Does Hra Comes Under 80c HRA comes under which section HRA deduction can be claimed under Section 10 13A for salaried individuals and under Section 80GG for self employed individuals or salaried people who do not get HRA

Who is eligible to claim deduction under Section 80GG Those who do not receive HRA in their salary structure but live in rented accommodations Conditions for claiming Section 80GG Taxpayer must be self employed or salaried individual who does not receive HRA Taxpayer must be paying rent for residential purpose only HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer

Does Hra Comes Under 80c

Does Hra Comes Under 80c

https://carajput.com/art_imgs/how-to-claim-hra-allowance-while-filing-income-tax-return.jpg

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

HRA Calculation Formula On Salary Change How HRA Exemption Is

https://i.ytimg.com/vi/O-wluM-mvG8/maxresdefault.jpg

Does this come under Sec 80C The NPS is a pension scheme that has been started by the Indian Government to allow the unorganised sector and working professionals to have a pension after retirement Investments of up to Rs 1 5 lakh can be used to avail tax deductions under Section 80C For most employees House Rent Allowance HRA is a part of their salary structure Although it is a part of your salary HRA unlike basic salary is not fully taxable Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961

Before discussing how to claim a deduction under Section 80GG it s important to understand what Section 80GG stands for Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes Know the HRA Exemption Rules how to calculate HRA on your salary Check out the eligibility criteria understand how HRA helps you to utilise Section 80C

