Does Tennessee Have Property Tax Exemptions Property tax exemptions are addressed in the Tennessee Code in Title 67 Chapter 5 The code defines the types of property that may qualify for tax exemption and establishes the requirements for obtaining exemption

Tennessee state law provides for property tax relief for low income elderly and disabled homeowners and as well as disabled veteran homeowners or their surviving spouses Tennessee s property tax relief program and property tax freeze offer financial assistance to eligible homeowners struggling with property tax burdens The state funds this program and successful applicants receive reimbursement to offset tax costs

Does Tennessee Have Property Tax Exemptions

Does Tennessee Have Property Tax Exemptions

https://assets.site-static.com/userFiles/1724/image/tennesseetaxationguide.png

Tennessee Property Tax Exemptions What Are They

https://cdn.carrot.com/uploads/sites/11901/2023/01/Tennessee-Property-Tax-Exemptions-What-Are-They.jpg

Tennessee Property Tax Exemptions What Are They

https://cdn.carrot.com/uploads/sites/11901/2023/01/Tennessee-Property-Tax-Exemptions-What-Are-They.-How-To-Find-Out-If-Youre-Exempt-from-Property-Taxes.jpg

There are several exemptions available to homeowners in Tennessee The most common exemptions are for veterans disabled persons and the elderly However there is a homestead exemption as well In order to qualify for an exemption you must file an application with your local county Contact your county trustee to apply Property tax relief is a payment made by the State of Tennessee to reimburse homeowners who qualify for the program To receive reimbursement you must pay all property taxes listed on your tax bill each year even if you qualify for relief

In Tennessee these real property tax exemptions are granted and overseen by the Tennessee State Board of Equalization The State of Tennessee passed legislation that permits counties to freeze property tax amounts for homeowners who are 65 or older on or before December 31 2024 and the combined 2023 annual income for you your spouse and all other owners of the property cannot exceed the income limit 60 000

Download Does Tennessee Have Property Tax Exemptions

More picture related to Does Tennessee Have Property Tax Exemptions

Florida Tax Exemptions 25 000 For Permanent Residents FGI Realty

https://fgirealty.com/wp-content/uploads/2021/12/Articulo-004.jpg

Tennessee Sales Tax Exemptions Agile Consulting Group

https://irp.cdn-website.com/9f73e11c/dms3rep/multi/tennessee-sales-tax-exemptions.jpeg

About Your Property Tax Statement Anoka County MN Official Website

https://anokacountymn.gov/ImageRepository/Document?documentID=21308

The Shelby County Trustee administers a state funded Tax Relief Program to help taxpayers 65 or older disabled citizens and veterans pay their property taxes In Tennessee there are some tax relief programs for seniors but a lot of people don t qualify Your income including spouse and all owners of the property can not exceed 33 460

Tennessee has the lowest homestead exemption of the states that do not allow the use of the federal homestead exemption and has the third lowest combined dollar value of all property exemptions after Missouri and Alabama Property tax exemptions are addressed in the Tennessee Code in Title 67 Chapter 5 The code defines the types of property that may qualify for tax exemption and establishes the requirements for obtaining exemption

