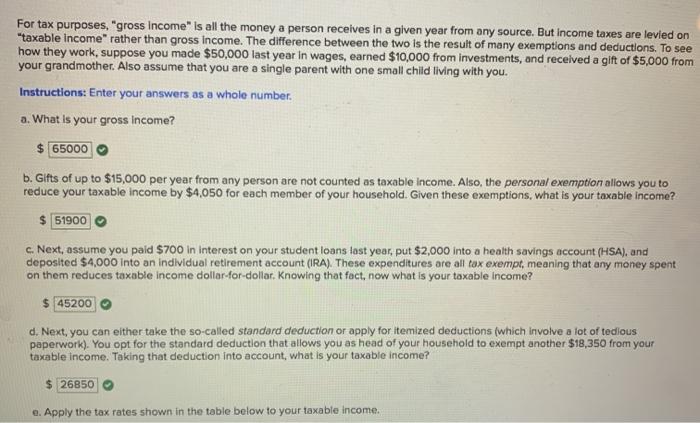

Does Standard Deduction Lower Your Taxable Income The standard deduction is a flat amount that reduces your taxable income and potentially your tax bill The amount set by the IRS could vary by tax year and filing status generally single married filing jointly married

Tax deductions are subtracted from your taxable income thereby lowering the amount of tax you owe You can choose the standard deduction or itemize your deductions on Schedule A of Form 1040 or A deduction reduces the amount of a taxpayer s income that s subject to tax generally reducing the amount of tax the individual may have to pay Most taxpayers now qualify for the standard deduction but there are some important details involving itemized deductions that people should keep in mind

Does Standard Deduction Lower Your Taxable Income

Does Standard Deduction Lower Your Taxable Income

https://dollarkeg.com/wp-content/uploads/2023/01/how-to-calculate-taxes-with-standard-deduction.png

7 Deductions That Lower Your Taxable Income CBS News

https://assets2.cbsnewsstatic.com/hub/i/r/2012/12/13/4a35bbb4-a645-11e2-a3f0-029118418759/thumbnail/1200x630/619dae63c02848d69536bdd76f6762b7/1040_return.jpg

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

https://www.investopedia.com/thmb/JjB8KxvTErLB2ZgozO3H_wkKoNA=/2338x2338/smart/filters:no_upscale()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg

The standard deduction is a specific dollar amount that reduces the amount of income on which you re taxed Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and or blindness Here s what that means If you earned 75 000 in 2023 and file as a single taxpayer taking the standard deduction of 13 850 will reduce your taxable income to 61 150 Standard Deduction

The standard deduction reduces your taxable income to help lower your federal tax bill The IRS updates the standard deduction amount each tax year to account for Tax deductions decrease your tax burden by lowering your taxable income and you can either claim the standard deduction or itemize your deductions when you file