Download Does Hra Comes Under 80c

More picture related to Does Hra Comes Under 80c

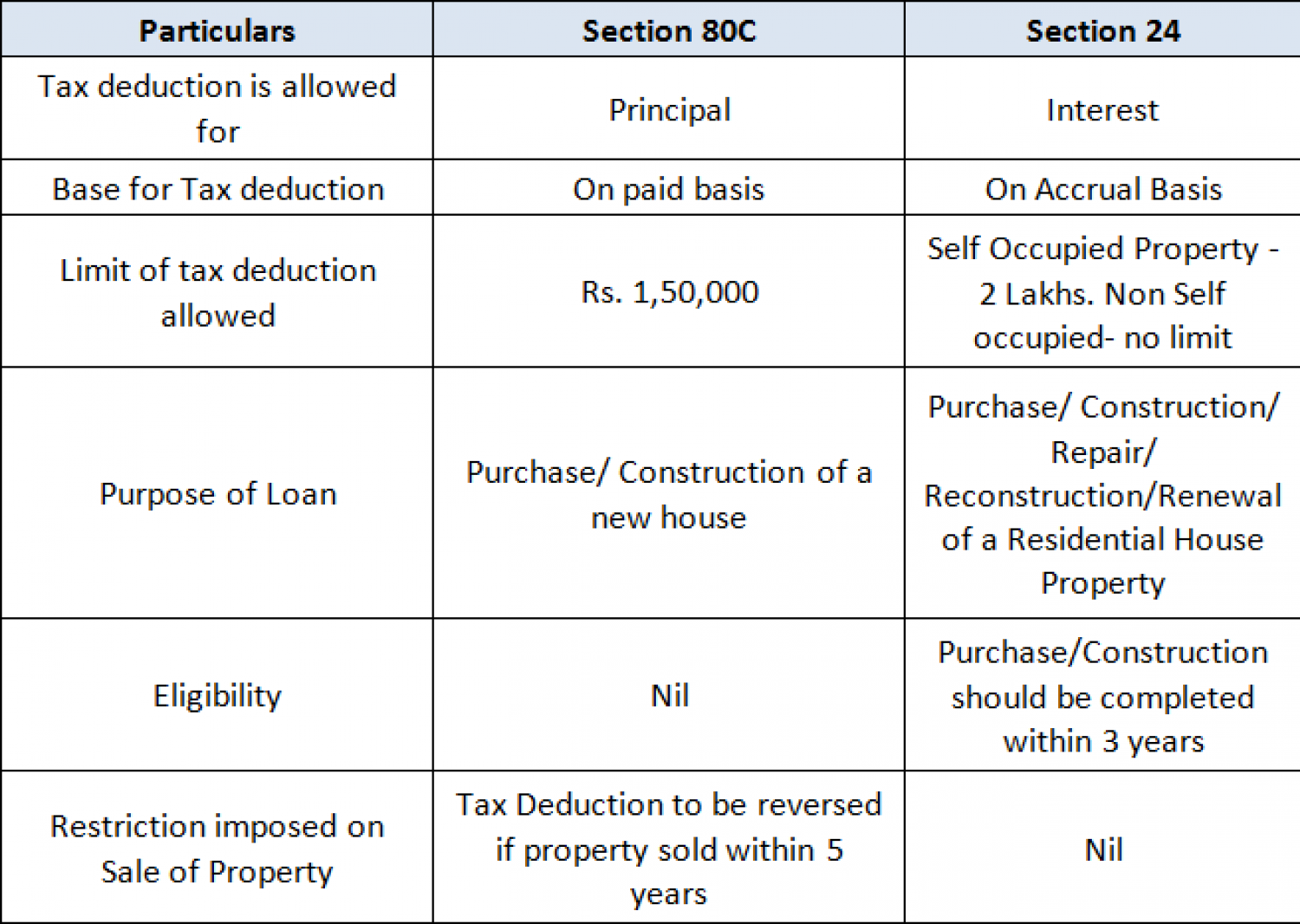

Deductions U S 80C Under Schedule VI Of Income Tax India Financial

https://www.caindelhiindia.com/blog/wp-content/uploads/2021/07/80c.jpg

Deductions Under Section 80C Does PF Come Under 80C

https://d3l793awsc655b.cloudfront.net/blog/wp-content/uploads/2022/08/PF-under-80C-768x319.jpg

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Q 4 Is the HRA deduction part of the 80C deduction and included under the amount of 1 50 000 Ans HRA is not a deduction U s 80C It is an allowance to be deducted as an exemption from salary Is House Rent Allowance deductible under section 80C No HRA is an allowance and is exempt from Salary Income u s 10 13A of the Income Tax Act Can HRA exemption be claimed if living parents

If the employer does you can claim HRA exemption when filing your income tax returns under Section 10 13A If however the employer doesn t offer HRA you can still claim a house rent deduction in income tax for the rent paid under Section 80GG 1 HRA exemption towards rent payment 2 Deduction on home loan interest as per Section 24 3 Principal Repayment under Section 80C 4 Deduction for interest on home loan under Section 80EE or Section 80EEA Conclusion Navigating the complexities of HRA exemptions requires a comprehensive understanding of tax laws and regulations

