Does Propane Qualify For Fuel Tax Credit Fueling equipment for natural gas propane liquefied hydrogen electricity E85 or diesel fuel blends containing a minimum of 20 biodiesel installed through December 31

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits This credit provides a 37 cents per gallon excise tax credit on the sale of propane when consumers use it in a motor vehicle or forklift In the near future NPGA

Does Propane Qualify For Fuel Tax Credit

Does Propane Qualify For Fuel Tax Credit

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEijO1qAMs_napos3v0ETHe96cx_283MPXVZQXocehgFGkIZ6xTYr0RfHfLiwzClgt1pNmbyCoGSW95DXvx_9PPk5WwQI6RomoDtBDcEFIVgflW04uIRTkMDrLhIZsWQ-upuVniwQQasrHnIe-nOvNw5SD0rXmfOFwsR1N0ob2tG3q6cavZuiSNBND-j/s762/ftc.jpg

Accountancy Group Fuel Tax Credit Changes Accountancy Group

https://www.accountancygroup.com.au/wp-content/uploads/fuel-tax.jpg

Fuel Tax Credit Extended For Propane Autogas Vehicles Link2Pump

https://www.link2pump.com/wp-content/uploads/2023/09/FuelTaxCreditExtendedForPropaneAutogasVehicles.jpg

The amount of the credit is 0 50 per gasoline gallon equivalent of propane which equates to approximately 0 37 per gallon of propane Learn more with this tax credit fact sheet On Sept 13 pursuant to the Inflation Reduction Act of 2022 IRA the IRS published Notice 2022 39 which provides rules that claimants must follow to make one time claims for alternative fuel tax

