Does The Uk Have Import Taxes Check if you need to pay import VAT when you import goods into Great Britain from outside the UK or outside the EU to Northern Ireland

The UK Global Tariff UKGT applies to all goods imported into the UK unless the country you re importing from has a trade agreement with the UK an exception applies such as a relief or So in this example the total of UK duty and VAT tax payable to import these goods to the UK is 192 5 1138 5 which is 1331 Here is a similar example created by our online calculator 2 FOB Free On Board This calculation does not take into account the cost of insurance and freight when calculating duty taxes

Does The Uk Have Import Taxes

Does The Uk Have Import Taxes

https://i1.wp.com/wonkhe.com/wp-content/wonkhe-uploads/2022/10/Shutterstock_371667148-1.jpeg?w=2049&ssl=1

UK Taxes How Does The UK Tax System Work StudySmarter YouTube

https://i.ytimg.com/vi/ZRJCzlNNfQM/maxresdefault.jpg

How Does The UK Budget 2021 Affect Small Businesses Countingup

https://countingup.com/wp-content/uploads/2021/06/report-calculator-computer-cog-money-code.png

This authority primarily enforces 2 types of duties and taxes on goods imported into the UK Customs Duties Value Added Tax Customs Duties HMRC applies customs duties to imported goods valued above GBP 135 These duties typically range from 0 to 25 of the goods value with the exception of gifts 4 5 of 22 000 is 990 22 000 0 045 So for the goods shipping and import duty you ll pay 22 990 in total As it s from outside the EU you ll also need to pay VAT on this amount Use our import duty calculator to calculate the expected duty that might accure when bringing goods into the UK

There are three types of tax that can be charged on goods imported into Great Britain customs duties sometimes called tariffs apply only to imported goods value added tax VAT applies to both sales of goods inside the UK and imports of goods from abroad but the way it is collected differs During the tax year ending April 2023 the UK imported almost 900 billion worth of goods Department for International Trade a 17 9 increase on the previous year Importing goods opens up opportunities for market expansion product variety and quality enhancement ultimately economic growth and job creation

