Does Kentucky Tax Military Retirement Web Kentucky Military Retired Pay Income Taxes The military retired pay of Service members who retired before January 1 1998 is completely exempt From Kentucky income taxes

Web 29 Sept 2023 nbsp 0183 32 States That Partially Tax Military Retirement Pay The following states partially tax military retirement pay or provide limited exclusions based on individual circumstances Colorado Delaware Georgia Idaho Kentucky Maryland Montana New Mexico Oregon Utah Vermont Virginia Web If you are retired military and receive a federal pension income greater than 31 110 you will need to complete Kentucky Schedule P Kentucky Pension Income Exclusion to determine how much of your pension income is taxable

Does Kentucky Tax Military Retirement

Does Kentucky Tax Military Retirement

http://www.moneyforveterans.com/wp-content/uploads/2016/10/Enlisted-Retirement-Table.png

List Military Retirement Income Tax Military Retirement Income Tax

https://i.pinimg.com/originals/29/7b/2b/297b2bbe9956826e0bf301f5ad6b738d.jpg

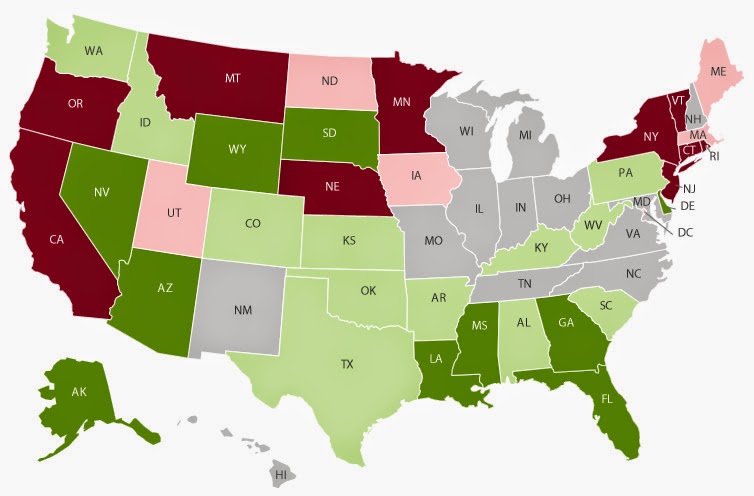

Tax Friendly Retirement States Map Map

https://3.bp.blogspot.com/-HbsXXc3fGeo/VCV-s-tmRuI/AAAAAAAAJY8/C6VO30fDoa0/s1600/retiree-tax-map.jpg

Web 23 Feb 2022 nbsp 0183 32 Benefits Military Pay Military Retirement and State Income Tax Military By Jim Absher Published February 23 2022 Some states don t charge income tax on military retired pay Web 10 Nov 2020 nbsp 0183 32 Kentucky All Kentuckians can exclude up to 31 110 in pension and retirement income from their state taxes Former service members who receive more than that in military retirement pay may be able to exclude more Veterans who retired before Jan 1 1998 can exempt all military retirement pay

Web 11 Nov 2023 nbsp 0183 32 taxes state tax Most Expensive States for Retired Military Service Members Veterans can keep more of their military retirement pay by avoiding these high taxed most expensive states Web 19 Jan 2022 nbsp 0183 32 Of the 41 states that tax personal income there are currently 23 that do not tax military retirement pay Kentucky is among the remaining states that include partial exemptions only

Download Does Kentucky Tax Military Retirement

More picture related to Does Kentucky Tax Military Retirement

Retiring These States Won t Tax Your Distributions

https://www.taxdefensenetwork.com/wp-content/uploads/2022/01/military-benefits-map-2500x1875.jpg