Download Does Standard Deduction Lower Your Taxable Income

More picture related to Does Standard Deduction Lower Your Taxable Income

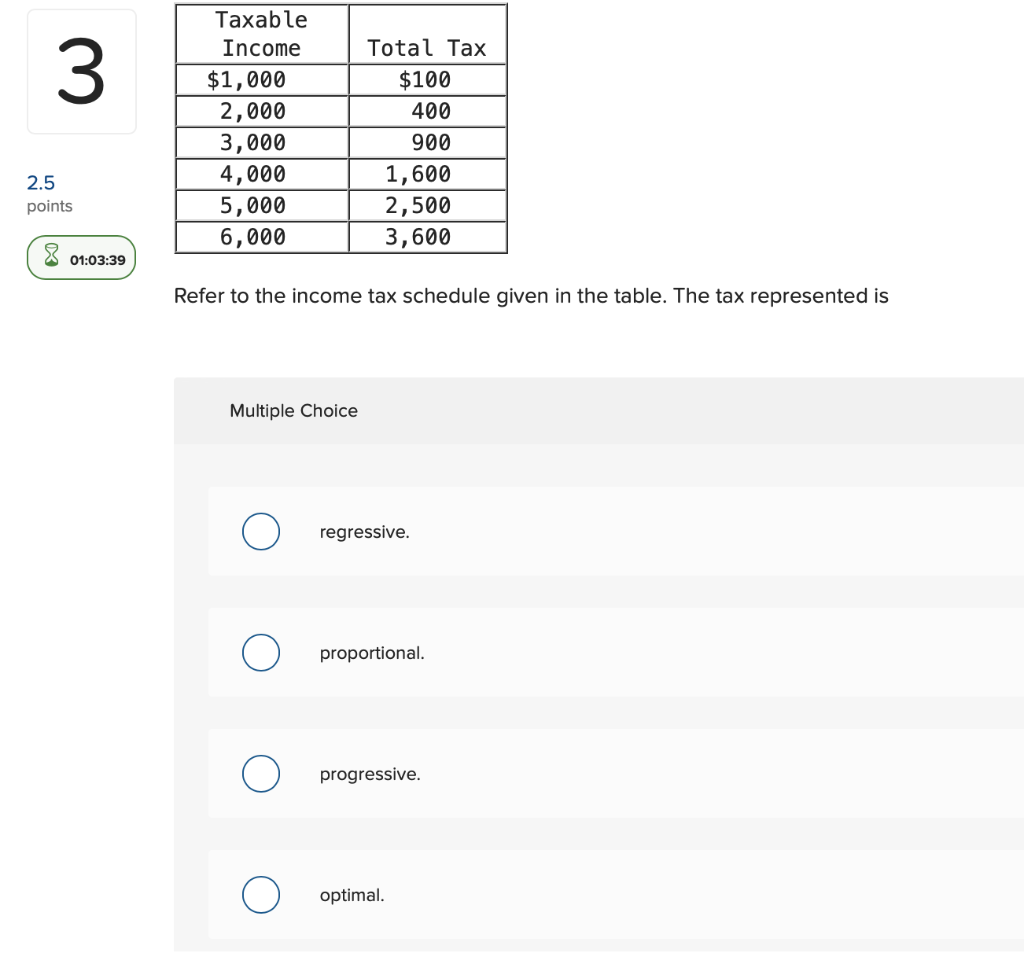

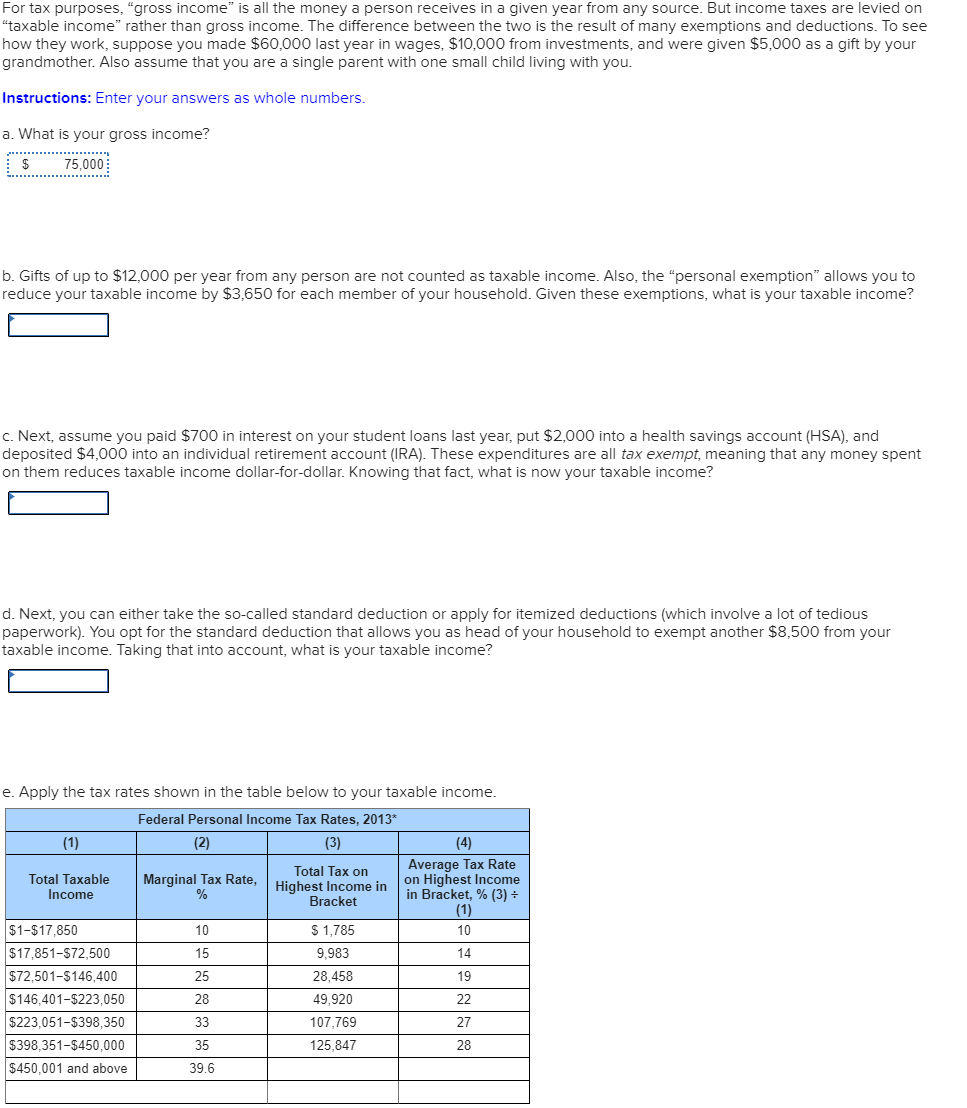

Solved E Apply The Tax Rates Shown In The Table Below To Chegg

https://media.cheggcdn.com/study/ff0/ff01d6ed-b06c-472c-9507-0ae6a6d4109a/image

5 Deductions That Will Greatly Increase Your Tax Refund Tax Refund

https://i.pinimg.com/originals/e6/97/88/e697885c772ebc04e72ebb01c99fd6ae.jpg

Income Tax Deadlines Are Normalizing But Not All Deductions Are

https://cdn-res.keymedia.com/cms/images/ca/155/0394_637792028600257200.jpg

What is the standard deduction Taxpayers use tax deductions to reduce their taxable income also called adjusted gross income or AGI Every dollar of a tax deduction reduces your taxable income by a dollar How does this look with the standard deduction Say you re a single taxpayer who makes 65 000 per year The IRS offers two major options for lowering your taxable income the standard deduction and itemized deductions Most taxpayers opt for the standard deduction simply because it s

The standard deduction can lower your taxable income by a set amount resulting in a lower tax bill The deduction is designed for simplicity so you can typically claim it The standard deduction reduces a taxpayer s taxable income It ensures that only households with income above certain thresholds will owe any income tax Taxpayers can claim a standard deduction when filing their tax returns thereby reducing their taxable income and the taxes they owe

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

https://images.squarespace-cdn.com/content/v1/5a60cb144c0dbf811647fce8/80259db2-916f-487a-833e-88aead19febd/2022-standard-deduction+copy.jpg

How To Reduce Your Tax Liabilities Expat US Tax

https://www.expatustax.com/wp-content/uploads/2022/05/Reduce-Tax-Liabilities-US-Expat.jpg

https://www.fidelity.com/.../standard-deduction

The standard deduction is a flat amount that reduces your taxable income and potentially your tax bill The amount set by the IRS could vary by tax year and filing status generally single married filing jointly married

https://www.investopedia.com/terms/t/tax-deduction.asp

Tax deductions are subtracted from your taxable income thereby lowering the amount of tax you owe You can choose the standard deduction or itemize your deductions on Schedule A of Form 1040 or

