Earned Income Tax Credit Filing Separately Web 26 Mai 2022 nbsp 0183 32 Percentage and threshold changes The credit percentage at which the EIC phases in out has been increased to 15 3 in 2021 previously 7 65 and the credit

Web 13 Dez 2023 nbsp 0183 32 Have investment income below 11 000 in the tax year 2023 Have a valid Social Security number by the due date of your 2023 return including extensions Be a Web 19 Okt 2023 nbsp 0183 32 If you were married filing jointly and earned less than 63 698 56 838 for individuals surviving spouses or heads of household in 2023 you may qualify for this

Earned Income Tax Credit Filing Separately

Earned Income Tax Credit Filing Separately

https://www.expatustax.com/wp-content/uploads/2022/09/Filing-Jointly-Vs-Separately.jpg

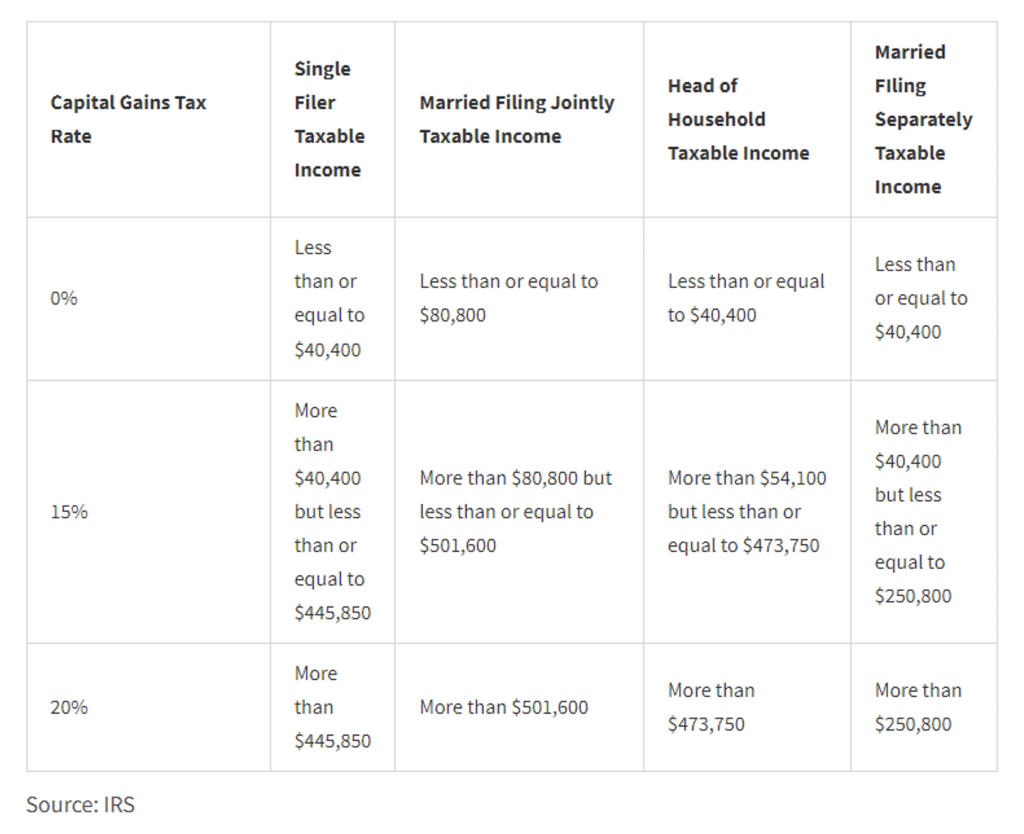

IRS 2021 Tax Tables Deductions Exemptions Purposeful finance

https://images.squarespace-cdn.com/content/v1/572ff08b044262a7f8c2405e/1611843812978-ODAF19Y1BP5NUAKIHJDB/2021+Income+Tax+Bracket+Table+MFJ+SF.png

Earned Income Tax Credit EITC Eligibility And Benefits Stealth

https://stealthcapitalist.com/wp-content/uploads/2023/02/AdobeStock_551436661-scaled.jpeg