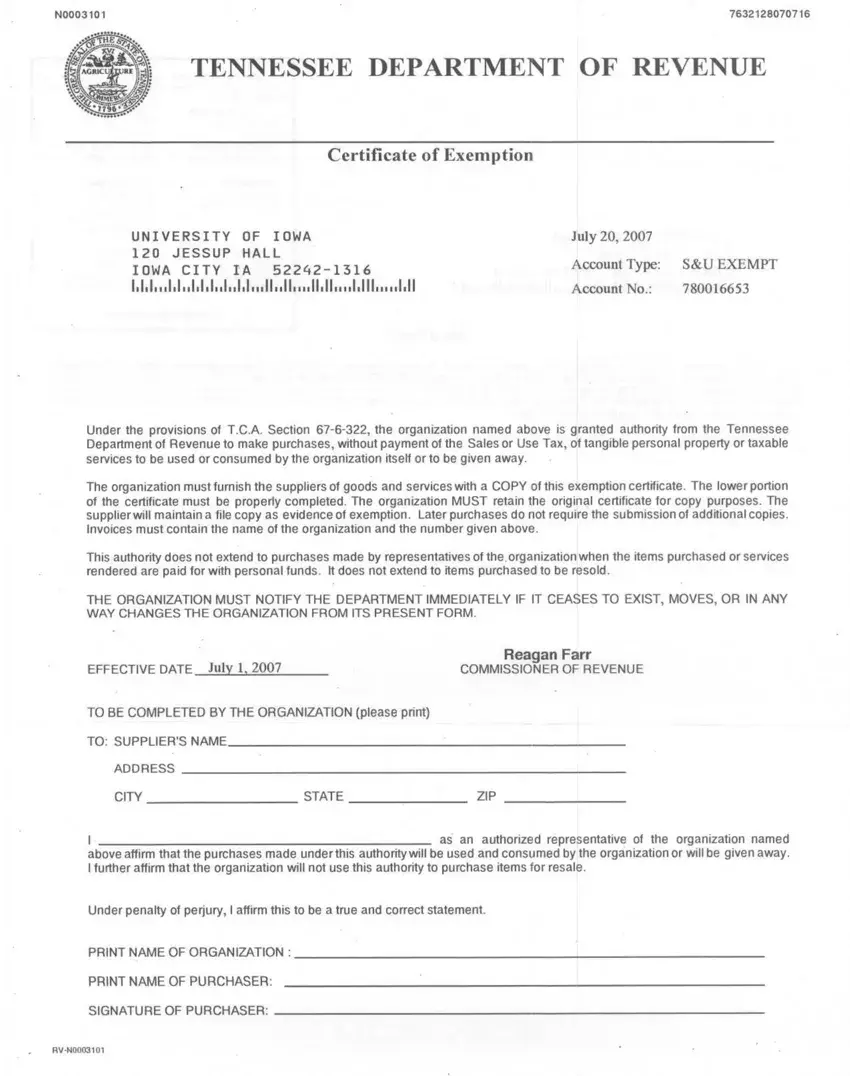

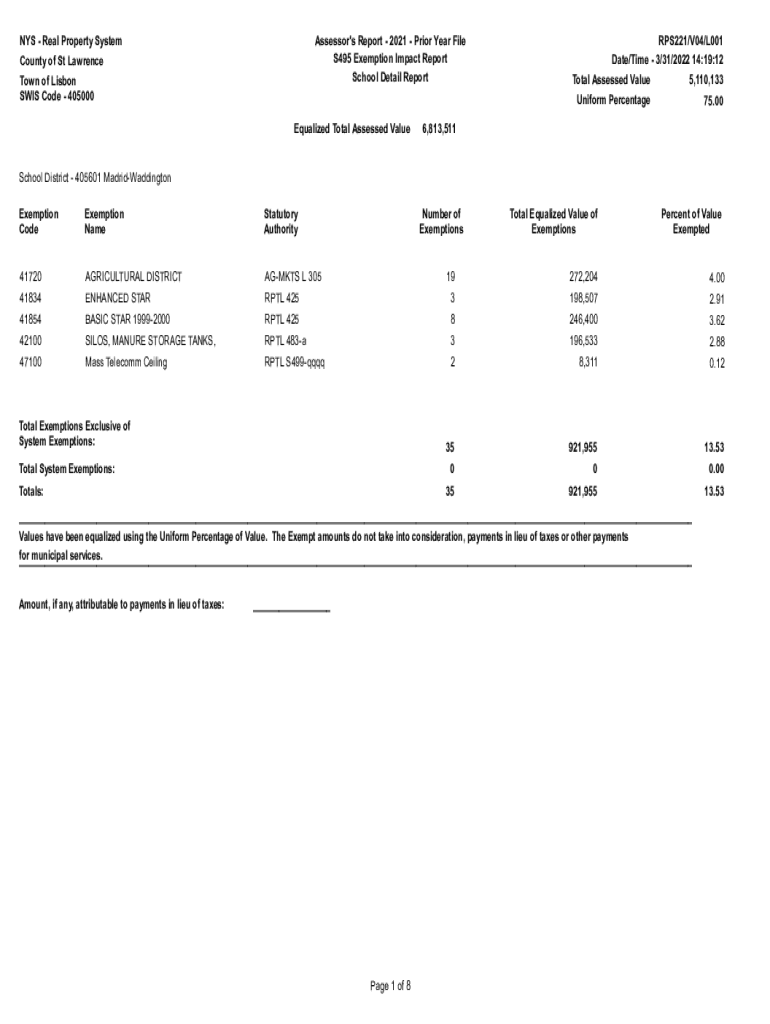

Tennessee Exemption Certificate PDF Form FormsPal

https://formspal.com/pdf-forms/other/tennessee-exemption-certificate/tennessee-exemption-certificate-preview.webp

Property Assessment Division

https://svc.mt.gov/dor/property/Content/images/backgrounds/bg_8.jpg

https://comptroller.tn.gov/boards/state-board-of...

Property tax exemptions are addressed in the Tennessee Code in Title 67 Chapter 5 The code defines the types of property that may qualify for tax exemption and establishes the requirements for obtaining exemption

https://comptroller.tn.gov/office-functions/pa/...

Tennessee state law provides for property tax relief for low income elderly and disabled homeowners and as well as disabled veteran homeowners or their surviving spouses

