Donation Rebate Under Income Tax Web Section 80G of the Income Tax Act primarily deals with donations made towards charity with an aim to provide tax incentives to individuals indulging in philanthropic activities

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals Web 28 juin 2018 nbsp 0183 32 1 Deduction U s 80G is Allowable to all kind of Assessee 2 Deduction U s 80G on Donation to Foreign Trust 3 Deduction U s 80G

Donation Rebate Under Income Tax

Donation Rebate Under Income Tax

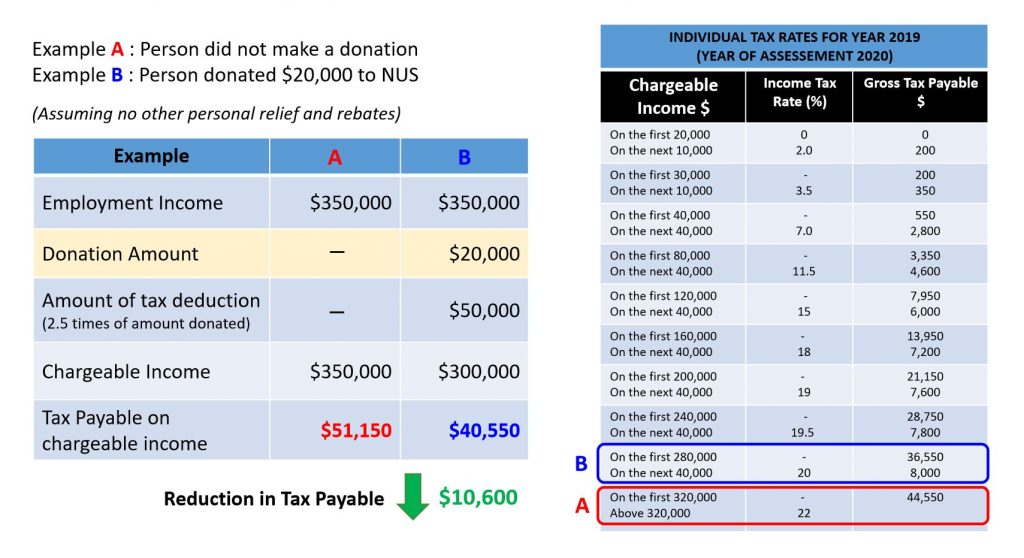

https://medicine.nus.edu.sg/giving/wp-content/uploads/sites/8/2020/04/Illustration-3-5-1024x558-1.jpg

Tax Rebate For Individual Most Individual Tax Rates Go Down Under The

https://enterslice.com/learning/wp-content/uploads/2019/06/Tax-Rebate-under-Section-87-A.jpg

Trick Of The Trade How Sadhguru s Isha Foundation Evades Paying Taxes

https://gumlet.assettype.com/newslaundry/2021-05/434efef2-e3f8-4f4b-b9dd-3cd8bc514564/donation_receipt.jpg?auto=format%2Ccompress

Web 23 sept 2021 nbsp 0183 32 Under 80G the amount donated to notified funds or institutions can be claimed as deduction at the time of filing income tax return Only donations made to Web To encourage people to donate the government also allows for income tax deductions under Section 80G for the amount which has been donated The amount which has

Web 5 juil 2021 nbsp 0183 32 A deduction of 50 or 100 of the amount contributed can be availed as a deduction Many people have lost their livelihoods during this pandemic and it is our Web 26 mai 2020 nbsp 0183 32 26 May 2020 349 882 Views 37 comments The amount donated towards charity attracts deduction under section 80G of the Income Tax Act Section 80G has been in the law book since financial

Download Donation Rebate Under Income Tax

More picture related to Donation Rebate Under Income Tax

Income Tax And Rebate For Apartment Owners Association

https://image.slidesharecdn.com/incometaxandrebateforapartmentownersassociation-091116034252-phpapp01/95/income-tax-and-rebate-for-apartment-owners-association-6-728.jpg?cb=1258343000

Tax Rebate Under Section 87A Claim Income Tax Rebate For FY 2018 19

https://assets1.cleartax-cdn.com/s/img/2019/02/01163903/Budget-2019-middle-class-1024x536.png

