Does Texas Have Business Personal Property Tax Personal property tax in Texas is imposed on income producing tangible personal property The local county appraisal district uses the Texas personal property tax to fund county

Neglecting business personal property tax can lead to compliance issues tax penalties and missed planning opportunities This Texas does provide a 500 exemption for business personal property Tax Code 11 145 and mineral interests Tax Code 11 146 The 500 level was set 20 years ago in 1997 and has

Does Texas Have Business Personal Property Tax

Does Texas Have Business Personal Property Tax

https://flashingfile.com/wp-content/uploads/2022/08/Business-Personal-Property-Tax.png

5 Common Real Estate Tax Mistakes Property Tax Consultant Tips

https://www.hegwoodgroup.com/wp-content/uploads/2020/09/texas-real-estate-tax-tips.jpg

Blog Real Estate Tax Vs Personal Property Tax What s The Difference

https://assets-global.website-files.com/609a9b9f093116273c836430/6129072ded6d732072e652e0_NewsMain.png

Texas requires filing an annual business personal property tax return that lists all assessable personal property owned by a business as of January 1 The return is due by April 15 each year to the local appraisal district Every company relies on personal property to conduct business But with property ownership comes taxes and liability In this post we break down everything taxpayers need to know about business personal property tax

When required by the chief appraiser you must render any taxable property that you own or manage and control as a fiduciary Section 22 01 b Texas Property Tax Code If you The State of Texas has jurisdiction to tax personal property if the property is Located in the state for longer than a temporary period Temporarily located outside the state and the owner

Download Does Texas Have Business Personal Property Tax

More picture related to Does Texas Have Business Personal Property Tax

Business Personal Property Tax Blog Incite Tax

https://incitetax.com/wp-content/uploads/2021/11/Business-Personal-Property-Tax-blog-1536x864.png

Hecht Group Paying Your Property Taxes Online In Russell Kansas

https://img.hechtgroup.com/1665369701273.jpg

Property Tax Notice Statement Mackenzie Gartside Associates

https://i2.wp.com/www.comoxmortgages.com/wp-content/uploads/2021/09/Property-Tax-Notice-example.png?ssl=1

Sections 11 01 and 11 14 of the Tax Code require that property taxes be levied on all tangible personal property that is used for the production of income in Texas Most tax officials refer Business Personal Property Tax Applicable Entities Businesses using personal property Tax Rate Varies by the appraisal district Filing Requirements Report annually to

Texas has relatively low tax rates on businesses and some small businesses pay no tax at all In addition it has no personal income tax which can save business owners money Business Personal Property Cost Schedules Below are some examples of personal property cost schedules developed by different appraisal districts around the statement They provide

Personal Property Tax YouTube

https://i.ytimg.com/vi/tDuSBq31Wjg/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGGUgYShVMA8=&rs=AOn4CLDloeNcFcR0_qzJb0Krt6bm81r68g

Personal Property Tax What Is It YouTube

https://i.ytimg.com/vi/xzIUSRzp6M4/maxresdefault.jpg

http://www.appraisaldistrictguide.com › personal-property-tax.html

Personal property tax in Texas is imposed on income producing tangible personal property The local county appraisal district uses the Texas personal property tax to fund county

https://www.legalzoom.com › articles › …

Neglecting business personal property tax can lead to compliance issues tax penalties and missed planning opportunities This

Tax Prep Checklist Tracker Printable Tax Prep 2022 Tax Etsy Canada

Personal Property Tax YouTube

Real Estate Commercial Property Tax Management

Commercial Property Tax Assessment

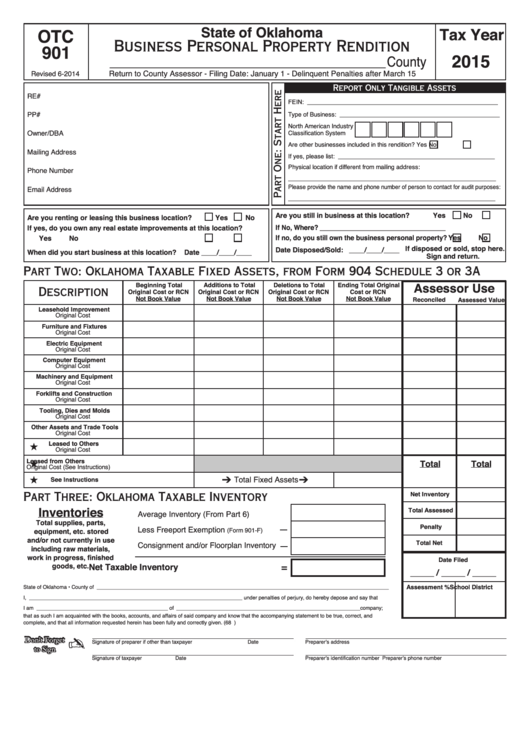

Fillable Business Personal Property Tax Return Form Printable Pdf

How High Are Property Taxes In Your State American Property Owners

How High Are Property Taxes In Your State American Property Owners

Texas Sales Tax Audits Peisner Johnson

WVa Gov Proposes Eliminating Personal Property Vehicle Tax

About Commercial Property Tax Management

Does Texas Have Business Personal Property Tax - There s no personal property tax except on property used for business purposes Real estate taxes are set and appraisals are performed by county districts