Does Missouri Have A Solar Tax Credit Between the federal tax credit and other state specific incentives you can save thousands on solar panels making them well worth the investment Here s how you can lower the cost of solar if you live in Missouri

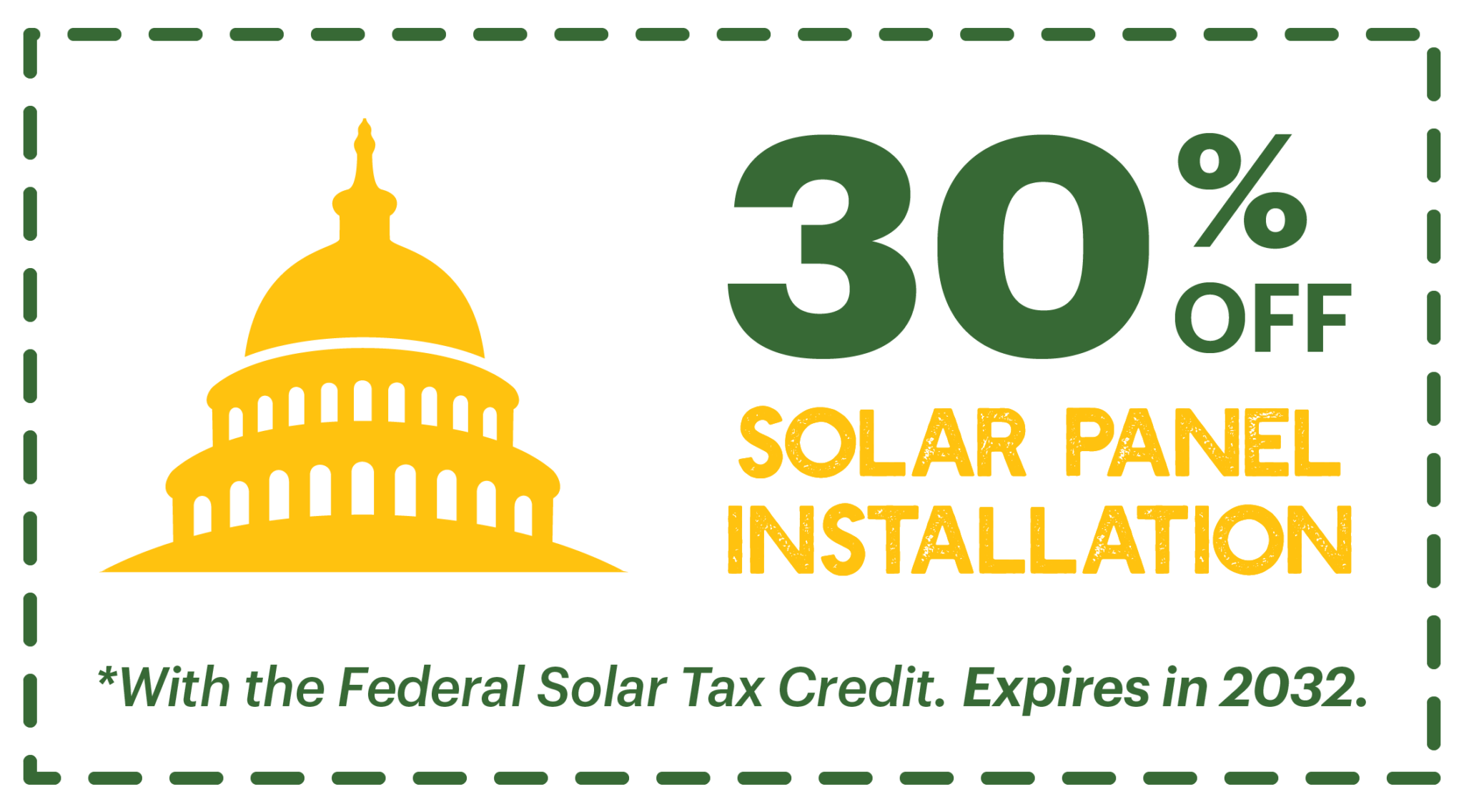

Contact your electric provider or a solar contractor for more information on your electric rate structure how much energy you use and how a solar photovoltaic system could affect your monthly bill NREL s PVWatts Residential Renewable Energy Tax Credit Solar Energy Contacts PUB2841 The federal solar credit is one of the most valuable solar incentives available to you as a Missouri resident and the federal government makes it accessible to all first time solar customers The credit is equal to 30 of your entire solar energy system cost which gets applied to your income tax liability for the tax year you install your