Web 20 Sept 2023 nbsp 0183 32 The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break If you qualify you can use the credit to reduce the Web Vor 2 Tagen nbsp 0183 32 Beginning with the 2021 tax year singles and married couples who have SSNs can claim the credit even if their children don t have SSNs In this instance they

Web 11 Dez 2023 nbsp 0183 32 Tax Year 2023 Income Limits and Range of EITC Number of Qualifying Children For Single Head of Household or Qualifying Surviving Spouse or Married Filing Web You can find more information on eligibility rules for qualifying children and filing status including special qualifying rules and considerations for married people not filing joint returns due to separation or living apart

Download Earned Income Tax Credit Filing Separately

More picture related to Earned Income Tax Credit Filing Separately

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

https://imageio.forbes.com/specials-images/imageserve/618c20ffbb2bc42be3bd8357/0x0.jpg?format=jpg&width=1200

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.23.12-PM-1024x834.png

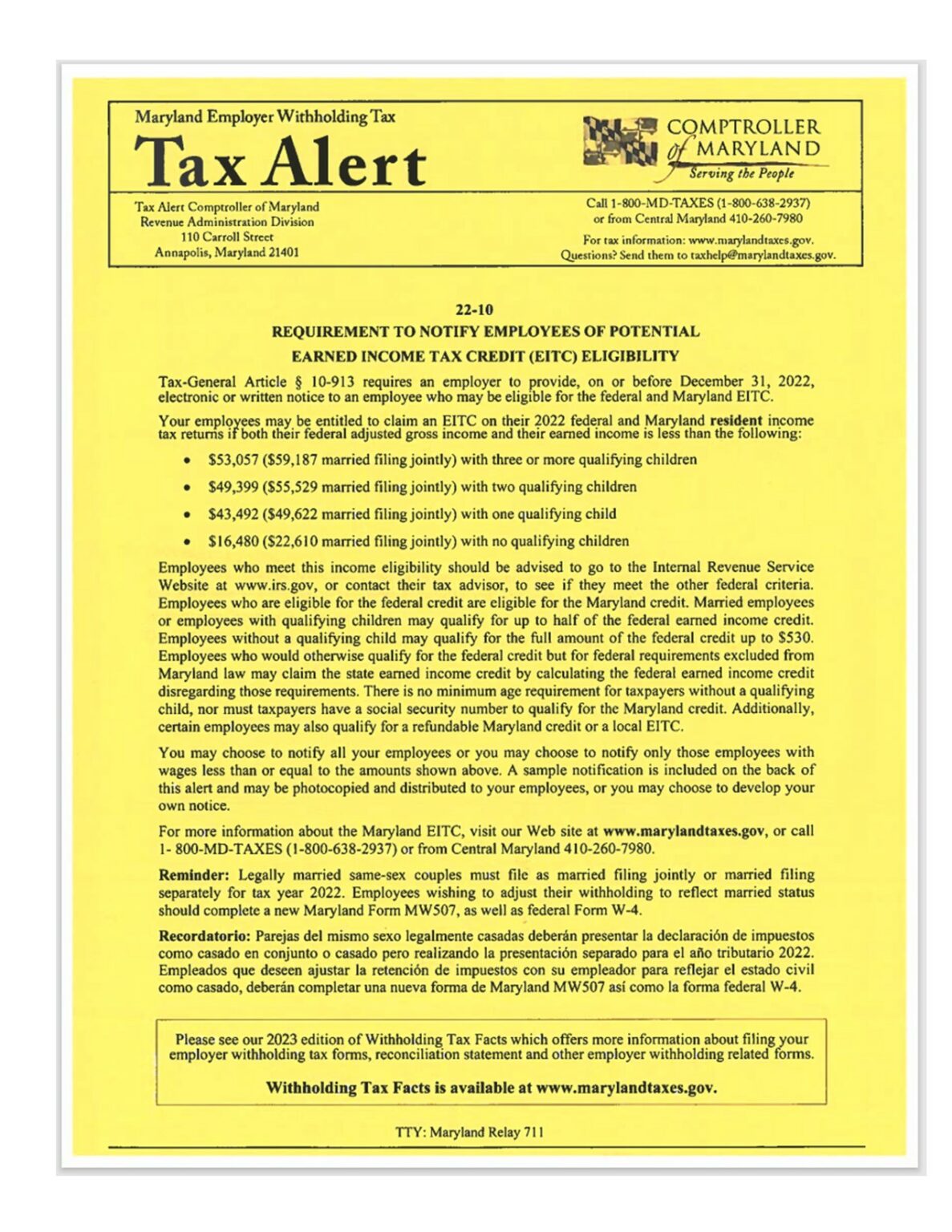

Earned Income Tax Credit Horizon Goodwill Industries

https://horizongoodwill.org/wp-content/uploads/2022/12/tax-1-1-1187x1536.jpg

Web 17 Nov 2010 nbsp 0183 32 You must not be filing as a married filing separately You cannot be the qualifying child of someone else If you don t have a qualifying child you must be between the ages 25 and 65 by the end of the year Web 25 Feb 2023 nbsp 0183 32 You can claim the earned income credit if you file jointly or can qualify as head of household If you have lived apart from your spouse for the last six months of the

Web The earned income tax credit or EITC is aimed at giving low to moderate income workers and families a tax break The dollar amout of credits ranges from 560 to Web 31 M 228 rz 2022 nbsp 0183 32 Do I qualify for the EITC I am married filing separately have 2 children living apart since Nov and Legally separated since Feb 2022 My spouse moved out