Download Does The Uk Have Import Taxes

More picture related to Does The Uk Have Import Taxes

What Does The UK Import From Russia

https://www.kentonline.co.uk/_media/img/XKBWQBLLDLY4HX6QZNXP.jpg

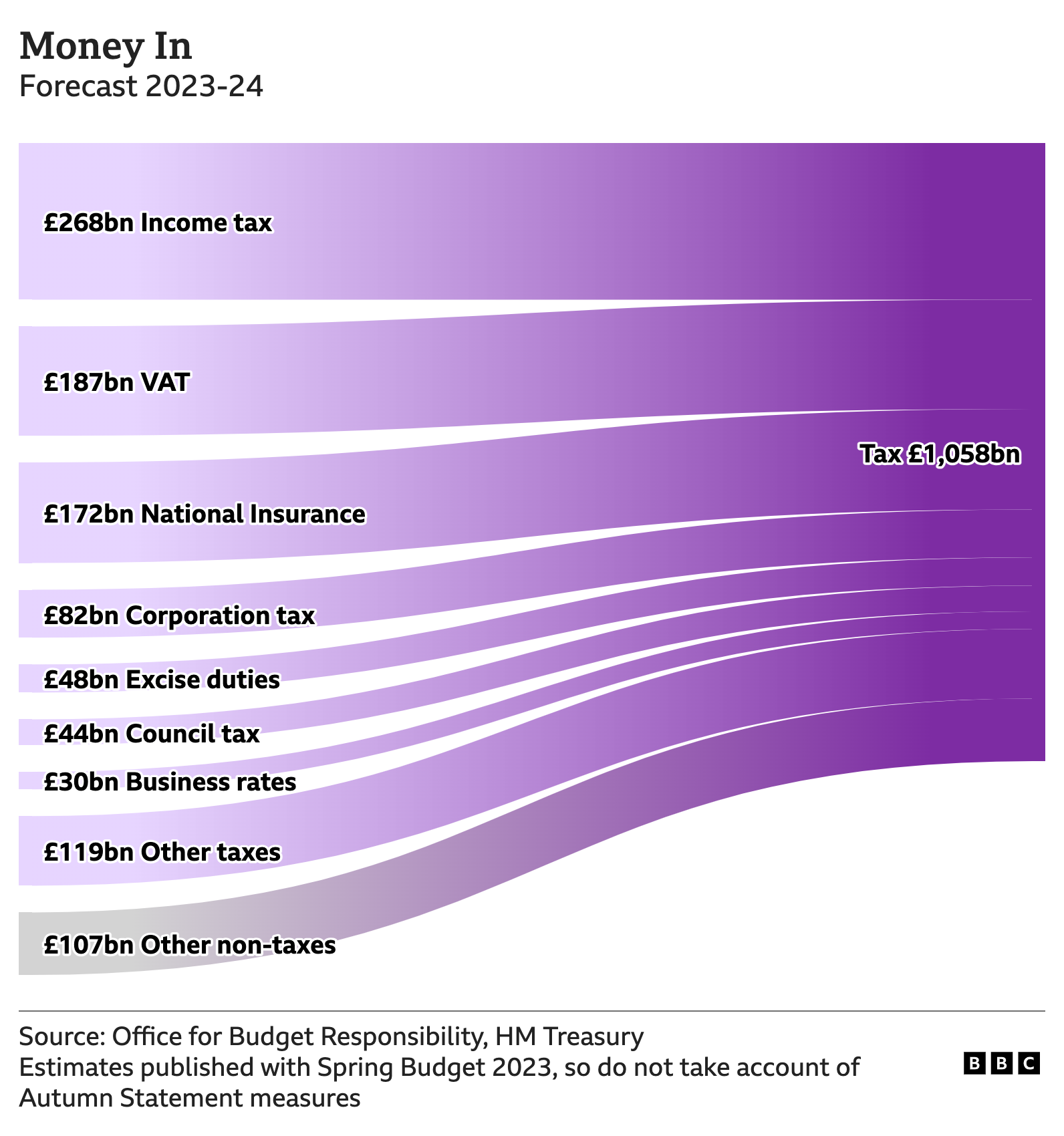

How Much Money Does The UK Government Raise And Spend Each Year BBC News

https://ichef.bbci.co.uk/news/976/cpsprodpb/CABA/production/_131789815_moneyin-nc.png

UK Retailers Spent 1 2 Billion Processing Card Payments In 2021

https://blog.wonderful.co.uk/content/images/size/w1384/2022/12/BRC-Payments-Survey-2022-1.png

Import VAT is a fee currently paid on goods sent to the UK from abroad but instead of the normal VAT you would pay at the checkout for your items you ll pay import VAT on the total cost of the item and shipping and handling costs accrued when the courier brings the purchase to the UK How do I calculate UK import duty and other taxes This UK import tax calculator developed by the experts at ChamberCustoms and Exabler is quick easy and free to use It can work out the different rates of duty available to your business when importing goods ChamberCustoms helps traders keep trading

The UK Government has been phasing in border controls for goods imports from the EU from 2021 Customs declarations are now required for all imported goods Businesses must pre notify imports of animals plants and high risk food and feed The UK is to cut import taxes on hundreds more products from some of the world s poorest countries to boost trade links The Developing Countries Trading Scheme comes into force in January

How Much Does The UK Tax The Average Worker Compared To The Rest Of

https://usercontent.one/wp/www.taxpolicy.org.uk/wp-content/uploads/2023/09/image-23.png?media=1704269790

How Does The UK Maximise The Success Of Its New Investment Zones Arup

https://www.arup.com/-/media/arup/images/perspectives/themes/cities/how-does-the-uk-maximise-investment-zones/how-does-the-uk-maximise-its-new-investment-zonesv2.jpg

https://www.gov.uk/guidance/vat-imports...

Check if you need to pay import VAT when you import goods into Great Britain from outside the UK or outside the EU to Northern Ireland

https://www.gov.uk/guidance/tariffs-on-goods-imported-into-the-uk

The UK Global Tariff UKGT applies to all goods imported into the UK unless the country you re importing from has a trade agreement with the UK an exception applies such as a relief or

