Double Tax Relief Time Limits Web 9 April 2016 Updated 12 December 2023 see all updates Contents INTM160000 INTM162500 INTM162560 UK residents with foreign income or gains claims for

Web 15 M 228 rz 2023 nbsp 0183 32 This measure limits access to double taxation relief DTR in certain circumstances Specifically it will prevent new claims for DTR credit calculated at the Web 20 Juli 2022 nbsp 0183 32 This measure comes into effect on 20 July 2022 The relevant legislation will be included in the 2022 Finance Bill The measure prevents certain new claims to

Double Tax Relief Time Limits

Double Tax Relief Time Limits

https://media.saffery.com/sf-content/uploads/2021/11/publication-double-tax-relief.jpg

LHDN Tax Relief What You Need To Know Properly

https://properly.com.my/wp-content/uploads/2022/07/LHDN-Tax-Relief-01-1110x855.jpg

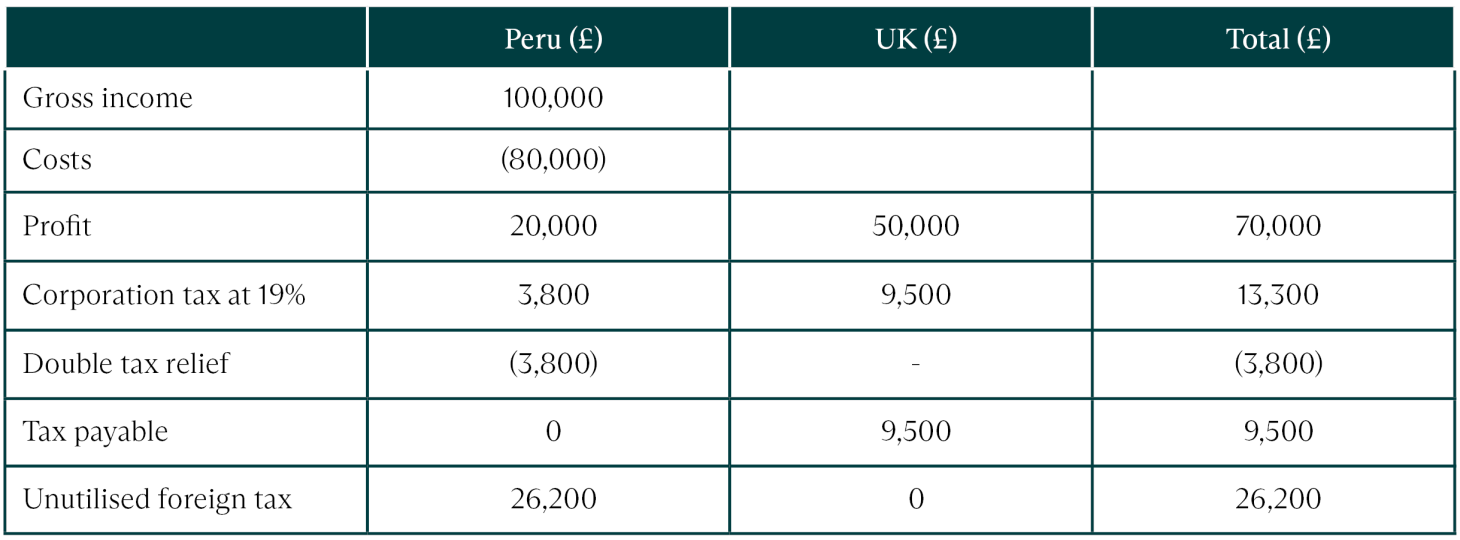

Double Taxation Avoidance Agreement Examples Sorting Tax

https://sortingtax.com/wp-content/uploads/2022/06/Double-Taxation-Avoidance-Agreement-Examples.png

Web The Convention aims to eliminate the double taxation of income and gains arising in one country and paid to residents of the other country This is done by allocating the taxing Web 23 Nov 2022 nbsp 0183 32 The UK has three options for providing relief from double taxation two via credit relief and one by way of deduction from the profits of the business For further commentary and examples see Simon s Taxes

Web 12 Aug 2023 nbsp 0183 32 In order to claim relief from double taxation you may need to prove where you are resident and that you have already paid taxes on your income Check with the Web 12 Apr 2023 nbsp 0183 32 Where will I pay taxes I am a Finnish pensioner living in Italy Can Italy tax me on the income from my Finnish pension plan to which I have contributed for over 40

Download Double Tax Relief Time Limits

More picture related to Double Tax Relief Time Limits

Double Tax Relief Saffery

https://saffery.s3.eu-west-2.amazonaws.com/sf-content/uploads/2020/02/Double-tax-relief-1460x540.png

Double Tax Relief PDF

https://imgv2-2-f.scribdassets.com/img/document/531529374/original/24ff2fecb1/1704206911?v=1

Double Tax Relief Foreign Tax Credit Relief

https://www.lewisbrownlee.co.uk/wp-content/uploads/2023/07/AdobeStock_474579377-scaled.jpeg

Web 24 Okt 2023 nbsp 0183 32 royalties pensions purchased annuities The relief available depends on the terms of each double taxation treaty and HMRC will decide if an application is allowable Web 13 Aug 2021 nbsp 0183 32 rules the PPT will not deny treaty relief if the taxpayer can prove that granting the treaty benefit in such circumstances is in accordance with the objective and

Web No extended time limit claim may be made on or after 20 July 2022 for a credit calculated by reference to a foreign nominal rate of tax unless subsection 2 or 3 applies in Web 30 Juni 2000 nbsp 0183 32 The double tax relief proposals were debated in Parliament again on June 20 this time by the standing committee A number of technical amendments mainly

