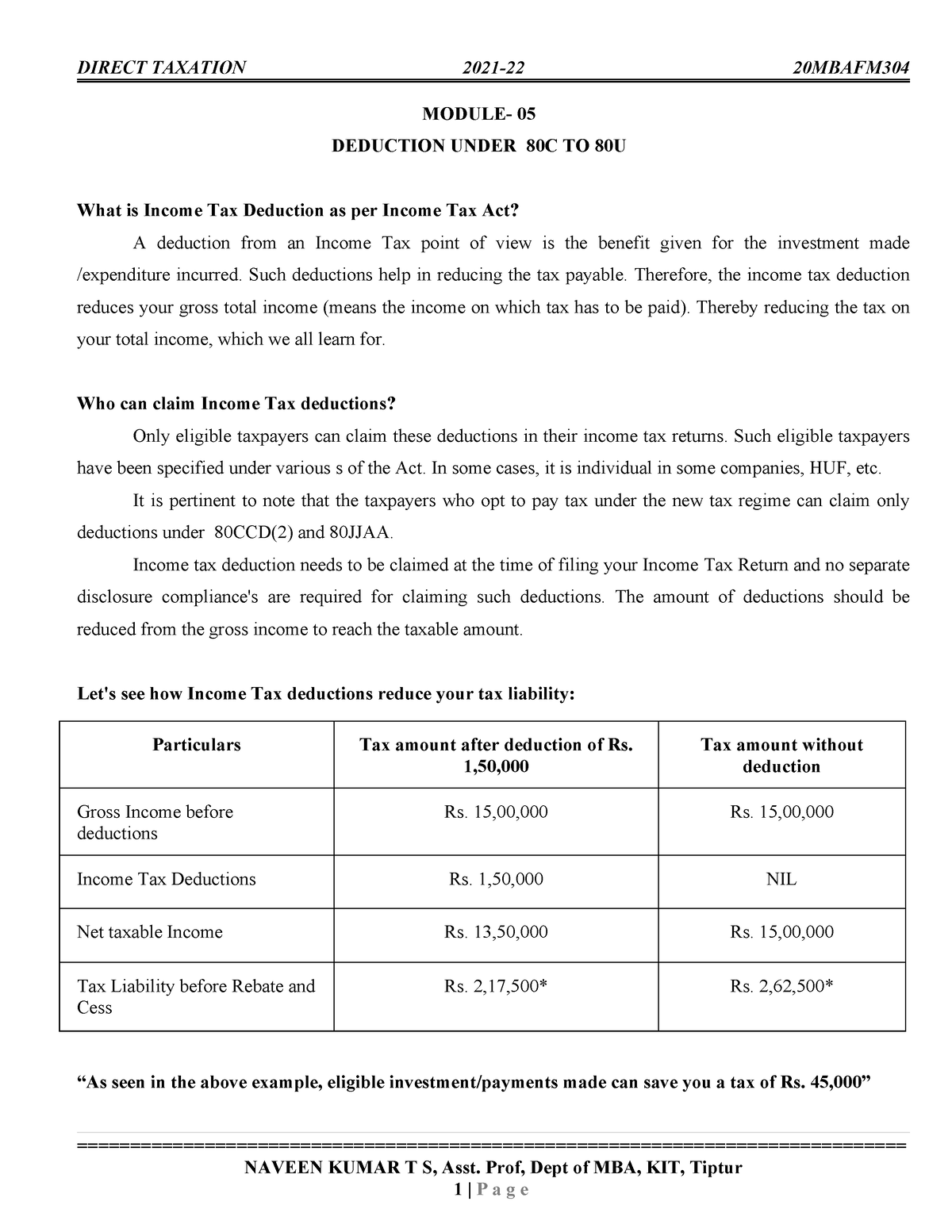

Does Nps Comes Under Section 80c Verkko 29 maalisk 2021 nbsp 0183 32 NPS is one of the listed investment options in which you can invest and save tax under Section 80C The deduction limit for this section is Rs 1 5 lakhs and you can invest the entire amount in NPS if you wish and claim the deduction

