Dutch Tax Percentage The annual taxable salary for an employee with a master s degree and who is younger than 30 years must be more than 35 048 2023 31 891 The annual taxable salary for other

A tax calculator that visually presents net and gross income out of a total sum allows individuals to easily determine the percentage of their income that goes towards taxes The total tax is the sum in the three boxes minus the general tax credit algemene heffingskorting a maximum of 3070 as of 2023 and labor tax credit arbeidskorting a maximum of 5052 as of 2023 that both are income dependent These are not to be confused with a tax deduction nl The resulting amount of tax may be less than zero in which case the amount is partially paid out provided that one has a spouse and the tax of both together is not less than zero

Dutch Tax Percentage

Dutch Tax Percentage

https://i.ytimg.com/vi/dLUYEet4p4c/maxresdefault.jpg

Guide 2022 The Netherlands Tax Overview Serviap Global

https://china.serviapgroup.com/wp-content/uploads/2022/06/the-netherlands-tax-overview.jpg

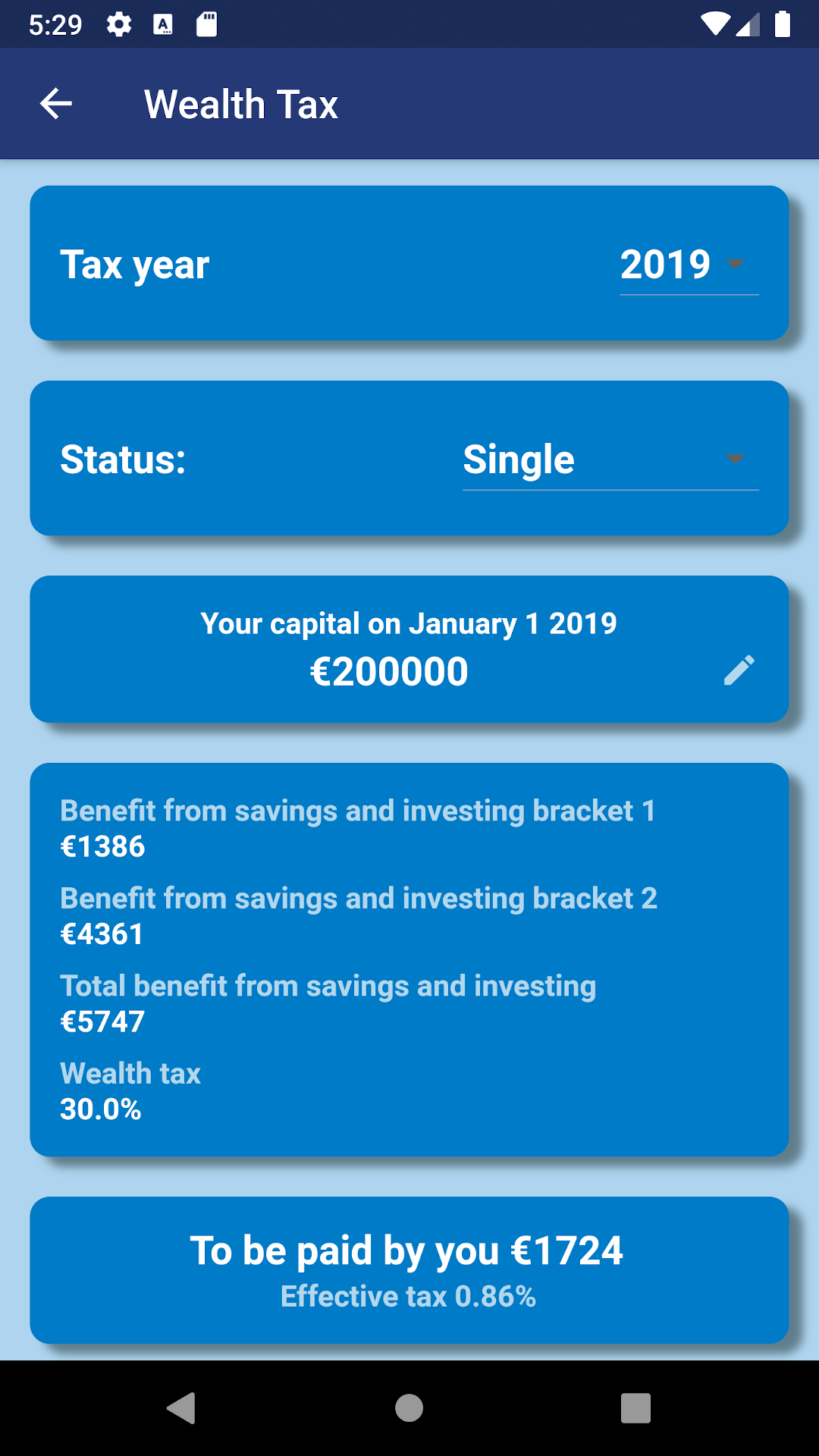

Dutch Tax Check It s All Widgets

https://itsallwidgets.com/screenshots/app-853-2.png?updated_at=2020-12-13 00:12:04

The 30 reimbursement ruling is a tax advantage for certain expat employees in the Netherlands The most significant benefit is that the taxable amount of your gross Taxable amount of 200 000 and above was taxed at a 25 tax rate The corporate tax rates are both due to decrease by 1 percentage point in 2019 1 5 percentage point in

