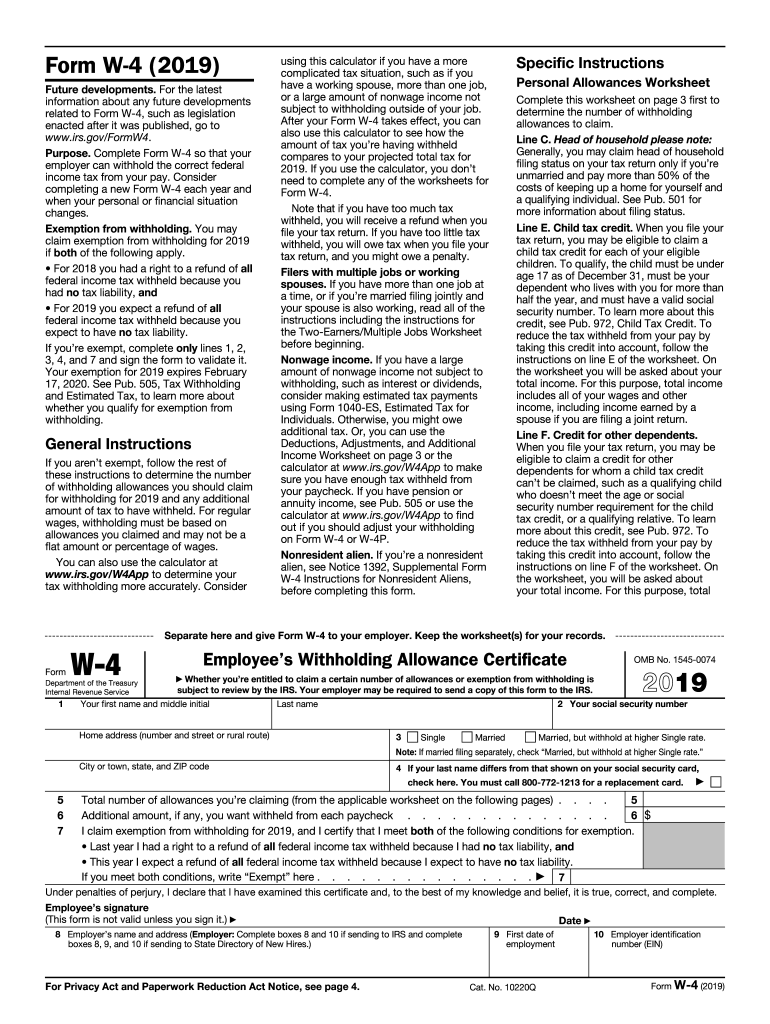

Does Missouri Have A State Withholding Form The withholding tax tables withholding formula MO W 4 Missouri Employer s Tax Guide Form 4282 and withholding tax calculator have been updated

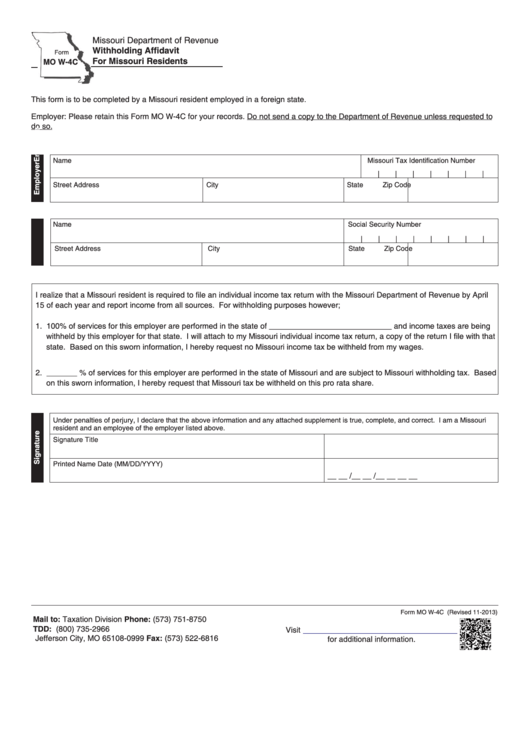

This certificate is for income tax withholding and child support enforcement purposes only Type or print Notice To Employer Within 20 days of hiring a new employee send a copy of Form MO W 4 to the Missouri Department of Revenue P O Box 3340 Jefferson City MO 65105 3340 or fax to 573 526 8079 Please visit Employers use state W 4s to determine state income tax withholding for employees States either use their own version of the state W 4 or the federal Form W 4 Unless your employees work in a state with no state income tax they generally must fill out the W 4 state tax form before starting a new job