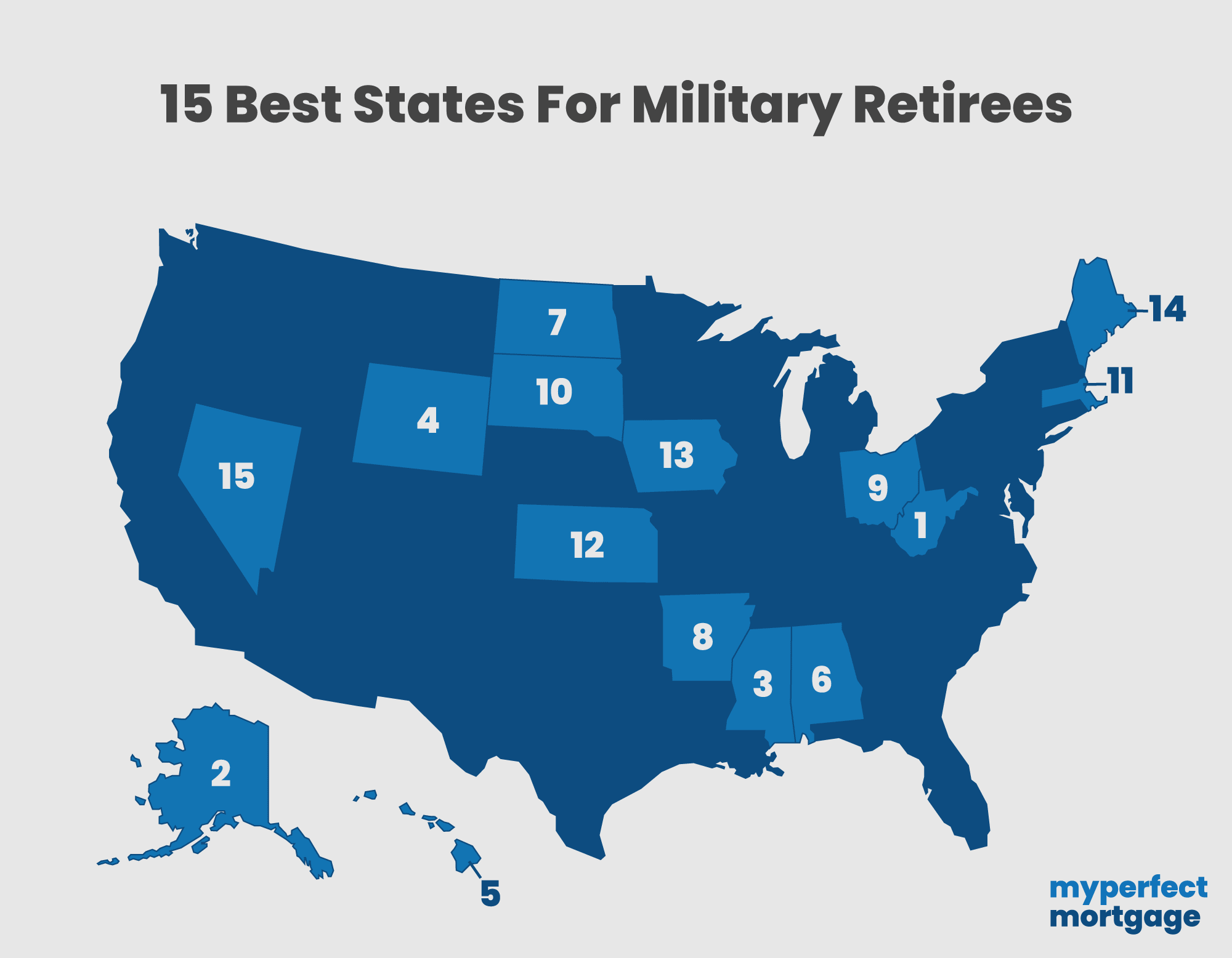

15 Best States For Military Retirees

https://myperfectmortgage.com/wp-content/uploads/Best-States-for-Military-Retirees-My-Perfect-Mortgage.png

States That Don t Tax Military Retirement Pay Discover Here

https://www.thesoldiersproject.org/wp-content/uploads/2023/04/military-retirement-tax-exemption.png

Web 2021 tax year deduction of 6 250 plus 75 of the remainder Full exemption beginning 2022 tax year Kentucky may be eligible to exempt up to 31 110 or more depending on retirement date Maryland 54 subtract up to 5 000 Web 30 Dez 2021 nbsp 0183 32 Bill proposes to exempt military retirees from state income tax By GINA CLEAR THE NEWS ENTERPRISE Dec 30 2021 Updated Dec 30 2021 0 With two military bases in Kentucky including one

Web 5 Jan 2022 nbsp 0183 32 Kentucky Veteran Financial Benefits Income Tax Military income is tax free Military retirement pay up to 31 110 is tax free Veterans may be able to exclude more in certain Web 22 Dez 2021 nbsp 0183 32 According to the release of the 41 states that tax personal income there are currently 23 that do not tax military retirement pay Kentucky is among the remaining states that include

Military Retirement Income Taxes By State Which States Don t Tax

https://i.pinimg.com/originals/08/7d/48/087d48328db34cf375799e042b60b5f5.png

How Kentucky Taxes Retirees YouTube

https://i.ytimg.com/vi/HTLIBfA5t-I/maxresdefault.jpg

https://myarmybenefits.us.army.mil/.../State/Territory-Benefits/Kentucky

Web Kentucky Military Retired Pay Income Taxes The military retired pay of Service members who retired before January 1 1998 is completely exempt From Kentucky income taxes

https://themilitarywallet.com/military-retirement-pay-tax-exempt

Web 29 Sept 2023 nbsp 0183 32 States That Partially Tax Military Retirement Pay The following states partially tax military retirement pay or provide limited exclusions based on individual circumstances Colorado Delaware Georgia Idaho Kentucky Maryland Montana New Mexico Oregon Utah Vermont Virginia

States That Tax Military Retirement Pay and States That Don t Kiplinger

Military Retirement Income Taxes By State Which States Don t Tax

10 Best States For Military Retirement 2023 Edition

States That Tax Military Retirement Pay and States That Don t Kiplinger

States That Don t Tax Military Retirement A Detailed List

States That Won t Tax Your Retirement Distributions In 2021

States That Won t Tax Your Retirement Distributions In 2021

Campaigns Daily Statement From Governor Phil Scott Following

MAP The Most And Least Tax friendly States Map Retirement Advice

States That Tax Military Retirement Pay and States That Don t Kiplinger

Does Kentucky Tax Military Retirement - Web Vor 5 Tagen nbsp 0183 32 Kentucky Military income Tax free Retired pay Up to 31 110 is tax free You may be able to exclude more in some situations Survivor Benefit Plan Same as retired pay