Does The State Of Nj Require You To File A Tax Return What are New Jersey s Filing Requirements According to the Resident Part Year and Nonresident filing instruction web pages you must file a return if Your filing status is Single or Married Filing Separate AND your gross income was at least 10 000 OR Your filing status is Married Filing Joint Head of Household or Qualifying Widow er

The Division of Taxation requires mandatory electronic filing for W 2s and 1099s This mandate includes Forms NJ W 3 W 2 W 2G 1094 1095 and all 1099s Visit our Employer Payroll Tax filing page for electronic filing options For more information see the New Jersey Gross Income Tax Withholdings Instructions NJ WT Most New Jersey Resident Tax Returns NJ 1040 and NJ 1041 can be e filed If you cannot e file a return Form NJ 1040 O the E File Opt Out Request Form must be completed You should enter a reason for your use of the form Also count these returns toward the threshold

Does The State Of Nj Require You To File A Tax Return

Does The State Of Nj Require You To File A Tax Return

https://media.product.which.co.uk/prod/images/original/gm-aa92bc57-ae83-4dfe-9de4-da82b9cd248b-tax-return-dec-2019.jpeg

Does Everyone Need To File An Income Tax Return Income Tax Return

https://i.pinimg.com/736x/92/5d/04/925d0401027c823c8df2532bb1929511.jpg

The Main Reasons To File A Tax Extension Beyond Late K 1s Online

https://i.pinimg.com/originals/0e/5c/4b/0e5c4b305a02bc221cad4a8771b4203d.png

You will be able to file your returns whether you are expecting a refund have a balance due or no balance The program accepts individual resident and non resident income tax returns NJ 1040 and NJ 1040NR and fiduciary income tax returns NJ 1041 It also accepts amended returns NJ Income Tax Resident Return This service allows you to prepare and electronically file your current year New Jersey return if you filed a New Jersey return for the previous year To access this feature you will need to validate that you did so by providing the New Jersey Gross Income amount from your prior year New Jersey Income Tax

NJ E File You can file your Form NJ 1040 for 2023 using NJ E File whether you are a full year resident or a part year resident Use tax software you purchase go to an online tax preparation website or have a tax preparer file your return You can file both federal and State Income Tax returns What is the deadline for filing New Jersey taxes in 2023 The deadline to file a New Jersey state tax return was April 18 2023 which was also the deadline for federal tax returns For help estimating your annual income taxes use AARP s Tax Calculator The deadline to file for a six month extension until Oct 16 2023 has also

Download Does The State Of Nj Require You To File A Tax Return

More picture related to Does The State Of Nj Require You To File A Tax Return

Why Teenagers Should File A Tax Return Even If It s Not Required By

https://star-telegram.wp.moneyresearchcollective.com/wp-content/uploads/sites/6/2022/04/a6fe8956c7-scaled.jpeg

How To Prove You Filed A Tax Return If The IRS Says You Didn t

https://imageio.forbes.com/specials-images/imageserve/52cda97366ca4d4c9a60005eac8100a0/0x0.jpg?format=jpg&width=1200

Do I Have To File A Tax Return RS Accountancy

https://rsaccountancy.co.uk/wp-content/uploads/2020/02/file-tax-return.jpg

Amending a Return Amending a Return You must file an amended New Jersey tax return if You need to correct or change your New Jersey return or The Internal Revenue Service IRS made changes to your federal return and it impacts your New Jersey Income Tax Filing an Amended Return When you file an amended How do you check if you ve paid taxes in New Jersey If you want to make sure your state taxes were paid contact the New Jersey Department of Taxation to see if your payment was received The contact information is as follows By Phone Email In Person In Writing Deducting NJ state income tax

Unless you live in one of the few states that don t collect income taxes you re on the hook for filing a state return The IRS will begin accepting federal returns on Jan 24 this year State Tax Identification Number You don t need a state tax identification number for your New Jersey LLC NJ LLC With No Activity Is a Tax Return Required Yes even if your LLC has no activity you must file an income tax return if you ve obtained an EIN for your business

How Do You Know If You Need To File A Tax Return Stuff co nz

https://resources.stuff.co.nz/content/dam/images/4/y/n/3/1/s/image.related.StuffLandscapeSixteenByNine.1420x800.4yn318.png/1593770667720.jpg

