Does Land Sale Have Gst You re liable for GST on the sale you can claim GST credits for your construction costs and any purchases you make related to the sale You can t claim GST credits for GST

The sale of vacant land can be taxable or exempt for purposes of GST HST under the Excise Tax Act Generally vacant land sold by individuals is exempt subject to certain exceptions Exempt sales of vacant land typically Sale of land does not come under the purview of GST and is not liable to pay GST The same has been clarified in its ruling by the Gujarat Advance Ruling Authority that GST is

Does Land Sale Have Gst

Does Land Sale Have Gst

https://navi.com/blog/wp-content/uploads/2022/07/gst-on-personal-loan.jpg

What Is GST GST BAS Guide Xero AU

https://www.xero.com/content/dam/xero/pilot-images/guides/guide-to-gst-bas-vat/354050_Hero_Guide to GST-BAS_whatx2.1646877577000.png

How To Get A GSTIN Number Step By Step Guide Razorpay Learn

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/12/how-toget-gstin.png

The information we need for a private ruling or objection about the GST payable on the sale of vacant or subdivided land includes details of the owner of the land and whether No you are not required to charge the GST HST on the sale of the vacant land since it was not capital property used primarily in a business and it is not being sold in the course of a business

A frequent question being asked is that whether a sale of a vacant block of land would be subject to GST In this worked example we walk through a scenario where a taxpayer disposes of a vacant block of land on which No the sale of the severed portion of vacant land is exempt from GST HST since it is not capital property used primarily more than 50 in a business and it is not being sold in the course of

Download Does Land Sale Have Gst

More picture related to Does Land Sale Have Gst

What You Should Know About GST On Land And Building

https://www.taxhelpdesk.in/wp-content/uploads/2022/02/GST-on-land-building.jpeg

DOES SALE OF LAND AND BUILDING ATTRACT GST

https://www.legalmantra.net/admin/assets/upload_image/blog/b190.jpg

When Is The Best Time To Sell Land

https://landscouts.com/media/original_images/when_to_sell_land.jpeg

Whether the sale of vacant land is subject to GST depends entirely on whether the supply satisfies the conditions set out in section 9 5 of the GST Act as the essential elements of a Sale of land doesn t attract GST even as states impose stamp duty and registration fees on such transactions Schedule III of CGST Act 2017 stipulates the activities or transactions which shall be treated neither as a

Sale of land and building except when sold before completion certificate is neither supply of service nor supply of goods as per Schedule III of CGST Act Taxability of Sale of Land Under GST and Exemptions As per Schedule III of the CGST Act the land sale is neither considered a sale of goods nor a supply of services The

GST For Small Business Small Business Resources Reckon AU

https://www.reckon.com/au/wp-content/uploads/2022/10/JOB2003014-2020-Website-PNG-GST-for-small-business.png