Does Missouri Have A Solar Tax Credit

Does Missouri Have A Solar Tax Credit

https://www.gov-relations.com/wp-content/uploads/2023/06/How-To-Claim-Solar-Tax-Credit.jpg

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

When Does The Federal Solar Tax Credit Expire Nationwide Solar

https://mynationwidesolar.com/wp-content/uploads/2021/05/How-to-get-a-solar-tax-credit.jpg

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Missouri If you install your photovoltaic system before the end of 2032 the federal tax credit is 30 of the cost of your solar panel system Missouri is missing a few key solar benefits such as a property tax exemption but it has plenty of other incentives to make going solar more affordable As energy costs increase so will your savings from a home solar system and other clean energy initiatives

Missouri has many federal state and local financial incentives for purchasers of solar energy systems These include the Federal Solar Investment Tax Credit ITC the Missouri Property Tax Exemption and One of the most significant incentives for solar energy in Missouri is the Federal Investment Tax Credit ITC This credit allows homeowners and businesses to claim a credit of 22 of the cost of their solar installation on their federal taxes

Download Does Missouri Have A Solar Tax Credit

More picture related to Does Missouri Have A Solar Tax Credit

How Does The Solar Tax Credit Work Solar Pricing NJ Solar Power

https://njsolarpower.com/wp-content/uploads/2021/05/iStock-697170112.jpg

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

How Does The Solar Tax Credit Work Advanced Solar

https://cdn.advancedsolarllc.com/wp-content/uploads/advanced-solar-tax-blog.jpg

Federal Solar Investment Tax Credit ITC The Green Energy Tax Credit officially known as the Federal Investment Tax Credit ITC is a valuable financial incentive available to Missouri residents and businesses installing solar energy systems Eligible participants can claim a tax credit of 30 of the total installation cost including Missouri will receive 156 million under the federal Inflation Reduction Act s Solar for All program President Joe Biden signed the act into law in August 2022 The Missouri funds are earmarked for helping low income residents benefit from solar either from their rooftop or from community solar projects according to Renew Missouri

The average federal solar investment tax credit value is 8 158 in Missouri You can also take advantage of rebates and loan programs Missouri homeowners with solar panels receive an estimated The first part is a short term balloon loan to cover the Federal Investment Tax Credit FITC This tax credit is issued for installation of a solar PV system and offsets your tax liability The expectation is that once you have reached tax season you can pay this part of the loan off in full

Everything You Need To Know About The Solar Tax Credit

https://gospringsolarnow.com/wp-content/uploads/2022/08/Everything-You-Need-To-Know-About-The-Solar-Tax-Credit-scaled-2560x1280.jpeg

The 30 Solar Tax Credit Has Been Extended Through 2032

https://quickelectricity.com/wp-content/uploads/2022/09/Solar-Federal-Tax-Credit-Increased-to-30-and-Extended-Through-2032-scaled.jpg

https://www.energysage.com/local-data/solar-rebates-incentives/mo

Between the federal tax credit and other state specific incentives you can save thousands on solar panels making them well worth the investment Here s how you can lower the cost of solar if you live in Missouri

https://dnr.mo.gov/energy/energy-resources/solar

Contact your electric provider or a solar contractor for more information on your electric rate structure how much energy you use and how a solar photovoltaic system could affect your monthly bill NREL s PVWatts Residential Renewable Energy Tax Credit Solar Energy Contacts PUB2841

Fact Finders Does Missouri Have A Maximum Number Of Hours Students Can

Everything You Need To Know About The Solar Tax Credit

What To Know About The Solar Federal Tax Credit Toplead

Solar Tax Benefits Guide Learn With Valur

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

Federal Solar Tax Credit How To Claim Yours IWS

Federal Solar Tax Credit How To Claim Yours IWS

How Does The Solar Tax Credit Work In Idaho IWS

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

2021 Solar Investment Tax Credit What You Need To Know

Does Missouri Have A Solar Tax Credit - The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Missouri If you install your photovoltaic system before the end of 2032 the federal tax credit is 30 of the cost of your solar panel system