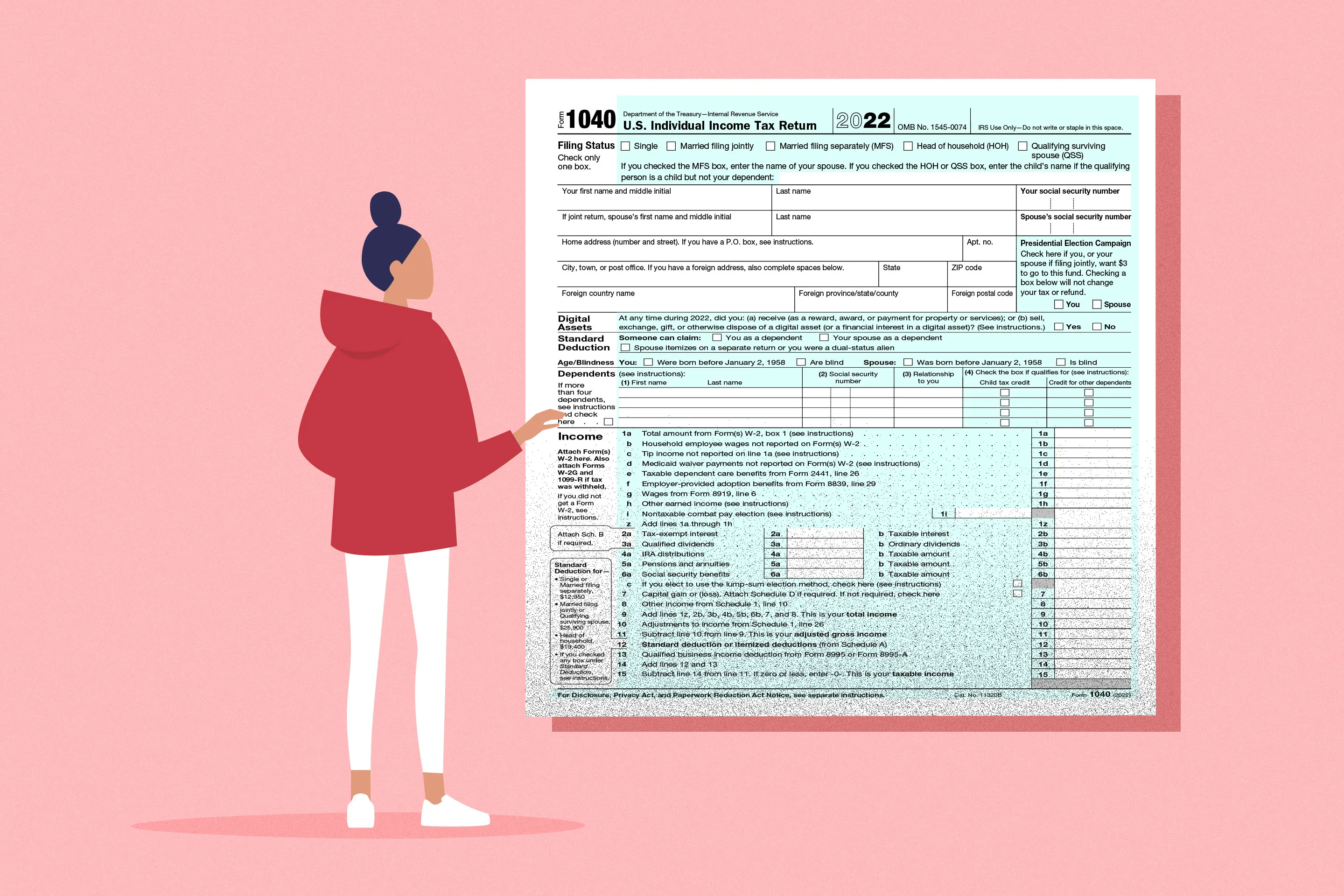

Do I Need To File A Tax Return Is It Mandatory To File A Tax Return

https://www.idealtax.com/wp-content/uploads/2022/06/Do-I-Need-to-File-a-Tax-Return.jpg

https://support.taxslayer.com/hc/en-us/articles/...

What are New Jersey s Filing Requirements According to the Resident Part Year and Nonresident filing instruction web pages you must file a return if Your filing status is Single or Married Filing Separate AND your gross income was at least 10 000 OR Your filing status is Married Filing Joint Head of Household or Qualifying Widow er

https://www.nj.gov/treasury/taxation/git/efilemand.shtml

The Division of Taxation requires mandatory electronic filing for W 2s and 1099s This mandate includes Forms NJ W 3 W 2 W 2G 1094 1095 and all 1099s Visit our Employer Payroll Tax filing page for electronic filing options For more information see the New Jersey Gross Income Tax Withholdings Instructions NJ WT

How To File Tax Extension Self Employed

How Do You Know If You Need To File A Tax Return Stuff co nz

Do I Have To File A Tax Return If I Don t Should I File One Anyway

2 Reasons To File A Tax Return Even If You Don t Have To EzTaxReturn

Stimulus Check 2023 Update Today Inflation Relief February 2023

How To File A Tax Extension

How To File A Tax Extension

How To File A Nonresident State Tax Return Sprintax

Do I Have To File A Federal Tax Return

Do I Need To File A Tax Return YouTube

Does The State Of Nj Require You To File A Tax Return - The Administration also lowered the minimum age eligibility for NJEITC from 21 to 18 and expanded eligibility to those 65 and older without dependents For Tax Year 2023 eligible New Jersey taxpayers could receive a refundable credit of up to 2 972 with three or more qualifying dependents or 240 without dependents