Does Hawaii Tax My Pension The good news is that public pension income is totally tax exempt in Hawaii The bad news is that all other forms of retirement income are taxed and are not eligible

Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If you Hawaii taxation of pension income is somewhat of a mixed bag Our income tax law has an exemption for compensation received in the form of a pension for past services that

Does Hawaii Tax My Pension

Does Hawaii Tax My Pension

https://i.vimeocdn.com/video/1749809096-2cbc4a7583ec67b6065d1316bda66f8f1c1002e1cb199dd54695fc65213a5435-d?f=webp

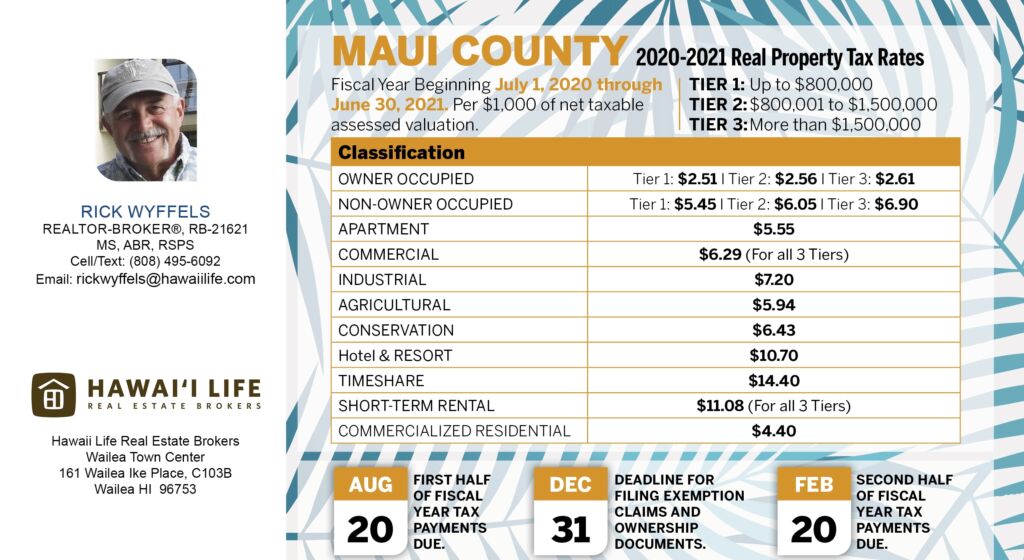

Hawaii TAX BENEFITS TO BE REMOVED On Second Homes For Better Or

https://i.ytimg.com/vi/MQ46mN5L6Pc/maxresdefault.jpg

How Can I Take My Pension SIPP Your Retirement Income Options

https://i.ytimg.com/vi/fMIbmdADRnY/maxresdefault.jpg

2024 W 4P Pension Tax Withholding Form FAQ Refer to tax withholding tables for approximate federal income taxes to be withheld Mailing Address ERS 211 Mailing Q How is my retirement benefits classified for income tax reporting i e IRA pension or annuity A The ERS is a qualified defined benefit public pension plan

Under current Hawaii law any retirement income from an out of state source is subject to the state income tax This includes pensions Social Security and other income that exceeds the exemptions set by the state code HONOLULU The Department of Taxation DOTAX reminds residents and nonresidents that Hawai i state individual income tax returns are due Monday April 22 2024 and the

Download Does Hawaii Tax My Pension

More picture related to Does Hawaii Tax My Pension

What Is Hawaii s General Excise Tax Grassroot Institute Of Hawaii

https://www.grassrootinstitute.org/wp-content/uploads/2023/02/GET-license.jpeg

/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png)

Does Hawaii Tax Pensions And Social Security

https://i2.wp.com/www.thebalance.com/thmb/FyniSZoEEqxL0so7fcVHWHLaKTo=/1000x1000/smart/filters:no_upscale()/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png

Are You Due A Huge Pension Tax Refund Which News

https://s3.eu-west-1.amazonaws.com/prod.news.product.which.co.uk/news/wp-content/uploads/2017/03/Pensions.jpg

In the new pension rules there is no change in Hawaii s net income tax treatment of those benefits E How Are Deductions for Contributions to a Nonqualified Plan Treated Under If you contributed after tax dollars to your pension or annuity your pension payments are partially taxable You won t pay tax on the part of the payment that

Hawaii does not tax distributions from qualified employer funded pension plans If your pension distribution was from an employer funded profit sharing defined contribution or Hawaii Tax on Retirement Benefits Social Security retirement benefits military and government pensions private pensions and Tier 1 Railroad Retirement

14 States That Won t Tax My Pension YouTube

https://i.ytimg.com/vi/5EdrvnEFQfg/maxresdefault.jpg

Attorney In Orange County CA Money Diary

https://www.refinery29.com/images/11312596.jpg?crop=40:21

https:// ttlc.intuit.com /community/retirement/...

The good news is that public pension income is totally tax exempt in Hawaii The bad news is that all other forms of retirement income are taxed and are not eligible

https:// support.taxslayer.com /hc/en-us/articles/...

Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If you

Retired Foreign Officer In Pittsburgh PA Money Diary

14 States That Won t Tax My Pension YouTube

What Are My Pension Options At Retirement Efficient Portfolio

If I Move To N J Will The State Tax My Pension Nj

August 13 2022

Will My N Y S Pension Be Taxed If I Move To N J Nj

Will My N Y S Pension Be Taxed If I Move To N J Nj

Does The State Of Hawaii Tax Retirement Income

Pension Calculator Ireland National Pension Helpline

Department Of Taxation State Of Hawaii Department Of Taxation

Does Hawaii Tax My Pension - Hawaii Pensions Hawaii doesn t tax all pension income but there are some things you should know to avoid a surprise at tax time