Does Missouri Have A State Withholding Form

Does Missouri Have A State Withholding Form

https://i0.wp.com/www.withholdingform.com/wp-content/uploads/2022/08/kentucky-state-withholding-form-w-4-2019-cptcode-se-4.png

Missouri Withholding Tax WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/missouri-withholding-tax.png

Utah Withholding Tax Form WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/w-4-employee-s-withholding-certificate-and-federal-income-tax-31.png

As an employer you must withhold Missouri State Income Tax from employees who are Earning wages in Missouri Missouri residents working in a state with no income tax Missouri residents working in a state with lower income tax rate than Missouri The following states have separate state tax withholding forms Employees should complete the form each year and give it to their employers so the proper amount is withheld for state taxes

Form MO W 4 is completed so you can have as much take home pay as possible without an income tax liability due to the state of Missouri when you file your return Deductions and exemptions reduce the amount of your taxable income Missouri Withholding Tax Multiply the employee s Missouri taxable income by the applicable annual payroll period rate Begin at the lowest rate and accumulate the total withholding amount for each rate The result is the employee s annual Missouri withholding tax

Download Does Missouri Have A State Withholding Form

More picture related to Does Missouri Have A State Withholding Form

Missouri State Withholding Tax Form 2022 WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/10/kentucky-state-withholding-form-w-4-2019-cptcode-se-4.png

Missouri State Withholding Tax Form 2022 WithholdingForm

https://www.withholdingform.com/wp-content/uploads/2022/08/irs-w-4-2019-fill-out-tax-template-online-us-legal-forms-1.png

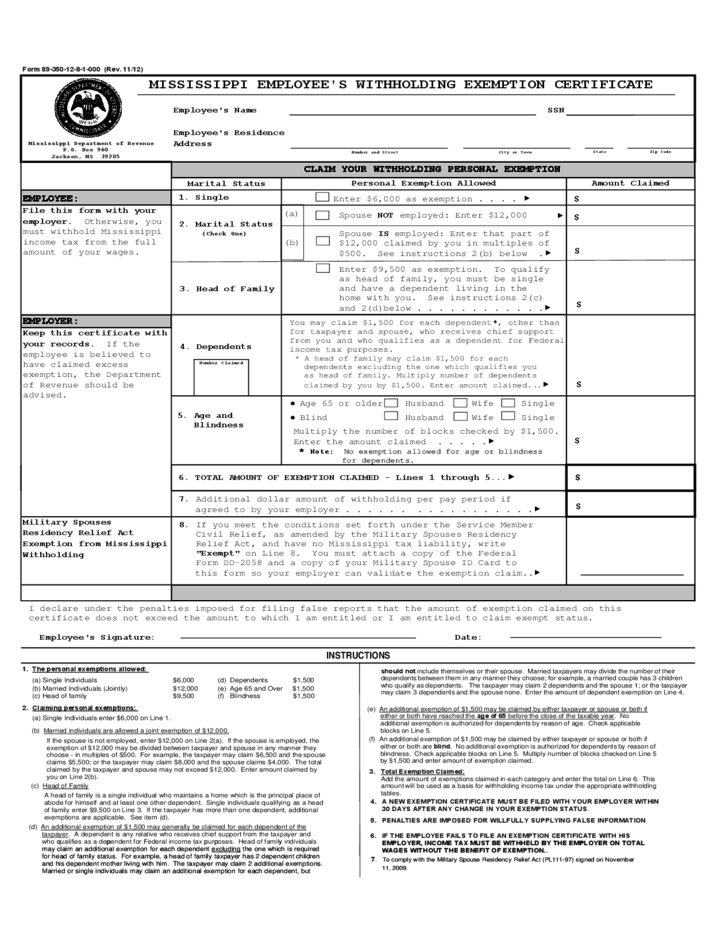

Mississippi State Withholding Form Personal Exemption ExemptForm

https://www.exemptform.com/wp-content/uploads/2022/08/employee-s-withholding-exemption-certificate-mississippi-free-download.png

