Does Hawaii Tax Retirement Distributions Hawaii has a steep top income tax but doesn t tax pension distributions at least the part that you didn t contribute to You ll get taxed on your contributions and

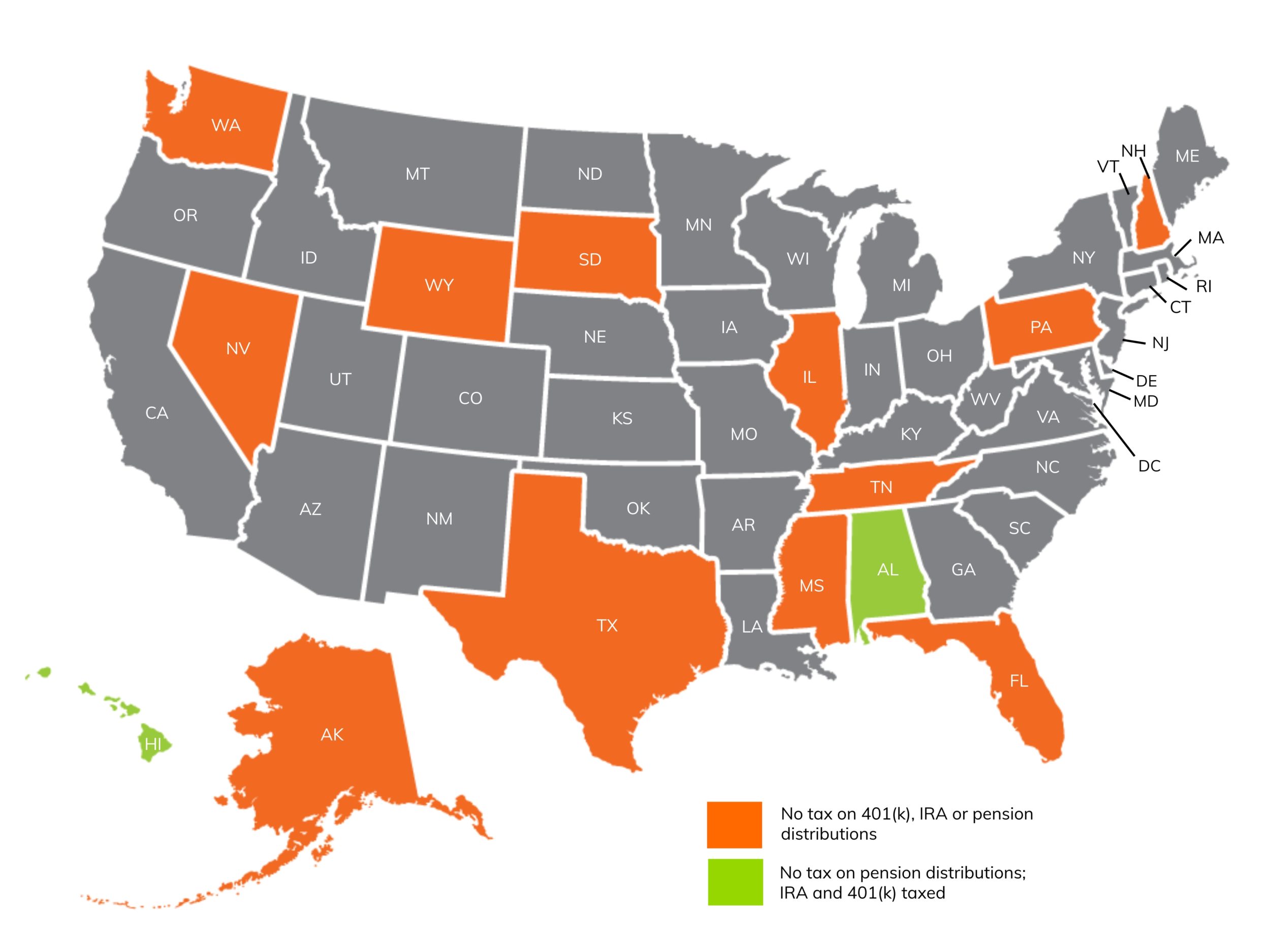

Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If Eight states Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming don t tax income at all New Hampshire taxes only interest and dividend income And six states

Does Hawaii Tax Retirement Distributions

Does Hawaii Tax Retirement Distributions

https://www.taxdefensenetwork.com/wp-content/uploads/2021/11/states-and-retirement-taxes-1-2500x1875.jpg