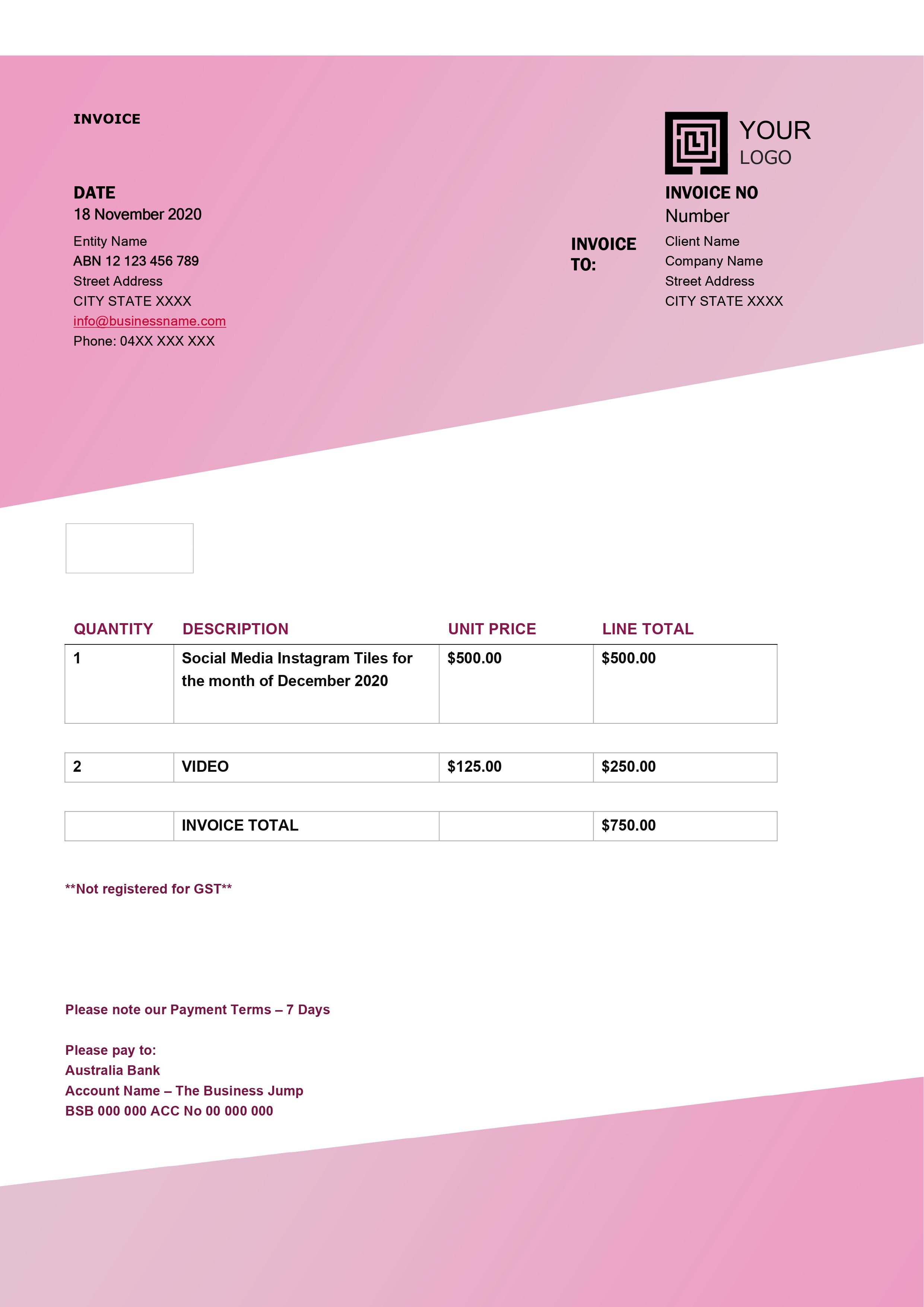

What Goes On My Invoice If I m Registered For GST If I m Not Home

https://images.squarespace-cdn.com/content/v1/5a2fb19029f1873938a231b7/1604022221341-7L2SHYC45L8RSCR8FX06/GNR+Invoice+template.jpg

https://www.ato.gov.au › ... › property › gst-and-property

You re liable for GST on the sale you can claim GST credits for your construction costs and any purchases you make related to the sale You can t claim GST credits for GST

https://www.bakertilly.ca › en › btc › publicat…

The sale of vacant land can be taxable or exempt for purposes of GST HST under the Excise Tax Act Generally vacant land sold by individuals is exempt subject to certain exceptions Exempt sales of vacant land typically

