Does Preschool Qualify For Child Care Tax Credit Yes preschool tuition counts for the Child and Dependent Care credit Nursery school preschool and similar pre kindergarten programs are considered child care by the IRS Summer day camps also count as child care

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care expenses for a child under 13 a spouse or parent unable to

Does Preschool Qualify For Child Care Tax Credit

Does Preschool Qualify For Child Care Tax Credit

https://prescottenews.com/wp-content/uploads/2021/08/Child-Tax-Credit.jpg

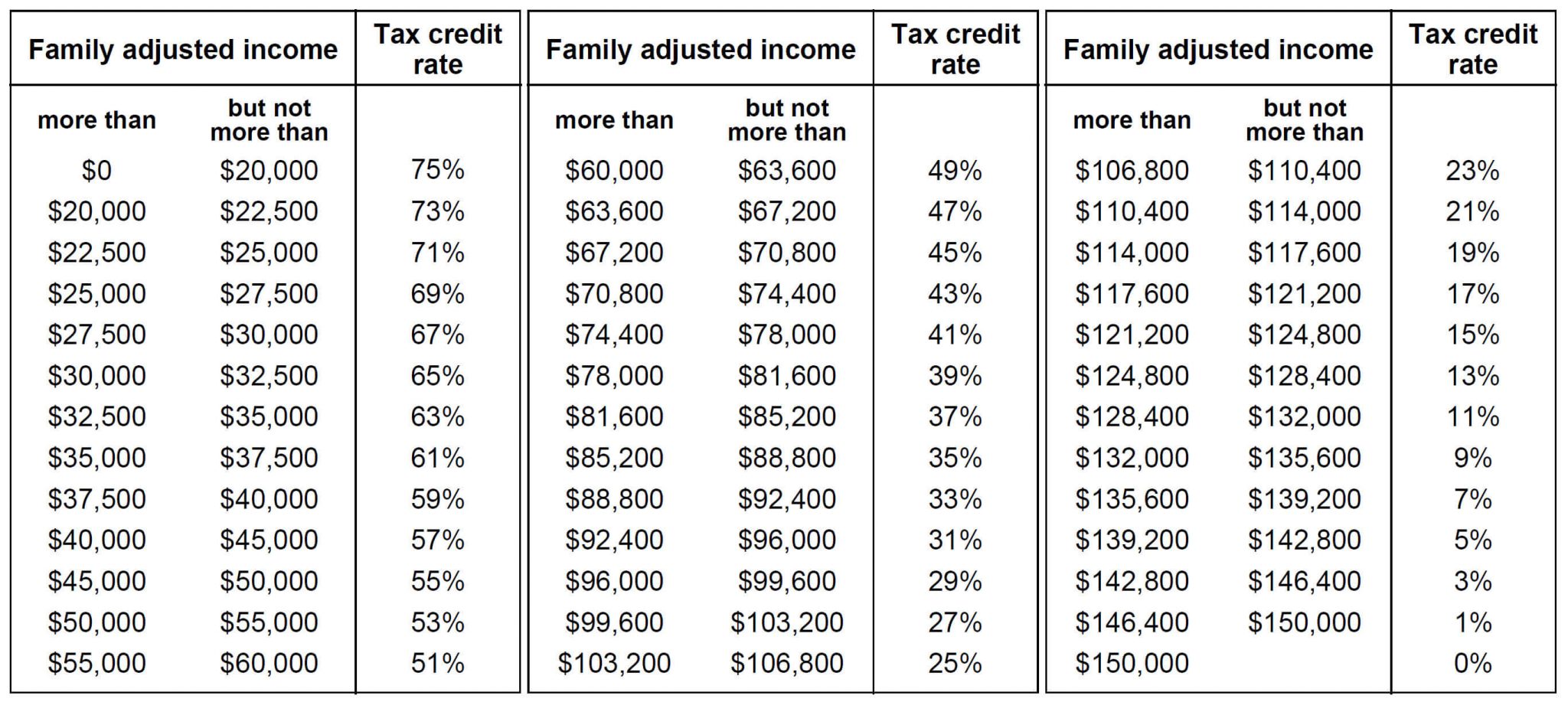

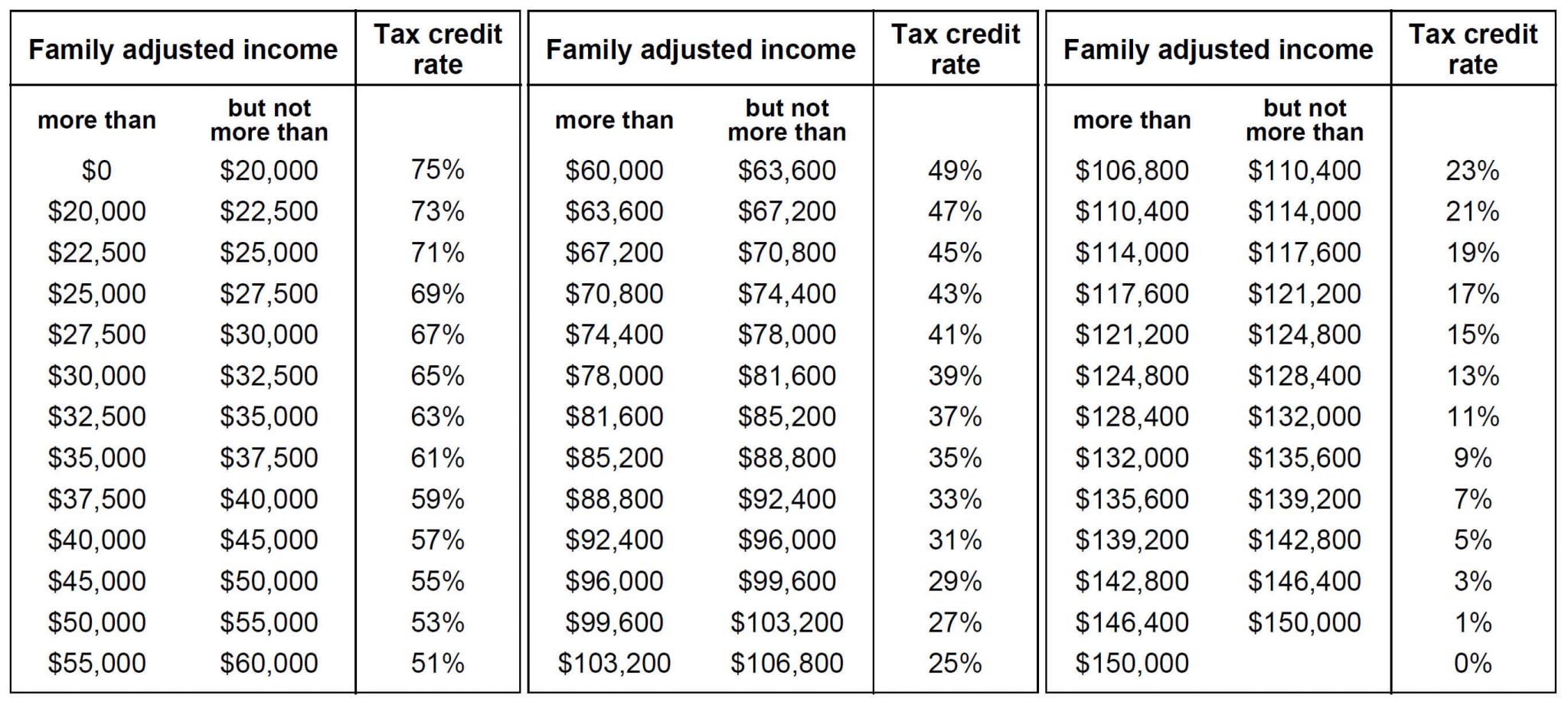

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

https://cdn.taxory.com/wp-content/uploads/2021/01/childcare-access-and-relief-from-expenses-tax-credit-2048x917.jpg

Child Tax Credit Schedule 8812 H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2017/06/child-tax-credit-1080x675.jpg

Yes you may claim the child tax credit CTC additional child tax credit ACTC or credit for other dependents ODC as well as the child and dependent care credit on your return if you qualify for those credits The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit can reduce your tax bill on a dollar for dollar

You can claim up to 3 000 in eligible child care expenses for one child or up to 6 000 for two or more children but the actual credit equals 600 to 1 050 if you have one child or The Child And Dependent Care Credit Is Worth Up to 8 000 This Tax Season Written By Kemberley Washington Tax Writer Korrena Bailie Reviewed Editorial Director Growth Projects

Download Does Preschool Qualify For Child Care Tax Credit