Taking A Stand For Children Through The Child Tax Credit Tax Credits

https://i0.wp.com/www.taxcreditsforworkersandfamilies.org/wp-content/uploads/2022/02/TCWF_knockout_horizontal.png?w=4439&ssl=1

Earned Income Tax Credit Claims Are Less Likely After IRS Audits

https://journalistsresource.org/wp-content/uploads/2018/04/tax-forms.jpg

https://accountants.intuit.com/taxprocenter/tax-law-and-news/earned...

Web 26 Mai 2022 nbsp 0183 32 Percentage and threshold changes The credit percentage at which the EIC phases in out has been increased to 15 3 in 2021 previously 7 65 and the credit

https://www.irs.gov/credits-deductions/individuals/earned-income-tax...

Web 13 Dez 2023 nbsp 0183 32 Have investment income below 11 000 in the tax year 2023 Have a valid Social Security number by the due date of your 2023 return including extensions Be a

Earned Income Tax Credit 2013 1040Return File 1040 1040ez And

Taking A Stand For Children Through The Child Tax Credit Tax Credits

And Taxes Fonrevem My Nean Do Your Federal Taxes While Romancing Your

Income Tax Form Malaysia Nathan Vance

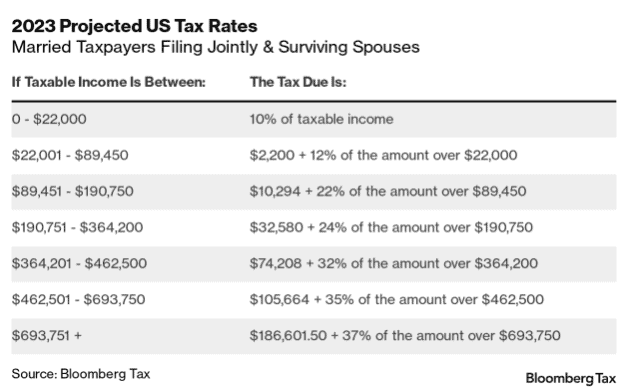

Tax Brackets 2022 Married Jointly Sustainablejulu

All About The Earned Income Tax Credit Account Abilities LLC

All About The Earned Income Tax Credit Account Abilities LLC

Standard Deduction For Assessment Year 2021 22 Standard Deduction 2021

Astounding Gallery Of Eic Tax Table Concept Turtaras

Earned Income Tax Credit 2013 1040Return File 1040 1040ez And

Earned Income Tax Credit Filing Separately - Web New law changes expand the EITC for 2021 and future years These changes include More workers and working families who also have investment income can get the credit