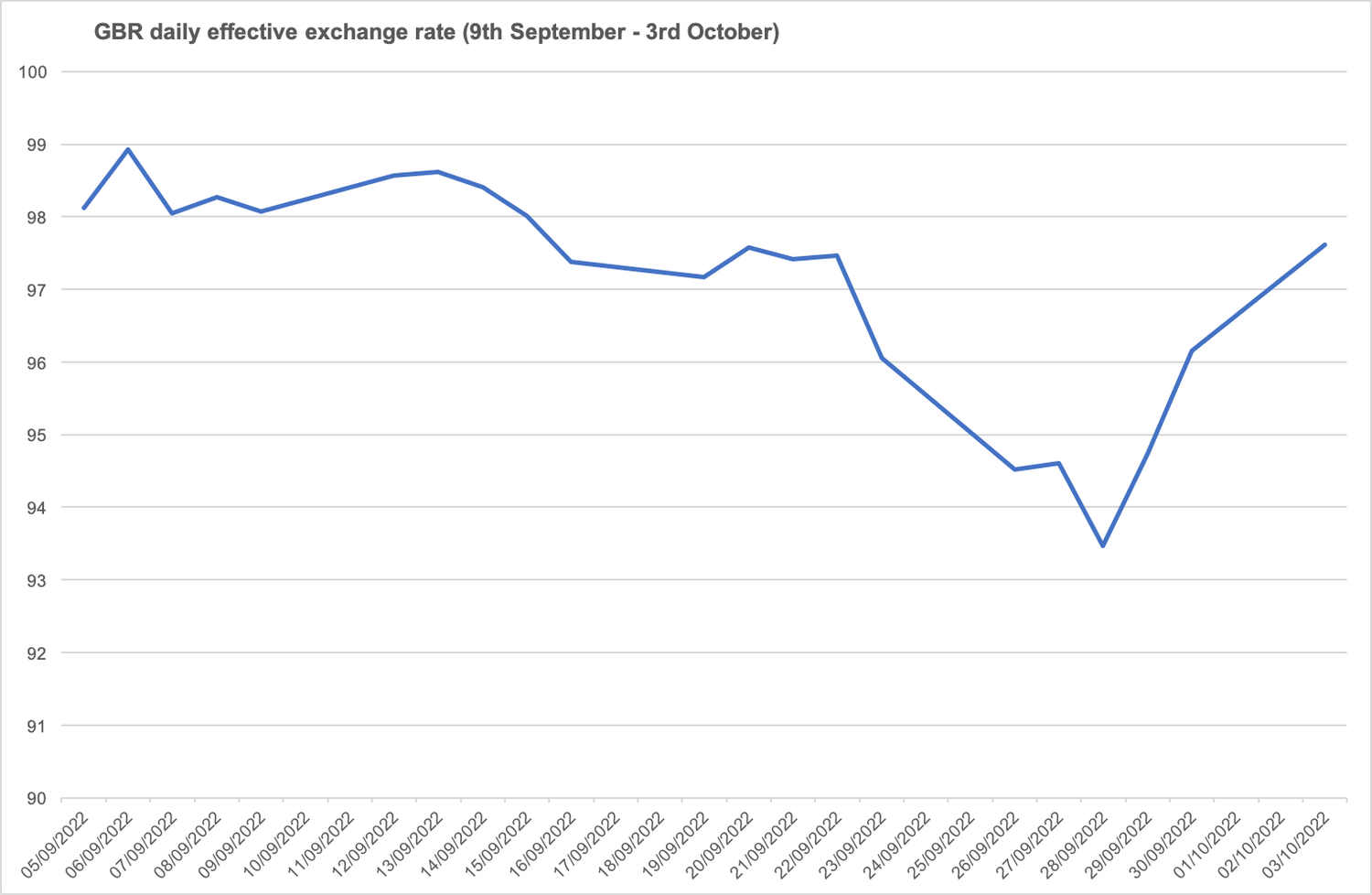

What Does The UK Election Result Mean For The Markets And How Should

How Much Does The UK Tax The Average Worker Compared To The Rest Of

Does The UK Economy Look On The Verge Of A Currency Crisis Kaleidic

How Does The UK State Pension Compare Pension Access

Does The UK U S Agreement Under The U S CLOUD Act Affect UK s

How Many Different Taxes Does The UK Have AIMS Accountants For Business

How Many Different Taxes Does The UK Have AIMS Accountants For Business

A Quick Guide To The UK Tax System Bookkeeping Services UK

UK Con Exam UK Con Question 1 The UK Constitution Relies Upon

The Benefits Of Using A Temporary UK SMS Verification Service Darksms

Does The Uk Have Import Taxes - Until 31 December 2020 the effective rate of UK import value added tax VAT on imports of art from non EU countries was usually 5 This rate remains the same from 1 January 2021 and it will now usually apply to imports from the EU as well as other countries