Does Texas Charge Sales Tax On Vehicles There is a 6 25 sales tax on the sale of vehicles in Texas However there may be an extra local or county sales tax added onto the base 6 25 state tax Local tax rates range from 0 to 2 with an

Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas A motor vehicle sale includes installment and credit sales and exchanges for property services Sales tax According to the Texas Department of Motor Vehicles any person that buys a car in Texas owes the government a motor vehicle sales tax The sales tax for cars in Texas is 6 25 of

Does Texas Charge Sales Tax On Vehicles

Does Texas Charge Sales Tax On Vehicles

https://hips.hearstapps.com/hmg-prod/images/new-cars-in-a-row-at-dealership-royalty-free-image-1584904680.jpg

Car Rental Tax And Fees In The US Hertz Resources

https://www.hertz.com/content/dam/hertz/global/blog-articles/resources/tax-when-renting-a-car.jpg

Should You Charge Sales Tax On Rental Equipment Quipli

https://quipli.com/wp-content/uploads/2022/01/sales-tax-on-rentals.jpg

The cost can vary by dealership and by vehicle Tax title and license fee on a new car in Texas that costs 25 000 would be around 1 700 This fee includes Sales Texas collects a 6 25 state sales tax rate on the purchase of all vehicles Some dealerships may charge a documentary fee of 125 dollars In addition to taxes car

Texas has a statewide sales tax of 6 25 that applies to all car sales The average tax on car sales including local and county taxes in Texas is 7 928 A motor vehicle purchased in Texas to be leased is subject to motor vehicle sales tax The lessor is responsible for the tax and it is paid when the vehicle is registered at the

Download Does Texas Charge Sales Tax On Vehicles

More picture related to Does Texas Charge Sales Tax On Vehicles

How To Charge Sales Tax In The US A Simple Guide For 2023 Business

https://i.pinimg.com/originals/34/5c/61/345c61204e4acc33022a9be1d9d8dce6.jpg

Sales Tax Basics For Interior Designers Capella Kincheloe

https://images.squarespace-cdn.com/content/v1/58406b84b3db2b7f14465fb8/1494268422868-5B16T0ZTDMV7TRE9N0ZN/sales-tax-basics-for-interior-designers-capella-kincheloe.png

Do I Have To Pay Sales Tax On A Car That Was Gifted Nj

https://www.nj.com/resizer/QmHEAPW_Hg4_4odQUTnCU7ZaHdk=/1280x0/smart/cloudfront-us-east-1.images.arcpublishing.com/advancelocal/DTHQOAF5LJDPDJK2DI2XLWHOKQ.jpg

Texas has a 6 25 sales tax applied to the purchase price or the standard presumptive value SPV of the car whichever is higher There are also fees associated Our Texas Car Sales Tax Calculator is a vital tool for anyone purchasing a car in Texas It offers accurate sales tax estimates and a clear understanding of additional costs

In Texas car sales tax varies depending on the city and county where the sale takes place The statewide sales tax rate is 6 25 while local rates can range between 1 and 2 Therefore the combined sales tax rate Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 6 25 percent on the purchase price or

Mass Sales Tax Calculator VerdunMaman

https://www.taxjar.com/wp-content/uploads/[email protected]

Sales Tax Vs VAT Explained Yonda Tax

https://yondatax.com/wp-content/uploads/2022/06/BlogCover_VatandTaxes.jpg

https://www.findthebestcarprice.com/texas …

There is a 6 25 sales tax on the sale of vehicles in Texas However there may be an extra local or county sales tax added onto the base 6 25 state tax Local tax rates range from 0 to 2 with an

https://comptroller.texas.gov/taxes/publications/96-254/mv-sales.php

Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas A motor vehicle sale includes installment and credit sales and exchanges for property services

