Does Nj Tax Social Security Social Security is not taxed at the state level in New Jersey State income taxes will also be low for any retirees with income from retirement accounts and pensions below 75 000 for single filers or 100 000 for joint filers

For federal purposes you would be taxed on 85 of your Social Security benefits said Neil Becourtney a certified public accountant and tax partner with CohnReznick in Holmdel But for New Jersey gross income tax purposes Social Social Security and Railroad Retirement benefits are not taxable under the New Jersey Income Tax and should not be reported as income on your State return Payments from a public or private pension plan because of total and permanent disability also are not taxable

Does Nj Tax Social Security

Does Nj Tax Social Security

https://www.thanksalattehollysprings.com/wp-content/uploads/2024/02/httpswww.thanksalattehollysprings.com10-firearms-companies-that-are-100-american-2-930x620.jpg

How To Use Census 2021 Data Womens Budget Group

https://wbg.org.uk/wp-content/uploads/2023/06/How-to-use-Census-Data-Website.png

Application PDF Withholding Tax Social Security Number

https://imgv2-1-f.scribdassets.com/img/document/162941122/original/bd47222c78/1669084235?v=1

Does New Jersey tax Social Security benefits No But you may pay federal taxes on a portion of your Social Security benefits depending on your income Certain items of income are not subject to New Jersey tax and should not be included when you file a New Jersey return Below is a partial list of such items Social Security benefits Railroad Retirement benefits both Tier 1 and Tier 2 United States military pensions and survivor s benefit payments

New Jersey does not tax Social Security benefits regardless of your income level This is a significant benefit for retirees as Social Security often accounts for a substantial part Social Security benefits and military pensions are not taxed in New Jersey All other state and federal pensions annuities and some IRA withdrawals are taxed but there are exclusions New Jersey taxpayers age 62 or older with 100 000 or less in state income can exclude up to 60 000 of pension annuity IRA or other retirement plan income

Download Does Nj Tax Social Security

More picture related to Does Nj Tax Social Security

New Jersey Security License License Lookup

https://licenselookup.org/images/2022-11/new-jersey-security-license-644a821a36.jpg

What Is The Social Security Phantom Tax YouTube

https://i.ytimg.com/vi/ykZE7WXUiAQ/maxresdefault.jpg

What States Don t Tax Social Security Mistersocialsecurity

https://i4.ytimg.com/vi/a3ok3woyMgw/sddefault.jpg

New Jersey tax on retirement income New Jersey doesn t tax Social Security retirement benefits Military pensions or Railroad Retirement benefits Taxpayers 62 and older or those Social Security benefits are exempt from income tax in New Jersey In fact the benefits aren t even reported anywhere on the state return But the federal rules for Social

[desc-10] [desc-11]

Is Yours One Of The States That Do Not Tax Social Security YouTube

https://i.ytimg.com/vi/vp5DRmgCwfY/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4AbYIgAKAD4oCDAgAEAEYZSBPKEEwDw==&rs=AOn4CLCJZ00HGqYB3ZAe66KQ5IWM97Cfrg

States That May Cut Taxes On Social Security Income SSI Texas

https://texasbreaking.com/wp-content/uploads/2023/02/GettyImages-1136346827-3eba69ab996a4abeb0836afe62abfd3c.jpg

https://smartasset.com › retirement › new-jersey-retirement-taxes

Social Security is not taxed at the state level in New Jersey State income taxes will also be low for any retirees with income from retirement accounts and pensions below 75 000 for single filers or 100 000 for joint filers

https://njmoneyhelp.com › does-my-social...

For federal purposes you would be taxed on 85 of your Social Security benefits said Neil Becourtney a certified public accountant and tax partner with CohnReznick in Holmdel But for New Jersey gross income tax purposes Social

NJ Innovation Fund Too Generous For Its Own Good NJ Spotlight News

Is Yours One Of The States That Do Not Tax Social Security YouTube

NJ To End Temporary Work from home Tax Rules NJ Spotlight News

State by State Guide To Taxes On Retirees Flagel Huber Flagel

States That Won t Tax Social Security Or My Pension In Retirement

Money On LinkedIn Which States Tax Social Security Benefits Missouri

Money On LinkedIn Which States Tax Social Security Benefits Missouri

A National Security Disaster Intel Officials Sound The Alarm Of The

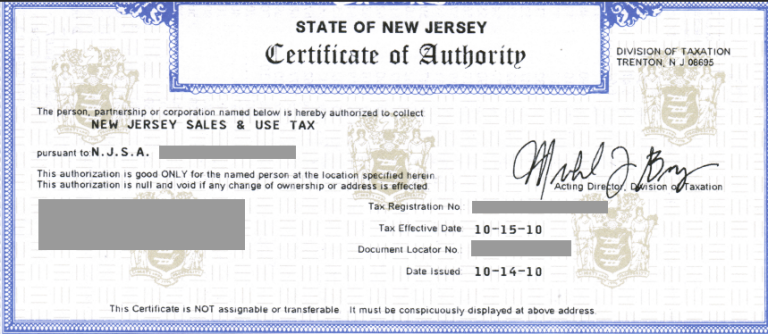

Nj Sales Tax Certificate Of Authority LLC Bible

July PAY STUB 03 PDF Federal Insurance Contributions Act Tax

Does Nj Tax Social Security - Certain items of income are not subject to New Jersey tax and should not be included when you file a New Jersey return Below is a partial list of such items Social Security benefits Railroad Retirement benefits both Tier 1 and Tier 2 United States military pensions and survivor s benefit payments