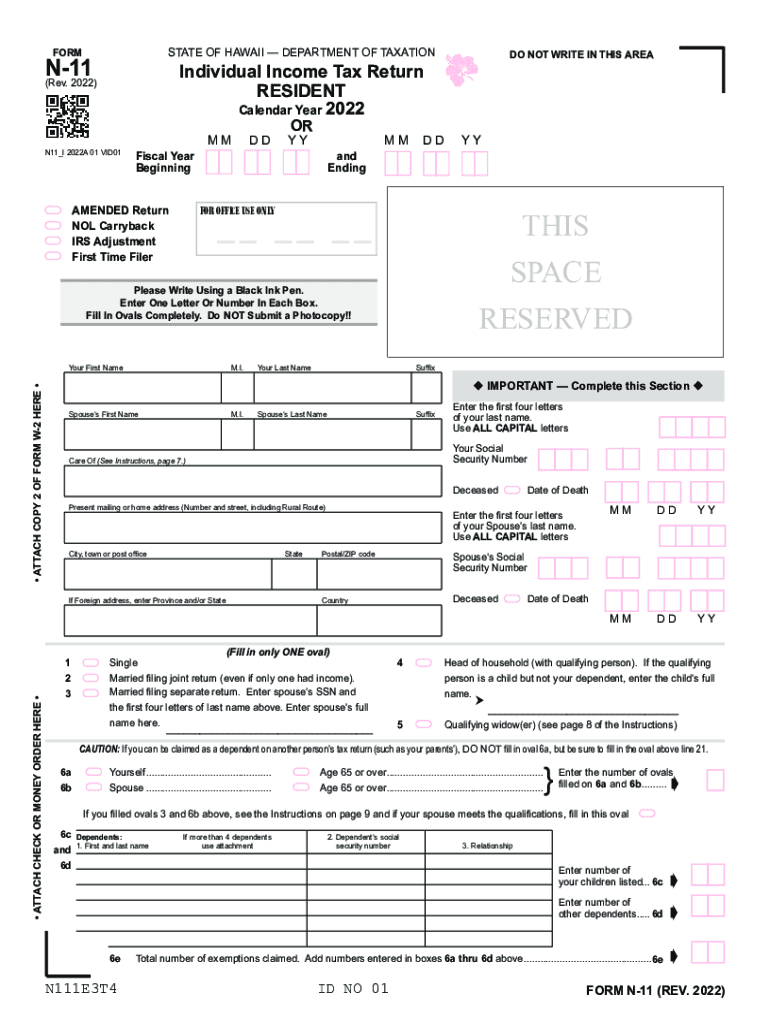

Hawaii Federal Tax Id Number Search April Tax

https://www.khon2.com/wp-content/uploads/sites/8/2019/10/image003_1555639513429_83193399_ver1.0.png?w=900

States That Tax Retirement Distributions Atlanta Seniors Real Estate

https://atlantaseniorsrealestate.com/atlseniors/wp-content/uploads/2023/02/1140-state-retirementincome-tax.png