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

Web 17 sept 2021 nbsp 0183 32 IR 2021 190 September 17 2021 WASHINGTON The Internal Revenue Service today explained how expanded tax benefits can help both individuals Web 21 juil 2020 nbsp 0183 32 Under the Income Tax Act you are allowed to make donations to charitable institutions and relief funds and this will be deducted from your gross income This means that only after this

Web 11 juil 2023 nbsp 0183 32 Are charitable donations tax deductible Yes In general you can deduct up to 60 of your adjusted gross income via charitable donations but you may be limited to Web 28 sept 2021 nbsp 0183 32 The law now permits taxpayers to claim a limited deduction on their 2021 federal income tax returns for cash contributions they made to certain qualifying

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

https://www.basunivesh.com/wp-content/uploads/2019/02/Revised-Tax-Rebate-under-Sec.87A-after-Budget-2019.jpg

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

https://freefincal.com/wp-content/uploads/2019/02/Screen-Shot-2019-02-02-at-8.49.53-AM.png

https://www.bankbazaar.com/tax/deduction-under-section-80g.html

Web Section 80G of the Income Tax Act primarily deals with donations made towards charity with an aim to provide tax incentives to individuals indulging in philanthropic activities

https://tax2win.in/guide/80g-deduction-donations-to-charitable-institutions

Web 11 juin 2019 nbsp 0183 32 Section 80G of the Income Tax Act provides for a deduction for donations made to certain charitable institutions or funds The deduction is available to individuals

Section 87A Rebate Income Tax Act Claim Rebate For FY 2019 20 AY

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

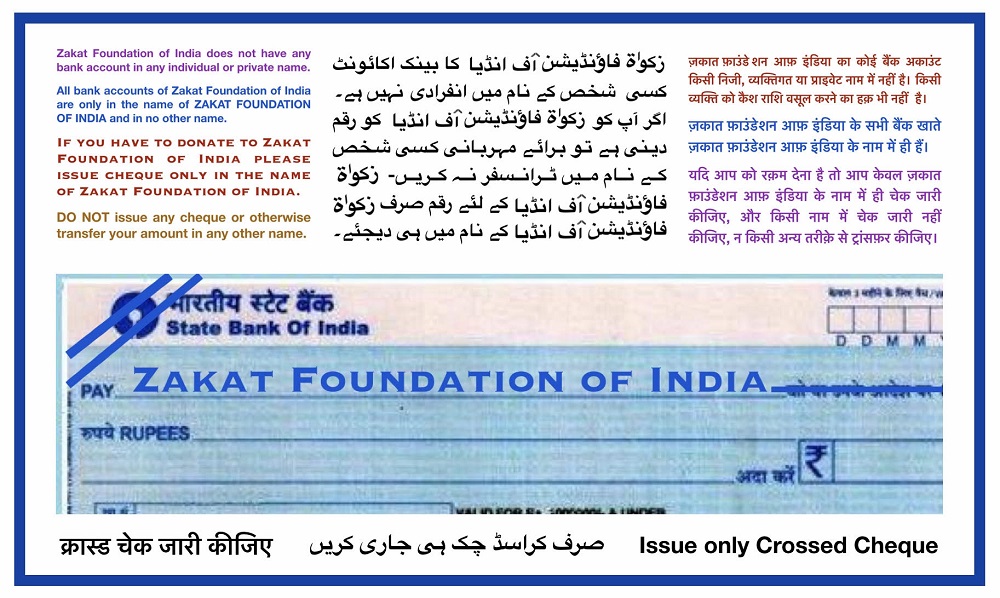

Zakat Foundation Of India

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

Individual Income Tax Rebate

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

501c3 Donation Receipt Template Addictionary 501c3 Donation Receipt

REBATE AND RELIEFS UNDER INCOME TAX

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Donation Rebate Under Income Tax - Web 21 d 233 c 2020 nbsp 0183 32 Contributions made to certain relief funds and charitable institutions can be claimed as a deduction under Section 80G of the Income Tax Act All donations