Sales Tax By State Here s How Much You re Really Paying Sales Tax

Mass Sales Tax Calculator VerdunMaman

Texas House Passes Bill That Would Remove Sales Tax On Menstrual

The Tax Free Syringe Excel medical

Chicago Sales Tax Clearance Discounts Save 44 Jlcatj gob mx

Washington Sales Tax For Businesses A Complete Guide FreeCashFlow io

Washington Sales Tax For Businesses A Complete Guide FreeCashFlow io

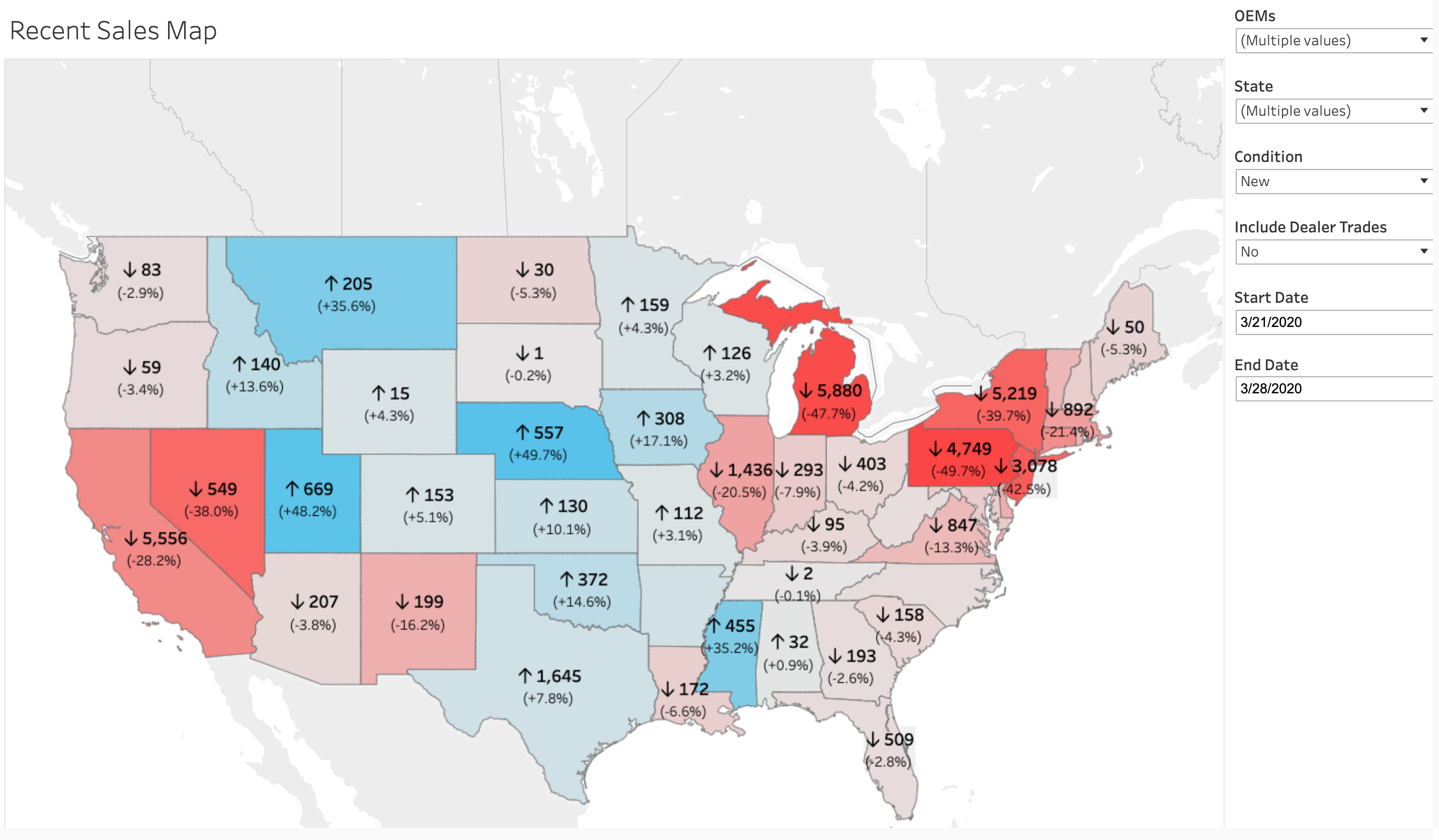

