Does Hawaii Tax Pensions Retirement distributions from a private or public pension plan are tax free in Hawaii only if you didn t make contributions to the plan Employee contributed retirement plans

What taxes do retirees pay in Hawaii Hawaii exempts some retirement income but income tax rates are on the high end for retirement income that is taxable Hawaii also has an estate tax The good news is that public pension income is totally tax exempt in Hawaii The bad news is that all other forms of retirement income are taxed and are not eligible for any kind of deduction

Does Hawaii Tax Pensions

Does Hawaii Tax Pensions

https://i2.wp.com/www.veteransunited.com/assets/craft/images/blog/retirement-income-tax.jpg

Does Hawaii Tax Pensions And Social Security

https://i2.wp.com/ei.marketwatch.com/Multimedia/2017/03/03/Photos/NS/MW-FH304_state__20170303175702_NS.png?uuid=b705325a-0064-11e7-8f01-001cc448aede

Does Hawaii Tax Pensions And Social Security

https://i2.wp.com/a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2020/07/931/523/Tax-free-retirement.png?ve=1&tl=1

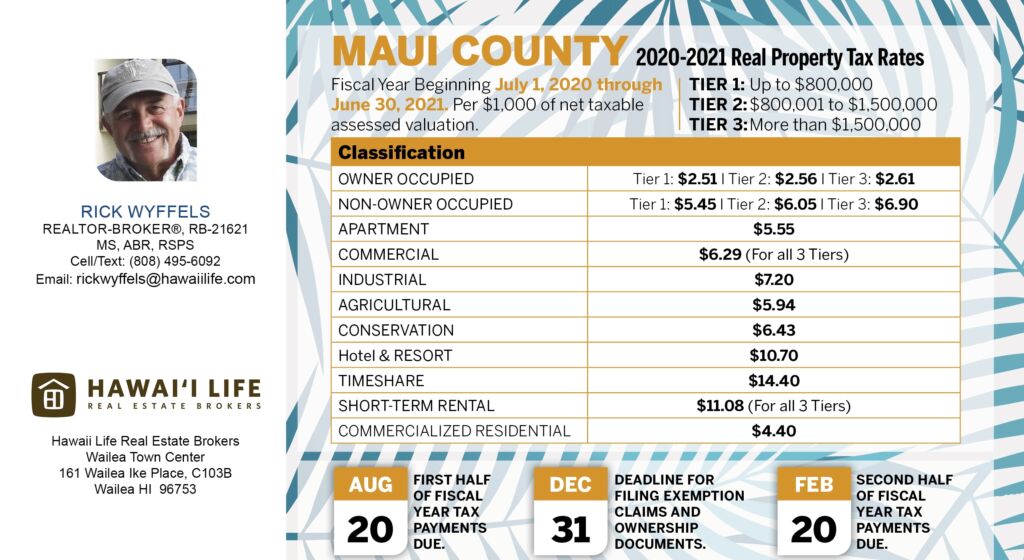

In the new pension rules there is no change in Hawaii s net income tax treatment of those benefits E How Are Deductions for Contributions to a Nonqualified Plan Treated Under Hawaii Law Some employers have retirement plans that are Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If you received distributions from a private employer pension plan and you made contributions to the pension plan your distribution is partially taxable

Hawaii Tax on Retirement Benefits Social Security retirement benefits military and government pensions private pensions and Tier 1 Railroad Retirement benefits are tax exempt Hawaii taxation of pension income is somewhat of a mixed bag Our income tax law has an exemption for compensation received in the form of a pension for past services that has been on our books since Act 169 of 1953

Download Does Hawaii Tax Pensions

More picture related to Does Hawaii Tax Pensions

Does Hawaii Tax Pensions And Social Security

https://i2.wp.com/www.sensiblemoney.com/learn/media/1040.png

Does Hawaii Tax Pensions And Social Security

https://i.pinimg.com/originals/a6/5a/9a/a65a9abf62c9f00b40c91bdf69941a27.png

State Taxes On Military Retirement Pay

https://themilitarywallet.com/wp-content/uploads/2008/01/GettyImages-1160636403-scaled.jpg

Retirement income exclusion from 35 000 to 65 000 Tax info 404 417 6501 or 877 423 6177 or dor georgia gov taxes Employer funded pension plans exempt these self funded plans may be fully or partly taxable Tax info 800 222 3229 or tax hawaii gov Does Hawaii tax retirement income In Hawaii Social Security military and government benefits are tax exempt as are private pensions and Tier 1 Railroad Retirement benefits However other retirement plan distributions or contributions including income from your 401 k IRA and other retirement savings accounts may be taxed in Hawaii

Here we take a look over the Hawaii retirement system including the different plans programs and taxes that are involved in the state 2 BENEFITS TAX EXEMPTION IN HAWAI I Federal Rule Pensions and Annuities If you contributed after tax dollars to your pension or annuity your pension payments are partially taxable You won t pay tax on the part of the payment that represents a return of the after tax amount you paid

Member Calendar Hawaii Business Roundtable

https://images.squarespace-cdn.com/content/v1/5ab00c02506fbe717ab92048/1532043313877-ONZYKMECOKB6ICFUIXEF/HBR_Transparent+-+REVISED.png?format=1500w

States That Don t Tax Pensions 2023 Wisevoter

https://wisevoter.com/wp-content/uploads/2023/03/States-That-Dont-Tax-Pensions.png

https://www.kiplinger.com/retirement/601819/states...

Retirement distributions from a private or public pension plan are tax free in Hawaii only if you didn t make contributions to the plan Employee contributed retirement plans

https://www.kiplinger.com/retirement/602202/taxes...

What taxes do retirees pay in Hawaii Hawaii exempts some retirement income but income tax rates are on the high end for retirement income that is taxable Hawaii also has an estate tax

Hawaii Federal Tax Id Number Search April Tax

Member Calendar Hawaii Business Roundtable

These Countries Have The Best Pensions In 2022 and The U S Didn t Make

Veteran Homes Hawaii Team Brokered By Coldwell Banker Pacific

We Have Preliminary Calculations Of Pensions After Standardization In

August 13 2022

August 13 2022

Retiring These States Won t Tax Your Distributions

Does The State Of Hawaii Tax Retirement Income

Two Major 2023 Pension Changes Contractors Should Know About Liquid

Does Hawaii Tax Pensions - Eight states Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming don t tax income at all New Hampshire taxes only interest and dividend income And six states Alabama Hawaii Illinois Iowa Mississippi and Pennsylvania exclude pension income from state taxes