Verkko Total deduction under Section 80C 80CCC 80CCD 1 Rs 1 50 000 80CCD 1B Investments in NPS outside Rs 1 50 000 limit under Section 80CCE Rs 50 000 80CCD 2 Employer s contribution towards NPS outside Rs 1 50 000 limit under Section 80CCE Central government employer 14 of basic salary DA Others 10 of basic Verkko 30 maalisk 2023 nbsp 0183 32 Investing in NPS Tier I offers three tax deductions Deduction of up to Rs 1 5 lakh from taxable income under Section 80C Additional deduction of up to Rs 50 000 under Section 80CCD 1B of the Income Tax Act exclusively available through NPS investment The third deduction is in the form of employer s contribution of up to

Does Nps Comes Under Section 80c

Does Nps Comes Under Section 80c

https://i.ytimg.com/vi/L1AUhzT9w0Y/maxresdefault.jpg

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

Section 80C Deduction Tax Saving Investment Options Under Section 80C

https://cdnblog.etmoney.com/wp-content/uploads/2019/12/Section-80C-768x319.jpg

Verkko 30 tammik 2023 nbsp 0183 32 Yes NPS is a government backed retirement scheme which also provides taxation benefits under Section 80C of Income Tax Act It is independent of any investment made in provident or pension schemes Verkko Can NPS be claimed under 80C Exclusive Tax Benefit to all NPS Subscribers u s 80CCD 1B An additional deduction for investment up to Rs 50 000 in NPS Tier I account is available exclusively to NPS subscribers under subsection 80CCD 1B This is over and above the deduction of Rs 1 5 lakh available under section 80C of

Verkko 22 marrask 2021 nbsp 0183 32 If you contribute to NPS under the All Citizens Model you are eligible for deductions under section 80C with a limit of Rs 1 5 lakh Verkko Does this come under Sec 80C The NPS is a pension scheme that has been started by the Indian Government to allow the unorganised sector and working professionals to have a pension after retirement Investments of up to Rs 1 5 lakh can be used to avail tax deductions under Section 80C

