Does Subscriptions Have Gst Verkko 118 rivi 228 nbsp 0183 32 8 syysk 2020 nbsp 0183 32 Hands up if you never know whether an overseas

Verkko 24 marrask 2021 nbsp 0183 32 Is there GST on overseas software subscriptions It can be very confusing for us and we do this all day everyday so if you are not getting those Verkko If your store is based in Australia then Australian goods and services tax GST applies to your Shopify subscription and any Shopify Shipping labels at a rate of 10 However

Does Subscriptions Have Gst

Does Subscriptions Have Gst

https://translationgst.com/wp-content/uploads/2022/08/gst-logo.png

The GST Compensation Cess Issue All You Need To Know Marketfeed news

https://149494764.v2.pressablecdn.com/wp-content/uploads/2020/10/gstblog2.jpg

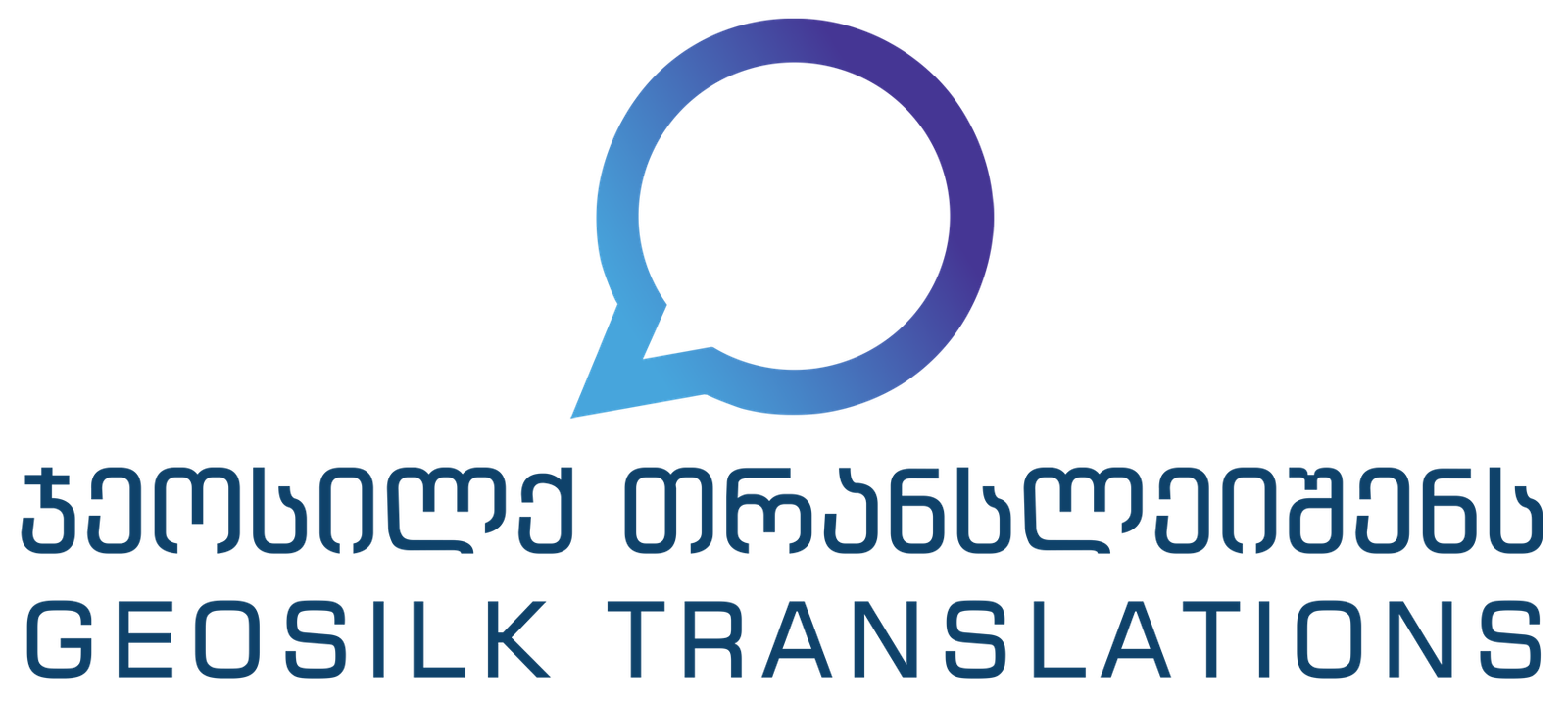

10 Days GST Return Service Accounts Details Rs 1000 month RCS GST

https://5.imimg.com/data5/SELLER/Default/2022/11/PD/QI/GO/31985580/gst-return-service-1000x1000.jpg

Verkko Charge and collect the GST HST on cross border digital products and services such as e books mobile apps or online services Verkko 18 jouluk 2023 nbsp 0183 32 The goods and services tax GST is a value added tax VAT levied on most goods and services sold for domestic consumption The GST is paid by consumers but it is remitted to the government by

