Donation To Political Party Income Tax Rebate Web 17 juil 2019 nbsp 0183 32 Under Section 80GGC any amount contributed to an electoral trust or a registered political party as per Section 29A of the Representation of the People Act

Web 8 f 233 vr 2019 nbsp 0183 32 As per Section 80GGB of the Income Tax Act 1961 any Indian company or enterprise that donates to a political party or an electoral trust registered in India can Web 16 nov 2015 nbsp 0183 32 Individuals can donate money to a recognised political party or an electoral trust and claim full tax deduction To avail the tax exemption under Section 80GGC of

Donation To Political Party Income Tax Rebate

Donation To Political Party Income Tax Rebate

https://www.eastcoastdaily.in/wp-content/uploads/2018/10/dqlwrlcx0aascun-768x538.jpg

Income Tax Notice For 80ggc Donation To Political Party Political

https://i.ytimg.com/vi/GhEsHv2CmPE/maxresdefault.jpg

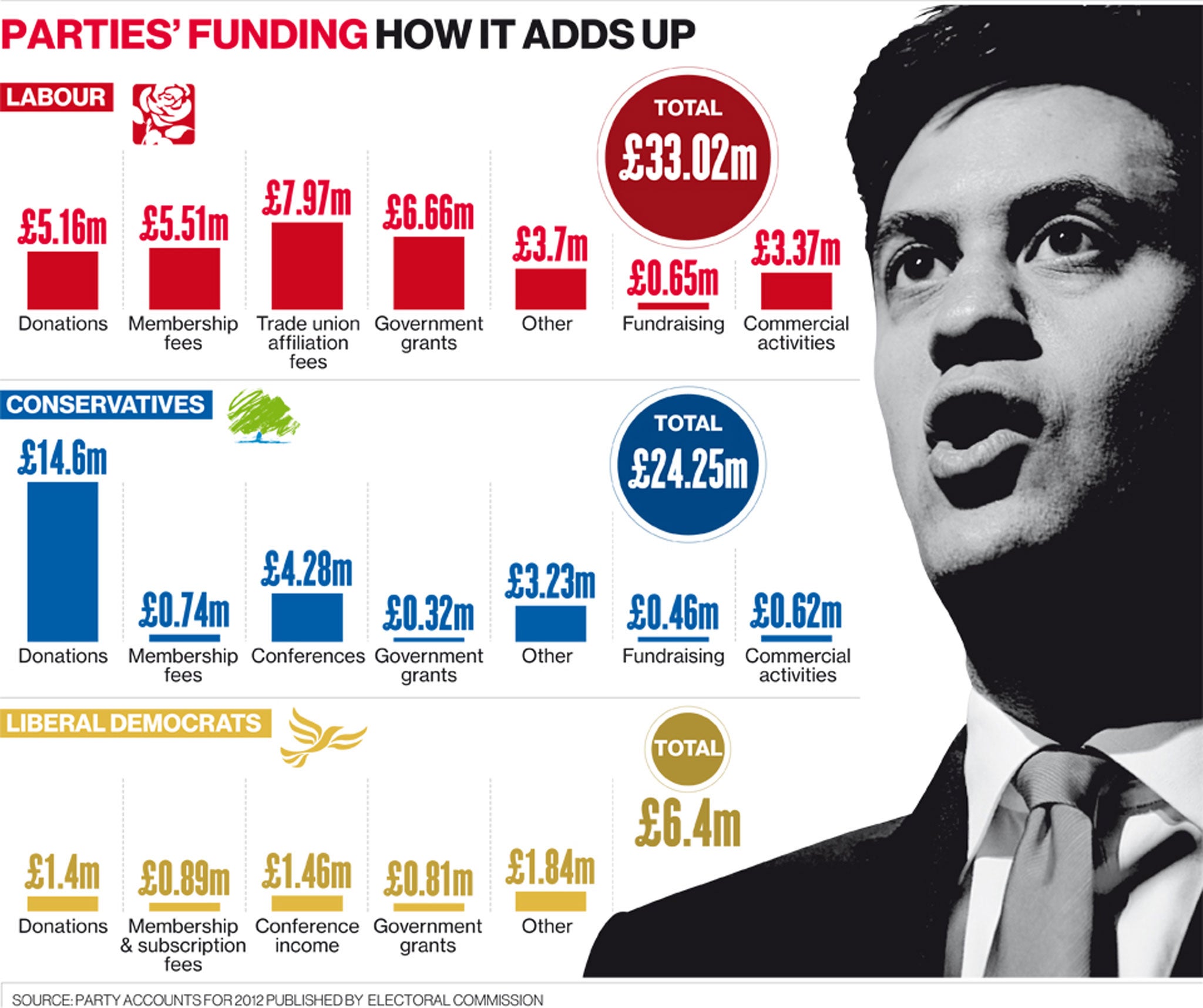

Political Party Contributions

https://www.fec.gov/resources/cms-content/images/fe120_2.original.png

Web 28 f 233 vr 2023 nbsp 0183 32 Section 80GGC of Income Tax Act allows taxpayers to avail of tax benefits for their contributions to political parties Hence if you meet certain eligibility criteria Web 30 d 233 c 2022 nbsp 0183 32 Section 80GGC under the Income Tax Act 1961 provides tax deduction benefits on donations made by any individual to political parties subject to certain

Web You can claim a credit for the amount of contributions that you or your spouse or common law partner made in the year to a registered federal political party a registered Web 27 f 233 vr 2020 nbsp 0183 32 Section 80GGB of the Income Tax Act 1961 deals in any Indian company or enterprise that donates to a political party or an electoral trust registered in India can