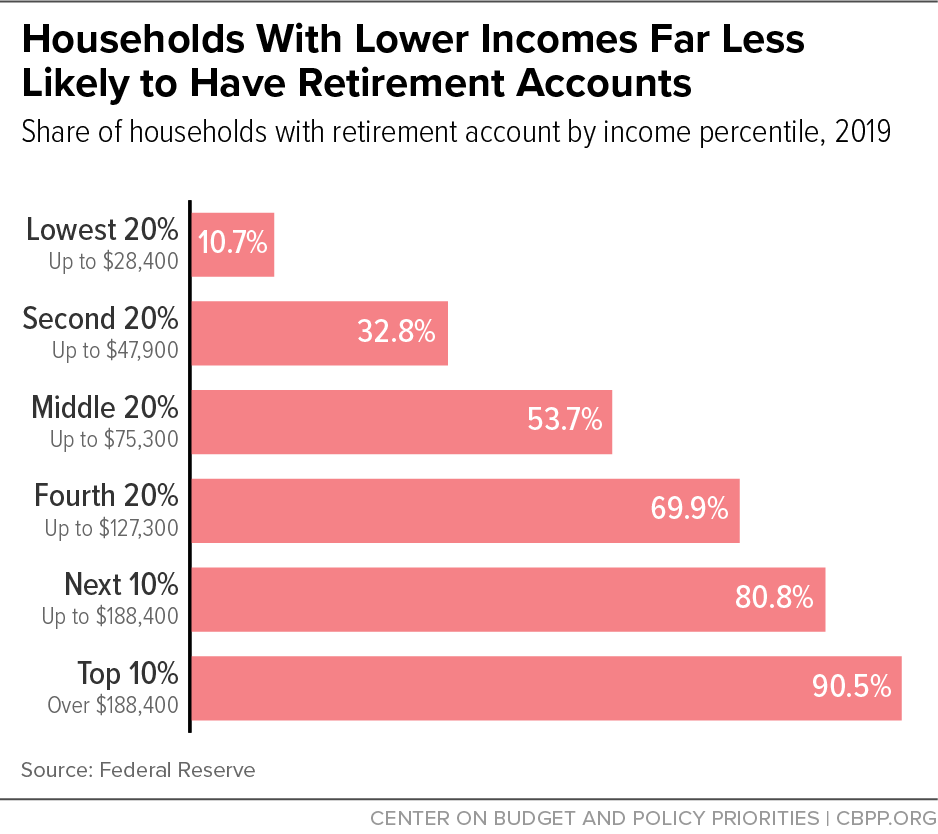

Hawai i taxation of retirement income is neither fair nor equitable they say The exemption of large portions of retirement income impairs tax adequacy Their recommendations Tax pension and other retirement Hawaii excludes certain distributions from state income tax for private retirement plans and for portions from company plans rolled over to a rollover IRA and

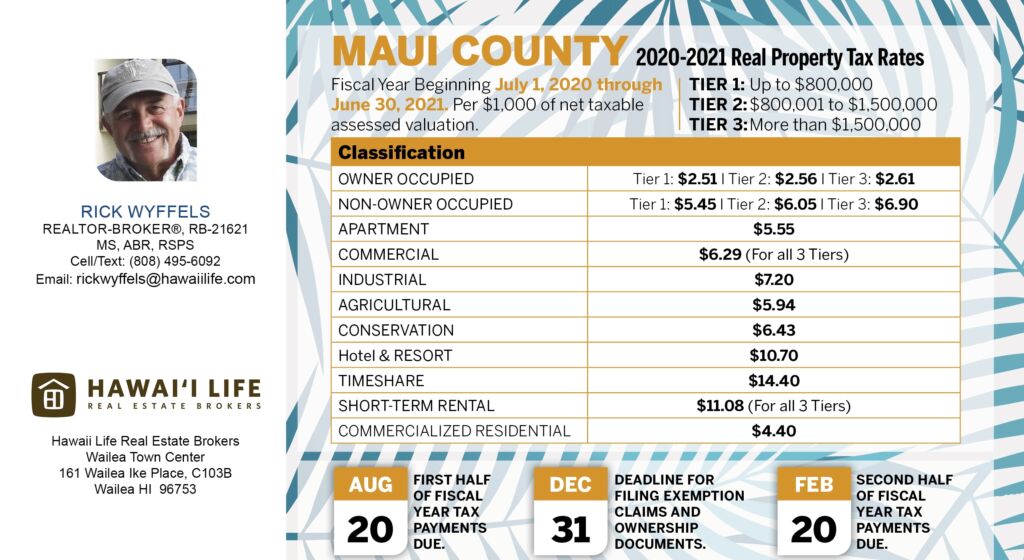

Residents in Hawaii endure higher than average income tax rates but they are offset by gloriously low property taxes Below we explain various Hawaii state taxes affecting retirement income such as From a qualified profit sharing or retire ment plan all or part of the distribution may be taxable You can use Form N 152 to figure your tax by special methods The capital

Download Does Hawaii Tax Retirement Distributions

More picture related to Does Hawaii Tax Retirement Distributions

Does The State Of Hawaii Tax Retirement Income

https://i1.wp.com/www.hawaiireporter.com/wp-content/uploads/2018/02/article-photo.png