Verkko GST registered businesses don t have to pay GST on services or subscriptions from overseas suppliers GST on exports You don t have to charge GST on exports so long as the goods leave Australia within Verkko Toll Free US amp Canada 1 888 732 6134 International 1 905 963 8780 UK 0203 966 7794

Download Does Subscriptions Have Gst

More picture related to Does Subscriptions Have Gst

How Does In context Learning Work A Framework For Understanding The

https://ai.stanford.edu/blog/assets/img/posts/2022-08-01-understanding-incontext/images/image11.gif

GST Report Corppedia

https://corppedia.in/wp-content/uploads/2022/01/GST-Report.png

Special Audit Under GST Regime

https://studycafe.in/wp-content/uploads/2017/09/special-audit-under-gst-regime.jpg

Verkko The GST is 5 for all Canadian subscribers and will be added to your subscription costs beginning August 19th 2021 Monthly subscriber 9 99 5 10 49 Annual Verkko GST HST Find out about the GST HST and e commerce if you need to register for a GST HST account typical electronic supplies and which GST HST rate you have to

Verkko GST registered businesses don t have to pay GST on services or subscriptions from overseas suppliers GST on exports You don t have to charge GST on exports which Verkko 17 maalisk 2022 nbsp 0183 32 GST Invoice for Microsoft Subscription Hello I purchased a MS Office subscription recently How do I get a GST Invoice that includes GST credentials of

