Does Private Employer Contribute To Nps All Indian citizens including NRIs who are above 18 years of age can make NPS contributions Also employers can make contributions to NPS accounts of their employees Private sector

If your employer offers NPS and you have no choice but enroll for it there is little you can do For instance if you are a public On the other hand an employer s contribution to NPS above 10 is a perk under the head salary and taxed if you belong to the private sector Example If your basic pay is Rs 9

Does Private Employer Contribute To Nps

Does Private Employer Contribute To Nps

https://www.smcknight.com/wp-content/uploads/2018/12/hiring.jpeg

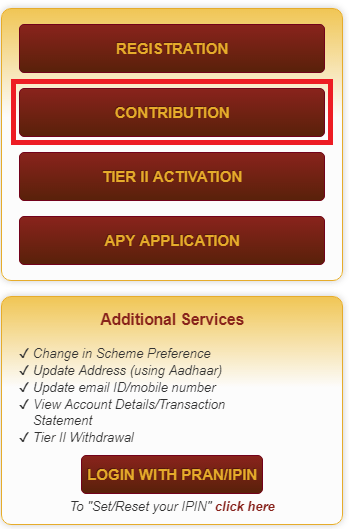

How To Contribute To NPS

https://i.ytimg.com/vi/SWBteGhI1UA/maxresdefault.jpg

Software Guys Contribute NPS Through Your Employer NPS Great Tool For

https://i.ytimg.com/vi/BiNWmCINZgQ/maxresdefault.jpg

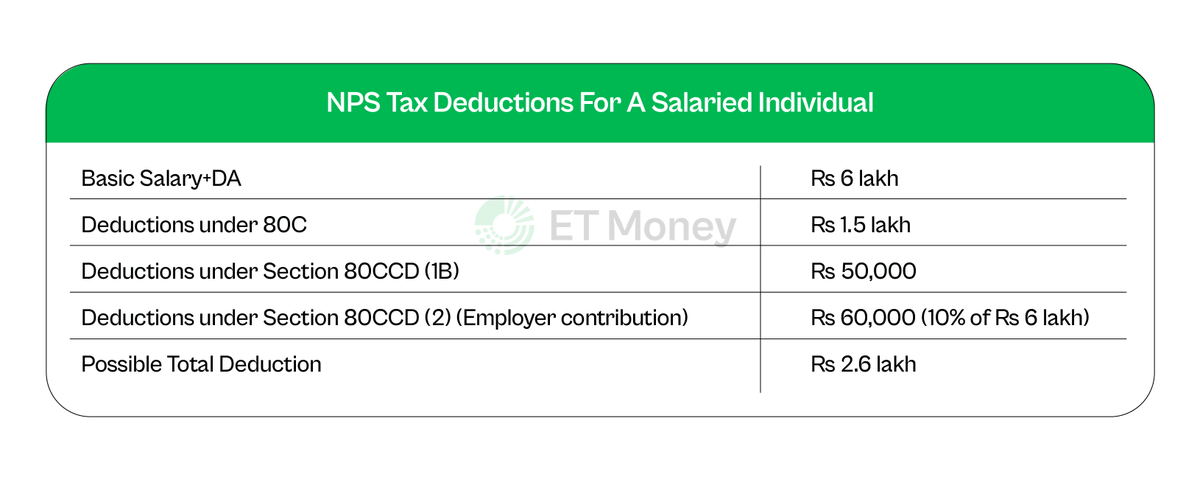

Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such For instance an employer may contribute 8 of the employee s basic salary to NPS regardless of whether the employee contributes to the scheme However

Now if you are a salaried employee and your cost to company structure is such that your employer contributes to your NPS you will qualify for a deduction of up to Tax Benefits under Section 80CCD 2 Contributions by the employer to NPS can also be claimed by salaried individuals under this NPS deduction section For government employees the cap is at 14

Download Does Private Employer Contribute To Nps

More picture related to Does Private Employer Contribute To Nps

Any Idea Why Deloitte USI Doesnt Contribute To NPS Fishbowl

https://files.getfishbowl.com/content_preview_images/any-idea-why-deloitte-usi-doesnt-contribute-to-nps-via-employer-contribution-saves-a-lot-of-tax.png

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh

https://certicom.in/wp-content/uploads/2020/09/Employee-Provident-Fund.png

Understanding Employer Contribution To Your NPS Account National

https://d3qp3qpnapuz4v.cloudfront.net/wp-content/uploads/2023/09/07175500/pexels-rdne-stock-project-7580751-1024x683.jpg

Employer s Contribution Tax benefits can also be claimed if the contribution has been made by the employer into your NPS account This tax exemption is available up to 10 of the basic Budget 2022 proposes to bring parity between the employees of central and state governments in terms of employer contribution towards NPS NPS income tax

Employer s Contribution Limit Employers can contribute up to 10 of the employee s basic salary and dearness allowance DA Maximum Limit The maximum allowable The Corporate NPS model aims to enable companies private sector public sector PSUs etc to incorporate NPS into their organisation and extend NPS benefits to

The Ultimate Guide For Managing Employee Provident Fund

https://media.licdn.com/dms/image/D4D12AQErlihog7WpIw/article-cover_image-shrink_600_2000/0/1667024546047?e=2147483647&v=beta&t=oTjyQmK2eoiFZcBzUfwMQCJmLDGlSYNOq-MozVRt92A

Solved Below Are Several Transactions For A Company For Year Chegg

https://media.cheggcdn.com/media/a27/a27900cf-02b3-490a-94a7-c1bf344c8e6d/php5kNR81

https://www.etmoney.com/learn/nps/nps-cont…

All Indian citizens including NRIs who are above 18 years of age can make NPS contributions Also employers can make contributions to NPS accounts of their employees Private sector

https://www.personalfinanceplan.in/invest-nps...

