Does Hvac Qualify For Energy Credit Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work

Does Hvac Qualify For Energy Credit

Does Hvac Qualify For Energy Credit

https://coolandheat.org.uk/wp-content/uploads/2022/03/what-is-hvac.jpg

Does My New Air Conditioner Qualify For Energy Credit Smart AC Solutions

https://www.nicksairconditioning.com/wp-content/uploads/2023/01/Adjusting-HVAC-System-Temperature.jpg

Inflation Reduction Act Of 2022 Clean Vehicle Energy Credit Bregante

https://bcocpa.com/wp-content/uploads/2022/10/AdobeStock_525155507-1-scaled.jpeg

Special limitation for certain qualified energy property Notwithstanding the limitations of the first two items above the credit for any tax year cannot exceed 2 000 with respect to amounts paid or incurred for specified heat pumps heat pump water heaters and biomass stoves and boilers What happens to the Energy Efficient Home Improvement Credit or the Residential Clean Energy Property Credit if a government or a public utility provides a subsidy for example an incentive grant or rebate to a taxpayer to purchase or install a qualifying property

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and The amended Energy Efficient Home Improvement Credit which begins in 2023 and extends through 2032 increases the tax credits as high as 600 for qualified air conditioner or gas furnace and up to 2000 for qualified heat pump heat pump water heater or boiler

Download Does Hvac Qualify For Energy Credit

More picture related to Does Hvac Qualify For Energy Credit

How Much Does HVAC Service Cost 2023 Bob Vila

https://empire-s3-production.bobvila.com/articles/wp-content/uploads/2022/04/HVAC_Service_Cost_Main.jpg

HVAC Salaries How Much Does HVAC Make Fieldcomplete

https://fieldcomplete.com/wp-content/uploads/2022/05/HVAC-Salary-State-By-State-1.jpg

Sustainable HVAC Solutions Australian Climate Agencies

https://australianclimateagencies.com.au/wp-content/uploads/2020/11/hvac.jpg

Energy efficient HVAC systems including furnaces boilers and central AC The 25C credit has an annual cap of 1 200 except heat pump Up to 600 each for a qualified air conditioner or gas furnace Up to 2 000 with a qualified heat pump heat pump water heater or boiler How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation

[desc-10] [desc-11]

How Much Does It Cost To Install An HVAC System Forbes Home

https://thumbor.forbes.com/thumbor/fit-in/900x510/https://www.forbes.com/home-improvement/wp-content/uploads/2022/07/featured-image-new-hvac.jpeg

Here s How To Qualify For Energy Efficient Hvac Tax credit

https://diamondairdesign.com/wp-content/uploads/2023/03/7xm.xyz292841-1024x576.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Home energy tax credits If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022

https://airconditionerlab.com/what-hvac-systems...

You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

Save Energy Consumption Of HVAC With Predictive Maintenance Facility

How Much Does It Cost To Install An HVAC System Forbes Home

Some Common HVAC Problems Ccsonoma

An Old Building With Lots Of Windows And Shutters

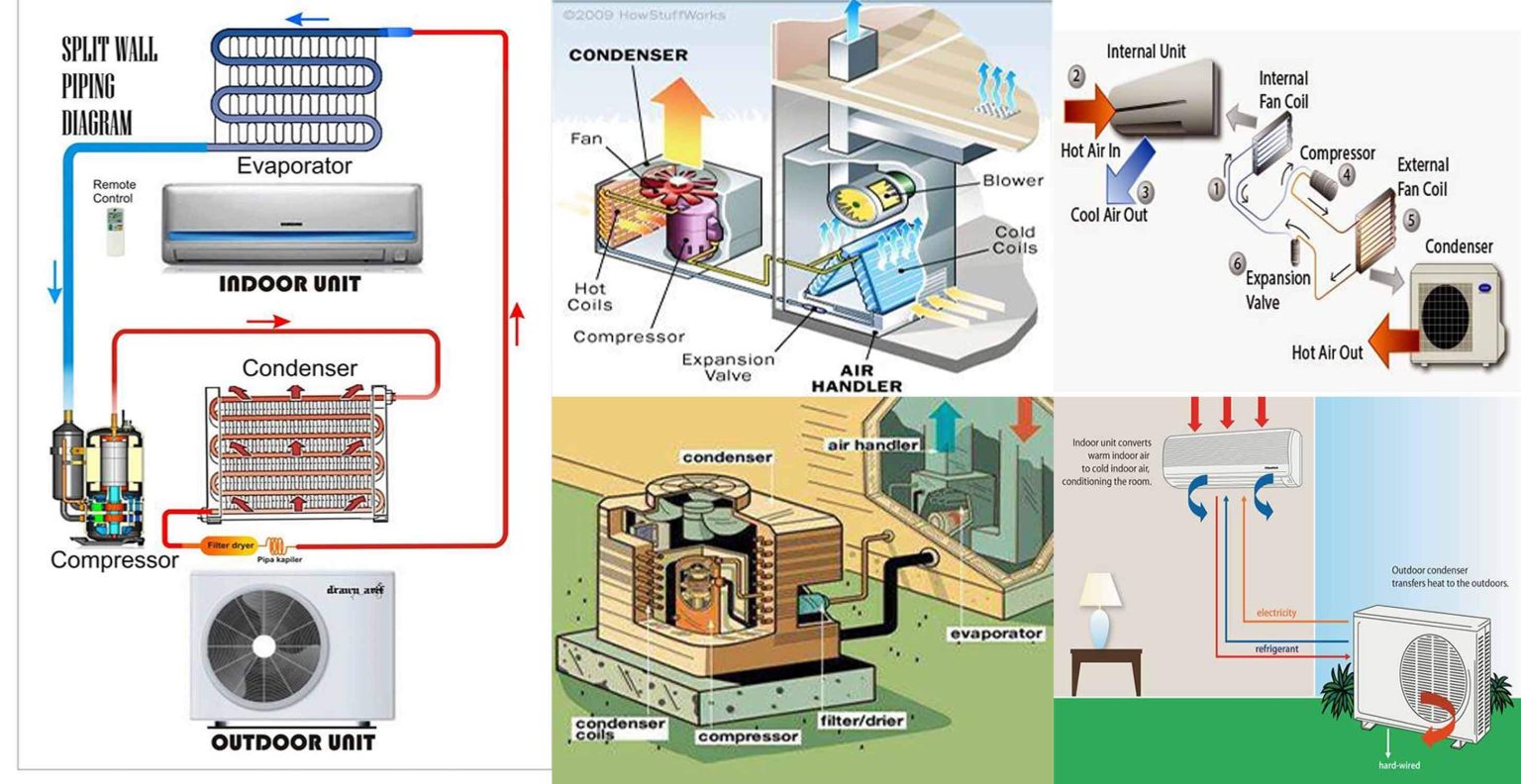

How Does An HVAC System Work Zone Home Solutions

This Simple Diagram Shows You How Your HVAC System s Ductwork Connects

This Simple Diagram Shows You How Your HVAC System s Ductwork Connects

Does A Home Generator Qualify For Energy Credit

Understanding The HVAC Systems Basics Work Types 2023

How Does A HVAC System Work Engineering Discoveries

Does Hvac Qualify For Energy Credit - The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and