Does Nebraska Have Personal Property Tax Anyone who brings personal property into the county between January 1 and July 1 must list the property for assessment before July 31 unless it can be shown that the

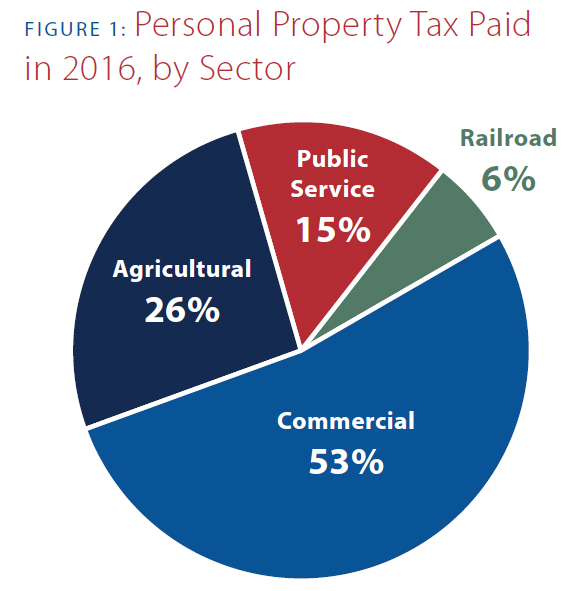

In 2016 personal property accounted for 5 6 percent of total property taxes levied in Nebraska Of that amount commercial personal property was the Delaware does not have personal property taxes and has an effective property tax rate of 0 43 Nebraska has an effective property tax rate of 1 76 It

Does Nebraska Have Personal Property Tax

Does Nebraska Have Personal Property Tax

https://symbols.geobop.com/wp-content/uploads/ne-tree.jpg

The Stunning Beauty Of Nebraska s 8 State Parks

http://cdn.onlyinyourstate.com/wp-content/uploads/2015/06/chadron-state-park.jpg

.jpg?itok=TW41vgTn)

Visit Nebraska Nebraska USA

https://www.visittheusa.co.uk/sites/default/files/styles/state_hero_l_x2/public/images/hero_media_image/2016-10/Getty_530293777_Brand_State_Nebraska_FinalCrop (1).jpg?itok=TW41vgTn

Within the state of Nebraska all items except cars and rental equipment are considered to have a value greater than zero Suppose you have depreciated property such as personal items that have a low Personal property rented or leased for income is taxable Depreciable personal property used in the production of electricity using wind and personal property in service at a

Two types of property are taxed in Nebraska real property and tangible personal property Real property includes land buildings improvements fixtures mobile The property tax base since 1930 has grown only 70 as fast as the state s economy measured by Nebraska personal income compared to 93 for the sales tax base and

Download Does Nebraska Have Personal Property Tax

More picture related to Does Nebraska Have Personal Property Tax

Should You Pay Your Commercial Property Taxes Early Hegwood Group

https://www.hegwoodgroup.com/wp-content/uploads/2022/11/pay-commercial-property-taxes-in-the-fall.jpg

Hecht Group Personal Property Taxes By State

https://img.hechtgroup.com/1664244317985.jpg

This Time It s Personal Nebraska s Personal Property Tax

https://files.platteinstitute.org/uploads/2020/05/Figure-1-1.jpg

LB1107 Repeals Nebraska s Tangible Personal Property Tax De Minimis Exemption One of the provisions in LB1107 that has largely been overlooked is a And have been exclusively levying property taxes since 1967 Today property tax is the primary revenue raising tool for political subdivisions and in fiscal year 2013 1014

Nebraska Personal Property Get Started Learn more Processing In 2021 concerns about rising property taxes led both Kansas and Nebraska to adopt similar laws Nebraska s new law serves the broad interests of public

Nebraska Karte Geographie Von Nebraska Karte Von Nebraska

https://www.worldmap-knowledge.com/image0438/c4/c4797af05a9e4382558fd2d468d4209f.gif

Free Printable Nebraska House Rental Form Printable Forms Free Online

https://freeforms.com/wp-content/uploads/2020/05/Nebraska-Residential-Lease-Agreement.png

https://revenue.nebraska.gov/about/frequently...

Anyone who brings personal property into the county between January 1 and July 1 must list the property for assessment before July 31 unless it can be shown that the

https://platteinstitute.org/this-time-its-personal...

In 2016 personal property accounted for 5 6 percent of total property taxes levied in Nebraska Of that amount commercial personal property was the

25 Best Places To Visit In Nebraska

Nebraska Karte Geographie Von Nebraska Karte Von Nebraska

Nebraska National Forest Crossroads Of The Sandhills

25 Jaw Dropping Photos Of Nebraska Scenery

Printable Federal 1040n Form Printable Forms Free Online

Tangible Personal Property State Tangible Personal Property Taxes

Tangible Personal Property State Tangible Personal Property Taxes

KRVN 880 KRVN 93 1 KAMI Nebraska Personal Property Return And

State Individual Income Tax Rates And Brackets Tax Foundation

Tourist Attractions In Nebraska Nebraska Tourist Nebraska Sandhills

Does Nebraska Have Personal Property Tax - Within the state of Nebraska all items except cars and rental equipment are considered to have a value greater than zero Suppose you have depreciated property such as personal items that have a low