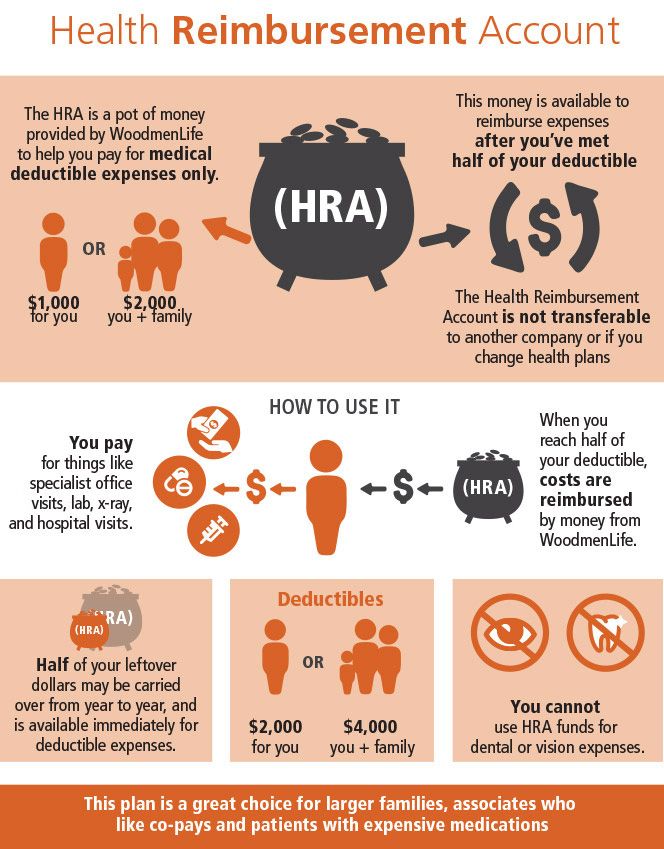

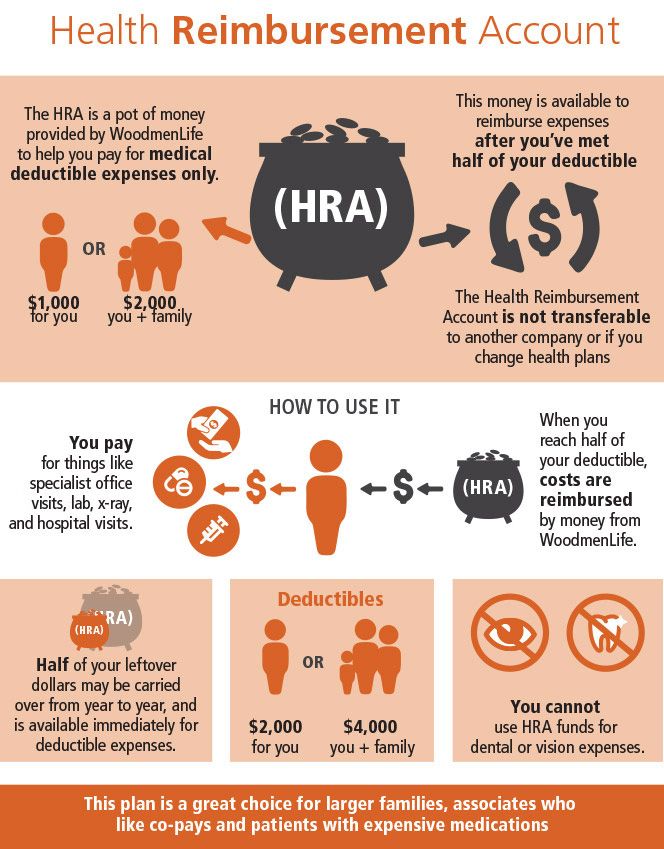

WoodmenLife Health Insurance HRA Explained WoodmenLife

https://www.woodmenlife.org/static/d4e4b3192b42371a08bfbd892c11ee64/5dcec/img-body-home-office-hra-1.jpg

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

https://carajput.com/art_imgs/can-hra-and-home-loan-benefits-be-claimed-when-itr-is-filing.jpg

https://www.etmoney.com/learn/saving-schemes/house-rent-allowance

HRA comes under which section HRA deduction can be claimed under Section 10 13A for salaried individuals and under Section 80GG for self employed individuals or salaried people who do not get HRA

https://cleartax.in/s/80c-80-deductions

Who is eligible to claim deduction under Section 80GG Those who do not receive HRA in their salary structure but live in rented accommodations Conditions for claiming Section 80GG Taxpayer must be self employed or salaried individual who does not receive HRA Taxpayer must be paying rent for residential purpose only

ABOUT HRA co

WoodmenLife Health Insurance HRA Explained WoodmenLife

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

How To Claim Both HRA Home Loans Tax Deductions With Section 24 And

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Hry Pro D ti P ED KOL K Spole ensk Hry Nau n Hry Pro D ti

Hry Pro D ti P ED KOL K Spole ensk Hry Nau n Hry Pro D ti

Efko Smol ek Z bavn Hra Pro D ti 4KIDS cz

Schedule HRA

Hra

Does Hra Comes Under 80c - Despite missing the March 31 2024 deadline to submit the rental agreement to your employer you may still claim the House Rent Allowance HRA tax exemption while filing your ITR Also if you receive HRA ensure to include this exemption to lessen your tax burden