If your employer offers NPS and you have no choice but enroll for it there is little you can do For instance if you are a public

A Study On Employee Perceptions On Employee Provident Fund In Amara

The Ultimate Guide For Managing Employee Provident Fund

How To Make Online Contributions To NPS Tier I And Tier II Accounts

Employer Contribution May Be Tax Free Under National Pension Scheme

Does Anyone Contribute To NPS Through HCL Like E Fishbowl

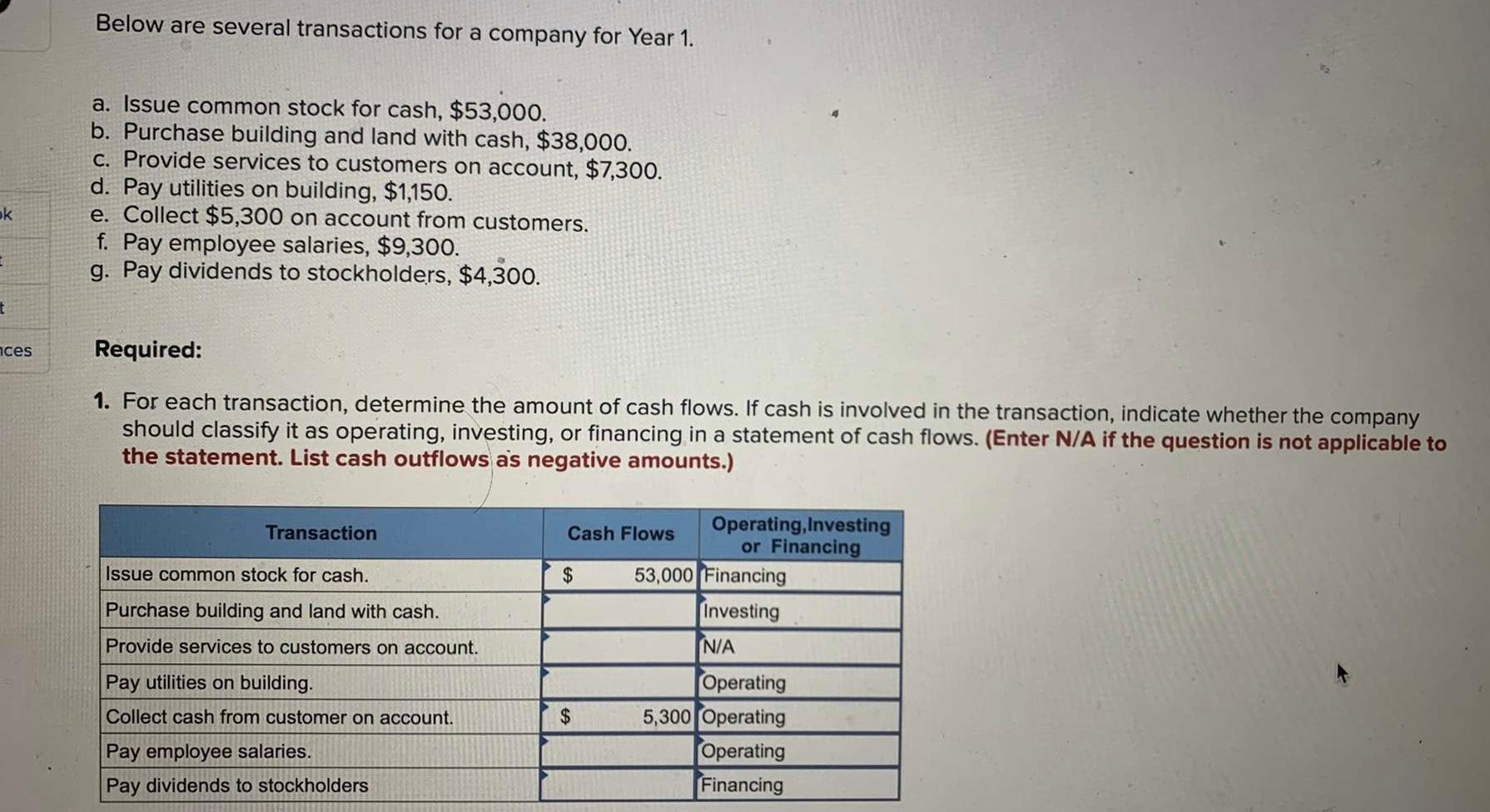

Enhancement Of Employer s Contribution From 10 To 14 In Central

Enhancement Of Employer s Contribution From 10 To 14 In Central

Invest Rs 50 000 Annually In NPS And You Can Create A Retirement

Employer Brand Monitoring ReviewTrackers

How To Invest In NPS Account Online Personal Finance Plan

Does Private Employer Contribute To Nps - Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such