Singapore Company GST Registration Procedure Importance And

https://www.wzwu.com.sg/wp-content/uploads/2021/11/gst-registration-min.jpg

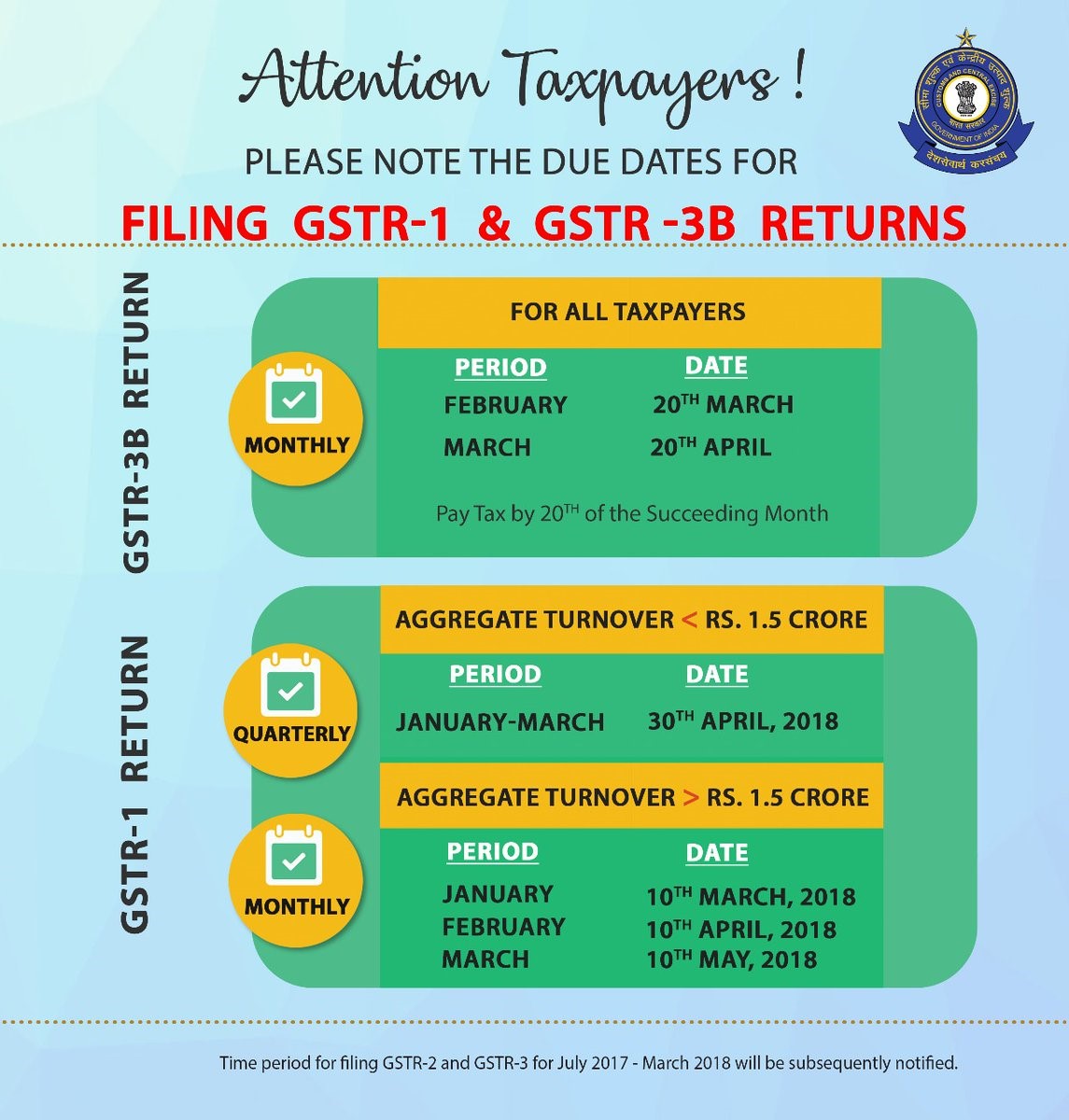

What Is GST How It Has Been Treating India Read More Here app

https://okcredit-blog-images-prod.storage.googleapis.com/2020/09/GST-1-1.jpg

https://www.alluviafinancial.com/blog/gst-on-overseas-subscriptions

Verkko 118 rivi 228 nbsp 0183 32 8 syysk 2020 nbsp 0183 32 Hands up if you never know whether an overseas

https://www.tradiesbookkeeping.com/post/is-there-gst-on-overseas...

Verkko 24 marrask 2021 nbsp 0183 32 Is there GST on overseas software subscriptions It can be very confusing for us and we do this all day everyday so if you are not getting those

GST A Done Deal

Singapore Company GST Registration Procedure Importance And

Why Should I Assign Subscriptions

Indirect Tax Reforms A Job Half Done GST Underperforms For Its Faulty

GST Compliant Subscription Management Software Zoho Subscriptions

GST Payment Dates In Canada In 2023 Dutton Employment Law

GST Payment Dates In Canada In 2023 Dutton Employment Law

Certificate Course On GST Return Filing

GSTNagar GST LATEST

GST India GST HSN Code Tax Rate APK For Android Download

Does Subscriptions Have Gst - Verkko GST registered businesses don t have to pay GST on services or subscriptions from overseas suppliers GST on exports You don t have to charge GST on exports so long as the goods leave Australia within