Does Nps Comes Under 80ccc The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000 allowed u s

Investment of up to 50 000 in the National Pension Scheme or NPS for all subscribers whether salaried or self employed qualifies for additional tax deduction under Section 80CCD 1B of the For someone in the 30 per cent tax bracket this is a clear benefit of Rs 15 000 on investment of Rs 50 000 over and above the Rs 1 5 lakh allowed under Section 80 C This article gives an overview of NPS explains NPS Tax

Does Nps Comes Under 80ccc

Does Nps Comes Under 80ccc

https://yt3.ggpht.com/ytc/AMLnZu914KiYJnoWmEmSMw6ueYX2xtnanwghFDdbQp70=s900-c-k-c0x00ffffff-no-rj

NPS Take off pressed ETS NORD

https://www.etsnord.fi/content/uploads/NPS-4.png

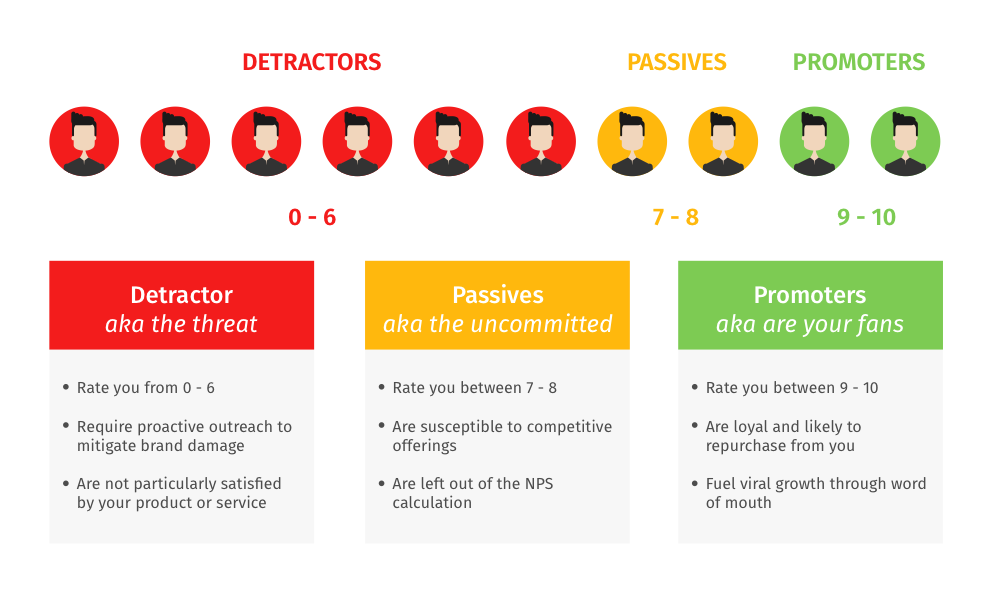

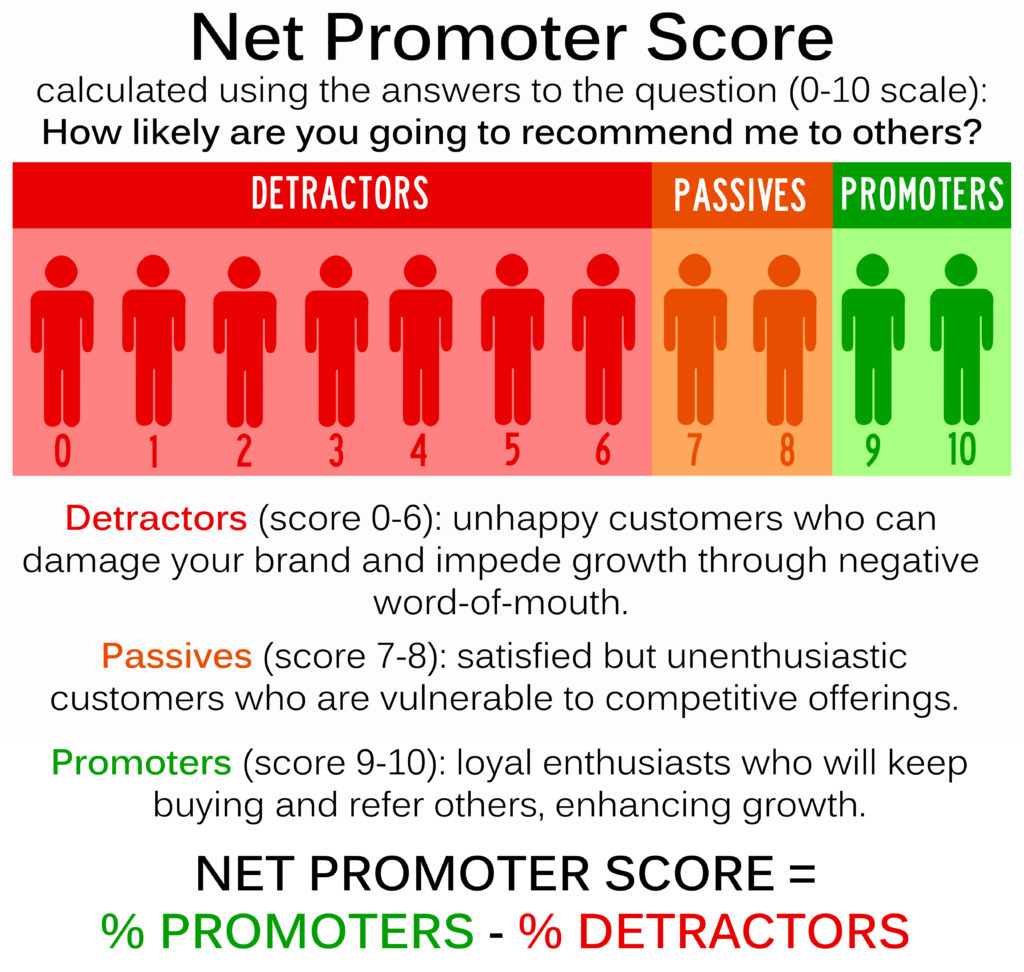

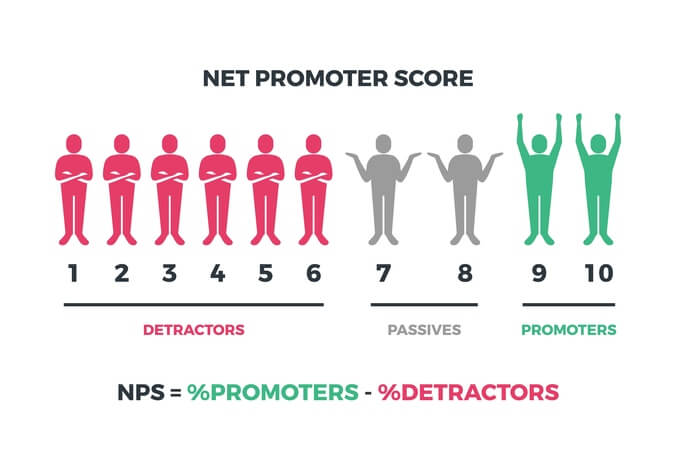

How Does NPS Works Beginner s Guide To Net Promoter Score QuestionPro

https://www.questionpro.com/blog/wp-content/uploads/2016/11/Blog-New-19-4.png

NPS tax benefits apart from Section 80CCD include Partial withdrawals made under the NPS account are fully exempt Lumpsum withdrawal at age 60 is fully exempt 40 of the total NPS used to buy Is the tax benefit available for contributions made to NPS or APY covered under section 80CCC No you cannot claim tax deduction under section 80CCC for contributions

Any payment from NPS to an employee because of closure or his opting out of the pension scheme is chargeable to tax However with effect from the assessment year 2017 18 the whole amount received by the nominee The contribution made in the National Pension System NPS qualifies for tax benefits under the Income Tax Act 1961 On the amount invested in NPS one can avail tax breaks under Section 80CCD 1 Section

Download Does Nps Comes Under 80ccc

More picture related to Does Nps Comes Under 80ccc

What Is A Net Promoter Score NPS Hartz Physical Therapy

https://www.hartzpt.com/wp-content/uploads/NPS-Graphic-1024x972.jpg

Data Analytics And Customer Loyalty Predicting Individual NPS Scores

https://www.lynxanalytics.com/hs-fs/hubfs/7942.jpg?width=15023&name=7942.jpg