Income tax rate The income tax you pay is the total amount of tax calculated on your income your financial interests in a company and your savings and investments less The annual taxable salary for an employee with a master s degree and who is younger than 30 years must be more than 31 891 2022 30 001 The annual taxable salary for other

Download Dutch Tax Percentage

More picture related to Dutch Tax Percentage

Dutch Tax Tips Deductible Costs On The Tax Return

https://www.iamexpat.nl/sites/default/files/styles/ogimage_thumb/public/oldimages/957dea4aa65e02deaea82997fca9c3d31366038014.png

Budget Day Special Dutch Tax Plan 2023 STP Tax

https://www.stp.nl/wp-content/uploads/2022/09/Afbeelding-Dutch-tax-plan.jpg

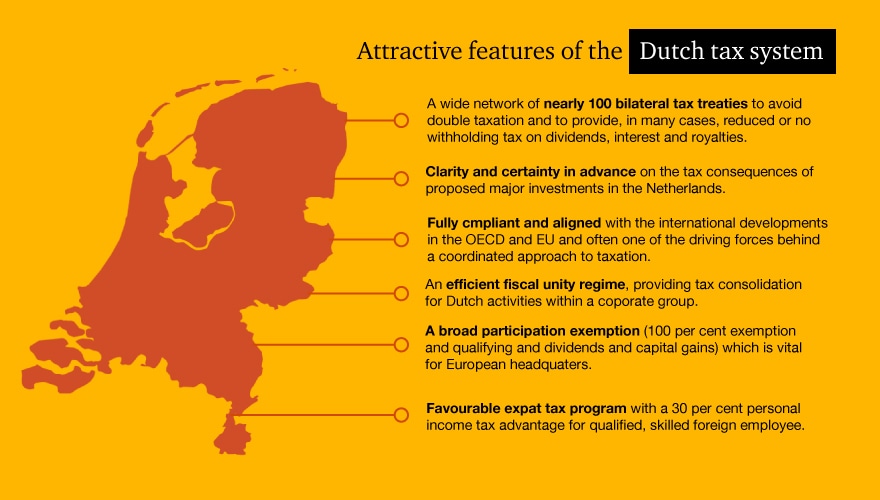

Taxation In The Netherlands Doing Business In The Netherlands 2020

https://www.pwc.nl/nl/tax/assets/images/attractive-features-of-the-dutch-tax-system.jpg

The Income tax rates and personal allowances in Netherlands are updated annually with new tax tables published for Resident and Non resident taxpayers The Tax tables Use our Dutch tax calculator to find out how much income tax you pay in the Netherlands Check the I enjoy the 30 ruling and find the maximum amount of tax you can save

The tax rate on income from savings and investments is 30 In addition workers are charged a National Insurance Contribution 27 65 In some cases for example with Dutch tax rates are updated every year Here you can find an overview of various tax rates in 2024 Use this information for your financial planning and tax matters Turnover tax

