Does Income Tax Increase Every Year The bottom half of taxpayers or taxpayers making under 42 184 faced an average income tax rate of 3 1 percent As household income increases average income tax rates rise

This is the phenomenon by which people are pushed into higher income tax brackets or have reduced value from credits or deductions due to inflation instead of an actual increase in real From 2022 to 2023 the income tax brackets increased by roughly 7 Other tax code provisions are updated annually to account for inflation including the commonly used standard

Does Income Tax Increase Every Year

Does Income Tax Increase Every Year

https://moneyvests.com/wp-content/uploads/2021/05/tax.jpg

Personal Income Tax Has Untapped Potential In Poorer Countries

https://www.imf.org/wp-content/uploads/2022/03/FAD-Charts-income-tax-blog-1.jpg

How Income Taxes Work HowStuffWorks

https://cdn.hswstatic.com/gif/how-income-tax-1000.jpg

The Federal Government s Current Revenue The U S government estimates its total revenue to be 5 49 trillion for fiscal year 2025 Per the White House s projections income taxes are slated to contribute 2 6 trillion Another 2 2 The IRS on Nov 10 announced that it adjusted federal income tax brackets for the 2022 tax year meaning the changes will impact tax returns filed in 2023 With inflation currently being

For tax year 2024 which applies to taxes filed in 2025 there are seven federal tax brackets with income tax rates of 10 12 22 24 32 35 and 37 These are the same tax For tax year 2024 each of the seven rates will apply to the following new income tax brackets 10 Income up to 11 600 23 200 for married couples filing jointly 12 Income over

Download Does Income Tax Increase Every Year

More picture related to Does Income Tax Increase Every Year

How Does Income Tax Work And What You Need To Know HloGadgets

https://hlogadgets.com/wp-content/uploads/2023/07/How-Does-Income-Tax-Work-and-What-You-Need-to-Know.jpg

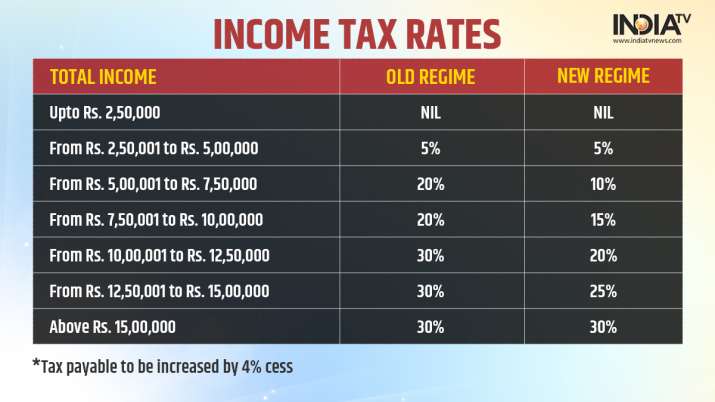

Income Tax Rates For FY 2021 22 How To Choose Between Old Regime And

https://resize.indiatvnews.com/en/resize/newbucket/715_-/2021/02/income-tax-1612869589.jpg

Testimony On SB276 Relating To temporary Income Tax Hike On Wealthy

https://www.grassrootinstitute.org/wp-content/uploads/2021/03/3-5-21-tax-increase-on-rich.jpeg

Whether your income went north or south or even stayed the same the rate at which your income is taxed could have changed when income ranges for the 7 federal tax brackets were Increasing your tax withholding now can help reduce or completely avoid this penalty It can also lower or prevent a tax bill when you file your federal tax return next year

The IRS changes the tax brackets and the standard deduction each year due to changes in the cost of living but this year s changes are more significant than usual Taxpayers will see these For tax year 2023 the top tax rate 37 percent applies to taxable income over 578 125 for single filers and over 693 750 for married couples filing jointly Additional tax schedules and rates apply to taxpayers who file as heads of

How High Are Income Tax Rates In Your State

https://www.richardcyoung.com/wp-content/uploads/2016/02/income-tax-rate-map.png

Do We Really Need To Raise Taxes That Soon Unscrambled sg

https://www.unscrambled.sg/wp-content/uploads/2017/12/tax-increase-1024x684.jpg

https://taxfoundation.org/data/all/federal/summary...

The bottom half of taxpayers or taxpayers making under 42 184 faced an average income tax rate of 3 1 percent As household income increases average income tax rates rise

https://taxfoundation.org/blog/it-matters-how-tax...

This is the phenomenon by which people are pushed into higher income tax brackets or have reduced value from credits or deductions due to inflation instead of an actual increase in real

How The Government Spends Your Tax Dollars CHART Business Insider

How High Are Income Tax Rates In Your State

/2016-Federal-Tax-Rates-57a631ca3df78cf459194b33.png)

An Explanation Of 2016 Federal Income Tax Rates

A COMPREHENSIVE GUIDE FOR INCOME TAX RETURN FILLING

Midwest State Income And Sales Tax Rates Iowans For Tax Relief

2023 Income Tax Declaration Form Fillable Printable Pdf Forms Vrogue

2023 Income Tax Declaration Form Fillable Printable Pdf Forms Vrogue

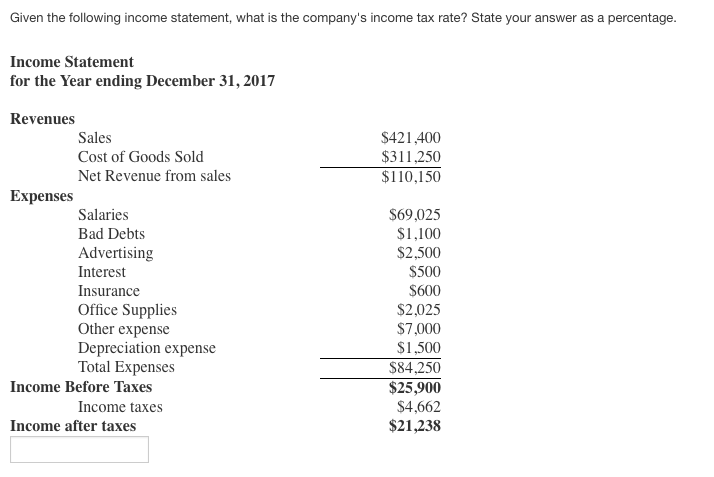

Solved Given The Following Income Statement What Is The Chegg

Data Driven Viewpoints A 99 YEAR HISTORY OF TAX RATES IN AMERICA

Making The Income Tax Fair Zenconomics

Does Income Tax Increase Every Year - For tax year 2024 which applies to taxes filed in 2025 there are seven federal tax brackets with income tax rates of 10 12 22 24 32 35 and 37 These are the same tax