Withholding Calculator The Missouri Department of Revenue Online Withholding Tax Calculator is provided as a service for employees employers and tax professionals Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W 4 Updated April 2024 Select state Past Missouri tax rates Missouri withholding forms Missouri Payroll Topics Missouri tax information Employee Withholding Requirements Missouri State Unemployment Insurance SUI Missouri State Disability Insurance SDI Missouri Family Leave Insurance FLI Missouri Local Taxes Missouri Minimum Wage

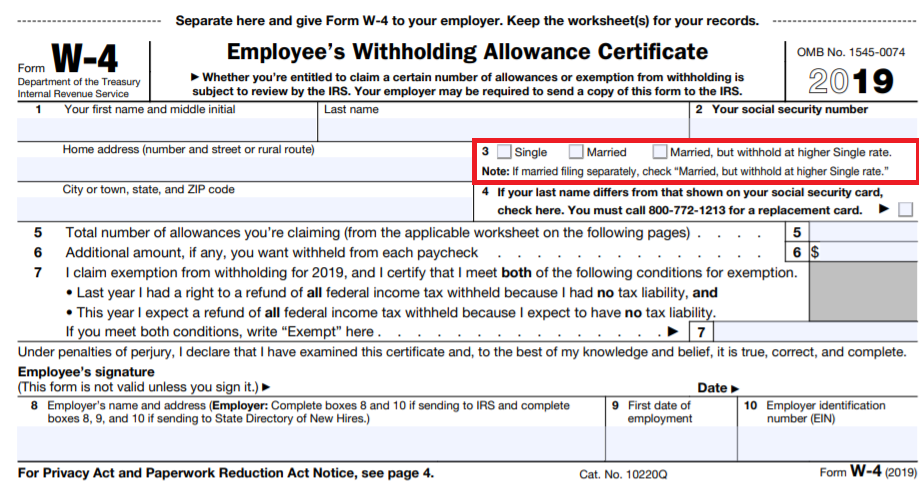

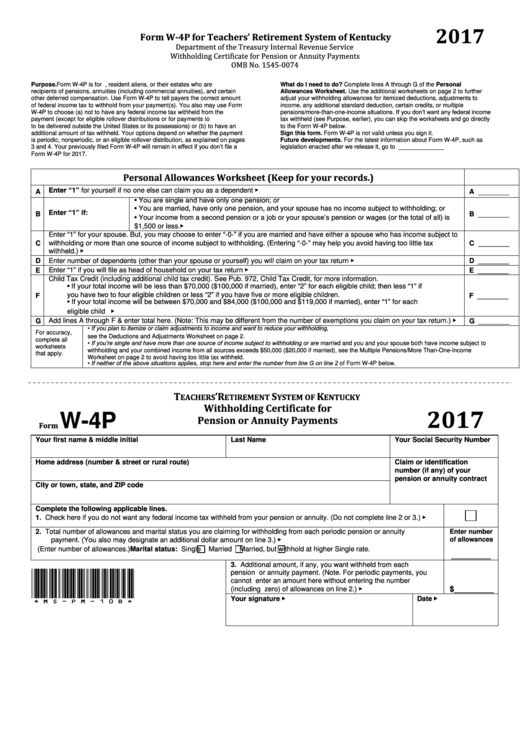

The majority of states have a state specific withholding certificate with only three states that use the federal Form W 4 Employee s Withholding Certificate for state withholding purposes The 2023 federal Form W 4 has recently been released Employee s Withholding Certificate Now let s look at the states The W 4 is a federal document and several states but not all accept the federal W 4 Below is a chart of states and what they accept If the state has their own withholding form then the federal W 4 is not allowed for state calculation of withholdings

Does Missouri Have A Social Host Liability Law

https://static.wixstatic.com/media/c34ae4_6e98e976a03d474e99433e70bae33544~mv2.jpg/v1/fill/w_940,h_726,al_c,q_85/c34ae4_6e98e976a03d474e99433e70bae33544~mv2.jpg