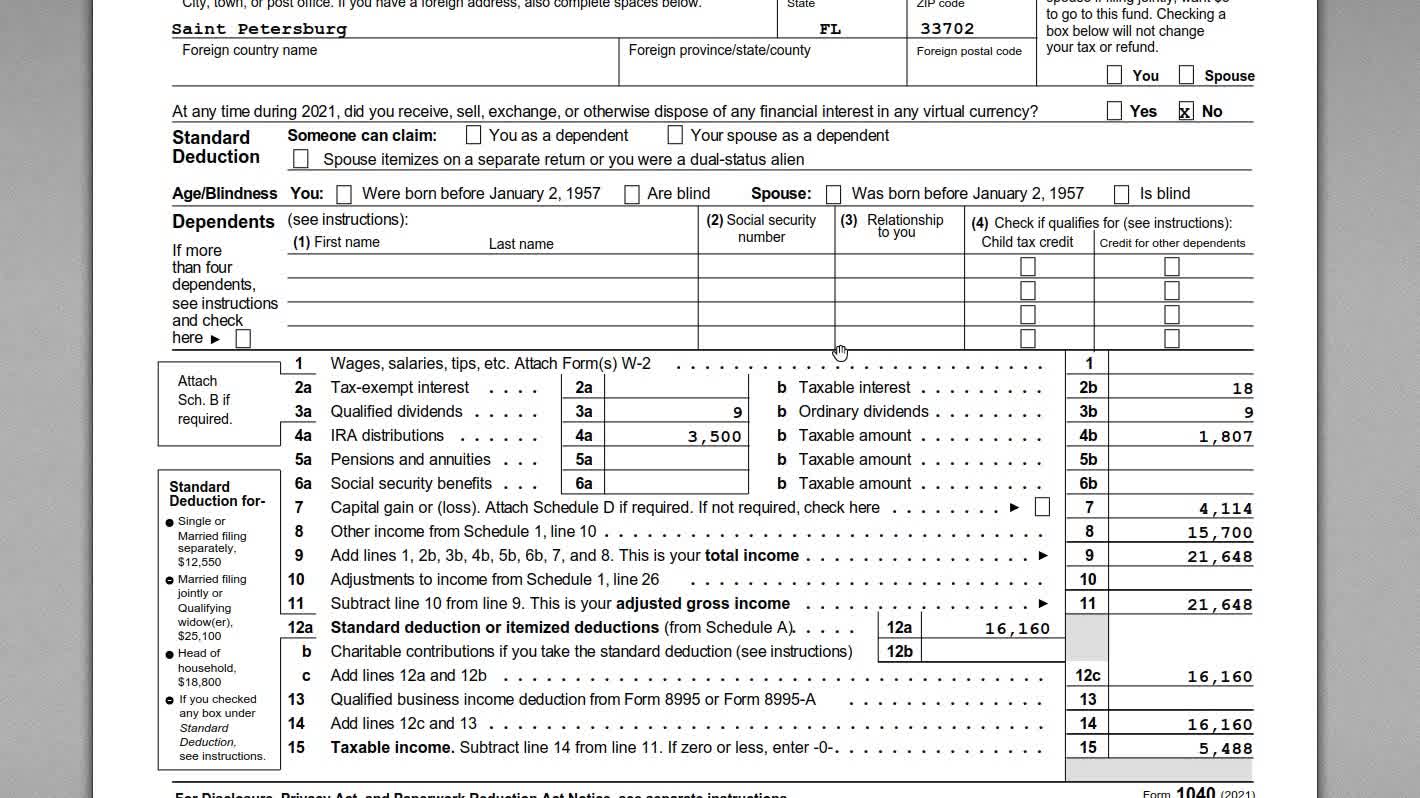

Nontaxable Distributions From Traditional IRA Complete Form 8606

https://sp.rmbl.ws/s8/6/J/Z/v/2/JZv2c.-3Af.jpg

How To Avoid The 10 Additional Tax On Early Retirement Distributions

https://www.journalofaccountancy.com/content/dam/jofa/issues/2016/jan/avoid-additional-tax.jpg

Three states tax income from 401 k s and IRAs but do not tax pensions Alabama Hawaii New Hampshire On most 401Ks the employer will match up to 6 of your salary If you make 50K per year the company will match 3 000 If you contribute 10K they will still only

Hawaii has a graduated state individual income tax rate ranging from 1 4 to 11 according to the Tax Foundation Hawaii Tax on Retirement Benefits Social While most states tax TSP distributions these 12 don t Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington Wyoming

/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png)

Does Hawaii Tax Pensions And Social Security

https://i2.wp.com/www.thebalance.com/thmb/FyniSZoEEqxL0so7fcVHWHLaKTo=/1000x1000/smart/filters:no_upscale()/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png

13 States That Don t Tax Your Retirement Income

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA17rloT.img?w=1280&h=720&m=4&q=81

https://www.aarp.org/money/taxes/info-2023/states...

Hawaii has a steep top income tax but doesn t tax pension distributions at least the part that you didn t contribute to You ll get taxed on your contributions and

https://support.taxslayer.com/hc/en-us/articles/...

Hawaii does not tax qualifying distributions from Employer funded pension plan Federal civil service retirement Military pension State or county retirement system If

All The States That Don t Tax Retirement Distributions

/states-without-an-income-tax-3193345_FINAL-5c0fe47cc9e77c0001ec54a0.png)

Does Hawaii Tax Pensions And Social Security

August 13 2022

State by State Guide To Taxes On Retirees Retirement Retirement

House Bill Would Further Skew Benefits Of Tax Favored Retirement

States That Won t Tax Your Retirement Distributions Income Tax Tax

States That Won t Tax Your Retirement Distributions Income Tax Tax

States That Don t Tax Military Retirement Pay Discover Here

Hawaii Income Tax Return Fill Out Sign Online DocHub

States That WON T Tax Retirement Distributions 4 Best Retirement

Does Hawaii Tax Retirement Distributions - From a qualified profit sharing or retire ment plan all or part of the distribution may be taxable You can use Form N 152 to figure your tax by special methods The capital