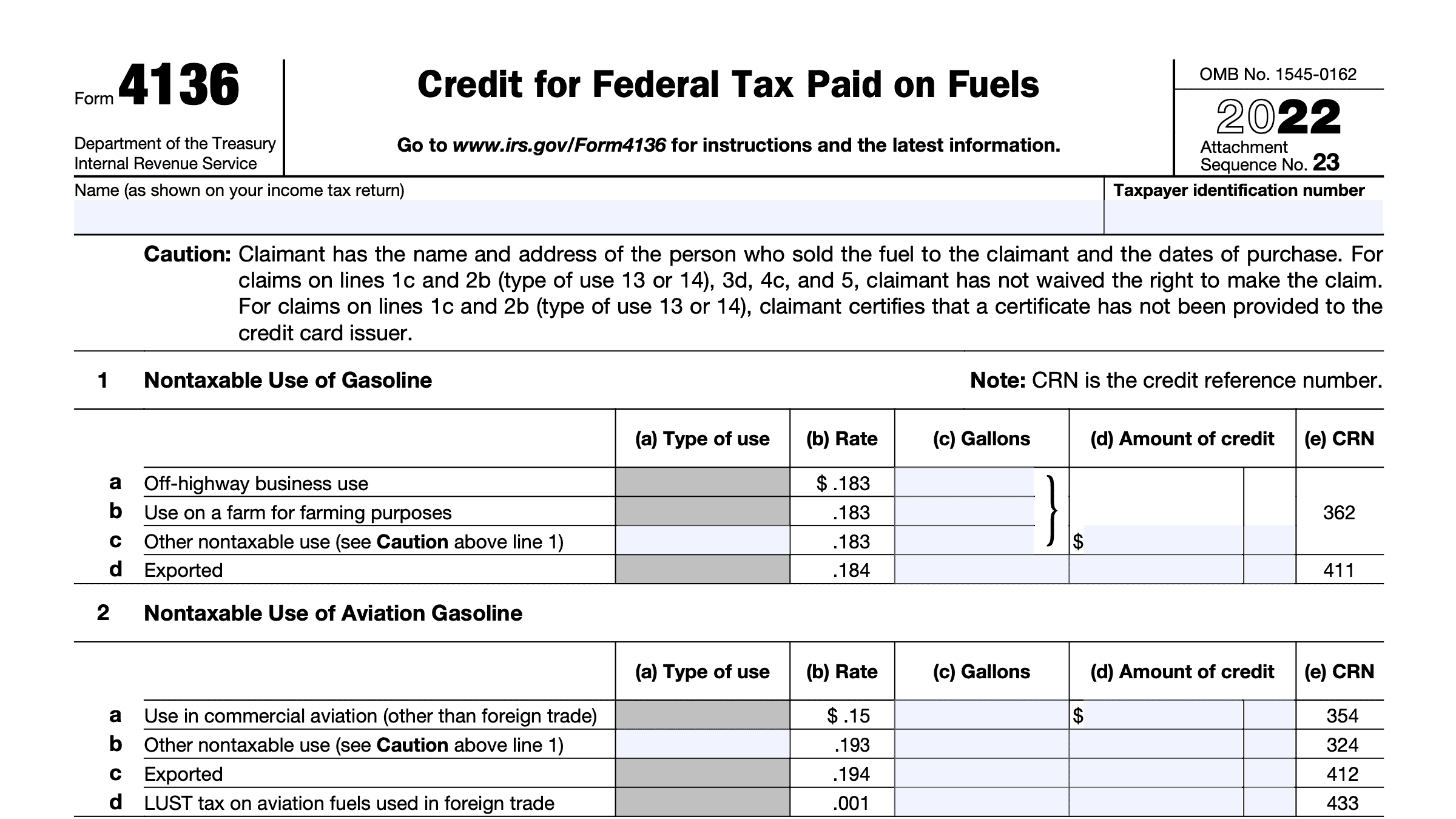

In general only the ultimate user of a fuel is eligible for a credit for untaxed use In other words if you weren t the one who burned the fuel then you usually can t claim the Attach Form 4136 to your tax return Instead of waiting to claim an annual credit on Form 4136 you may be able to file Form 8849 Claim for Refund of Excise Taxes to claim a

Download Does Propane Qualify For Fuel Tax Credit

More picture related to Does Propane Qualify For Fuel Tax Credit

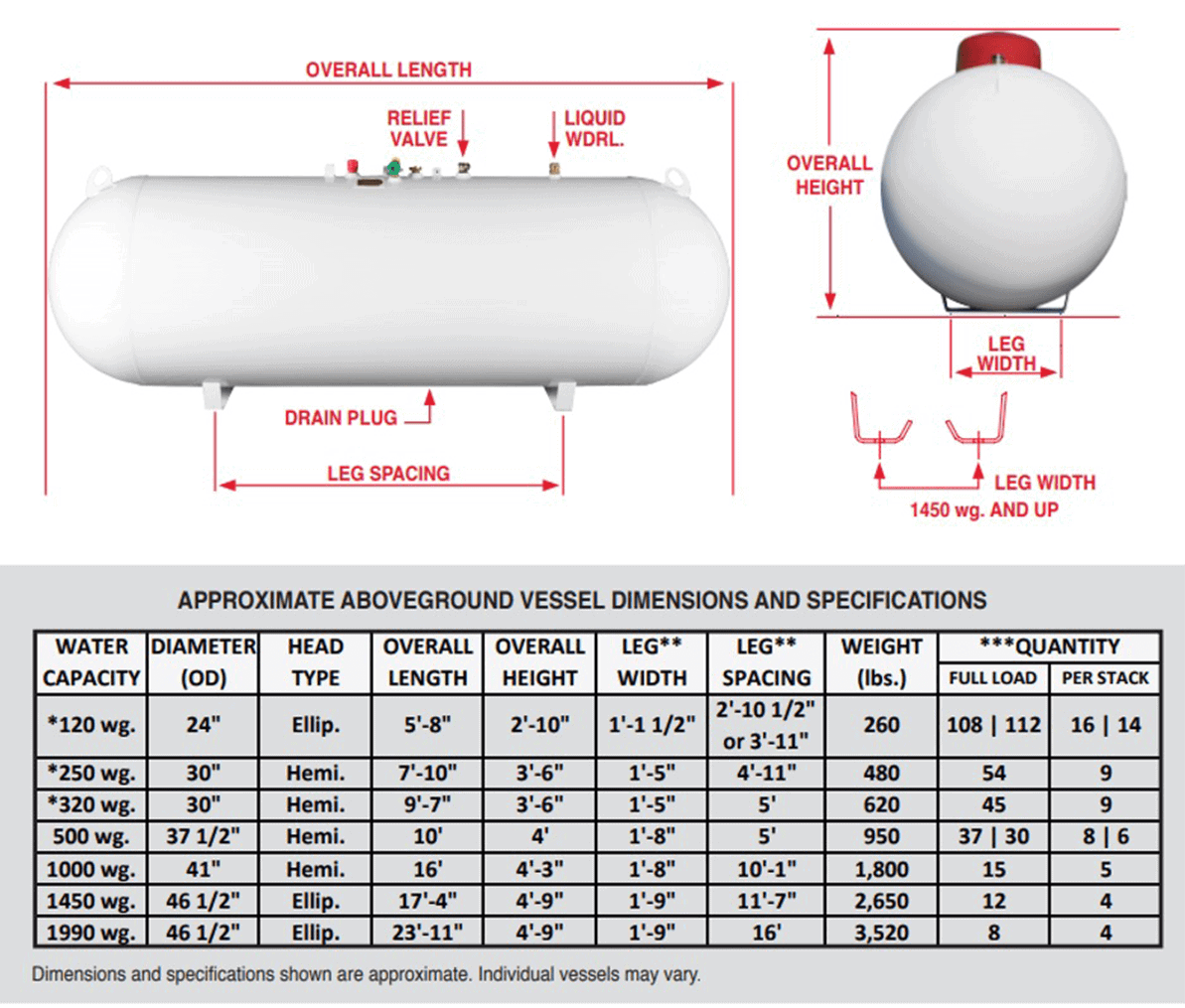

Horizontal Propane Tank Size Chart

https://qualitysteelcorporation.com/wp-content/uploads/2020/09/product_chart_image.png

