Does Turbotax File Property Tax Refund TurboTax DOES eFile the Minnesota Property Tax form M1PR for 2020 IMPORTANT It does not automatically eFile when you eFile the Fed and State You have to go back in to the program and select File and go through the eFile process a second time In my case that second time was after the Federal and State returns were accepted

Learn how to deduct property taxes you pay on your main residence and other real estate you own from your federal income tax bill Find out what types of property taxes are deductible what fees and charges are not and how the 10 000 limit affects you You have until August 15 2023 to file your 2021 Property Tax Refund August 15 2024 for your 2022 refund While TurboTax Intuit did not e file my 2021 property refund it did e file my 2022 one verified I was able to find the address to mail it to at the bottom of the tax form

Does Turbotax File Property Tax Refund

Does Turbotax File Property Tax Refund

https://www.bhphotovideo.com/images/images1000x1000/intuit_426934_turbotax_premier_federal_e_file_1197063.jpg

Turbotax File For Extension

https://digitalasset.intuit.com/IMAGE/A3svFcKhv/What_are_tax_extensions_L5IG9YiQ7.jpg

Turbotax 2016 Home And Business Mac Torrent Tracker Wallkurt

https://digitalasset.intuit.com/IMAGE/A4FlkPIMl/[email protected]

If you paid for TurboTax to prepare your Minnesota M1PR and you prepared the form the return can be found in your TurboTax software This TurboTax Help states Yes you can paper file your M1PR when you prepare your Minnesota taxes in TurboTax We ll make sure you qualify calculate your Minnesota property tax refund and fill out an M1PR form which you Learn how to apply for a Property Tax Refund if you re a Minnesota homeowner or renter with low income Find out how to check your refund status amend your application or create a Certificate of Rent Paid

Learn how to file for the Property Tax Refund online or on paper by August 15 Find out how to check your refund status contact info and FAQs Learn how to pay property taxes online using credit cards or ACH payments and how to deduct them on your federal tax return Find out the eligibility timing and reporting requirements for property tax deductions

Download Does Turbotax File Property Tax Refund

More picture related to Does Turbotax File Property Tax Refund

Create Turbotax Login Account Is An American Tax Preparation Software

https://i.pinimg.com/originals/ad/fb/33/adfb339342d2ae41d0302ce67fd9c790.jpg

TurboTax Lets You File Taxes For Free but There s A Catch Money

https://content.money.com/wp-content/uploads/2018/04/turbo-tax-free-tax-filing.jpg?quality=85

TurboTax Official Site File Taxes Online Tax Filing Made Easy

https://i.pinimg.com/originals/4f/dd/e3/4fdde3fd0ad92e8a640368bf61dcd21e.jpg

Learn what personal property taxes are how to file them and when you can deduct them on your federal tax return Find out the requirements rules and examples of personal property taxes for different states and localities For example if you paid your 2022 property taxes in 2023 claim them on your 2023 taxes However you can t include any late fees interest or penalties just the tax itself Starting with tax year 2017 you can still claim prepaid property tax but only if it was also assessed in the tax year you re attempting to claim it

Learn where to enter your property taxes in TurboTax Online for rental or personal use Find out how to include them on your 1098 or separately as part of your deductions and credits Property taxes are local taxes that fund local government programs and help pay for services and projects that benefit your community Learn how property tax is calculated why we have property taxes and how to deduct them on your tax return

TurboTax How To File Federal State Tax Returns Free

https://www.freebfinder.com/wp-content/uploads/2020/01/turbotax-file-free.jpg

Do You Use TurboTax To File Your Tax Returns Read This LibertyID

https://www.libertyid.com/wp-content/uploads/2017/03/turbotax.png

https://ttlc.intuit.com › community › state-taxes › discussion

TurboTax DOES eFile the Minnesota Property Tax form M1PR for 2020 IMPORTANT It does not automatically eFile when you eFile the Fed and State You have to go back in to the program and select File and go through the eFile process a second time In my case that second time was after the Federal and State returns were accepted

https://turbotax.intuit.com › tax-tips › home...

