Does Used Ev Qualify For Tax Credit Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a

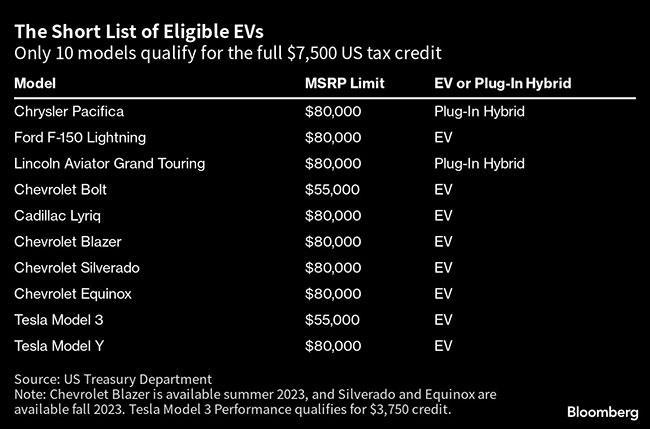

Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified

Does Used Ev Qualify For Tax Credit

Does Used Ev Qualify For Tax Credit

https://scx2.b-cdn.net/gfx/news/hires/2022/which-evs-qualify-for.jpg

Here Are The Electric Vehicles That Are Eligible For The 7 500 Federal

https://i.pcmag.com/imagery/articles/04InvhVC1HTje7XJcv9Tb7Q-4.fit_lim.v1681756100.jpg

Should These EVs Qualify For The Federal EV Tax Credit EVAdoption

https://evadoption.com/wp-content/uploads/2021/08/Should-these-EVs-qualify-for-the-federal-EV-tax-credit-1024x557.png

Do used electric cars qualify for federal tax credits Yes Under revised terms in the Inflation Reduction Act Used EVs will now qualify in addition to new vehicles as previously stated Shoppers considering a used electric vehicle EV costing less than 25 000 could obtain up to a 4 000 tax credit The Clean Vehicle tax credit is available to buyers within certain

Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit As part of the Biden Administration s Inflation Reduction Act we get a revamped federal EV tax credit Now there s a credit of up to 4 000 for used EVs

Download Does Used Ev Qualify For Tax Credit

More picture related to Does Used Ev Qualify For Tax Credit

2023 EV Tax Credit How To Save Money Buying An Electric Car Money

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?quality=85

Electric Vehicles Qualify For Tax Credit Electric Vehicle Latest News

https://infoevs.com/wp-content/uploads/2022/08/cropped-These-electric-vehicles-qualify-for-7500-tax-credit-under-Inflation-Reduction-Act-1.jpg

GM EVs Discounted After No Longer Qualifying For Tax Credit In 2024

https://www.usatoday.com/gcdn/authoring/authoring-images/2024/01/03/USAT/72096177007-usatsi-19045022.jpg?crop=2398,1348,x2,y75&width=2398&height=1348&format=pjpg&auto=webp

Those who buy new electric vehicles may be eligible for a tax credit of up to 7 500 and used electric car buyers may qualify for up to 4 000 New in 2024 consumers can also opt to transfer Used EV buyers can qualify for a tax credit of up to 4 000 If the car is eligible potential purchasers next need to see if they qualify which depends on their adjusted gross income and a few other factors

2021 Chevrolet Bolt EV 2017 Chevrolet Volt The Model Year Eligibility Criteria Since one of the requirements for eligibility is that a car s model year is at least The IRS released a long list of used EVs and PHEVs that in theory qualify for a tax credit However the list doesn t take into account restrictions on a vehicle s

The New Federal Tax Credit For EVs

https://blog.greenenergyconsumers.org/hubfs/Federal Tax Credit Blog header.png

Lawmakers Try To Delay EV Tax Credit Requirements

https://i.kinja-img.com/gawker-media/image/upload/c_fill,f_auto,fl_progressive,g_center,h_675,pg_1,q_80,w_1200/14bb001fb0a96378884c82ce9957d8d4.png

https://electrek.co/2024/03/18/here-are-…

Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a

https://www.irs.gov/newsroom/topic-a-frequently...

Beginning Jan 1 2023 eligible vehicles may qualify for a tax credit of up to 7 500 The amount of the credit depends on when the eligible new clean vehicle is

These Electric Cars Qualify For The EV Tax Credits

The New Federal Tax Credit For EVs

7 500 EV Tax Credit Use It Or Lose It YouTube

How To Qualify Almost Any EV For U S Tax Credit

These Electric Vehicles Qualify For A 7 500 Tax Credit

Consumer Leases Will Now Qualify For EV Tax Credits

Consumer Leases Will Now Qualify For EV Tax Credits

IRS Changes EV Tax Credit Vehicle Classifications Here s The New List

Only 10 EVs Qualify For Full 7 500 US Tax Credit Transport Topics

U S Treasury Says Consumer Leases Can Qualify For EV Tax Credits

Does Used Ev Qualify For Tax Credit - Do used electric cars qualify for federal tax credits Yes Under revised terms in the Inflation Reduction Act Used EVs will now qualify in addition to new vehicles as previously stated