What You Should Know About GST On Land And Building

GST For Small Business Small Business Resources Reckon AU

GST Registration Consultant In Ahmedabad Get GST No In 3 Days

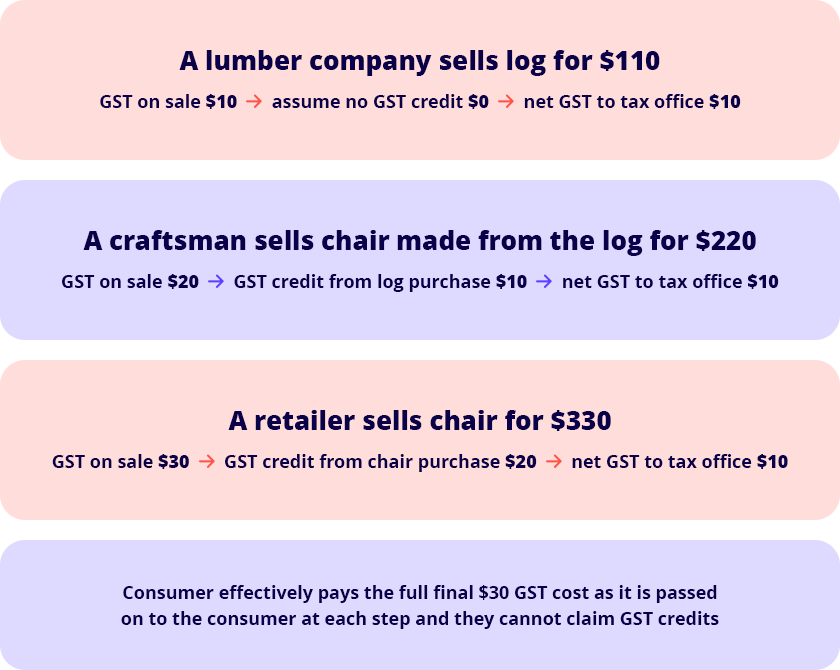

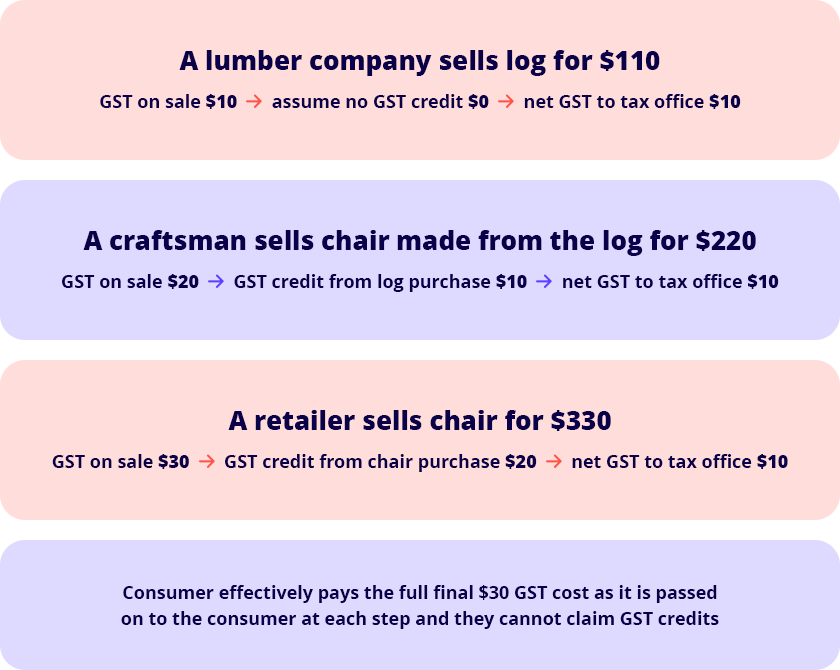

Gst And How It Works Bank2home

Beautiful Gst Tax Invoice Template Excel Sample Network Diagram In

Applicability Of GST On Sale Of Land Akgvg Blog

Applicability Of GST On Sale Of Land Akgvg Blog