Double Taxation Avoidance Agreement DTAA In USA And India

https://ebizfiling.com/wp-content/uploads/2022/04/Tax-avoidance.png

Double Tax Relief PDF

https://imgv2-2-f.scribdassets.com/img/document/601074916/original/66ed9d7e55/1705192432?v=1

https://www.gov.uk/hmrc-internal-manuals/international-manual/int…

Web 9 April 2016 Updated 12 December 2023 see all updates Contents INTM160000 INTM162500 INTM162560 UK residents with foreign income or gains claims for

https://www.gov.uk/.../double-taxation-relief-time-limit-for-claims

Web 15 M 228 rz 2023 nbsp 0183 32 This measure limits access to double taxation relief DTR in certain circumstances Specifically it will prevent new claims for DTR credit calculated at the

What Is Double Taxation And How Can I Prevent It

Double Taxation Avoidance Agreement DTAA In USA And India

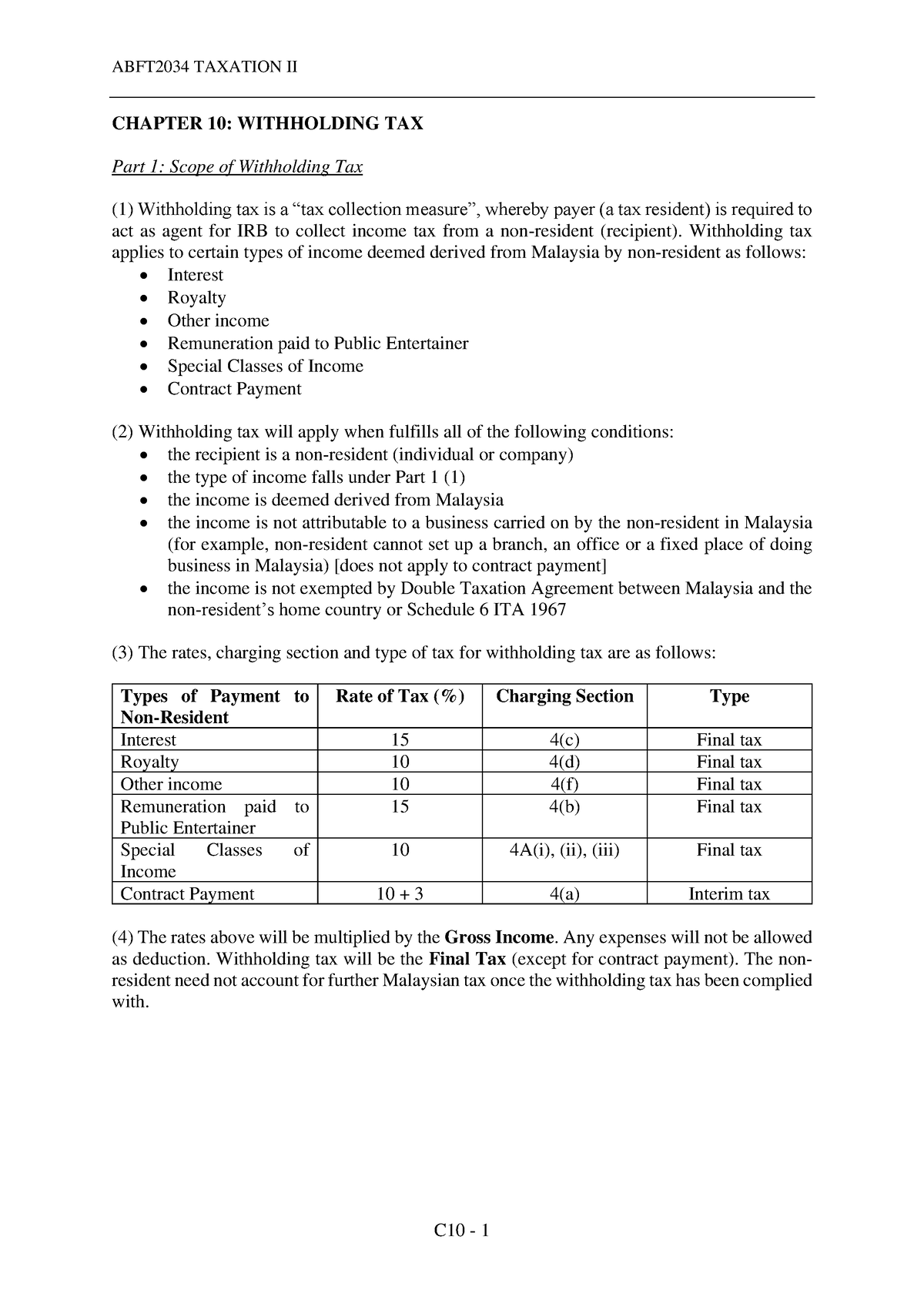

ABFT2034 Chapter 10 Withholding Tax CHAPTER 10 WITHHOLDING TAX Part

Tax Guide Claiming Double Tax Relief In Singapore Paul Wan Co

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

Double Taxation Relief M Meilak Associates Tax Advisors Malta

Double Taxation Relief M Meilak Associates Tax Advisors Malta

:max_bytes(150000):strip_icc()/double_taxation.asp-final-3d97801e71d649c28bebdbc3313a038e.png)

What Double Taxation Is And How It Works

What Is A Double Tax Agreement

India s DTAA Regime A Brief Primer For Foreign Investors

Double Tax Relief Time Limits - Web 23 Nov 2022 nbsp 0183 32 The UK has three options for providing relief from double taxation two via credit relief and one by way of deduction from the profits of the business For further commentary and examples see Simon s Taxes