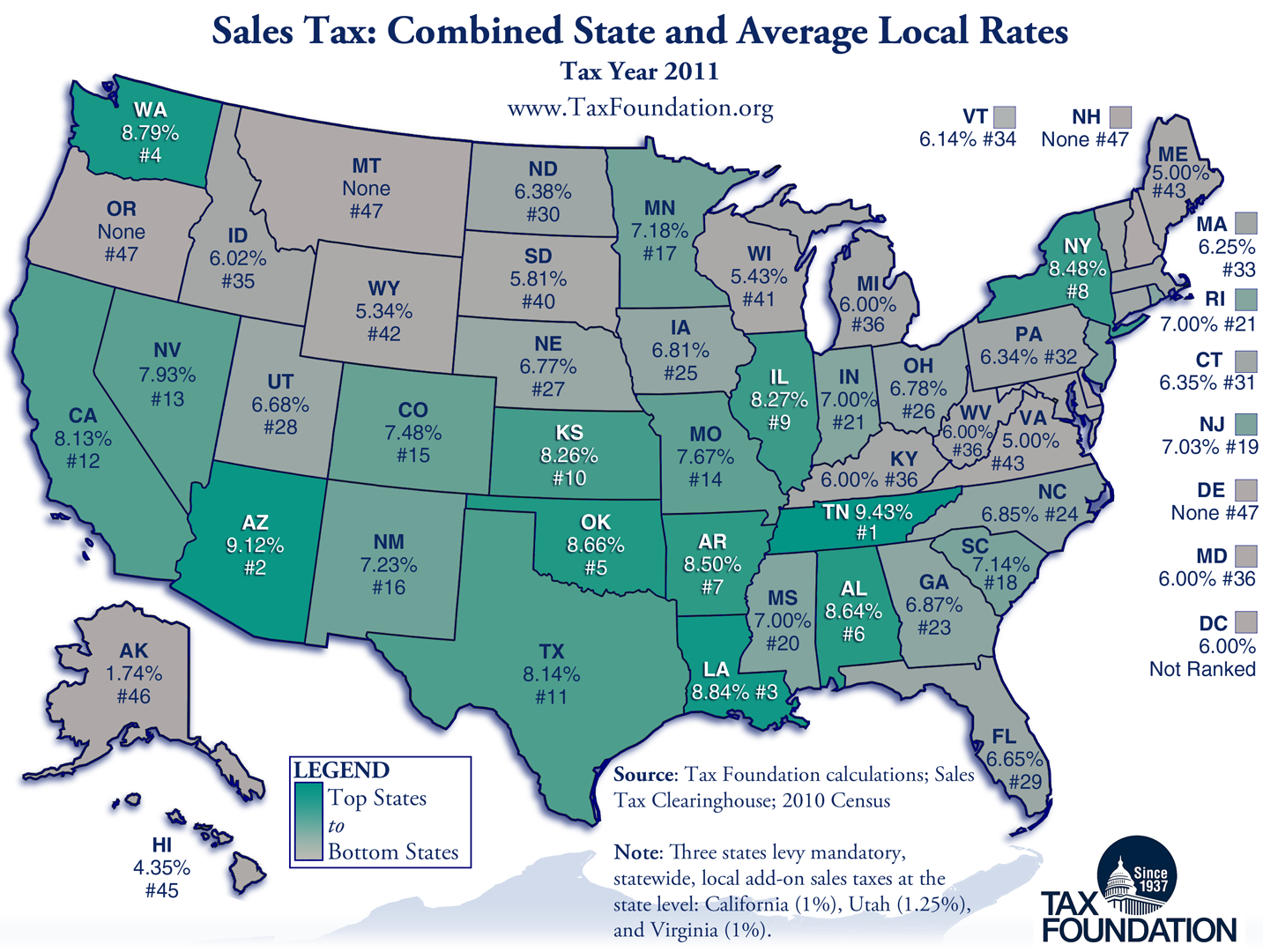

The county surcharge only applies to transactions subject to the 4 0 GE and use tax rate The county surcharge does not apply to activities taxed at the 0 5 rate If the taxes were passed on at the maximum rate of 4 712 47 12 would have been collected as tax on the transaction The GET due would have been 41 89 1 047 12 x

Hawaii imposes a general excise tax GET on business gross income The base GET rate is 4 statewide Additionally Hawaii s 4 counties can impose a county Hawaii sales and use tax rates in 2024 range from 4 to 4 5 depending on location Use our calculator to determine your exact sales tax rate

Does Hawaii Have Casinos Does Hawaii Have Casinos Hawaii Flickr

https://live.staticflickr.com/65535/52971124655_3cae29f159_b.jpg

Does Hawaii Have Amazon Hawaii Star

https://www.hawaiistar.com/wp-content/uploads/2023/08/does-hawaii-have-amazon.webp

https://www.salestaxhandbook.com/hawaii/rates

Hawaii Sales Tax 4 Average Sales Tax With Local 4 5 Hawaii has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 0 5

https://tax.hawaii.gov/geninfo/get

What is Hawaii s sales tax rate Are we allowed to pass on the business tax to the customer What is the formula for calculating penalty What is the formula for

Sales Tax I Hawaii Hawaiibloggen

Does Hawaii Have Casinos Does Hawaii Have Casinos Hawaii Flickr

Colorado Sales Tax Changes Small business Owners Oppose New Rules

Does Hawaii Have An Aquarium Ouestny

Can Hawaii Sink

Kauai Hawaii A World To See

Kauai Hawaii A World To See

Does Hawaii Have America s Strongest Identity YouTube

Here s The Best Time To Visit Hawaii In 2023 Planner At Heart

Hawaii Rent Increase Laws What Is Isn t Legal

Does Hawaii Have 4 712 Sales Tax - No Hawaii does not have a sales tax The GET is diferent from a sales tax because a A sales tax is a tax on customers whereas GET is a tax on businesses and b Businesses