Due Date Tax Return Australia Lodgment due date for income tax returns for companies and trusts that were taxable medium to large business clients in the prior year and are not required to lodge earlier

You need to lodge a tax return each year to report your assessable income and claim deductions You may also need to lodge yearly reports or returns for PAYG withholding What is the due date to submit a 2024 tax return Although the latest ATO figures suggest that plenty of people have already lodged their 2023 24 tax returns the critical date for individual taxpayers to mark in their

Due Date Tax Return Australia

Due Date Tax Return Australia

https://kajabi-storefronts-production.kajabi-cdn.com/kajabi-storefronts-production/blogs/22911/images/mjKadbKSESjeE9mo7wig_cc87da09-c801-46fd-b628-83306b809d4a.jpg

Tax Return Australia 2021 FAQs By Rick Mon Accountants Business

https://image.isu.pub/210603055126-f7bbc5b396d48d8de531259cea3b823f/jpg/page_1.jpg

Extension Of Due Dates Of Income Tax Returns Non Tax Audit Reports

https://taxconcept.net/wp-content/uploads/2023/07/Income-Tax-Return-filing-due-dates-extended1-1.png

The due date for lodging your income tax return in Australia depends on how you choose to lodge If you lodge your return yourself it s due on 31 October However if you lodge through a registered tax agent you may When is the Australian tax return deadline The key date you need to know is October 31 October 31 is the tax return due date if you re lodging your tax return yourself for the previous

Tax return deadline When is my tax return due Your 2023 24 tax return is due by 31 October 2024 if you re lodging online or mid May 2025 if you re using a tax agent When is the tax deadline for 2022 23 If you are lodging your tax return with the ATO yourself the deadline is Tuesday October 31 If you re planning to lodge through a registered tax agent they will have a little more

Download Due Date Tax Return Australia

More picture related to Due Date Tax Return Australia

File Your ITR For AY 2022 23 Income Tax Return Due Date Tax Return

https://i.pinimg.com/736x/75/28/06/752806031a70da929ff80ea5dd344327.jpg

Income Tax Due Dates For FY 2021 22 AY 2022 23 CACube

https://cacube.in/wp-content/uploads/2018/08/pexels-photo-6863259.jpeg

Tax Return Y La Devoluci n De Impuestos En Australia Chapka Seguros

https://blog.chapkadirect.es/wp-content/uploads/2022/03/tax-back-australia-2048x1367.jpeg

When a due date falls on a Saturday Sunday or public holiday you can lodge or pay on the next business day The payment due date for a tax return is determined by client Due dates vary depending on the type of business and tax return If your client lodges independently this is the standard due date for lodging individual and trust tax returns for the previous financial year July 1st to June

Deadline for lodging your Australia tax return for the fiscal year 1 July 2023 30 June 2024 If you use a Registered Tax Agent like us for help the deadline is usually later but you ll still need to consult with them before the Taxation can be complex but understanding key dates can simplify the process Your tax return covers income from July 1 to June 30 The most crucial date is October 31 the last filing

Individual Tax Return Expert Education Australia

https://experteducation.com/australia/wp-content/uploads/sites/5/2020/07/individual-tax-return-banner.png

Due Dates For Your Tax Return Avance

https://avance.com.au/wp-content/uploads/2022/08/tax-time-1140x783-1-1024x703.jpg

https://www.ato.gov.au › ... › income-tax

Lodgment due date for income tax returns for companies and trusts that were taxable medium to large business clients in the prior year and are not required to lodge earlier

https://www.ato.gov.au › ... › due-dates-by-topic

You need to lodge a tax return each year to report your assessable income and claim deductions You may also need to lodge yearly reports or returns for PAYG withholding

