Does Home Improvements Qualify For Tax Credit Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation

Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an The energy efficient home improvement credit can help homeowners cover costs related to qualifying improvements made from 2023 to 2032 The maximum credit

Does Home Improvements Qualify For Tax Credit

Does Home Improvements Qualify For Tax Credit

https://www.energytexas.com/blog/wp-content/uploads/2022/11/AdobeStock_82265451.jpeg

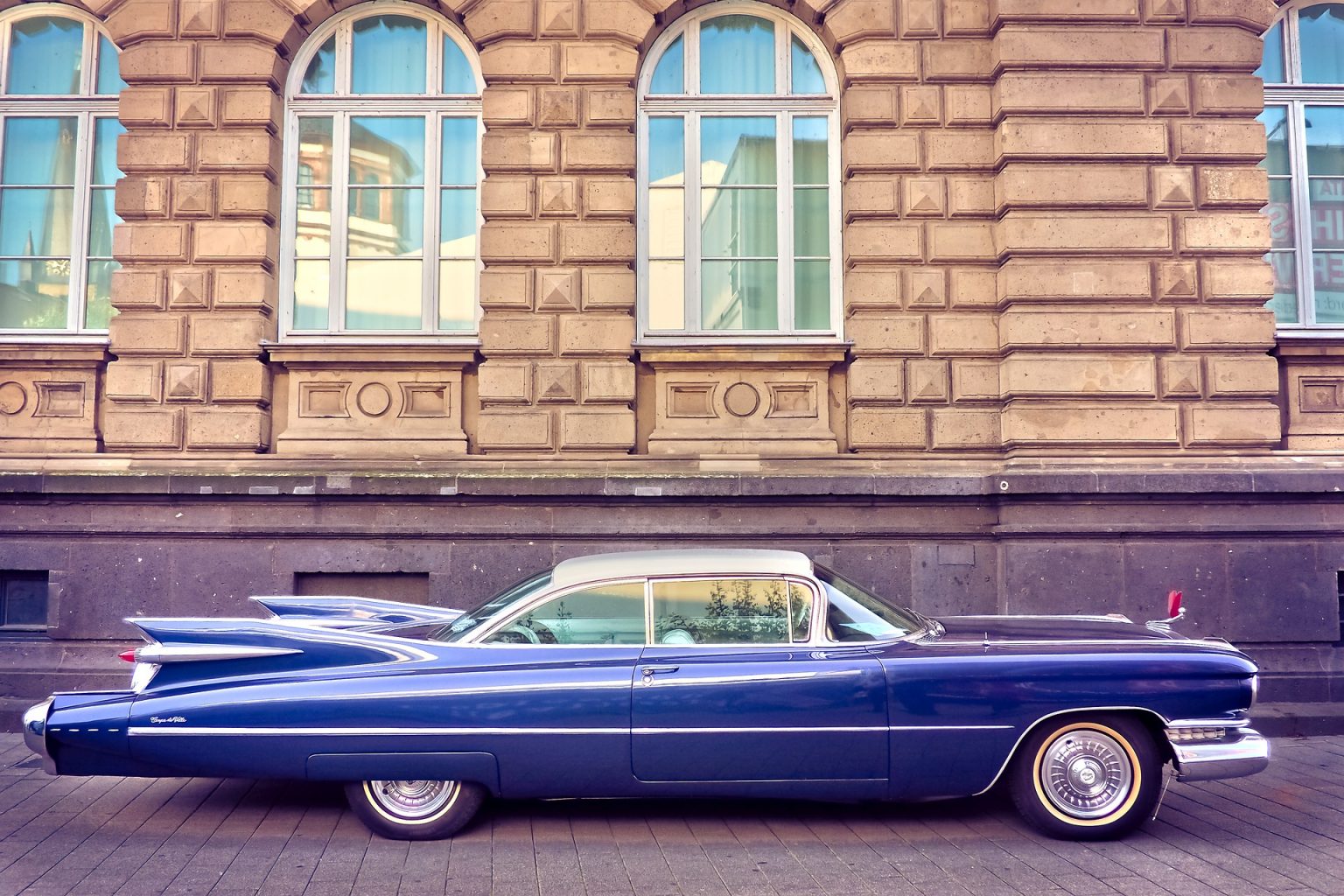

Does The Nissan Leaf Qualify For The EV Tax Credit

https://www.motorbiscuit.com/wp-content/uploads/2021/06/2021-Nissan-LEAF-SV-Plus.jpg?w=1200