Download Does Nps Comes Under Section 80c

More picture related to Does Nps Comes Under Section 80c

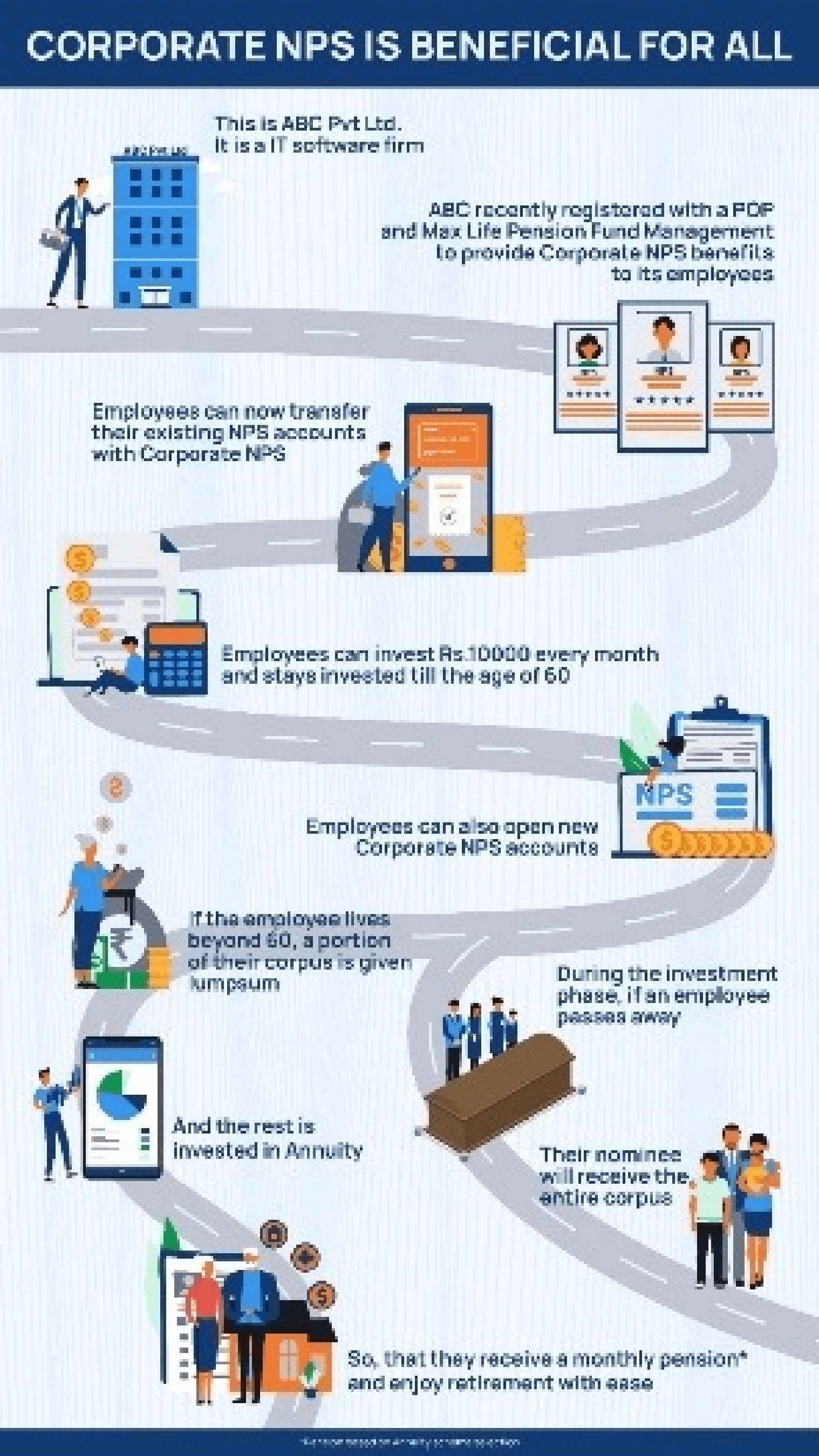

Nps Solutions

https://www.maxlifepensionfund.com/content/dam/pfm/nps-solutions/corporate-nps-working-image.png