Download Donation To Political Party Income Tax Rebate

More picture related to Donation To Political Party Income Tax Rebate

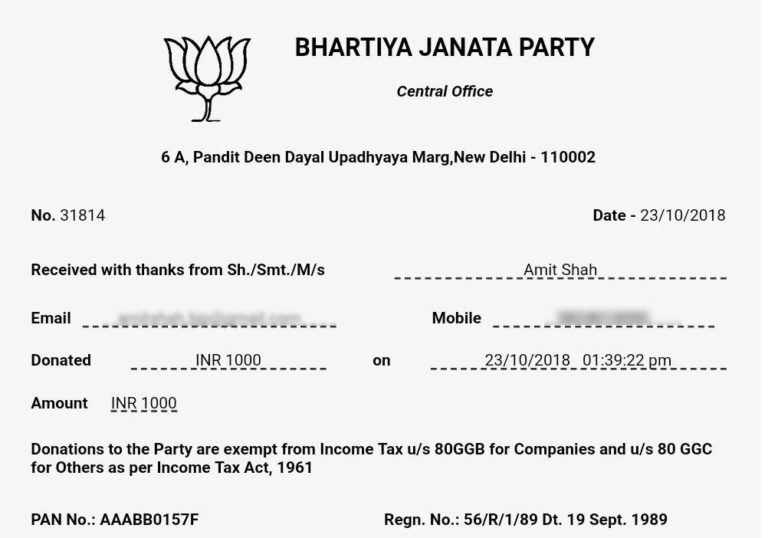

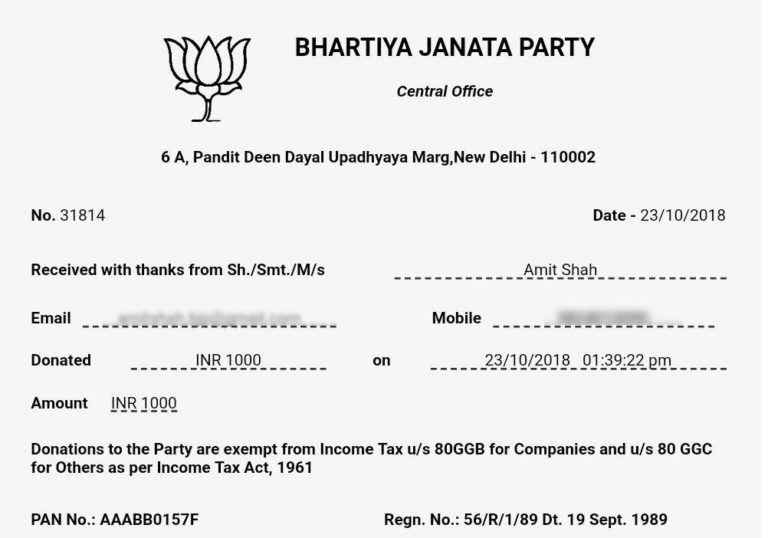

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

https://www.autospyders.com/how-to/wp-content/uploads/2022/08/Meta-App-Installer-1.jpg

80ggc Donation To Political Party Donation To Political Party Limit

https://i.ytimg.com/vi/sMVNp-_Y66M/maxresdefault.jpg

Donation To Political Party Get Deduction Under Income Tax 80GGB

https://1.bp.blogspot.com/-8buHZhLUxTw/X_iLrydeO2I/AAAAAAAAoX4/7P9sCLyMOjo7u1L3t_TYeCbW23YfhHnPQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Donation%2Bto%2BPolitical%2Bparty.jpg

Web 11 sept 2023 nbsp 0183 32 Receipt provided by the political party for the donation made is required to claim tax deduction under Section 80GGC This receipt provides detailed information of Web 12 avr 2023 nbsp 0183 32 Section 80GGC of the Income Tax Act provides tax deductions for contributions made to political parties The amount of deduction that can be claimed depends on the mode of payment If the

Web 28 sept 2022 nbsp 0183 32 Section 80GGC By Anjana Dhand Updated on 10 Nov 2022 What is Section 80GGC Section 80GGC provides for a tax deduction on any sum contributed in Web 15 oct 2020 nbsp 0183 32 2 Minute Read Federal political contributions are donations that were made to a registered federal political party or a candidate for election to the House of

Donation To Political Parties Claim Tax Deduction Under Section 80GGC

https://ebizfiling.com/wp-content/uploads/2023/05/Section-80GGC-Donation-of-Political-Parties.png

Donation To Political Party IncomeTax Planning Goes Wrong shorts

https://i.ytimg.com/vi/AKxiiYhjgNM/maxresdefault.jpg

https://tax2win.in/guide/section-80ggc

Web 17 juil 2019 nbsp 0183 32 Under Section 80GGC any amount contributed to an electoral trust or a registered political party as per Section 29A of the Representation of the People Act

https://cleartax.in/s/section-80ggb

Web 8 f 233 vr 2019 nbsp 0183 32 As per Section 80GGB of the Income Tax Act 1961 any Indian company or enterprise that donates to a political party or an electoral trust registered in India can

Donation To Political Party Or Electrol Trust Limits Process Income

Donation To Political Parties Claim Tax Deduction Under Section 80GGC

Deduction For Donation To Political Party Section 80GGC YouTube

Deduction For Donations Given To Political Parties FinancePost

Donate Us 80g Tipslopez

Sample Official Donation Receipts Canada ca Donate Receipts

Sample Official Donation Receipts Canada ca Donate Receipts

A 5 000 Cap On Donations Debt laden Labour Call For State Funding Of

BJP Prez Amit Shah Donates 1 000 To Own Party Shares Receipt

Anthony Pratt Tops Political Donations List

Donation To Political Party Income Tax Rebate - Web 10 sept 2022 nbsp 0183 32 Tax benefits on donations to political parties are available under two sections namely 80GGB and 80GGC Deduction under Section 80GGB Eligible Tax