NPS Miar Sukcesu Blog Bluerank

https://www.bluerank.pl/wp-content/uploads/2018/07/NPS_4.jpg

You can avail tax benefits for NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and 80CCD 2 Now let s delve deeper into each of these sections NPS tax deductions you Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate deductions and maximize tax benefits with NPS

Can NRIs claim deduction under Section 80CCC Yes NRIs can certainly claim deductions under Section 80CCC However the claim deductions can be made only on the contributions made to their pension funds under Section 10 23AAB Income tax benefits for NPS You can claim tax deductions against NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B and

NPS Vs PPF Which Is Better Personal Finance Plan

https://www.personalfinanceplan.in/wp-content/uploads/2019/04/20190415_NPS-vs-PPF-vs-NPS-or-PPF-which-is-good.png

Tom Haws NPS Global 1 0 My First Explanation Of Where NPS Came From

https://4.bp.blogspot.com/-ZFt85jRJm10/WePVlOKIOgI/AAAAAAAACdc/iGdd9QP_AzUJ_vRoK-yh4E9A-yXzVvzFgCLcBGAs/s1600/nps-t-shirt-pkd.png

https://cleartax.in/s/80c-80-deductions

The maximum deduction under Section 80C 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000 allowed u s

https://www.livemint.com/Money/7n1fb7…

Investment of up to 50 000 in the National Pension Scheme or NPS for all subscribers whether salaried or self employed qualifies for additional tax deduction under Section 80CCD 1B of the

NPS Lojala Kunder r N jda Kunder Webropol se

NPS Vs PPF Which Is Better Personal Finance Plan

SNP Comes Under Attack For Centralising Power

NPS Builders Consultants And Engineers Muzaffarpur

REMIX ER NPS Music

SCVNews NPS Director Addresses Environmental Societal Changes

SCVNews NPS Director Addresses Environmental Societal Changes

NPS Old Pension Scheme Difference In Hindi NPS

Predictive NPS By Gemseek Medallia Xchange

Deductions Under The New Tax Regime Budget 2020 Quicko Blog

Does Nps Comes Under 80ccc - NPS is one of the listed investment options in which you can invest and save tax under Section 80C The deduction limit for this section is Rs 1 5 lakhs and you can invest the