Data Analysis U S New Car Sales By State

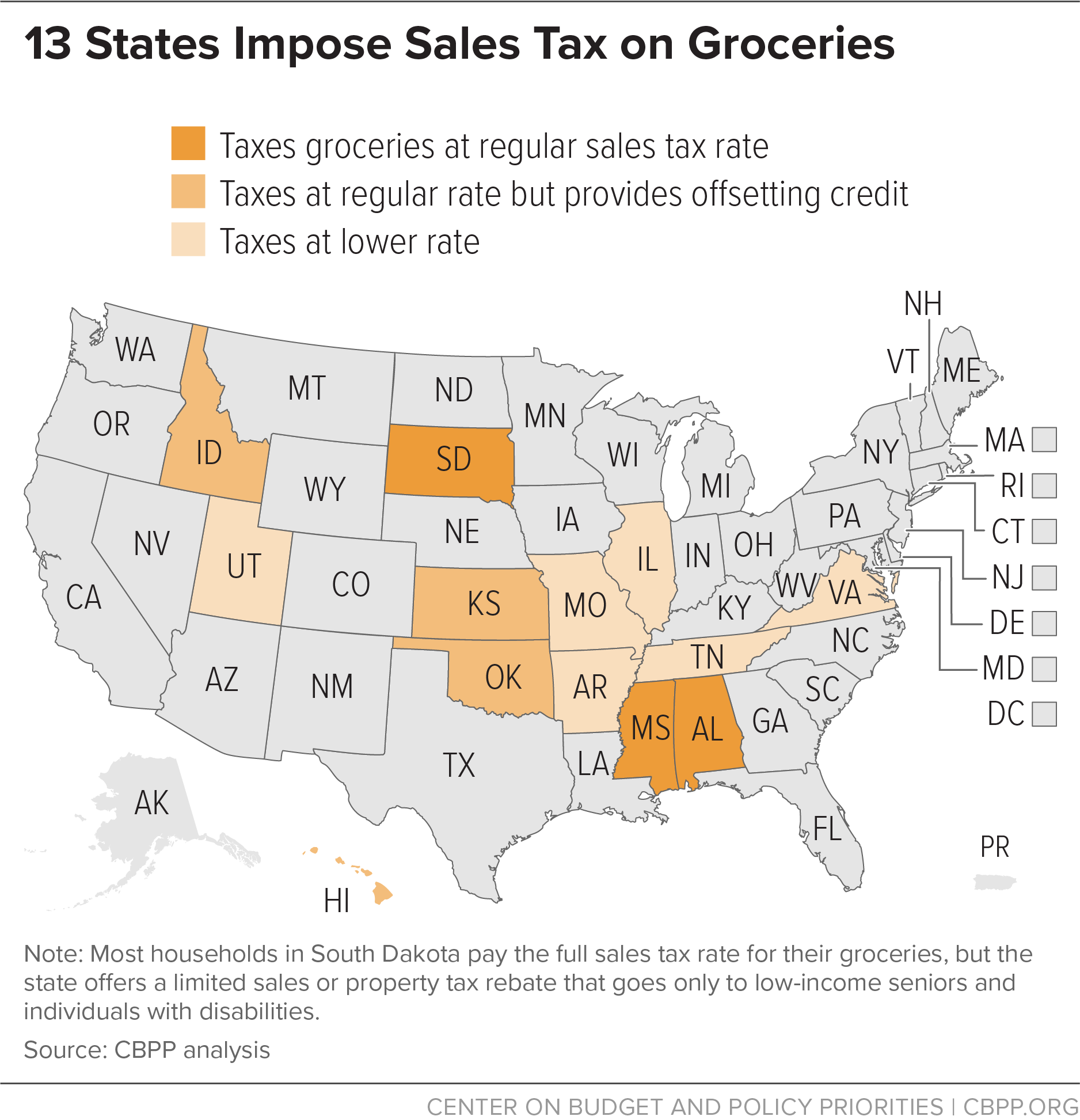

Ending The Food Tax In Utah Rational Nuggets

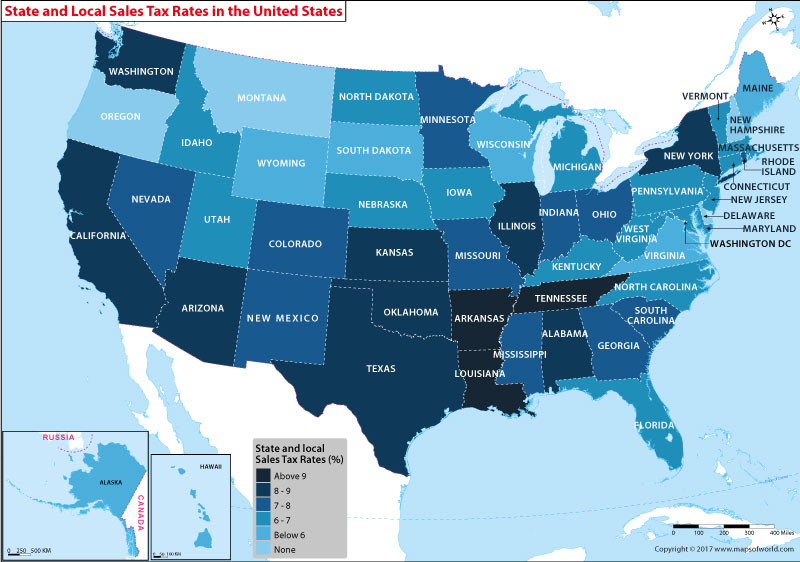

The State And Local Sales Tax Rates In The US States Our World

Does Texas Charge Sales Tax On Vehicles - The cost can vary by dealership and by vehicle Tax title and license fee on a new car in Texas that costs 25 000 would be around 1 700 This fee includes Sales