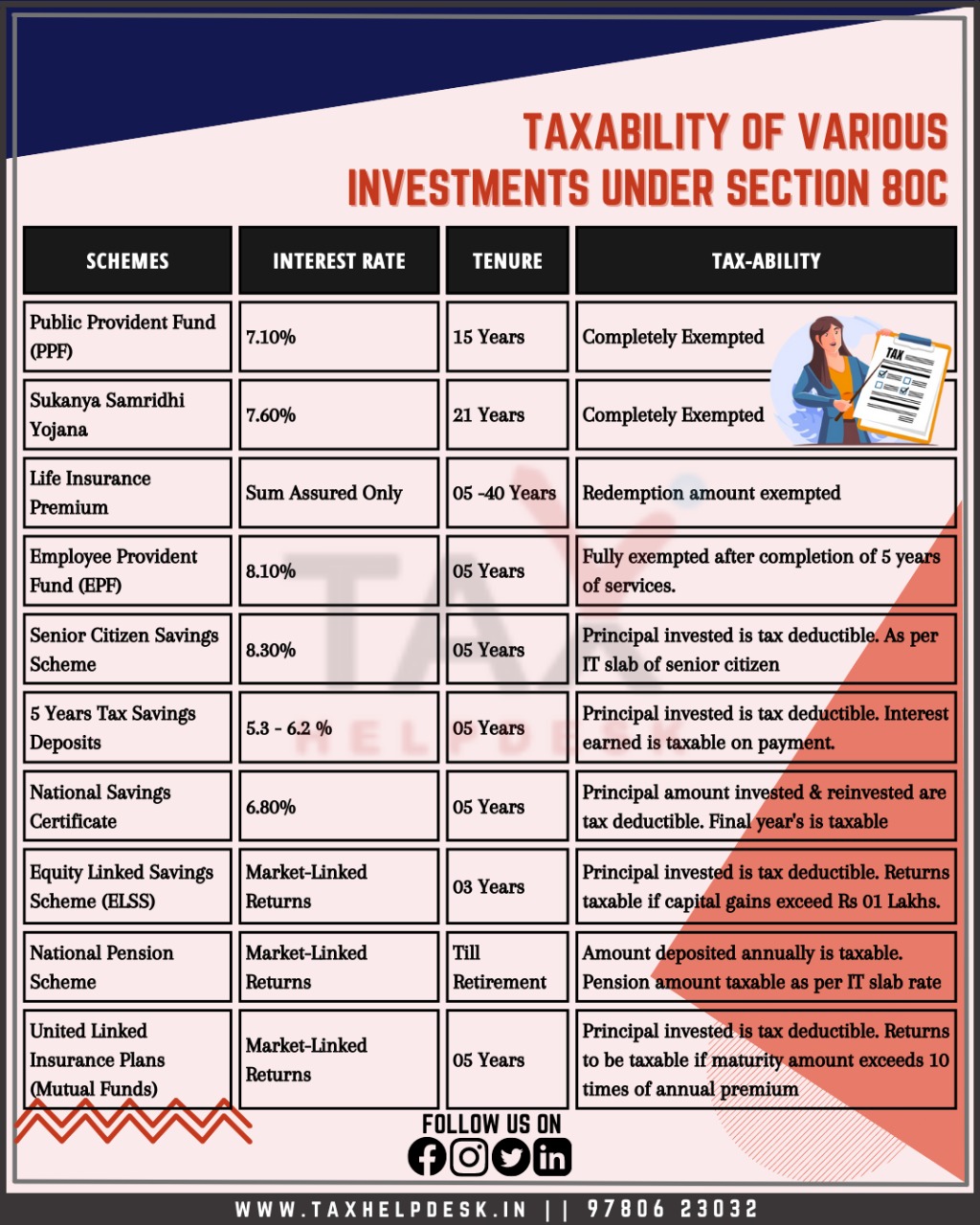

Understand About Taxability Of Various Investments Under Section 80C

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Investments-under-Section-80C.jpeg

Deductions Under Section 80C Benefits Works Myfinopedia

https://www.myfinopedia.com/wp-content/uploads/2023/01/Deductions-Under-Section-80C-1024x576.jpg

Verkko 20 syysk 2022 nbsp 0183 32 NPS National Pension Scheme tax benefits available only in Tier 1 NPS accounts NPS tax saving comes under Sec 80CCD 1 80CCD 1B 80CCD 2 deduction one can claim a tax deduction of up to Rs 2 lakh by simply investing in NPS i e investing Rs 1 5 lakh under Section 80C and another Rs 50 000 under Section Verkko Contributions to NPS receive tax exemptions under Section 80C Section 80CCC and Section 80CCD 1 of Income Tax Act Starting from 2016 an additional tax benefit of Rs 50 000 under Section 80CCD 1b is provided under NPS which is over the 1 5 lakh exemption of Section 80C Private fund managers are important parts of NPS

Verkko 25 helmik 2016 nbsp 0183 32 You can take out the money at any time Only the NPS subscriber can claim tax benefits If you invest in NPS which is in your spouse s name then you cannot claim the tax deduction Your contribution to NPS can be claimed under Section 80CCD1 b as well as Section 80C Verkko The term Life insurance is covered in section 80C and the term medical insurance is covered under section 80D Q Does investing in NPS come under section 80C Yes investment done in National pension scheme comes under the ambit of 80C

Income Tax Deduction Under Section 80C To 80U FY 2022 23

https://navi.com/blog/wp-content/uploads/2022/05/Section-80-of-the-Income-Tax-Act.webp

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

https://community.greythr.com/t/nps-comes-under-section-80c-or-80-ccd...

Verkko 29 maalisk 2021 nbsp 0183 32 NPS is one of the listed investment options in which you can invest and save tax under Section 80C The deduction limit for this section is Rs 1 5 lakhs and you can invest the entire amount in NPS if you wish and claim the deduction

https://cleartax.in/s/80c-80-deductions

Verkko Total deduction under Section 80C 80CCC 80CCD 1 Rs 1 50 000 80CCD 1B Investments in NPS outside Rs 1 50 000 limit under Section 80CCE Rs 50 000 80CCD 2 Employer s contribution towards NPS outside Rs 1 50 000 limit under Section 80CCE Central government employer 14 of basic salary DA Others 10 of basic

HOW TO SAVE TAX UNDER SECTION 80 C WHAT COMES UNDER SECTION 80C FULL

Income Tax Deduction Under Section 80C To 80U FY 2022 23

Deductions Under Section 80C Does PF Come Under 80C

Deductions Under Section 80C Its Allied Sections

How To Calculate For Nps Haiper

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Module 05 Deduction Under Section 80C TO 80U Theory Studocu

Deduction From Gross Total Income Section 80C To 80U Graphical Table

Section 80C Deduction Under Section 80C In India Paisabazaar

Does Nps Comes Under Section 80c - Verkko 22 marrask 2021 nbsp 0183 32 If you contribute to NPS under the All Citizens Model you are eligible for deductions under section 80C with a limit of Rs 1 5 lakh