Alternative Fuel Tax Credit Retroactively Extended For Propane Autogas

https://stnonline.com/wp-content/uploads/2022/09/thumbnail_PropaneRefueling-1024x682.jpg

Fuel Tax Credit Calculator Banlaw

https://www.banlaw.com/wp-content/uploads/2022/04/[email protected]

The alternative fuel credit is claimed by companies that sell or use alternative fuel in a motor vehicle or motorboat Alternative fuel includes propane A 0 50 per gallon credit is available for natural gas liquefied hydrogen propane P Series fuel liquid fuel derived from coal through the Fischer Tropsch

A tax credit in the amount of 0 50 per gallon is available for the following alternative fuels natural gas liquefied hydrogen propane P Series fuel liquid fuel derived from coal When using a fuel for a different purpose a taxpayer is likely to be exempt from the fuel excise tax As discussed below while a taxpayer may use fuel for a nontaxable use

NPGA Update Alternative Fuel Tax Credit Reinstated Retroactive

https://bpnews.com/sites/default/files/images/Alt-Fuels-Corridor-Sign.jpg

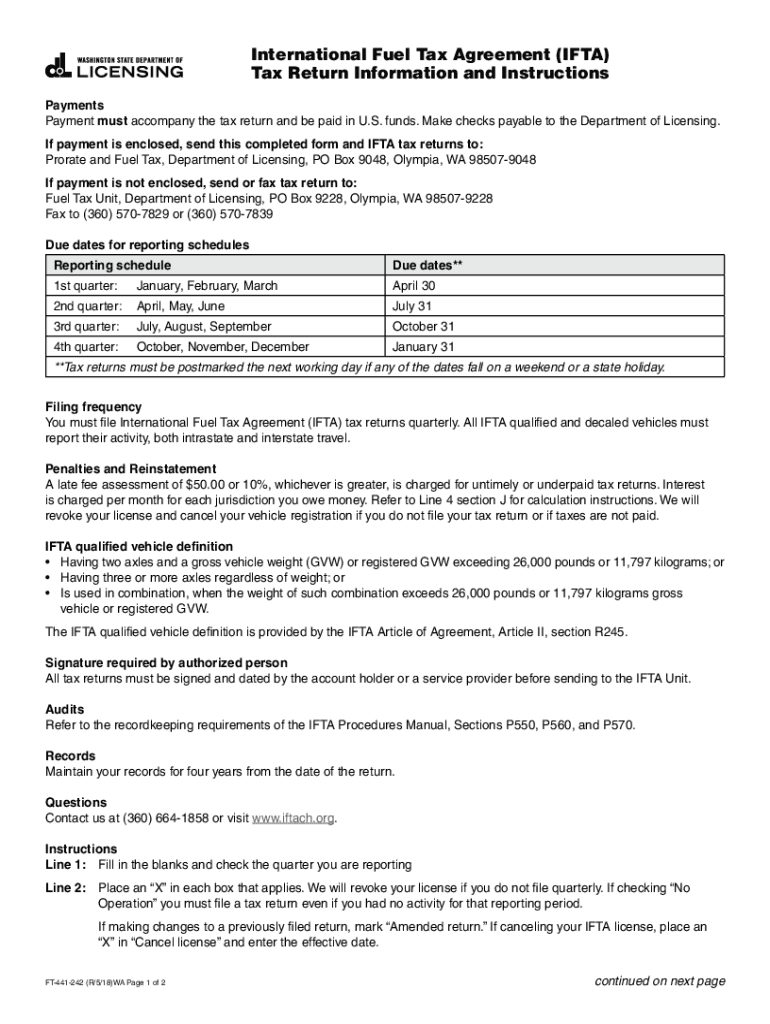

International Fuel Tax Agreement IFTA Tax Return Information And

https://www.signnow.com/preview/549/386/549386760/large.png

https://afdc.energy.gov/fuels/laws/LPG?state=US

Fueling equipment for natural gas propane liquefied hydrogen electricity E85 or diesel fuel blends containing a minimum of 20 biodiesel installed through December 31

https://www.irs.gov/.../fuel-tax-credits

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits

Opinion Before We Invest Billions In This Clean Fuel Let s Make Sure

NPGA Update Alternative Fuel Tax Credit Reinstated Retroactive

30 Federal Tax Credits For Heat Pump Water Heaters 2023

IRS Form 4136 A Guide To Federal Taxes Paid On Fuels

The End Of Fuel Excise Cuts And What This Means For Fuel Tax Credits

Cars That Qualify For Ev Tax Credit 2024 Denyse Gerianne

Cars That Qualify For Ev Tax Credit 2024 Denyse Gerianne

.png#keepProtocol)

Fuel Tax Credits New Credit Rates Update February 2023

Ag Gets Guidance On Sustainable Aviation Fuel High Plains Journal

P E I Government Ending Rebates For High efficiency Oil Furnaces

Does Propane Qualify For Fuel Tax Credit - Businesses and individuals are eligible for an income tax credit of up to 50 of the equipment and labor costs for converting vehicles to operate using alternative