Solved 3 Taxable Income 1 000 2 000 3 000 4 000 5 000 6 000 Chegg

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

Itemized Vs Standard Tax Deductions Pros And Cons 2024

What Is Lower Tax Deduction Certificate

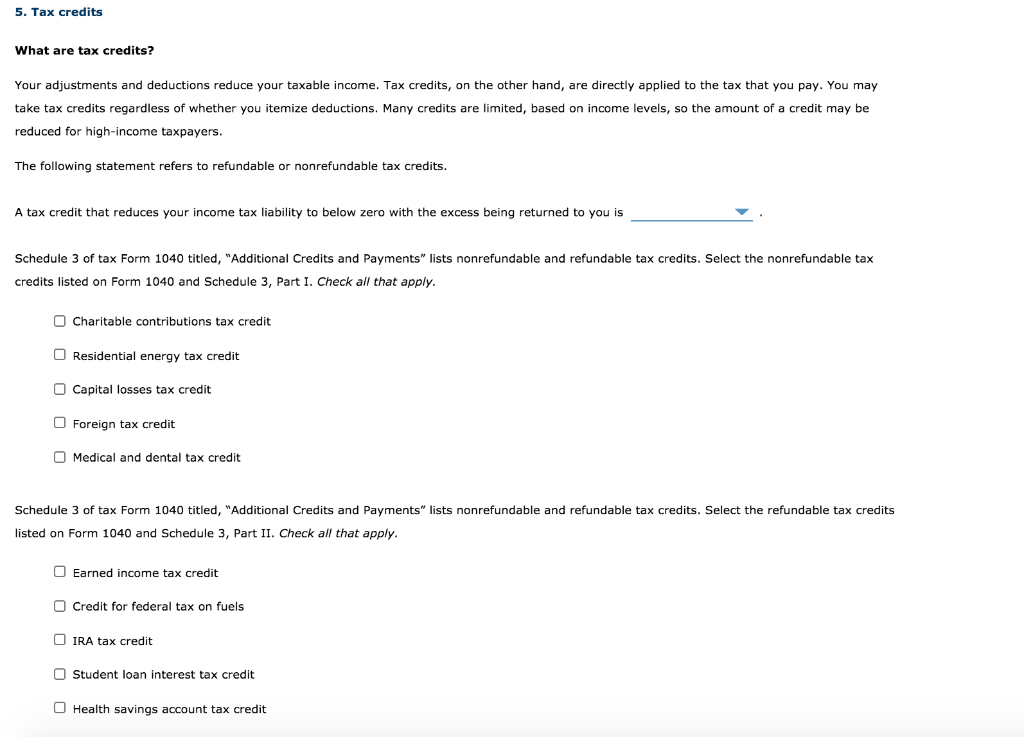

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

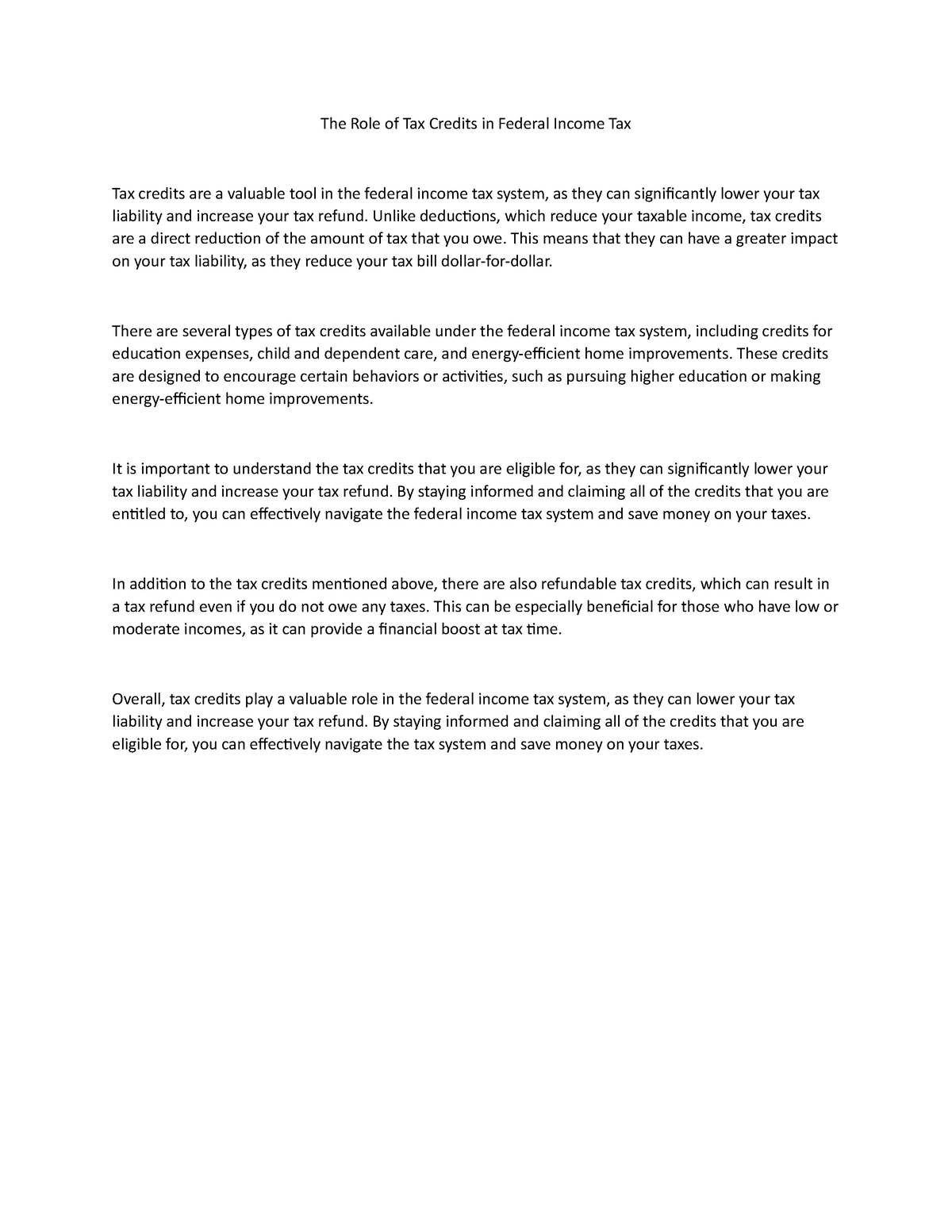

The Role Of Tax Credits In Federal Income Tax Unlike Deductions

The Role Of Tax Credits In Federal Income Tax Unlike Deductions

Investment Expenses What s Tax Deductible Charles Schwab

For Tax Purposes gross Income Is All The Money A Chegg

Foreign Tax Credit Carryover Worksheet

Does Standard Deduction Lower Your Taxable Income - The standard deduction is the government s built in subtraction that you can take while preparing your taxes Taxpayers other option is to itemize deductions Itemizing is composed