Taxation Updates Mayur J Sondagar On Twitter Income Tax Return And

Individual Tax Return Expert Education Australia

Revised Income Tax Return And Tax Audit Due Date For Financial Year

Personal Income Tax Rates For Australian Residents 2018 2019

How To Prepare Tax Return Australia 2020 21 Explained YouTube

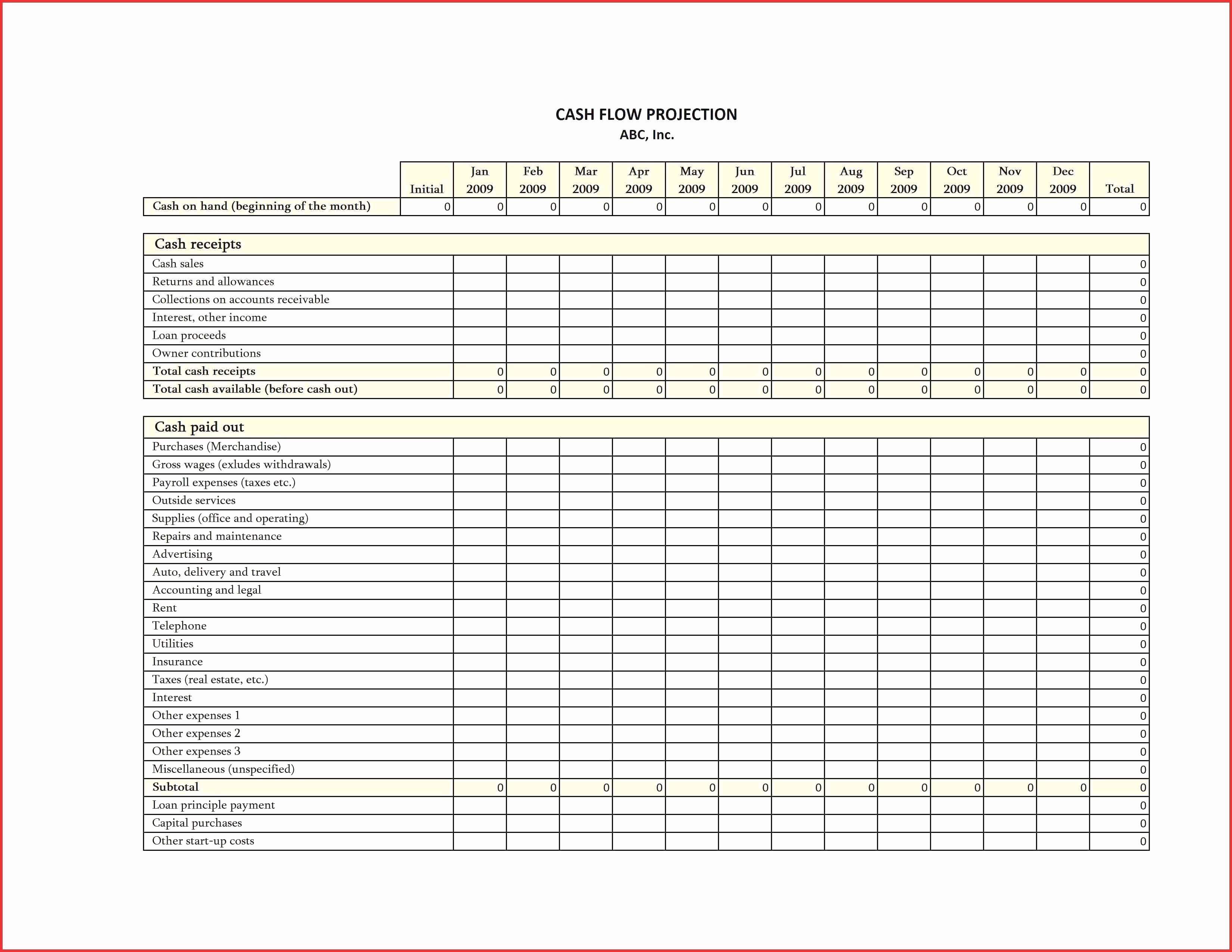

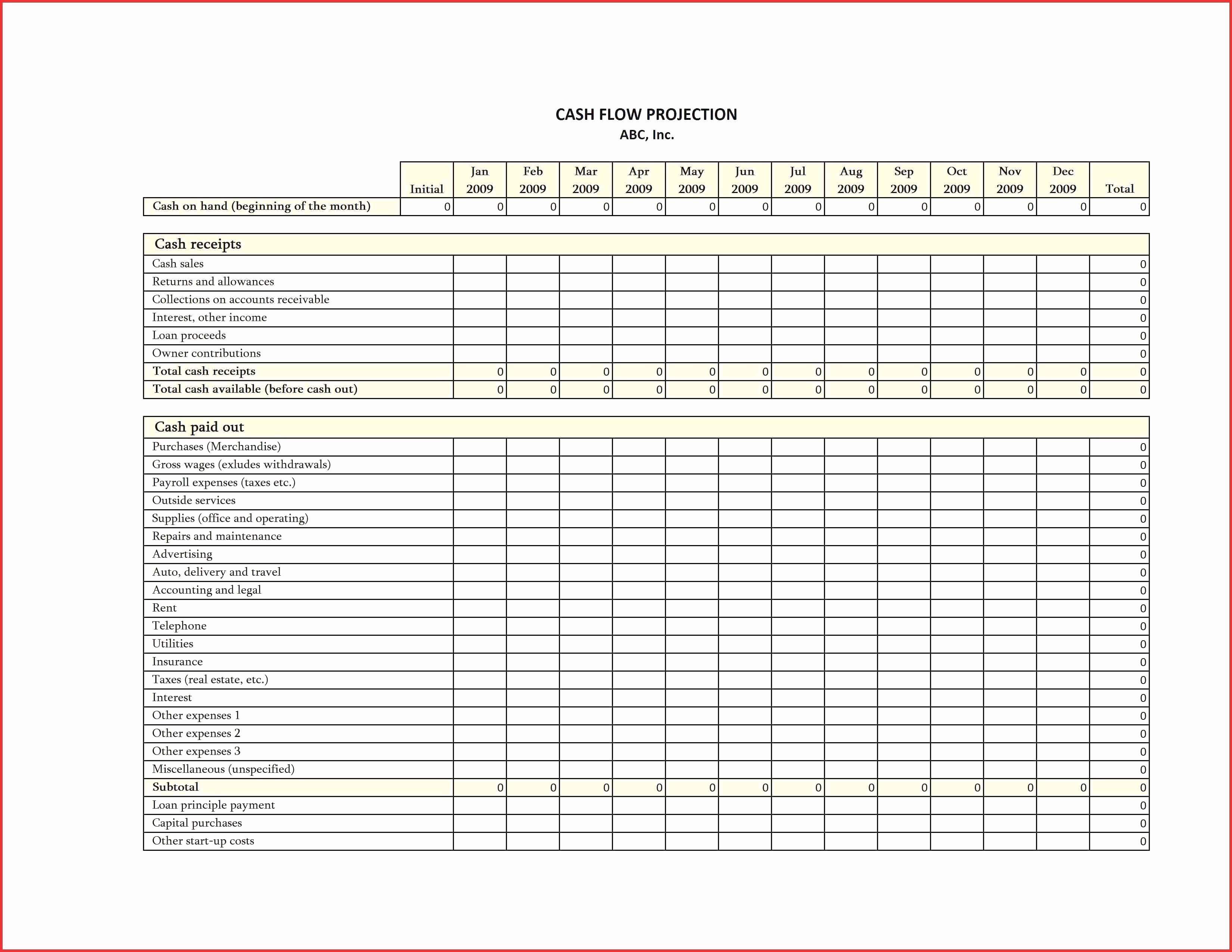

Tax Expenses Template

Tax Expenses Template

Australian Income Tax Work And Travel In Australia

Concequencies Of Not Filing Income Tax Return By Due Date

Individual Tax Return Deadline When Is It Due Taxpro

Due Date Tax Return Australia - If you are preparing and lodging your tax return without the assistance of a tax agent the due date typically falls on October 31 2024 for the 2024 financial year This