Pennsylvania State Withholding Form 2023 Printable Forms Free Online

https://www.pdffiller.com/preview/488/345/488345271/large.png

https://dor.mo.gov/taxation/business/tax-types/withholding

The withholding tax tables withholding formula MO W 4 Missouri Employer s Tax Guide Form 4282 and withholding tax calculator have been updated

https://dor.mo.gov/forms/MO W-4_2019.pdf

This certificate is for income tax withholding and child support enforcement purposes only Type or print Notice To Employer Within 20 days of hiring a new employee send a copy of Form MO W 4 to the Missouri Department of Revenue P O Box 3340 Jefferson City MO 65105 3340 or fax to 573 526 8079 Please visit

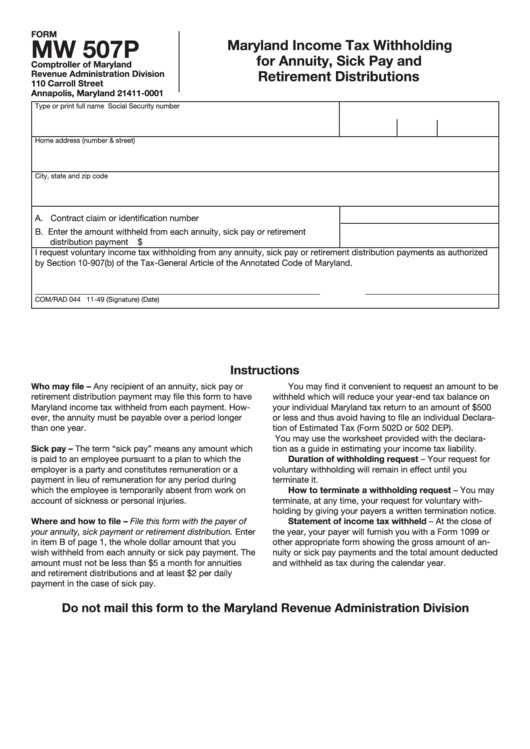

Maryland Withholding Tax Form WithholdingForm

Does Missouri Have A Social Host Liability Law

Idaho State Tax Withholding Form 2023 Printable Forms Free Online

Missouri State Withholding Tax Form 2022 WithholdingForm

Missouri Form Mo W 4 PDF Withholding Tax Tax Deduction

W 4 Employee S Withholding Allowance Certificate 2021 2022 W4 Form

W 4 Employee S Withholding Allowance Certificate 2021 2022 W4 Form

Fact Finders Does Missouri Have A Maximum Number Of Hours Students Can

Oklahoma Employee Tax Withholding Form 2023 Employeeform

Alabama Employee Withholding Form 2023 Employeeform

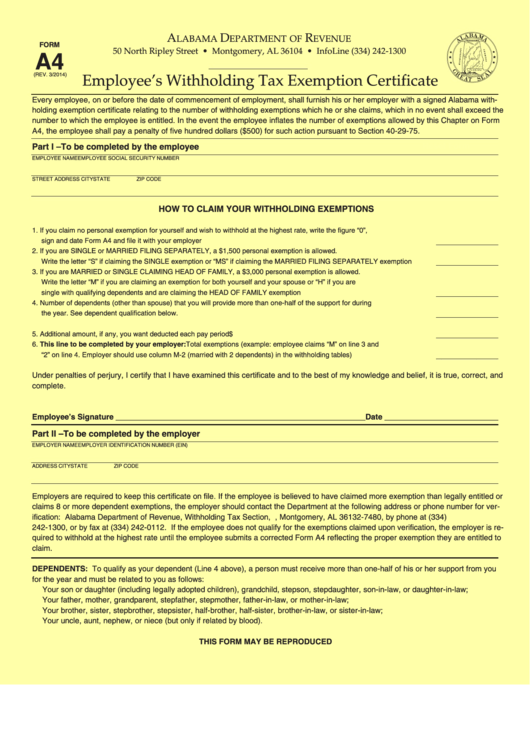

Does Missouri Have A State Withholding Form - All employees are required to complete a federal and state withholding allowance certificate Failure to provide Payroll with a valid withholding allowance certificate will result in the withholding tax to be withheld at the highest rate of Single marital status and zero allowances until a form W 4 is completed