2023 EV Tax Credit How To Save Money Buying An Electric Car Money

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?quality=85

Which home improvements qualify for the Energy Efficient Home Improvement Credit Beginning January 1 2023 the credit becomes equal to the lesser of 30 of the sum of OVERVIEW If your home renovation project includes the installation of energy efficient equipment a tax credit may be available to you TABLE OF

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to Beginning with the 2023 tax year tax returns filed now in early 2024 the credit is equal to 30 of the costs for all eligible home improvements made during the

Download Does Home Improvements Qualify For Tax Credit

More picture related to Does Home Improvements Qualify For Tax Credit

5 Reasons To Buy A 2022 Hyundai Ioniq 5 Not A Ford Mustang Mach E

https://www.motorbiscuit.com/wp-content/uploads/2022/06/Hyundai-Ioniq-5.jpg

Ev Car Tax Rebate Calculator 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/06/tax-credits-drive-electric-northern-colorado.png

The Federal Tax Credit For Electric Cars Is Set To Expire OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

What Home Improvements Are Tax Deductible in 2023 Most home improvements like putting on a new roof or performing routine maintenance don t Homeowners may be able to save thousands of dollars by claiming tax credits and rebates under the Inflation Reduction Act of 2022

The energy efficient home improvement credit is allowed to offset regular income tax reduced by the foreign tax credit plus alternative minimum tax Sec 26 Two federal income tax credits reward energy efficient home improvements very differently Which credit you use depends on the improvements you

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

https://www.rivianforums.com/forum/attachments/d428cfec-e782-475a-be36-314fe3df331f-jpeg.30501/

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

https://www.irs.gov/newsroom/irs-home-improvements...

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 As part of the Inflation

https://www.irs.gov/credits-deductions/frequently...

Under the Energy Efficient Home Improvement Credit a taxpayer can claim the credit only for qualifying expenditures incurred for an existing home or for an