More picture related to Does Preschool Qualify For Child Care Tax Credit

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

https://www.sittercity.com/wp-content/uploads/2020/02/GettyImages-1180592592-1-scaled-e1581105297103.jpg

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

DAYCARE TAX STATEMENT Childcare Center Printable End Of The Etsy In

https://i.pinimg.com/originals/32/9e/c2/329ec24df04c77c70081e4a28267c980.jpg

The cost of day care preschool before and after school care day camp or a nanny or other babysitter can count toward the credit How much is the credit worth That depends on the number of To qualify for the child and dependent care credit you must have paid someone such as a daycare provider to care for one or more of the following people A child under age 13 when the care was provided whom you claim as a dependent on your tax return

If you re a parent or caretaker of young children disabled dependents or a disabled spouse listen up you may qualify for a special tax credit used for claiming child care expenses and dependent care expenses What is the child and dependent care credit This credit allows taxpayers to reduce their tax by a portion of their child and dependent care expenses The credit may be claimed by taxpayers who in order to work or look for work pay someone to take care of their qualifying person A qualifying person is a Qualifying child under age 13

Why Do Parents Pay So Much For Child Care When Early Educators Earn So

https://i.pinimg.com/originals/ba/6c/89/ba6c89329ae53d213007445626ad9273.png

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/7a55e3/3981264249/il_1140xN.3981264249_lgte.jpg

https://ttlc.intuit.com/turbotax-support/en-us/...