Committee Hears Motion To End Tax Exemptions For Religious Groups In

Tennessee Exemption Certificate PDF Form FormsPal

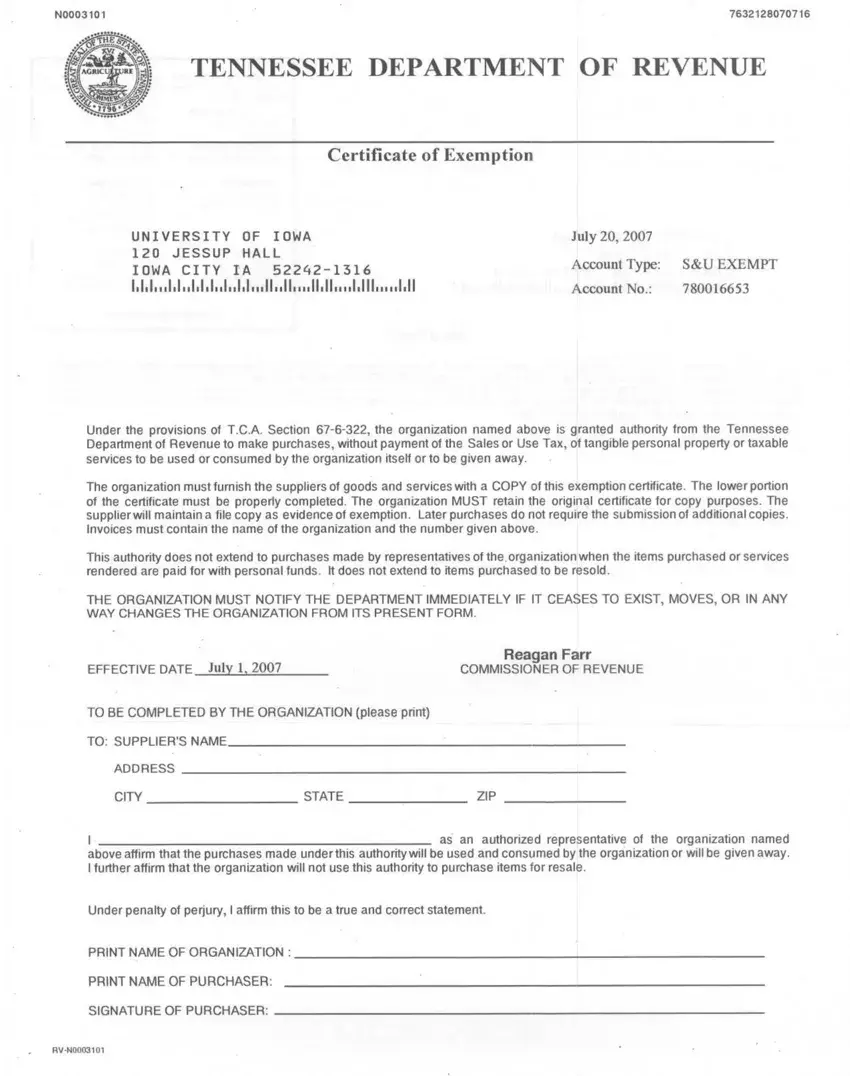

Property Tax By State From Lowest To Highest Rocket Homes

Four Property Tax Exemptions To Eliminate Or Reduce Your Bill Are You

Happy Belated Tax Freedom Day 2012 Freedom Day Worlds Of Fun Freedom

Blanket Certificate Of Exemption Form Fill Online Printable

Blanket Certificate Of Exemption Form Fill Online Printable

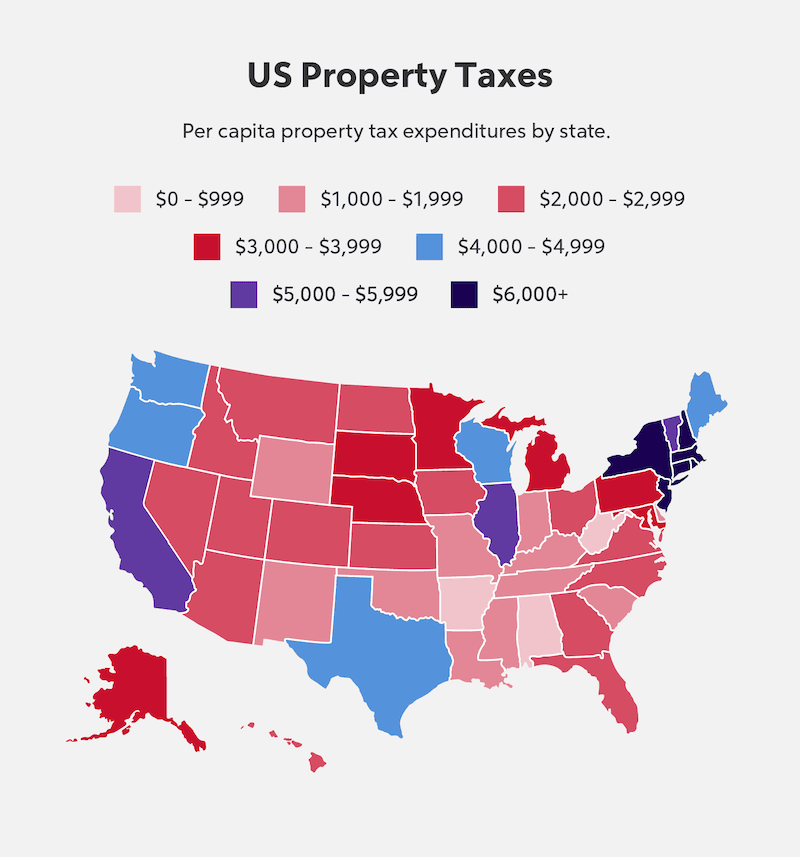

PropertyTax Exemptions In Jamestown At 37 Percent Higher Than 30

Fillable Online Property Tax Exemptions Government Of New York Fax

Qualifying Trusts For Property Tax Homestead Exemption Sprouse

Does Tennessee Have Property Tax Exemptions - There are several exemptions available to homeowners in Tennessee The most common exemptions are for veterans disabled persons and the elderly However there is a homestead exemption as well In order to qualify for an exemption you must file an application with your local county Contact your county trustee to apply