The Best Self Employed Tax Deductions And Credits In 2022

Rivian Forums R1T R1S Owners News Discussions RIVN Stock

Energy Tax Credit Which Home Improvements Qualify SCL

Article Basics 8 Moving On Up Tax Credit Household Transfer Rules

Car Donation Tax Deduction Tax Benefits Of Donating A Car

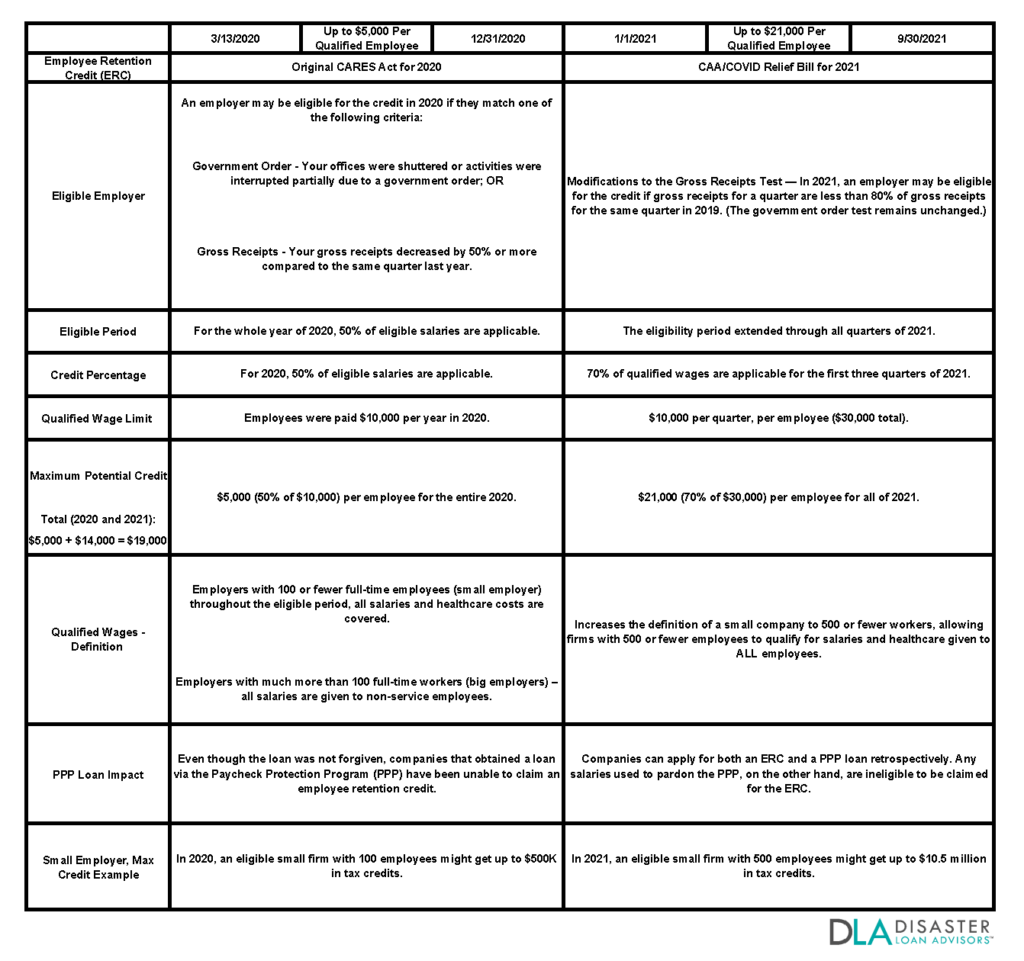

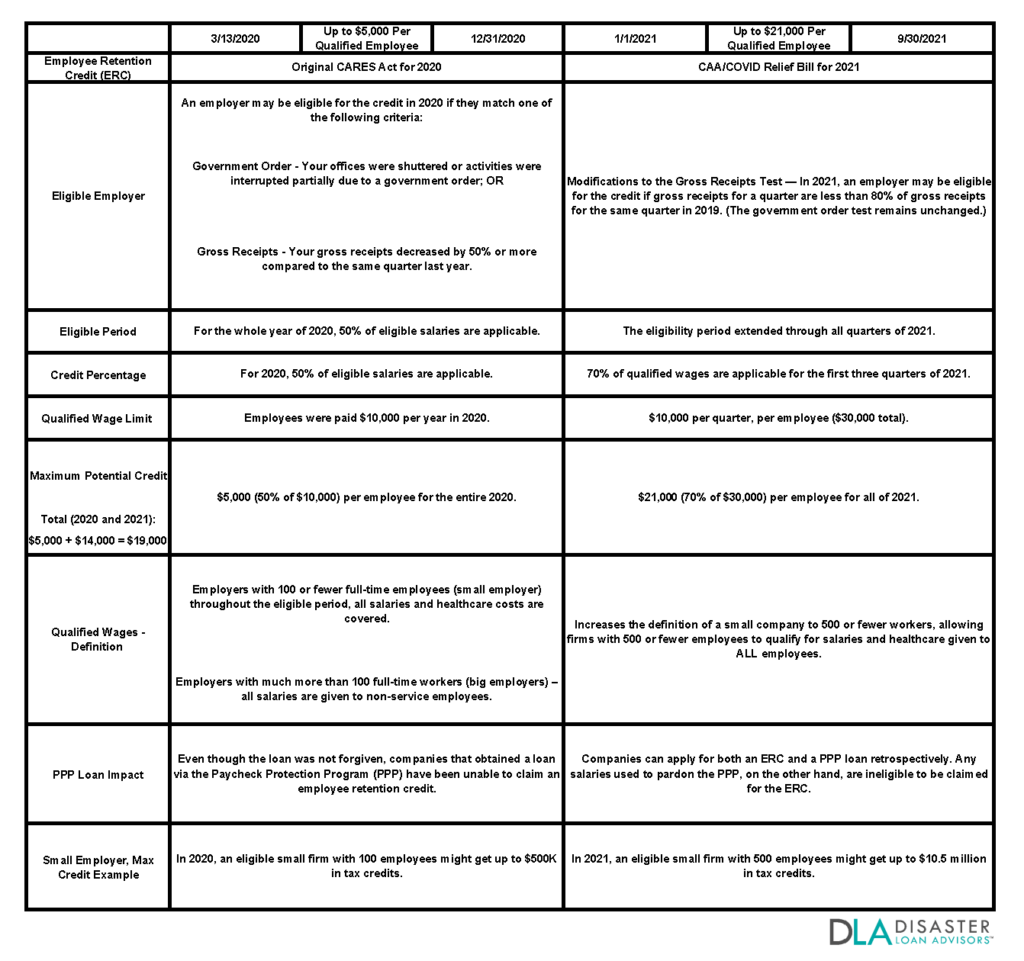

Can You Still Claim Employee Retention Credit For 2020 Leia Aqui What

Can You Still Claim Employee Retention Credit For 2020 Leia Aqui What

Which Home Improvements Qualify For An Energy Tax Credit

Dallas Low Income Tax Credit Apartments Pay 30 In Rent Each Month

Blank Nv Sales And Use Tax Form How To Fill Out A Combined Sales Use

Does Home Improvements Qualify For Tax Credit - Home improvements that qualify as capital improvements are tax deductible but not until you sell your home