An Insight Positive Impacts Of GST On Indian Real Estate Industry

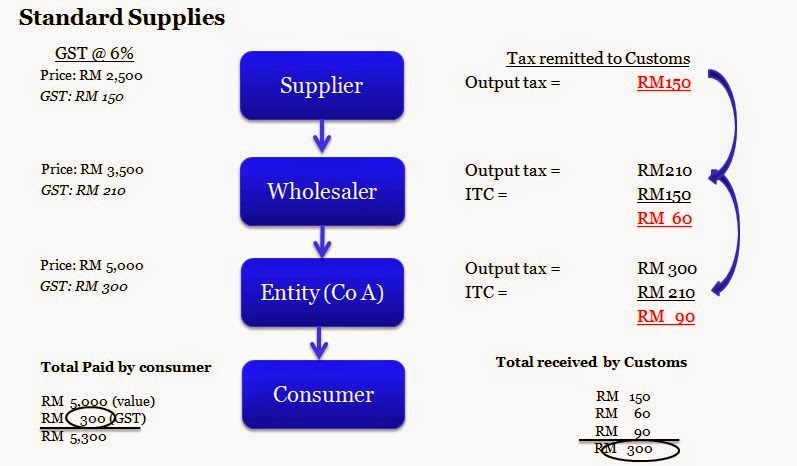

Disadvantages Of Gst In Malaysia Justin Morrison

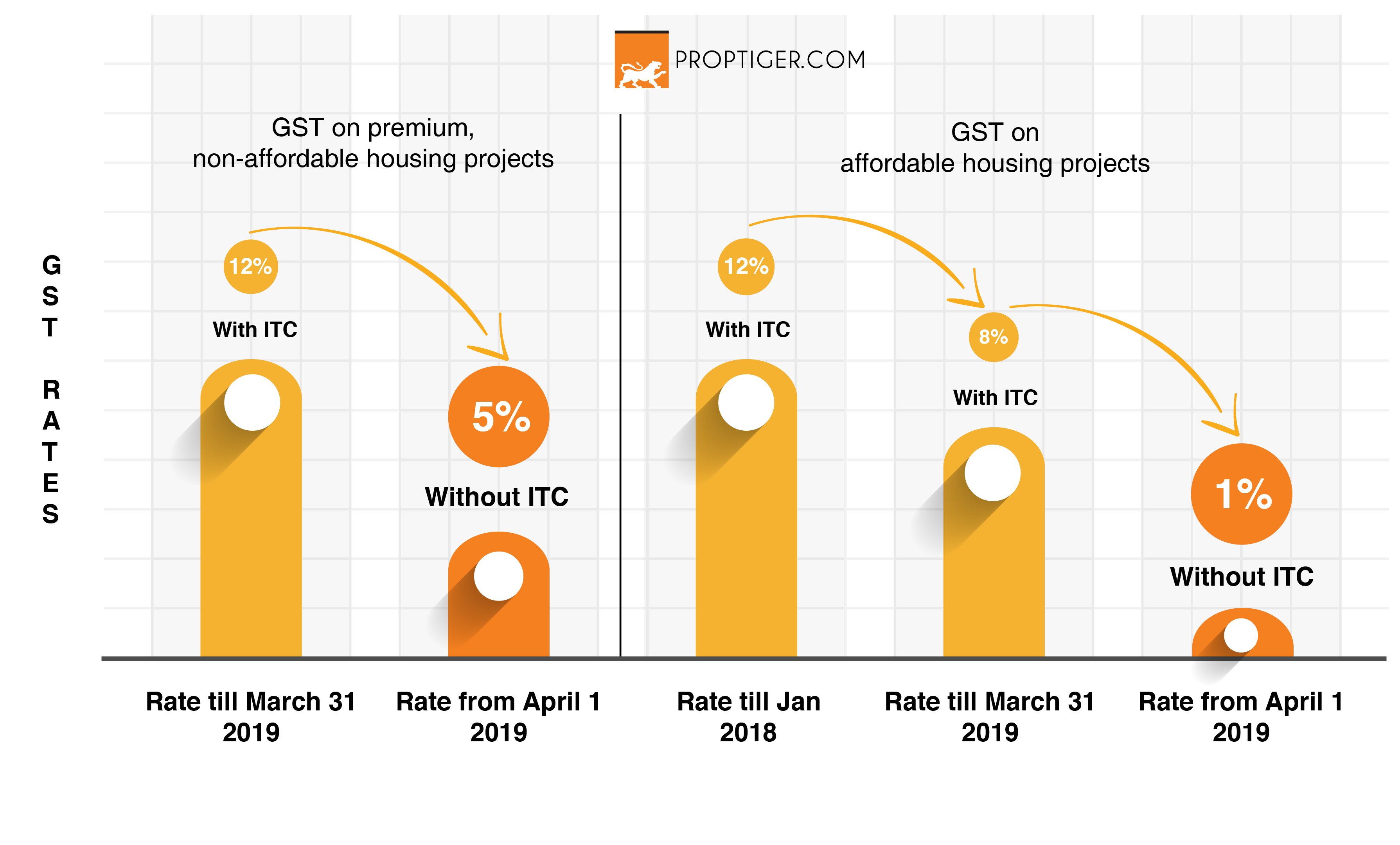

GST On Real Estate Cut To 1 For Affordable Housing

Does Land Sale Have Gst - No the sale of the severed portion of vacant land is exempt from GST HST since it is not capital property used primarily more than 50 in a business and it is not being sold in the course of