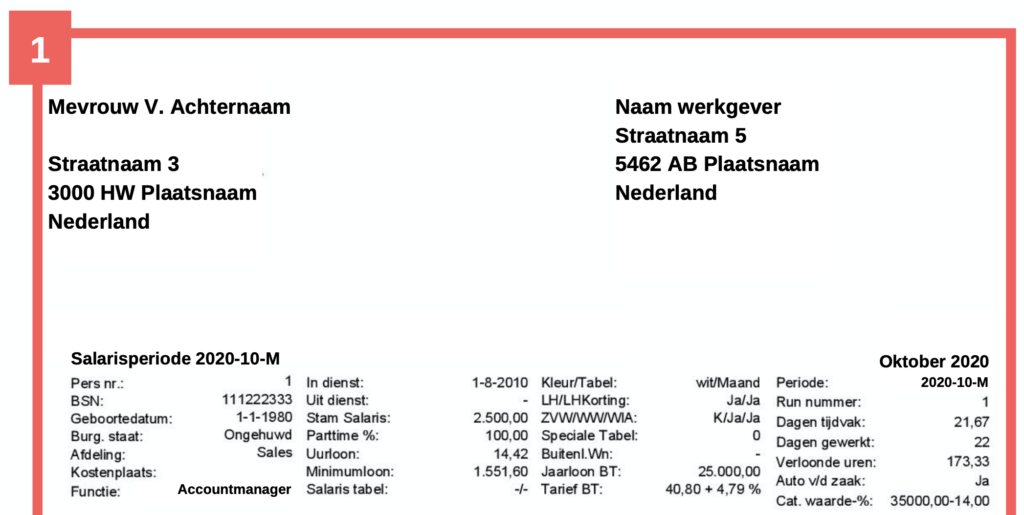

How To Read and Understand Your Dutch Payslip DutchReview

https://dutchreview.com/wp-content/uploads/middle-of-dutch-payslip-1024x521.jpg

GitHub Stevermeister dutch tax income calculator Dutch Tax Income

https://user-images.githubusercontent.com/1526680/68068657-5a458b80-fd57-11e9-83a8-8c3d2ebac18d.png

https://thetax.nl

The annual taxable salary for an employee with a master s degree and who is younger than 30 years must be more than 35 048 2023 31 891 The annual taxable salary for other

https://dutchtaxcalculator.nl

A tax calculator that visually presents net and gross income out of a total sum allows individuals to easily determine the percentage of their income that goes towards taxes

Payslip In The Netherlands Explained

How To Read and Understand Your Dutch Payslip DutchReview

Dutch Tax Check It s All Widgets

Https www tax consultants international read Dutch Value Added

Filing Your Dutch Tax Return 10 Things You Need To Know

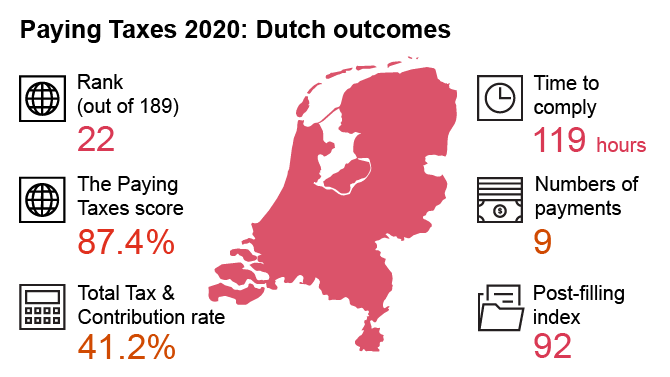

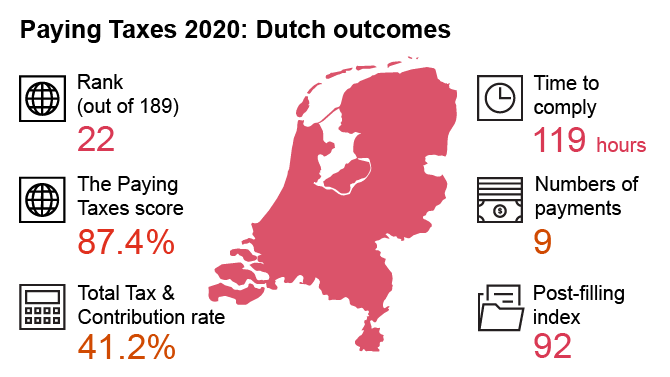

Paying Taxes 2020 Insights And Publications Services Tax PwC

Paying Taxes 2020 Insights And Publications Services Tax PwC

Dutch Tax Tips 2012 Tax Return

The Netherlands A Tax Haven Infographic Facts

Dutch Tax

Dutch Tax Percentage - Income tax rate The income tax you pay is the total amount of tax calculated on your income your financial interests in a company and your savings and investments less