Learn how to deduct property taxes you pay on your main residence and other real estate you own from your federal income tax bill Find out what types of property taxes are deductible what fees and charges are not and how the 10 000 limit affects you

Turbotax File For Extension

TurboTax How To File Federal State Tax Returns Free

Intuit TurboTax Deluxe 2017 Boxed 605033 B H Photo Video

Learn How File Your Taxes For Free With TurboTax Free Edition Improve

TurboTax Canada File Your Tax Return Online For Free In 2023

TurboTax Review 2023 This Online Tax Software Still Dominates CNET

TurboTax Review 2023 This Online Tax Software Still Dominates CNET

2018 Turbotax Business And Home Tracoeformadesign

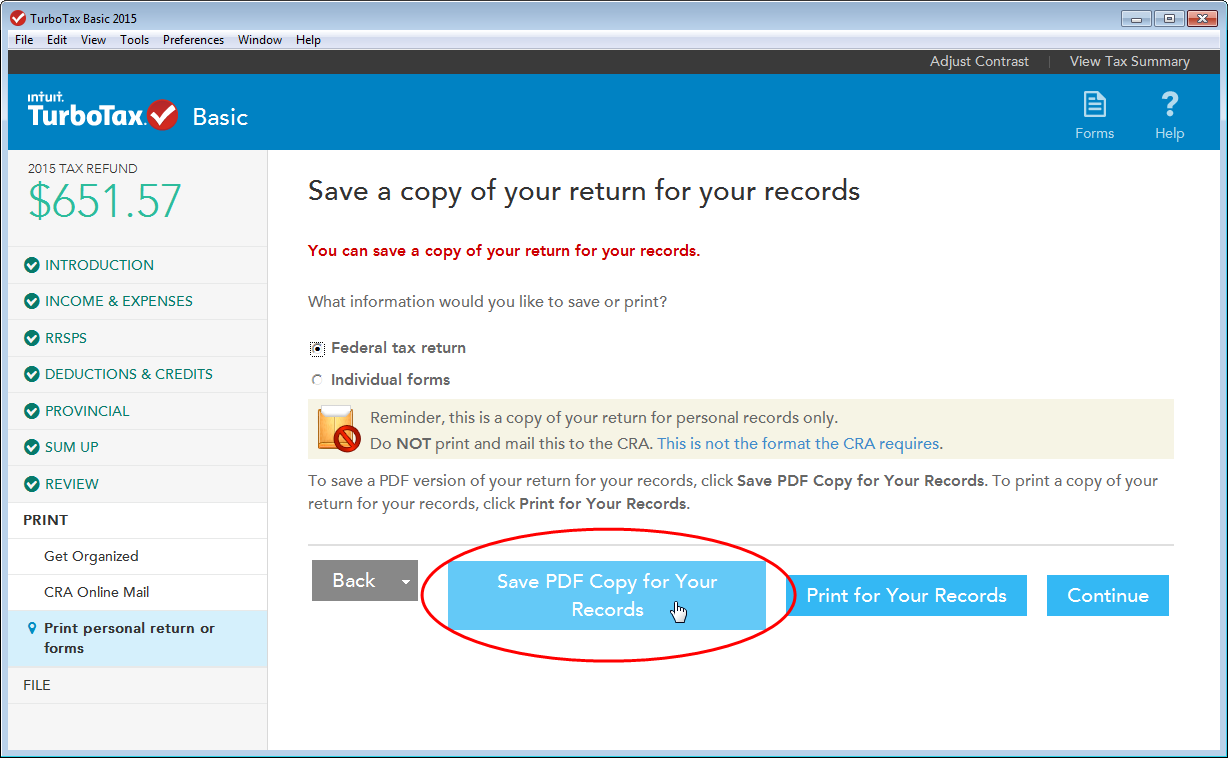

How Do I Save A PDF Copy Of My Tax Return In TurboTax AnswerXchange

File Your Own Taxes Online TurboTax Official

Does Turbotax File Property Tax Refund - If you paid for TurboTax to prepare your Minnesota M1PR and you prepared the form the return can be found in your TurboTax software This TurboTax Help states Yes you can paper file your M1PR when you prepare your Minnesota taxes in TurboTax We ll make sure you qualify calculate your Minnesota property tax refund and fill out an M1PR form which you