Yes preschool tuition counts for the Child and Dependent Care credit Nursery school preschool and similar pre kindergarten programs are considered child care by the IRS Summer day camps also count as child care

https://www.irs.gov/taxtopics/tc602

You may be able to claim the child and dependent care credit if you paid expenses for the care of a qualifying individual to enable you and your spouse if filing a joint return to work or actively look for work

30 Child Tax Credit Worksheet 2019 Worksheets Decoomo

Why Do Parents Pay So Much For Child Care When Early Educators Earn So

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

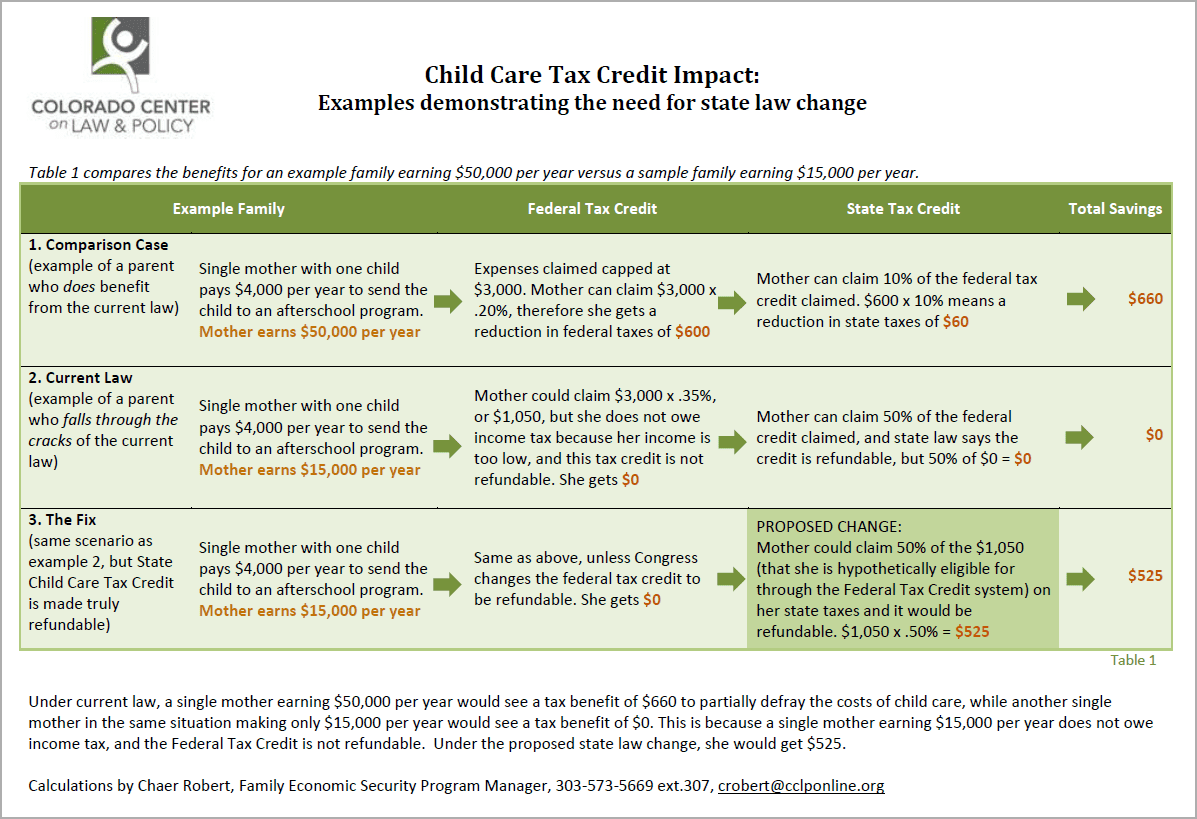

Fixing The Child Care Tax Credit EOPRTF CCLP

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

Why Do I Owe Tax Credits Leia Aqui Do I Have To Pay Back My Tax Credits

Why Do I Owe Tax Credits Leia Aqui Do I Have To Pay Back My Tax Credits

Do I Get Child Tax Credit If I Don t Work Leia Aqui Can A Stay At

Who Gets Tax Credits Leia Aqui Who Gets Federal Tax Credits

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

Does Preschool Qualify For Child Care Tax Credit - The Child And Dependent Care Credit Is Worth Up to 8 000 This Tax Season Written By Kemberley Washington Tax Writer Korrena Bailie Reviewed Editorial Director Growth Projects